Despite high housing costs and a limited supply of homes for sale, many people are out house hunting.

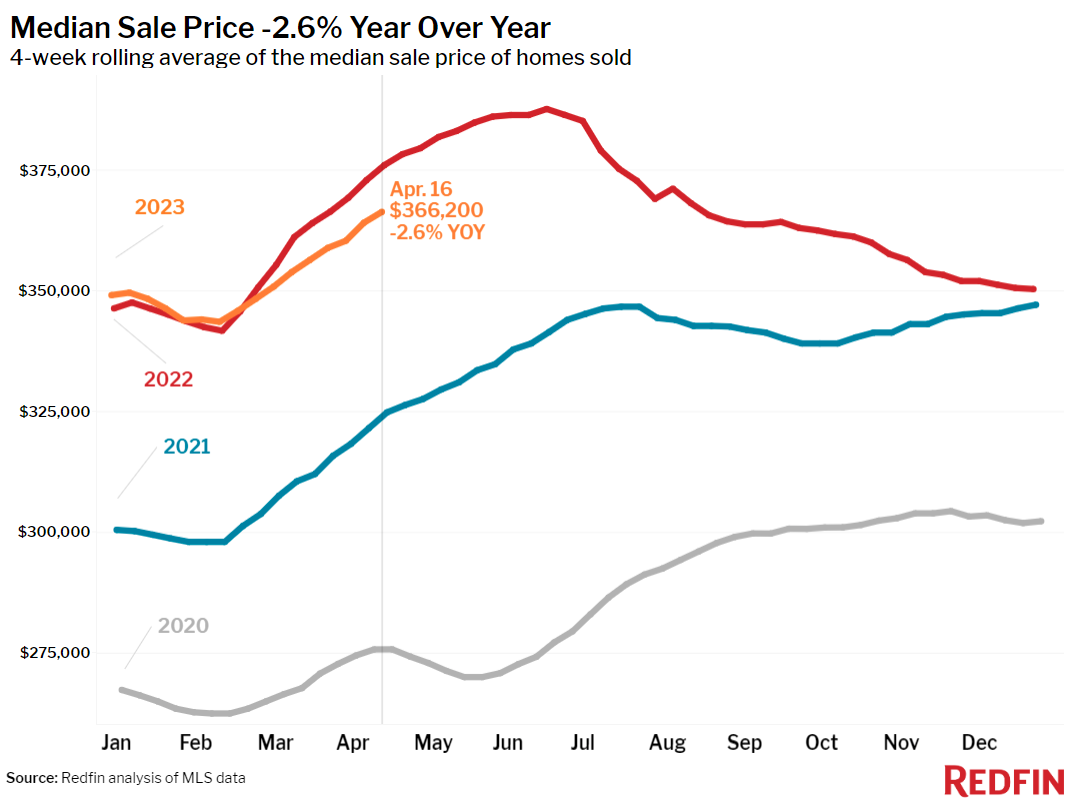

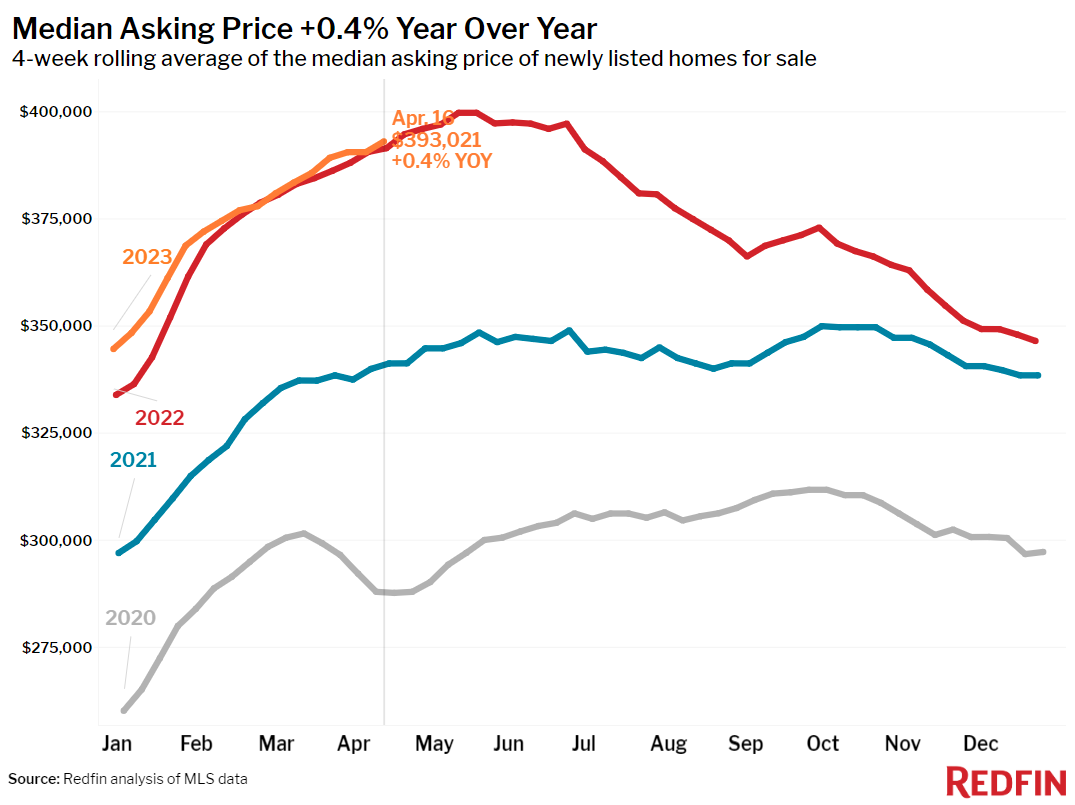

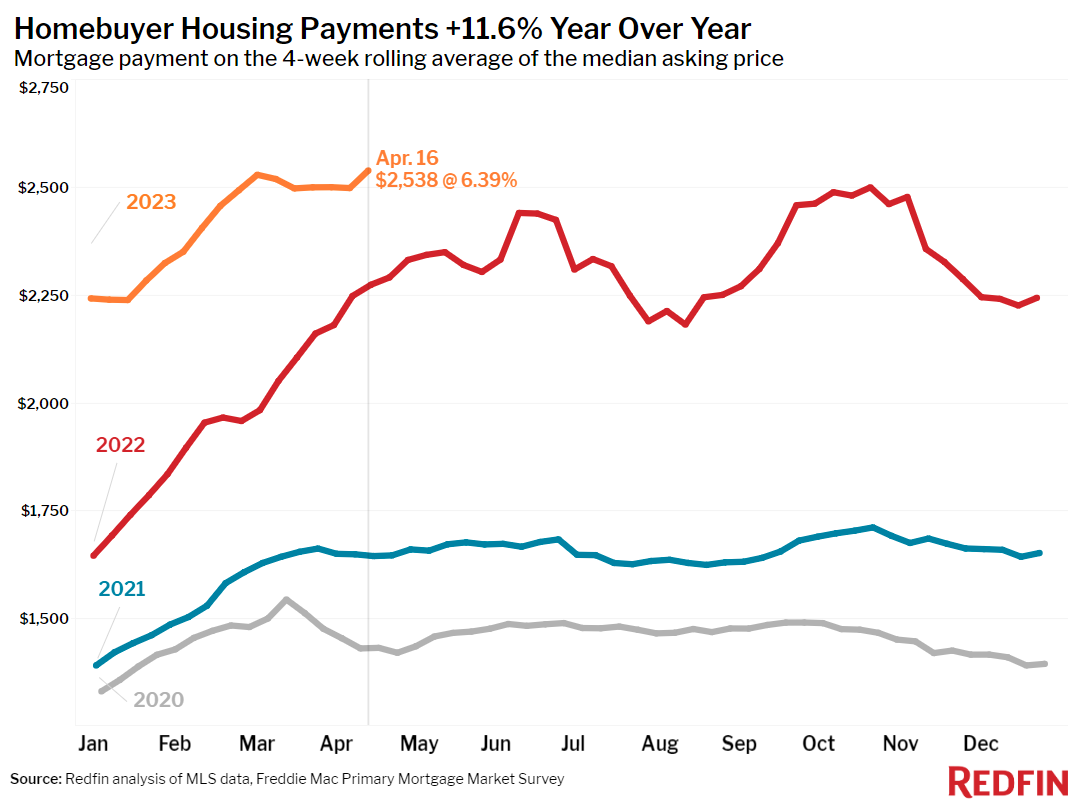

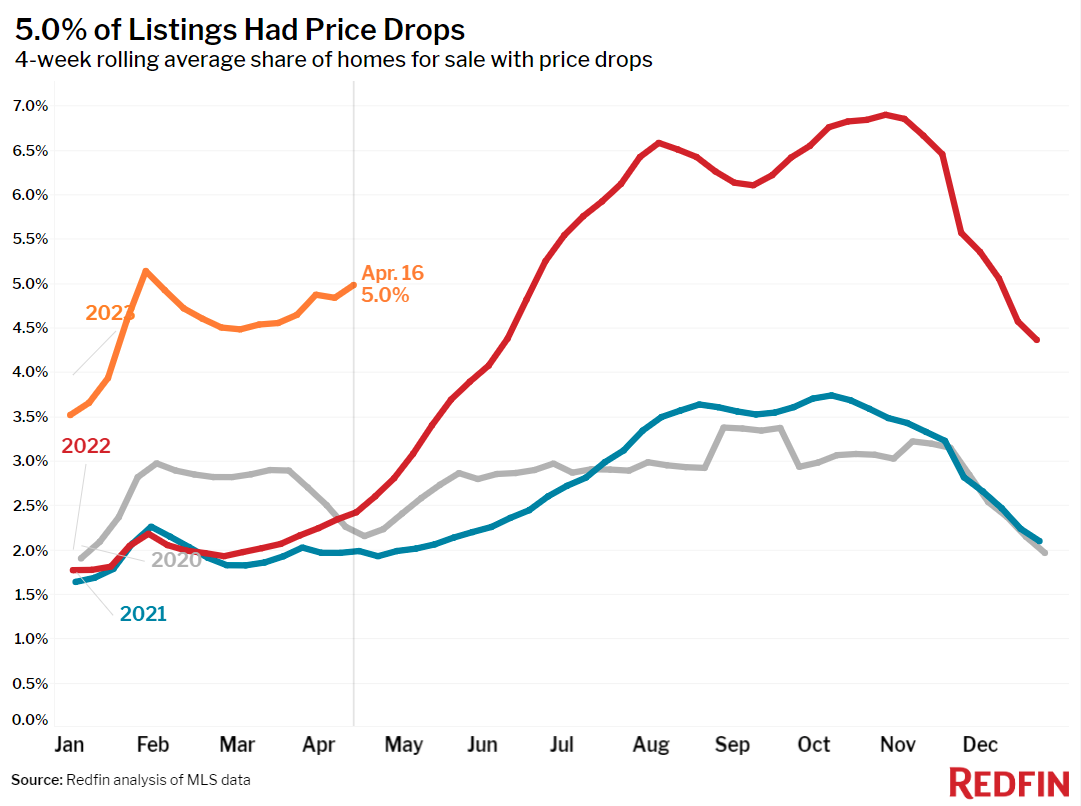

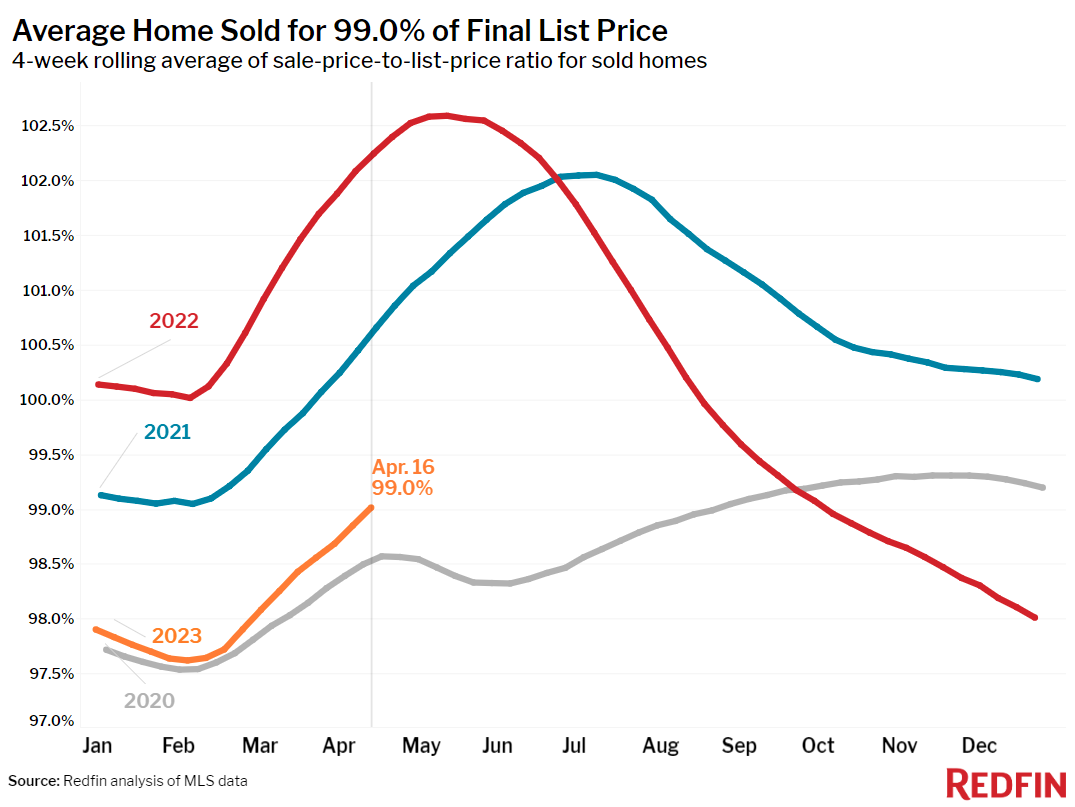

The typical U.S. homebuyer’s monthly housing payment hit an all-time high of $2,538 as average weekly mortgage rates rose to 6.39% after five consecutive weeks of declines. The new high comes in spite of the median home-sale price dropping 2.6% from a year earlier during the four weeks ending April 16, the biggest decline in over a decade.

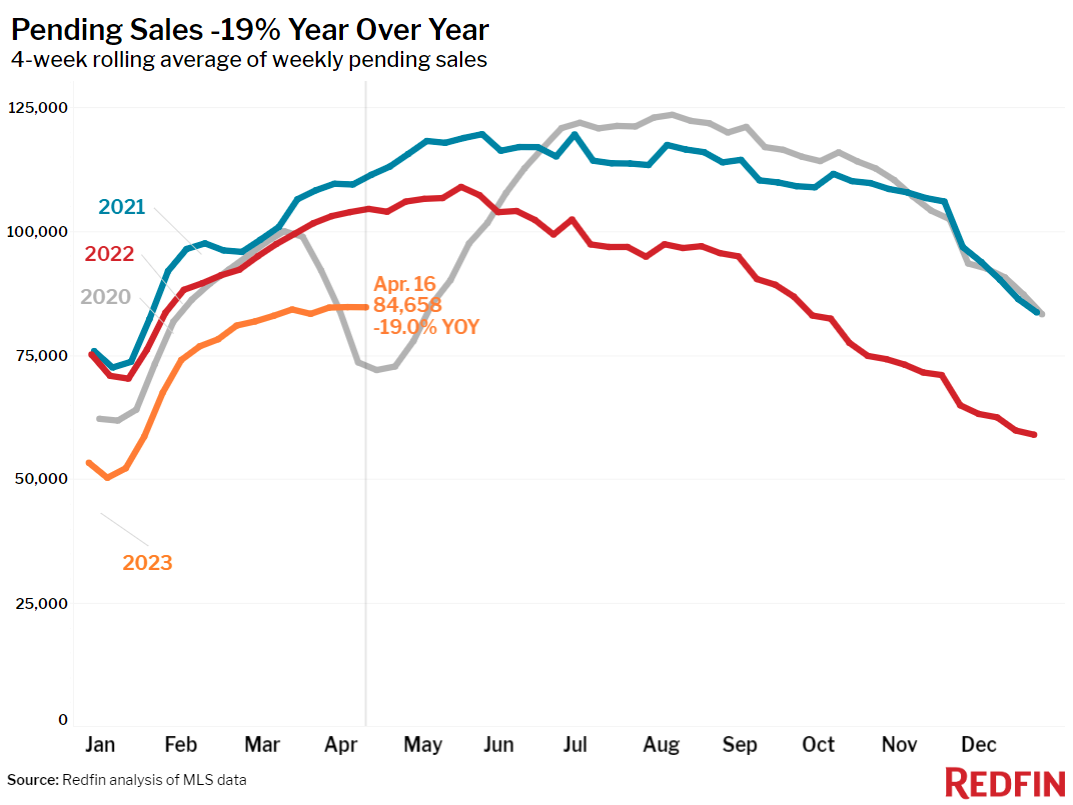

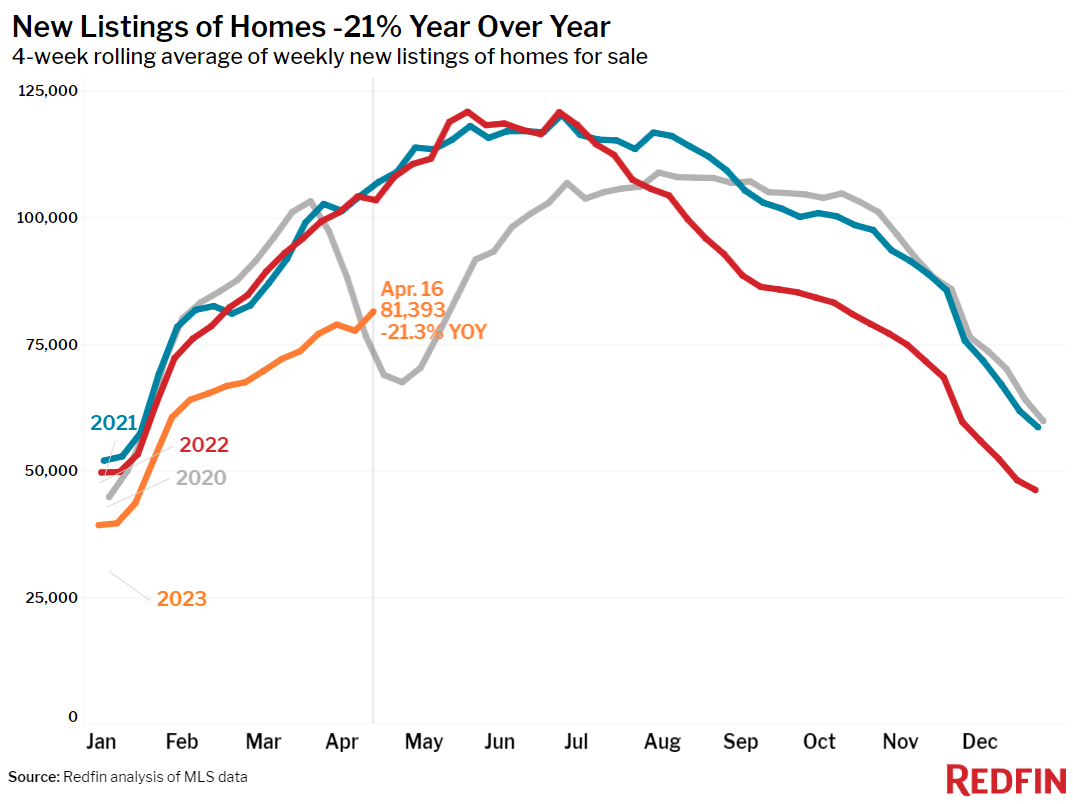

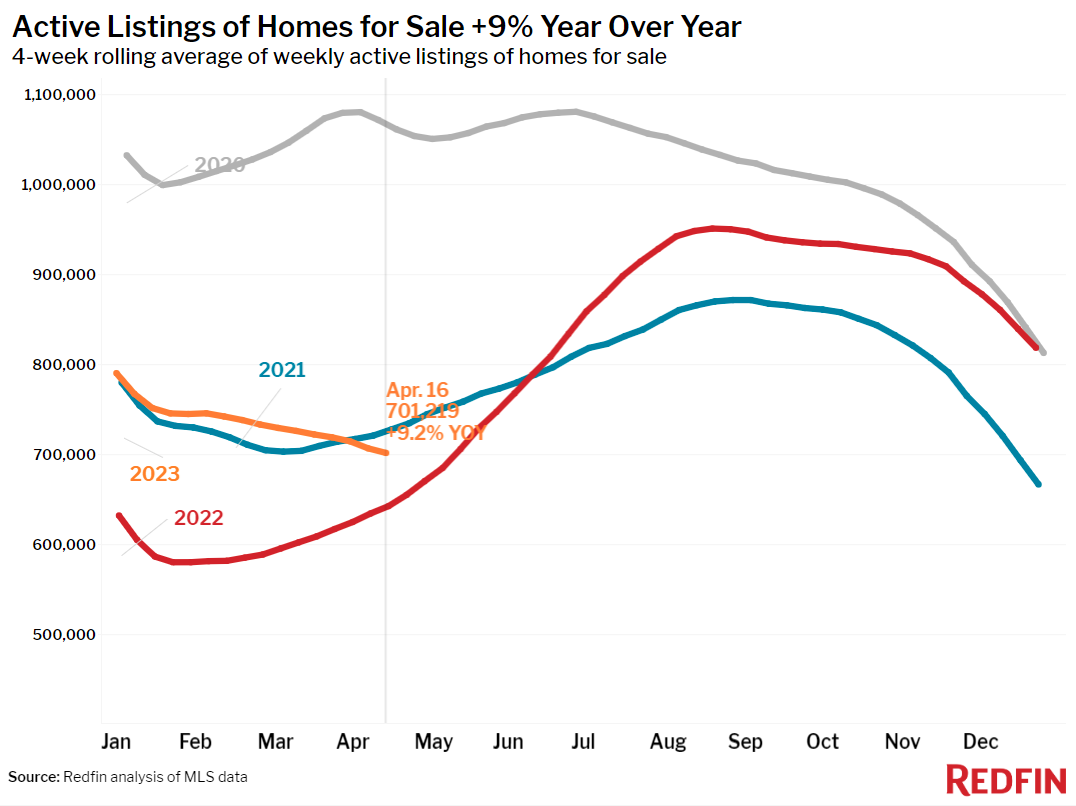

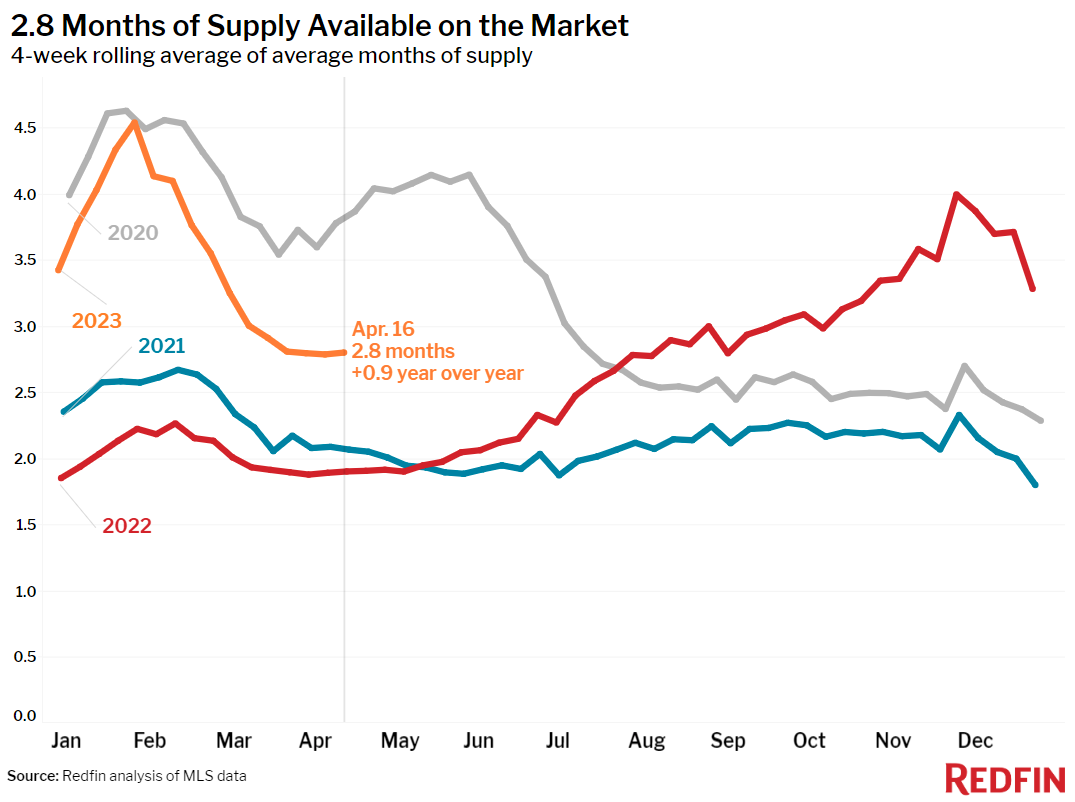

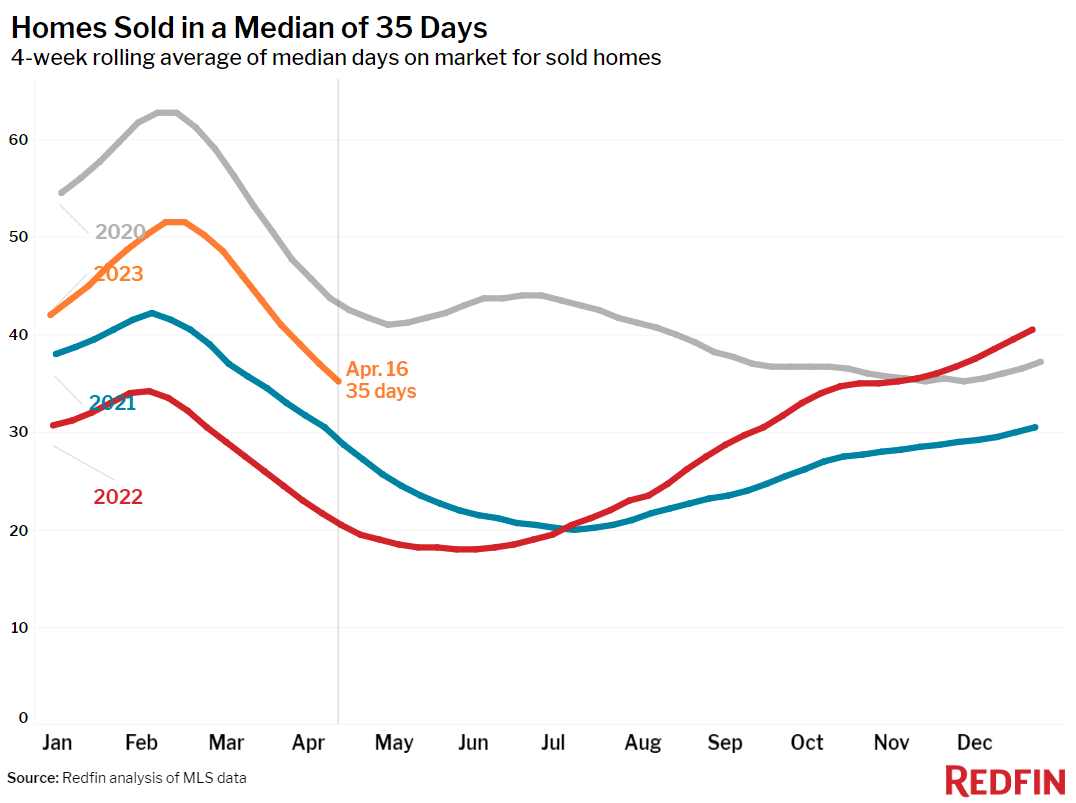

Elevated housing costs are one reason would-be homebuyers are backing off: Pending home sales are down 19% from a year ago, the biggest drop in nearly three months, and mortgage-purchase applications declined 10% over the last week. Buyers are also limited by the shortage of homes for sale, with new listings down 21% as homeowners stay put to hang onto comparatively low mortgage rates.

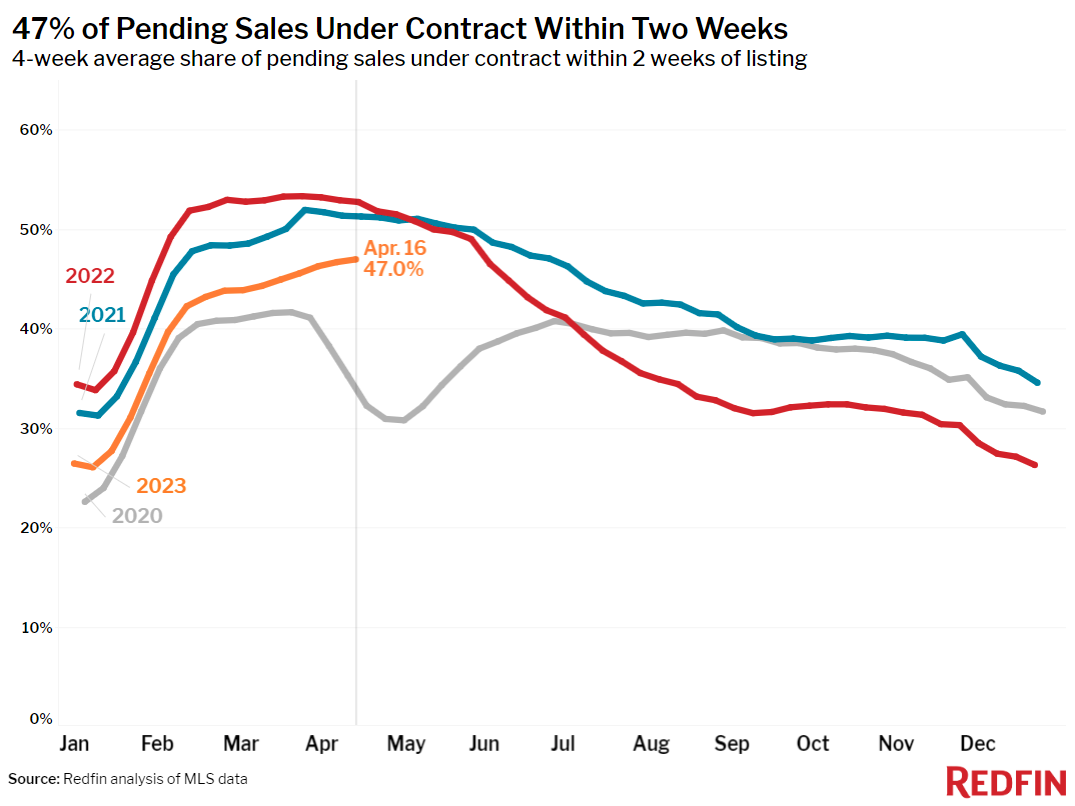

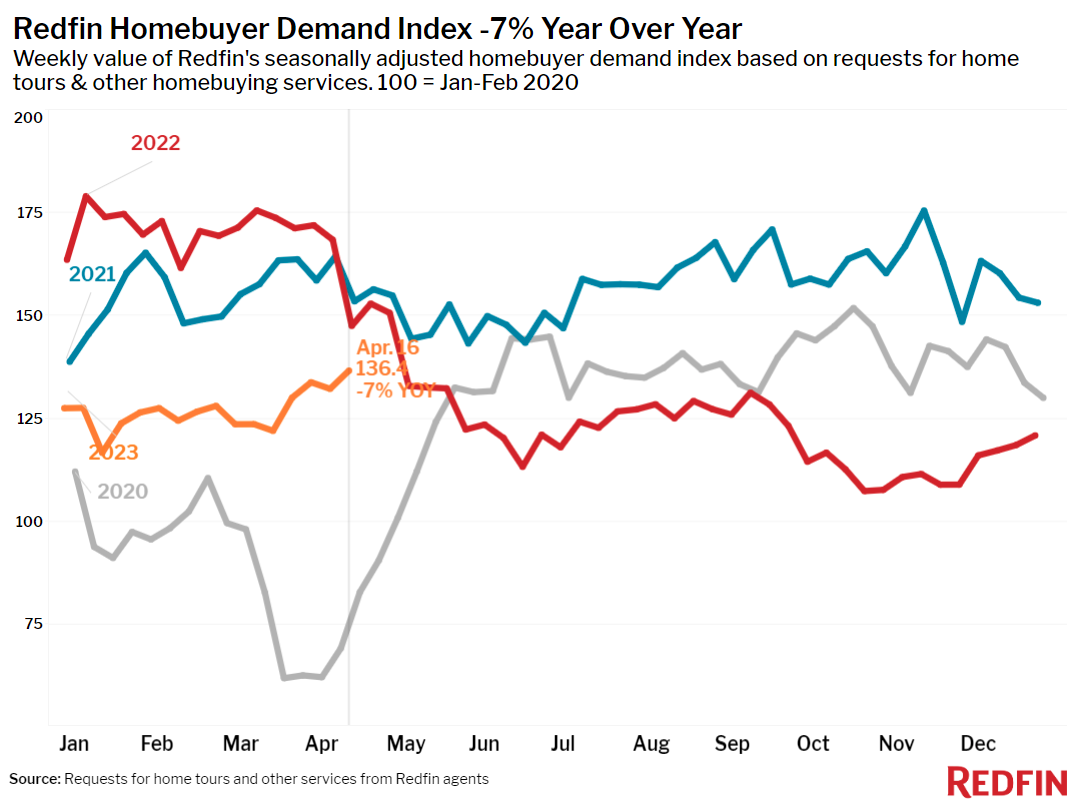

But while fewer people are buying homes, many are searching. Redfin’s Homebuyer Demand Index–a measure of requests to tour homes, make an offer or start a home search–rose 3% from a week earlier and 12% from a month earlier during the week ending April 16. The demand index was down 7% from a year ago, but that’s the smallest decline in eleven months.

“Homebuyers are window shopping and many are entering the store, but few of them are making it to the cash register yet,” said Redfin Deputy Chief Economist Taylor Marr. “There’s not much on the shelves to choose from, and high mortgage rates and still-high prices are making homes too expensive for many buyers. Some buyers are discouraged by mortgage rates rising this week, which is partly due to stronger-than-expected bank earnings making it more likely the Fed will hike interest rates next month.”

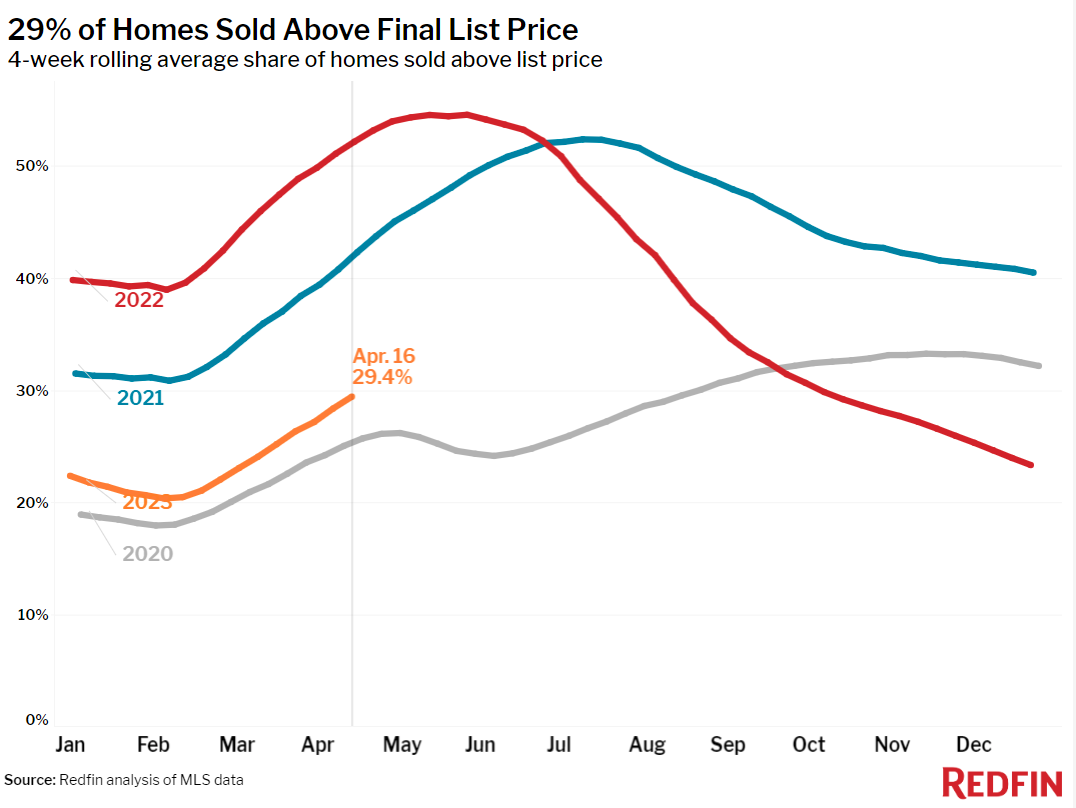

The market looks different in different parts of the country. Los Angeles Redfin agent Costanza Genoese Zerbi said that while few homeowners are moving, locked in by low rates, first-time buyers are on the hunt . There’s enough demand and such limited supply that all her recent listings received multiple offers.

“I listed a three-bedroom home that needed work in a desirable part of Long Beach. It was listed at $1.3 million, got 17 offers and sold for $1.5 million,” she said. “My advice for today’s buyers is to look for a home you love, not an investment. Mortgage rates are high and prices are still high, so you may not earn equity as quickly as you would have if you’d purchased a home two years ago. But if you’re buying your dream home in a place you want to live, it’s worth it.”

In Washington, D.C., some homeowners are taking advantage of limited supply and the uptick in competition. “Many sellers are sitting on a ton of equity. Maybe they bought their home 10 years ago and it’s gone up in value by hundreds of thousands of dollars,” said local Redfin agent Marshall Carey. “Even with high rates, it’s a good time to move up because they have so much money in the bank to get a nicer home in a better location.”

The median U.S. home-sale price fell for the eighth straight four-week period after more than a decade of increases.

Home-sale prices dropped in 30 of the 50 most populous U.S. metros, with the biggest drop in Austin, TX (-15.1% YoY). It’s followed by Oakland, CA (-11.5%), Sacramento, CA (-9.5%), San Francisco (-9.2%) and Seattle (-9.1%).

On the other end of the spectrum, sale prices increased most in Fort Lauderdale, FL, where they rose 9.1% year over year. Next come Cincinnati (9%), Miami (8.5%), West Palm Beach, FL (8%) and Milwaukee (7.2%).

Unless otherwise noted, the data in this report covers the four-week period ending April 16. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.