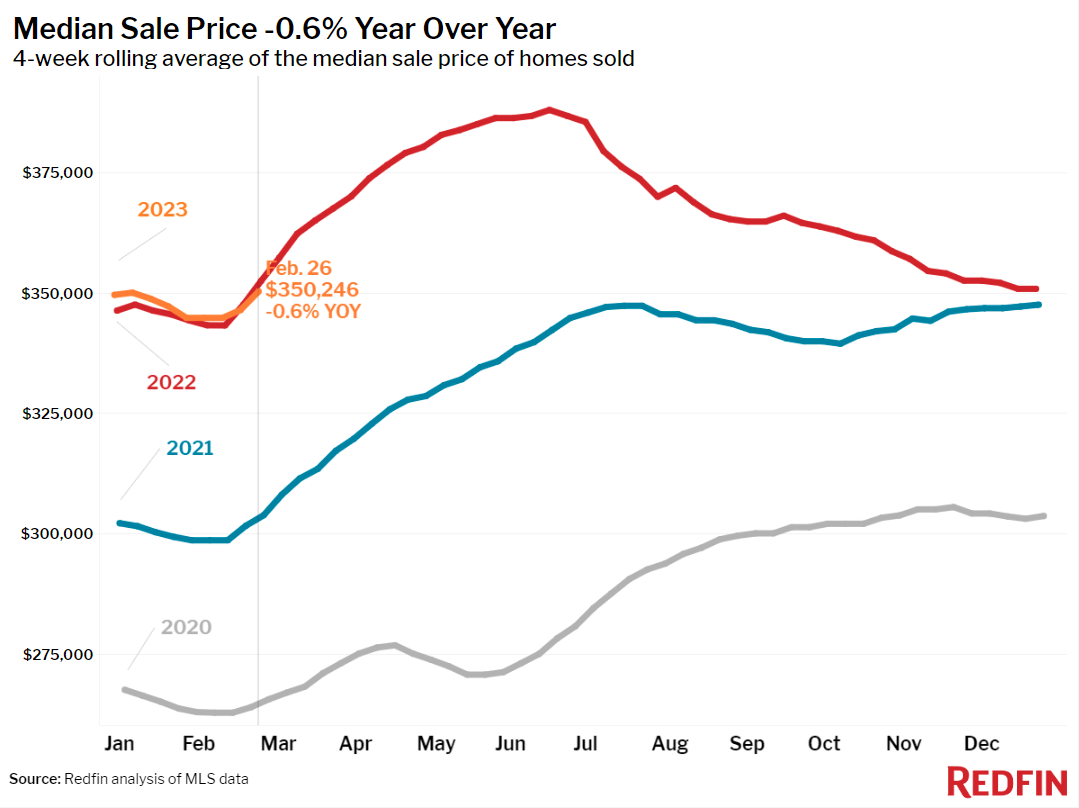

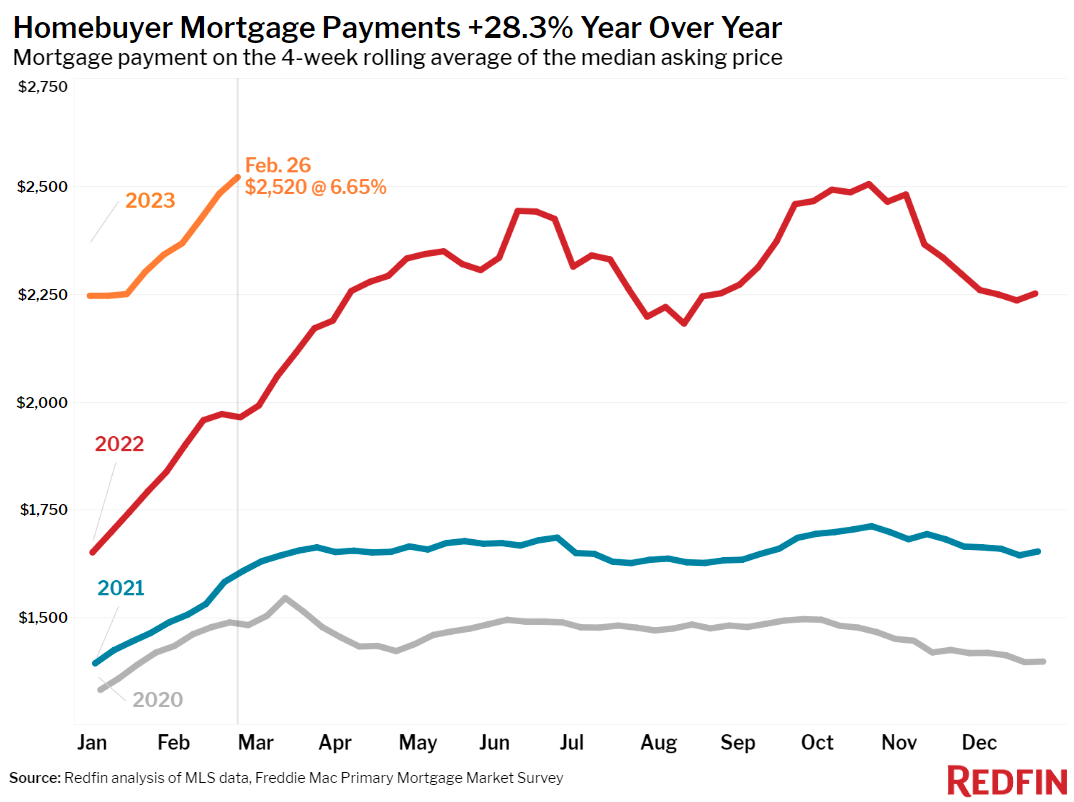

The median U.S. home-sale price declined 0.6% year over year in February, marking the first annual drop since 2012–but high rates mean homes aren’t more affordable. The milestone comes as daily average mortgage rates hit 7.1%, dampening homebuying demand.

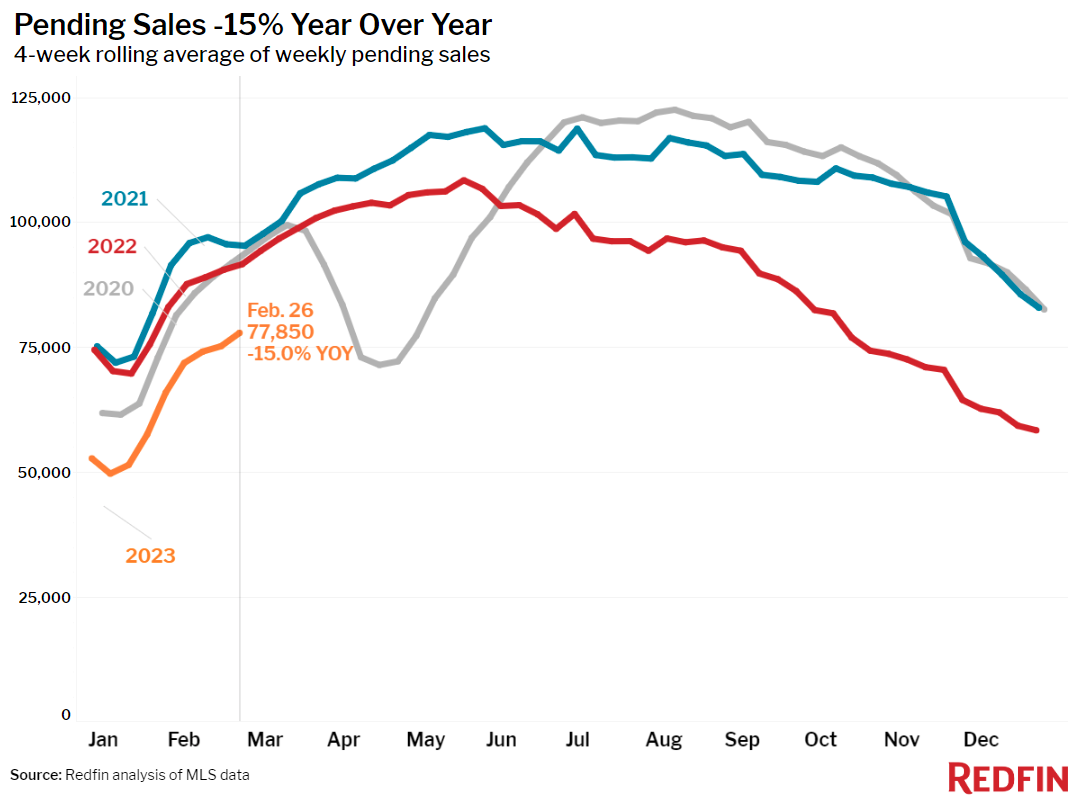

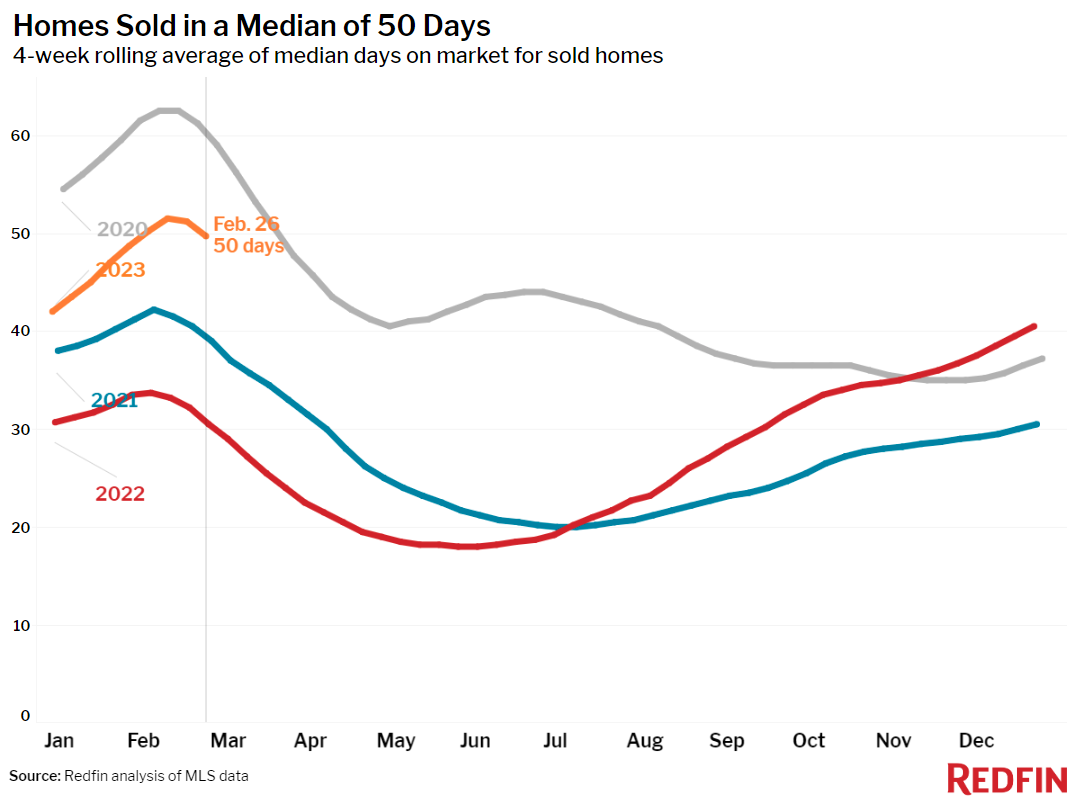

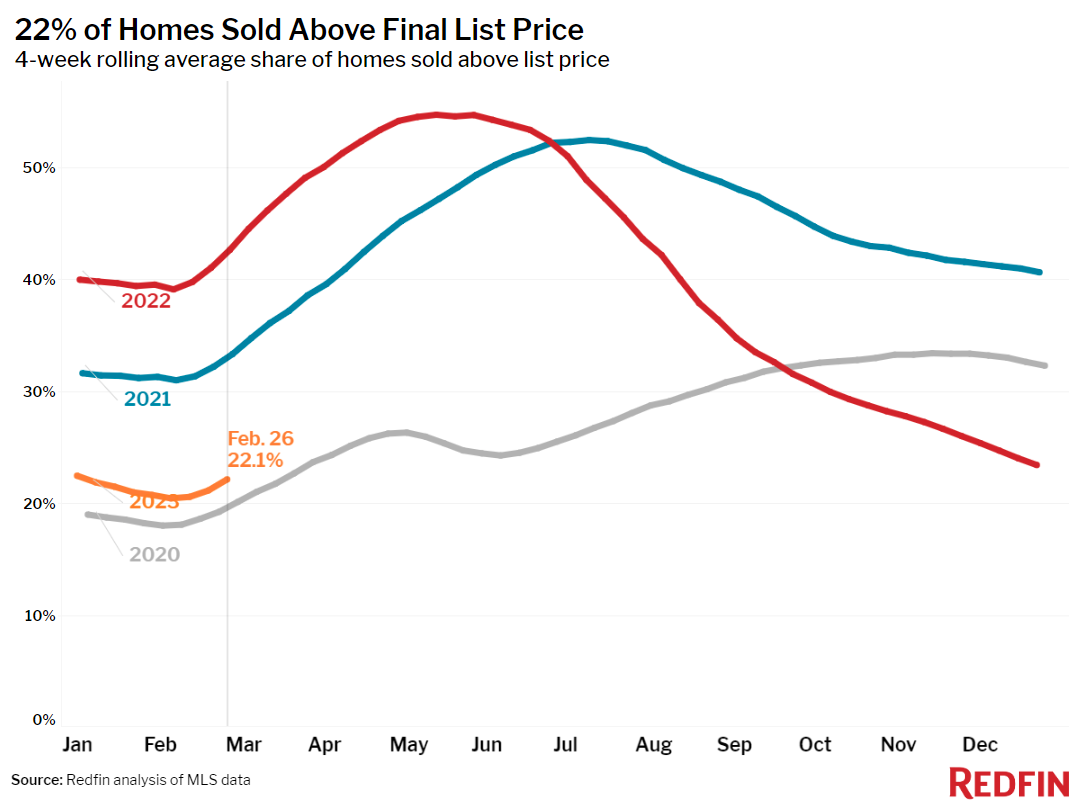

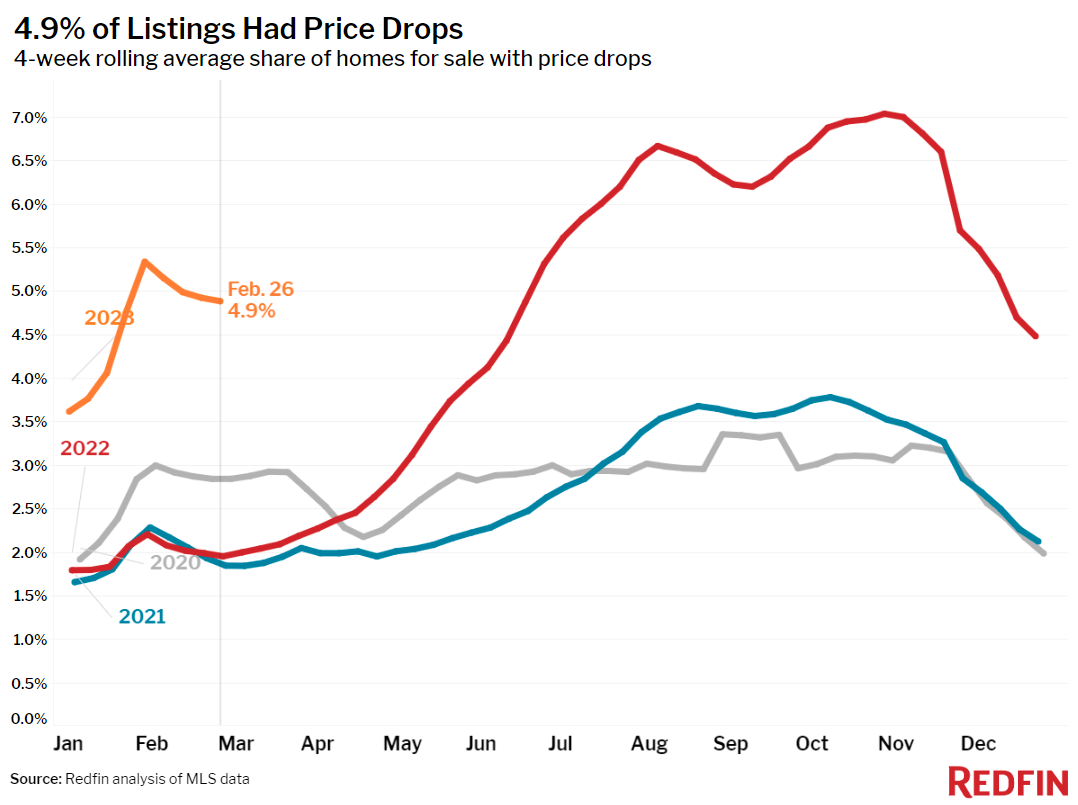

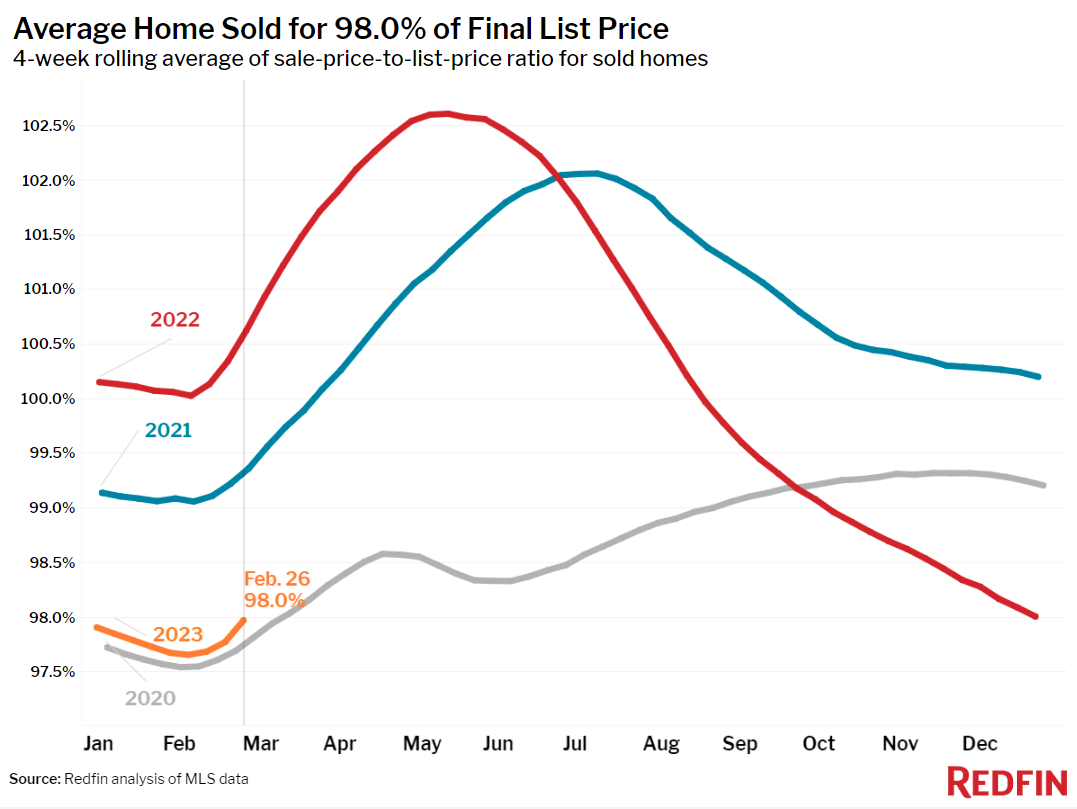

U.S. home-sale prices have fallen from a year earlier for the first time in more than a decade. The milestone comes as mortgage rates hitting their highest level since November sideline buyers and sellers are forced to lower their asking price to accommodate high rates. The typical U.S. home sold for $350,246 during the four weeks ending February 26, down 0.6% year over year, marking the first time prices have dropped since February 2012 (except the prior four-week period; Redfin’s revised weekly data shows a 0.3% drop for the four weeks ending February 19).

But that doesn’t mean homes are more affordable. The typical monthly mortgage payment for today’s homebuyer is at a record high of $2,520, due to elevated mortgage rates. That could lead to a prolonged winter for the housing market. Many homebuyers and sellers are likely to wait at least until the summer, when rates may dip, to jump into the market.

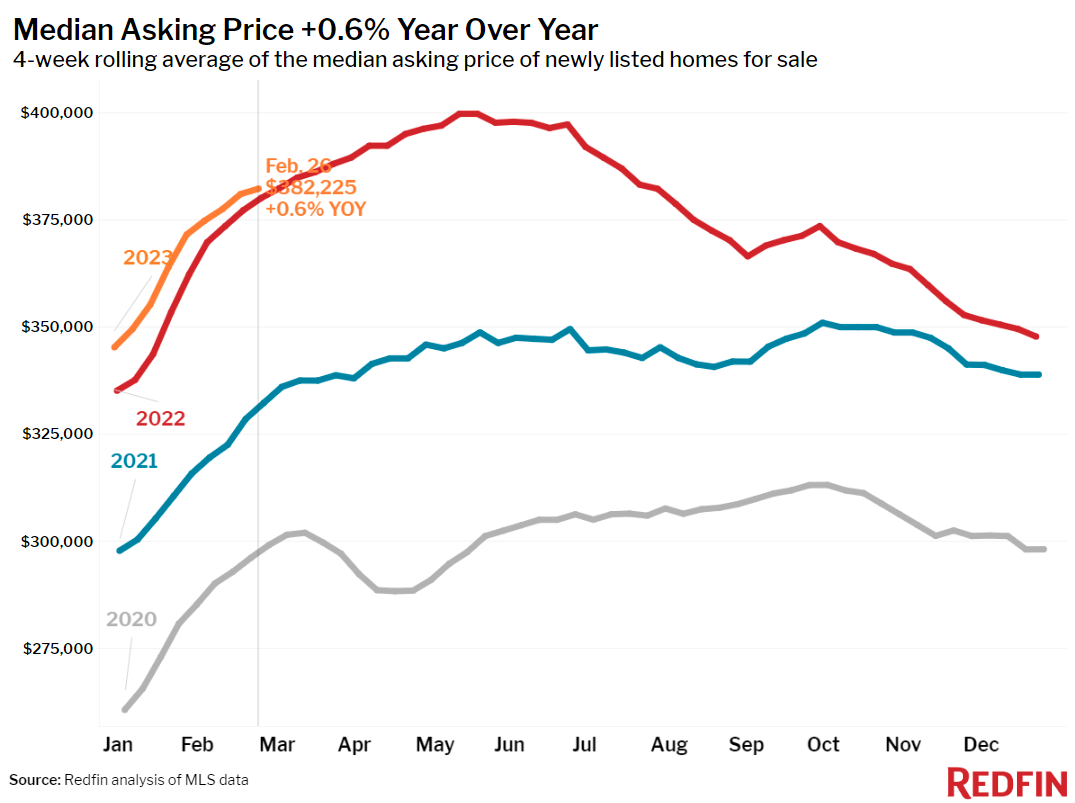

“Prices falling from a year ago is a milestone because it hasn’t happened since the housing market was recovering from the 2008 subprime mortgage crisis. But it’s not surprising and in many ways, it’s welcome,” said Redfin Deputy Chief Economist Taylor Marr. “Home prices skyrocketed so much over the last few years that they were likely to come down once rates rose from historic lows. Mortgage rates rising to the 7% range was the straw that broke the camel’s back, dampening homebuying demand and leading to sellers asking less for their home.”

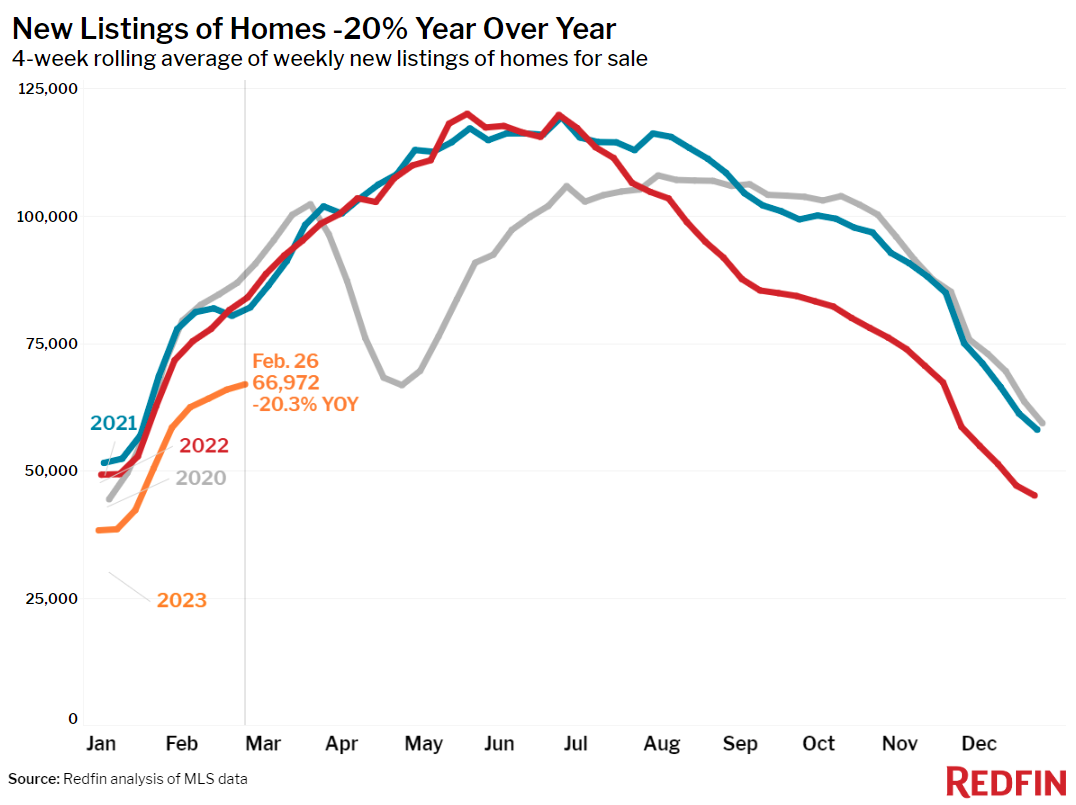

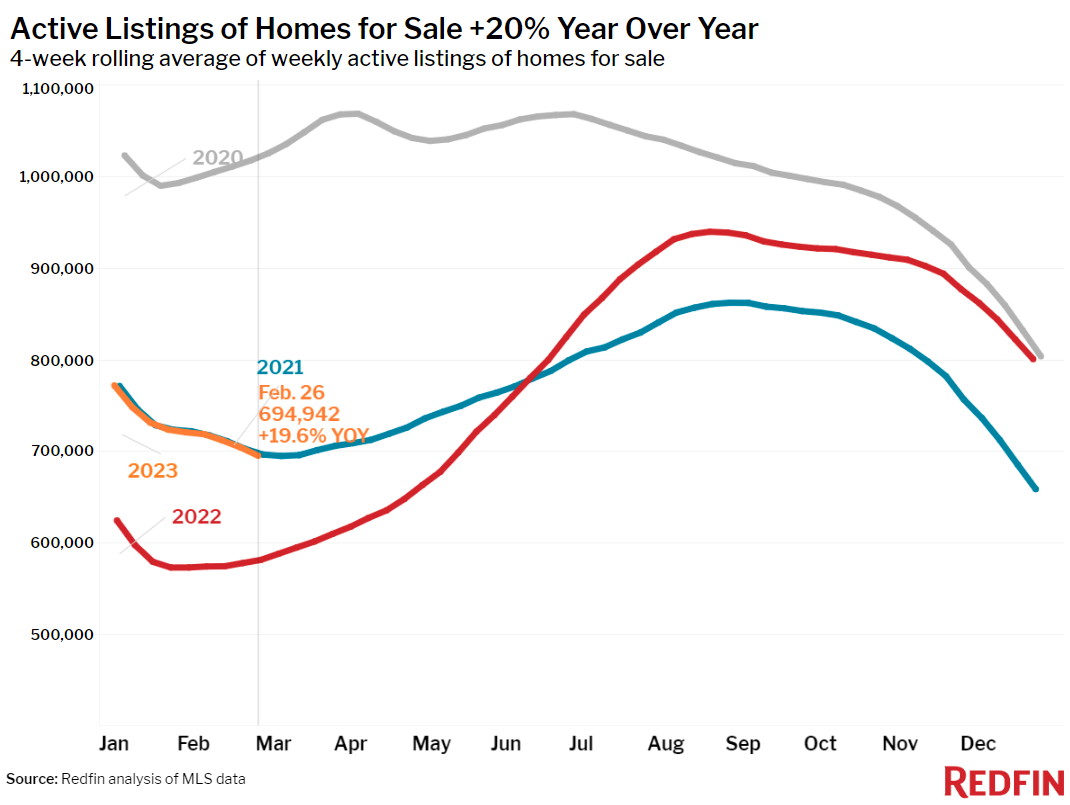

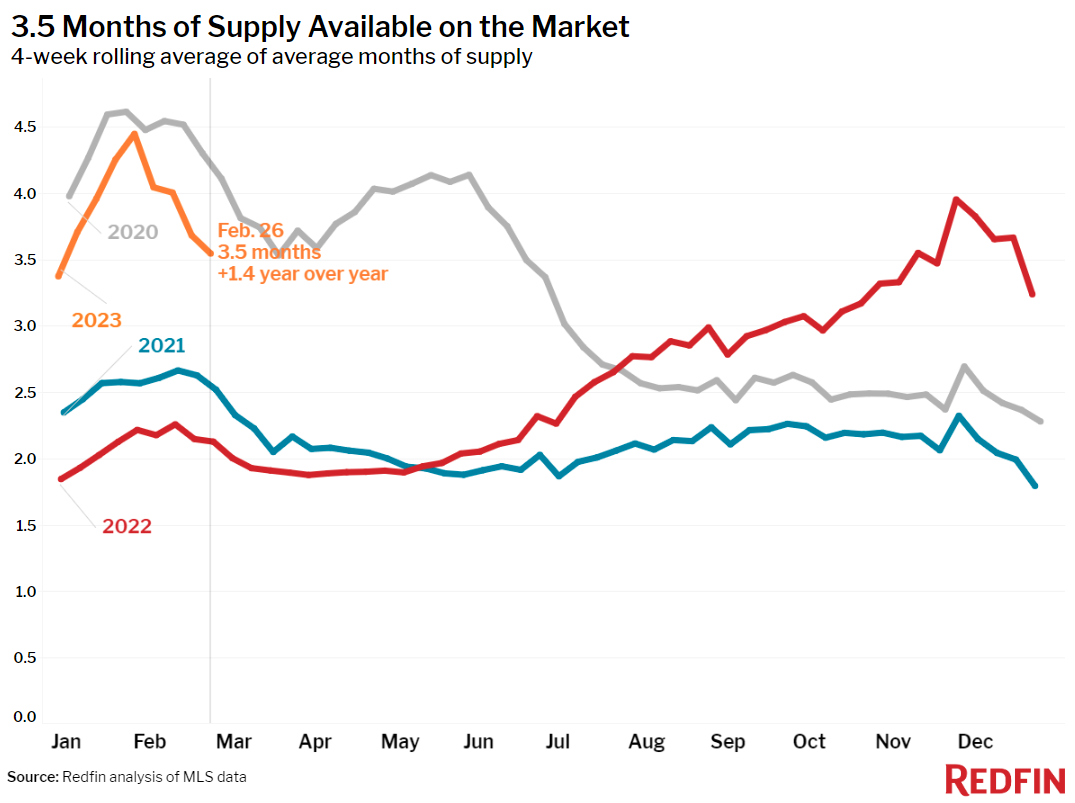

“Prices will probably decline a bit more in the coming months, but first-time buyers hoping to score a major deal this year are likely out of luck,” Marr continued. “That’s because so few homeowners are listing their homes for sale. Limited inventory and continued interest in turnkey homes in desirable neighborhoods will keep prices somewhat propped up–and high rates will continue to be a hit on affordability.”

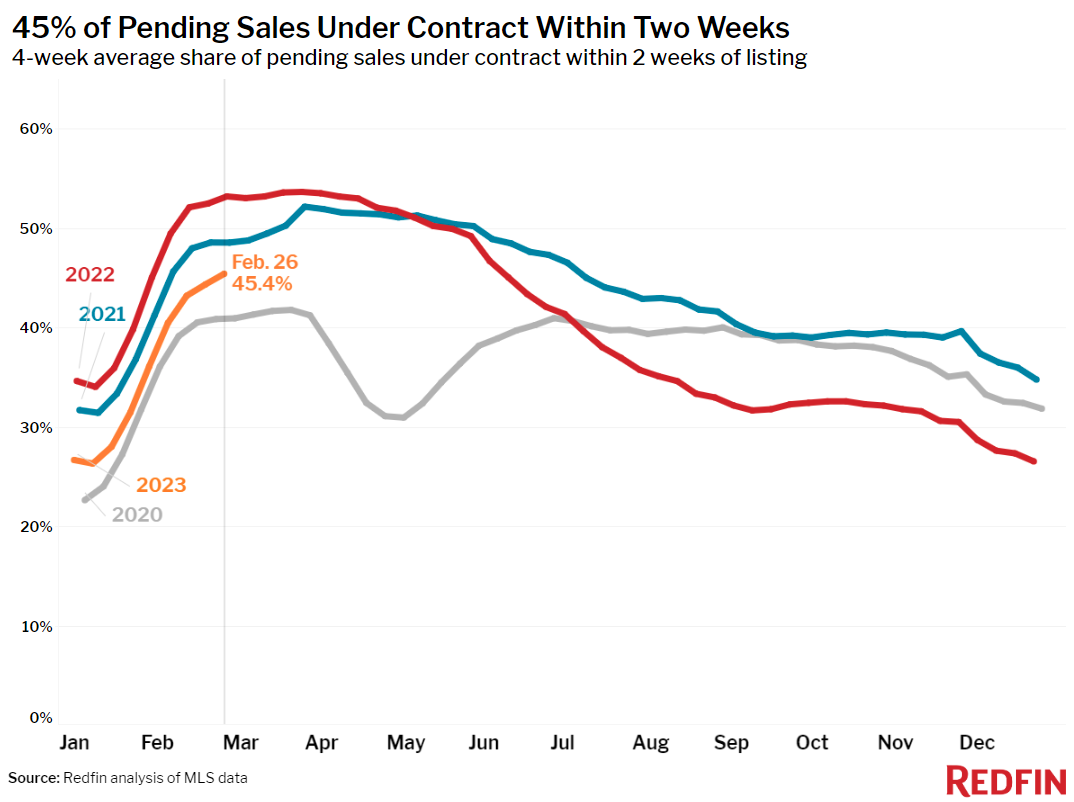

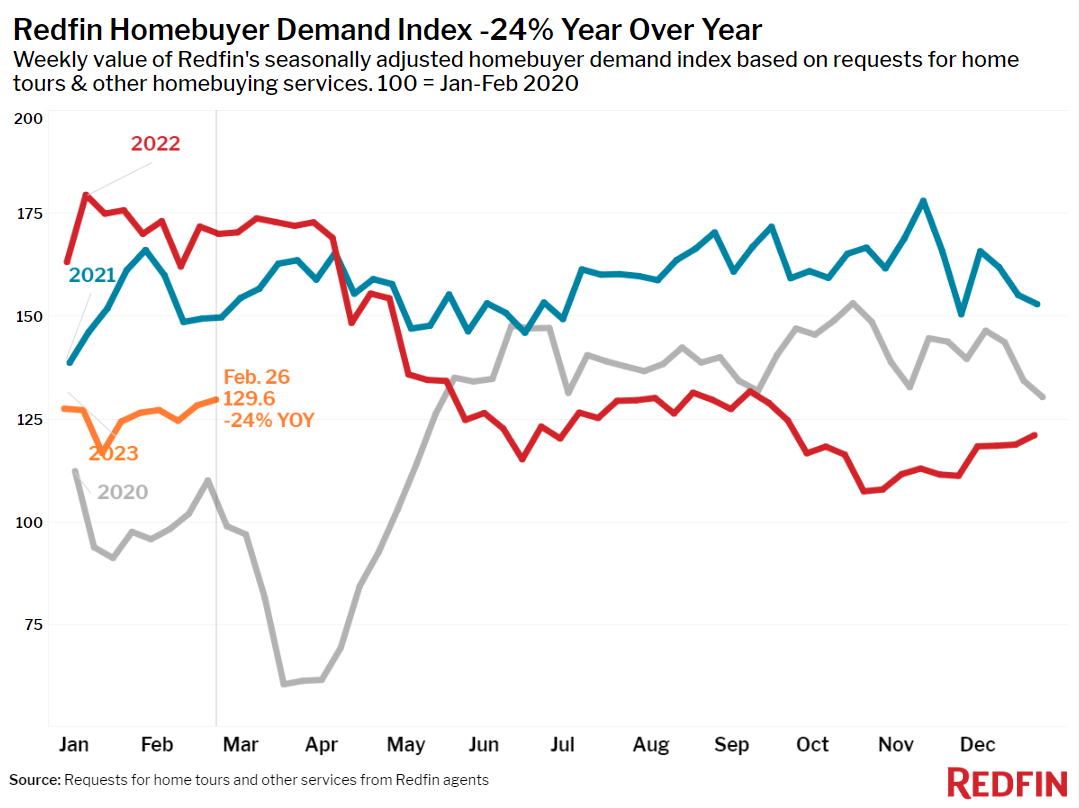

Although homebuying demand is down from last year, it’s still up from last fall’s low point. Redfin’s Homebuyer Demand Index–a measure of requests for home tours and other services from Redfin agents–hit its highest level since September; online searches of homes for sale are also up significantly from their trough. Pending home sales posted their smallest decline since July. But mortgage-purchase applications have declined to their lowest level since the 1990s.

Unless otherwise noted, the data in this report covers the four-week period ending February 26. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.