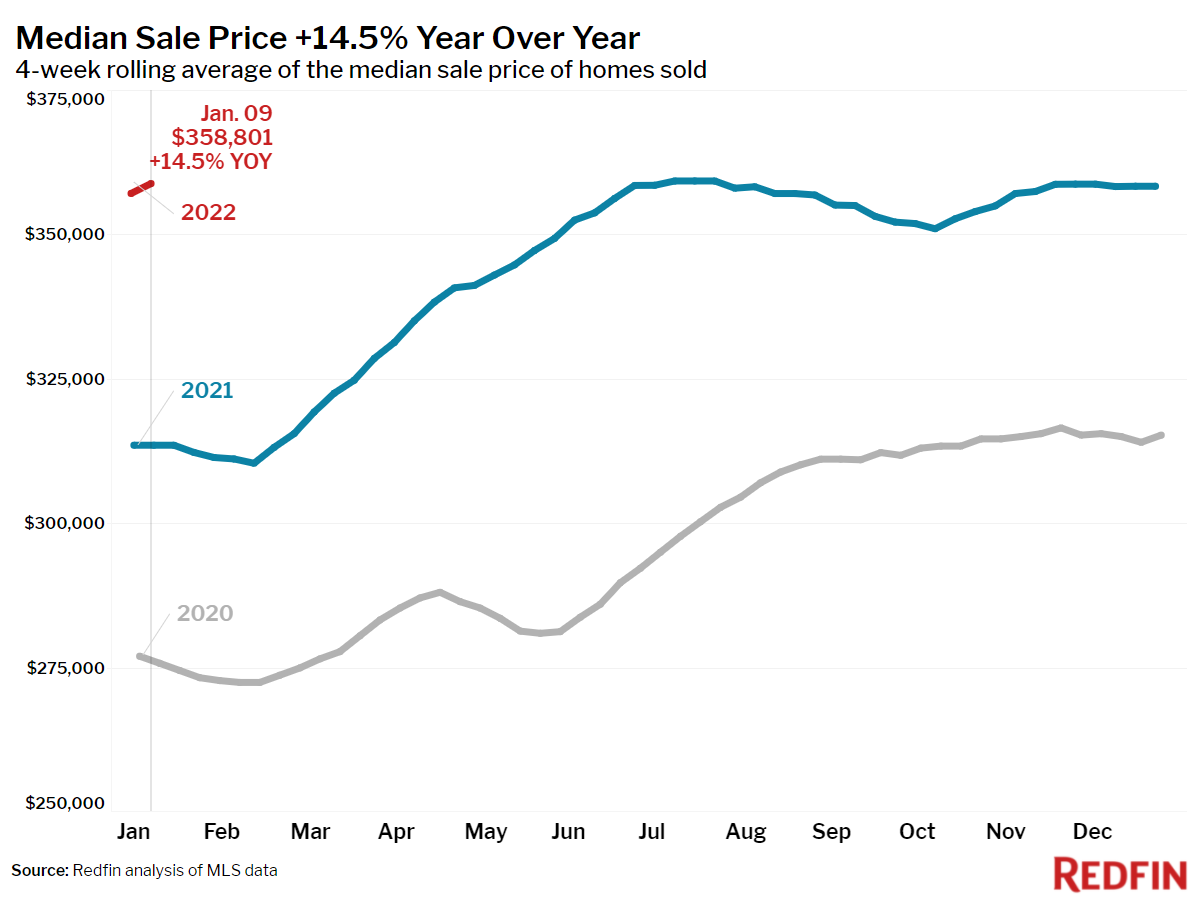

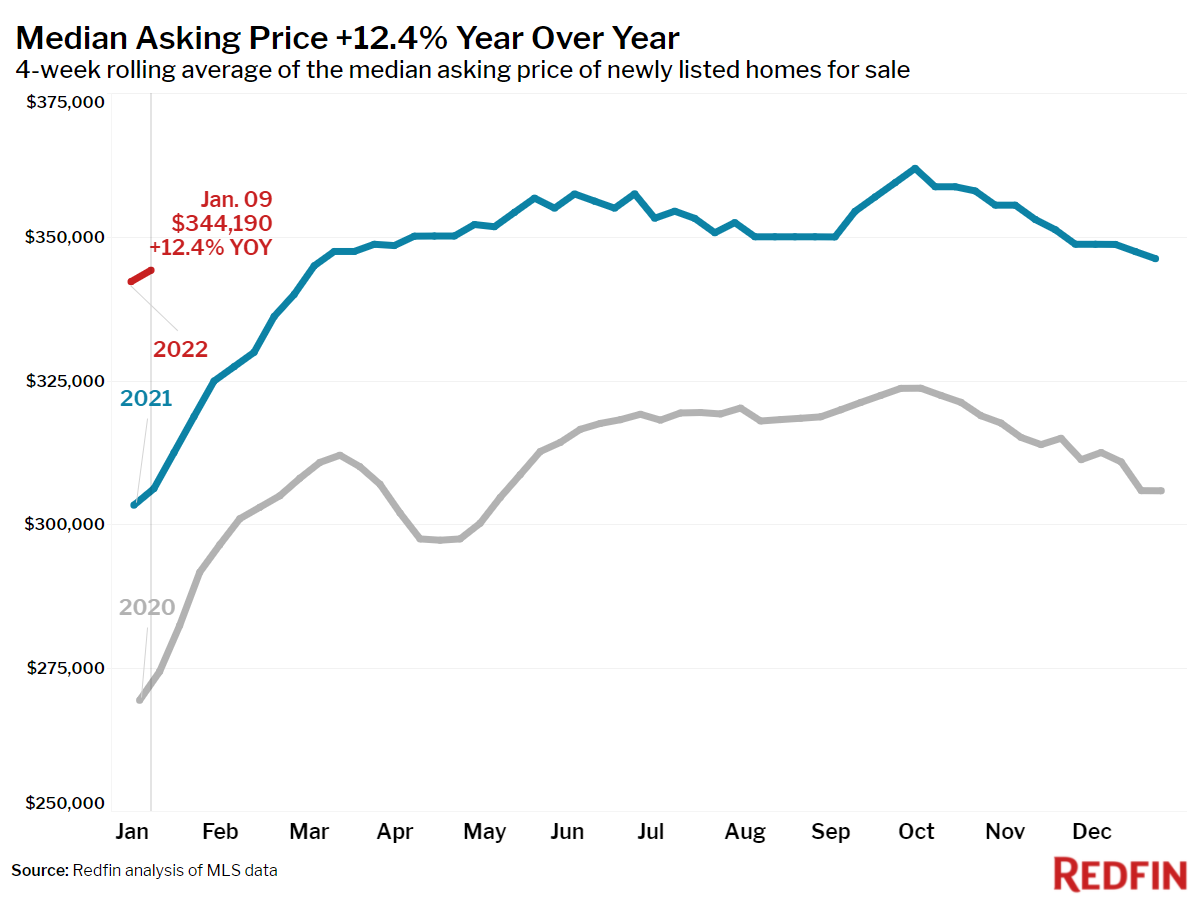

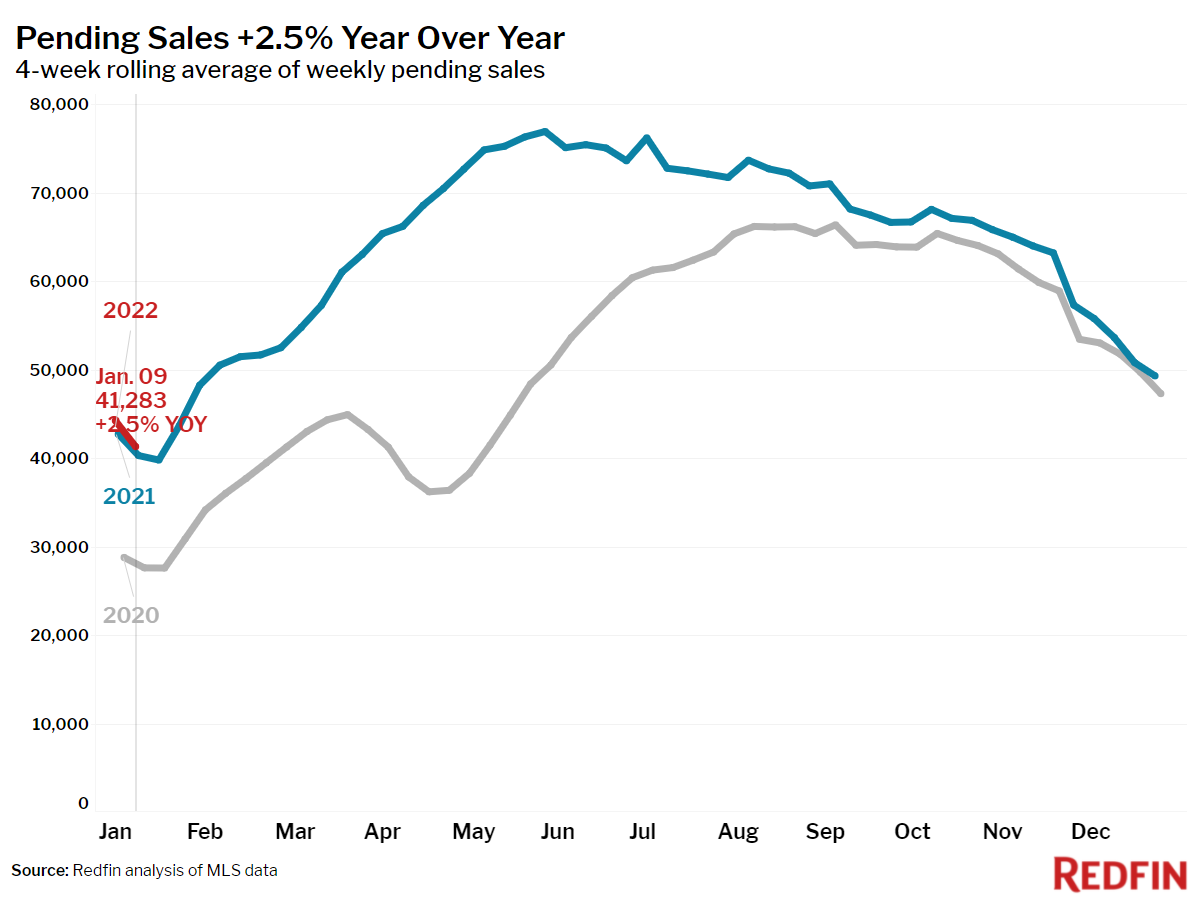

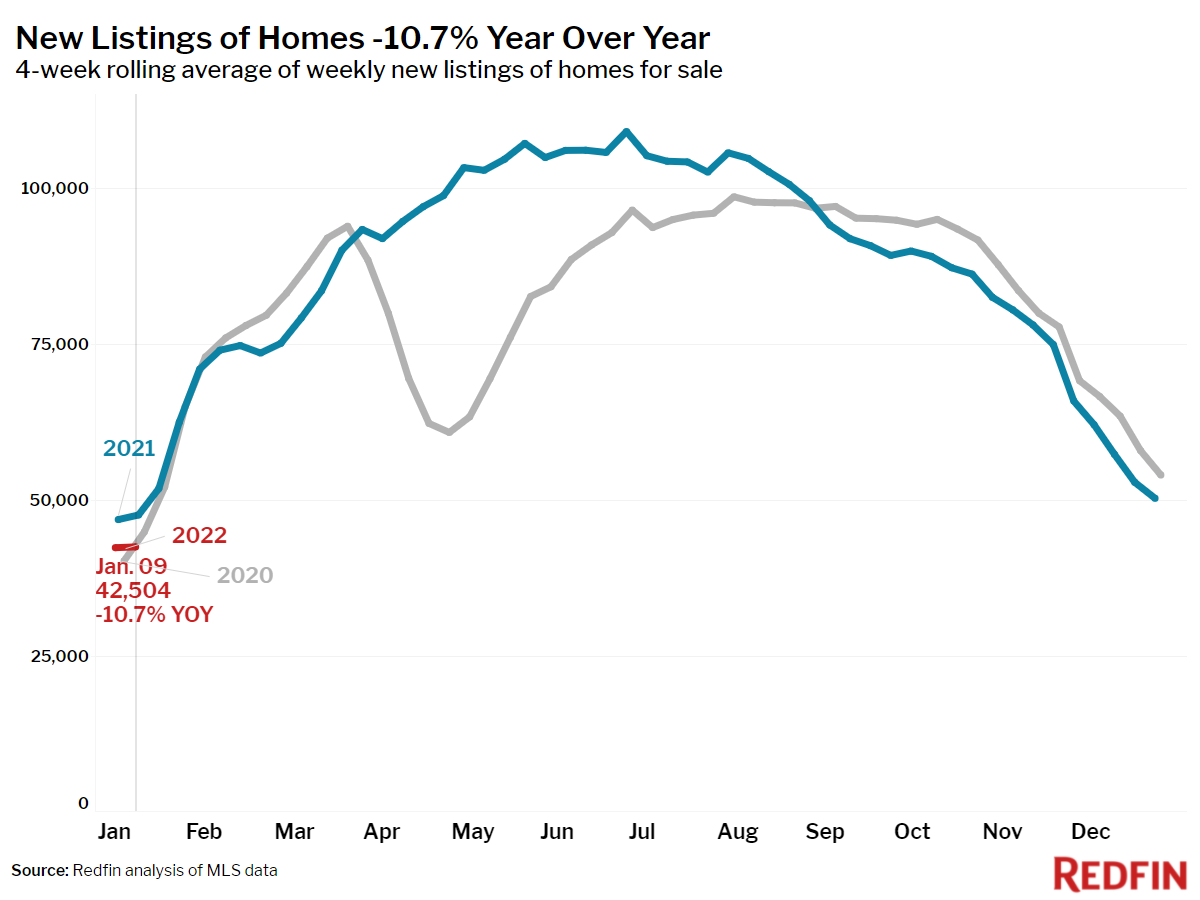

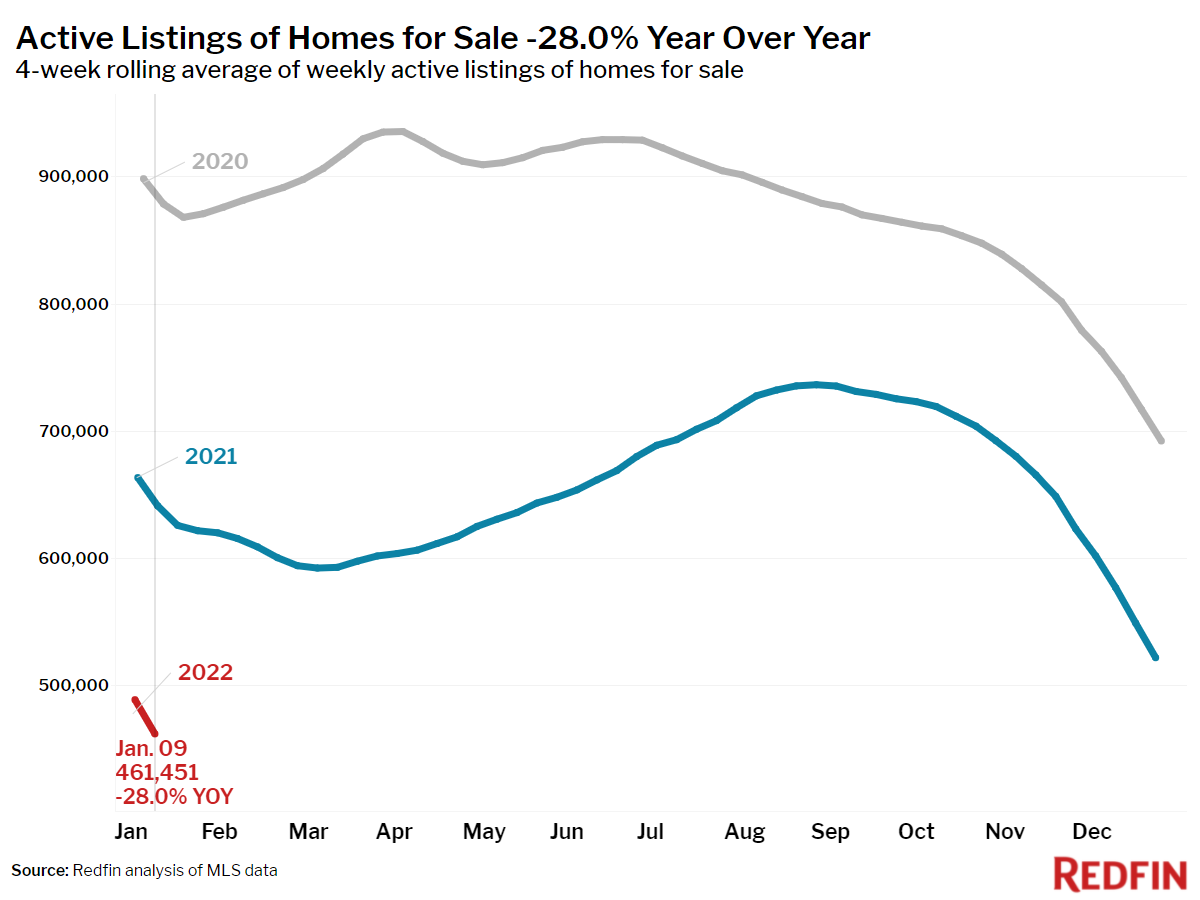

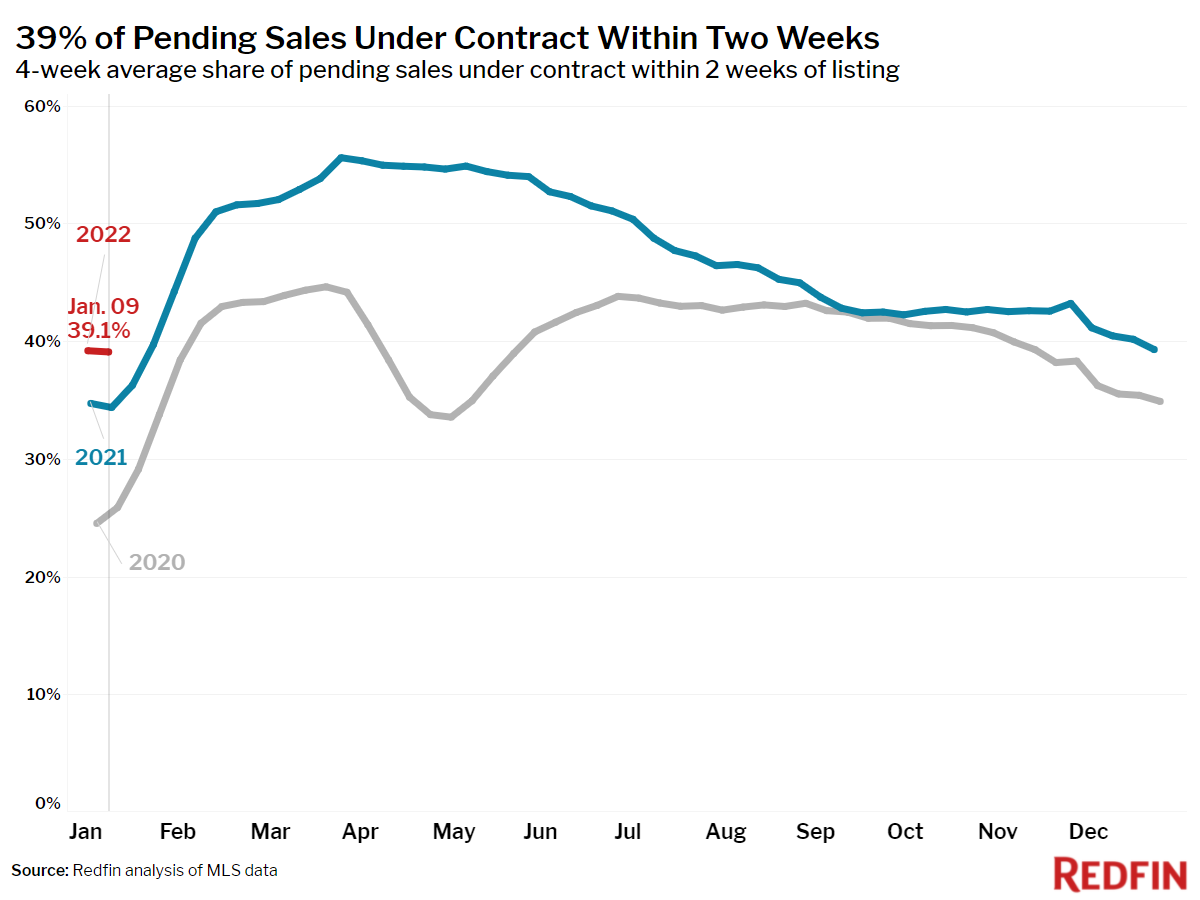

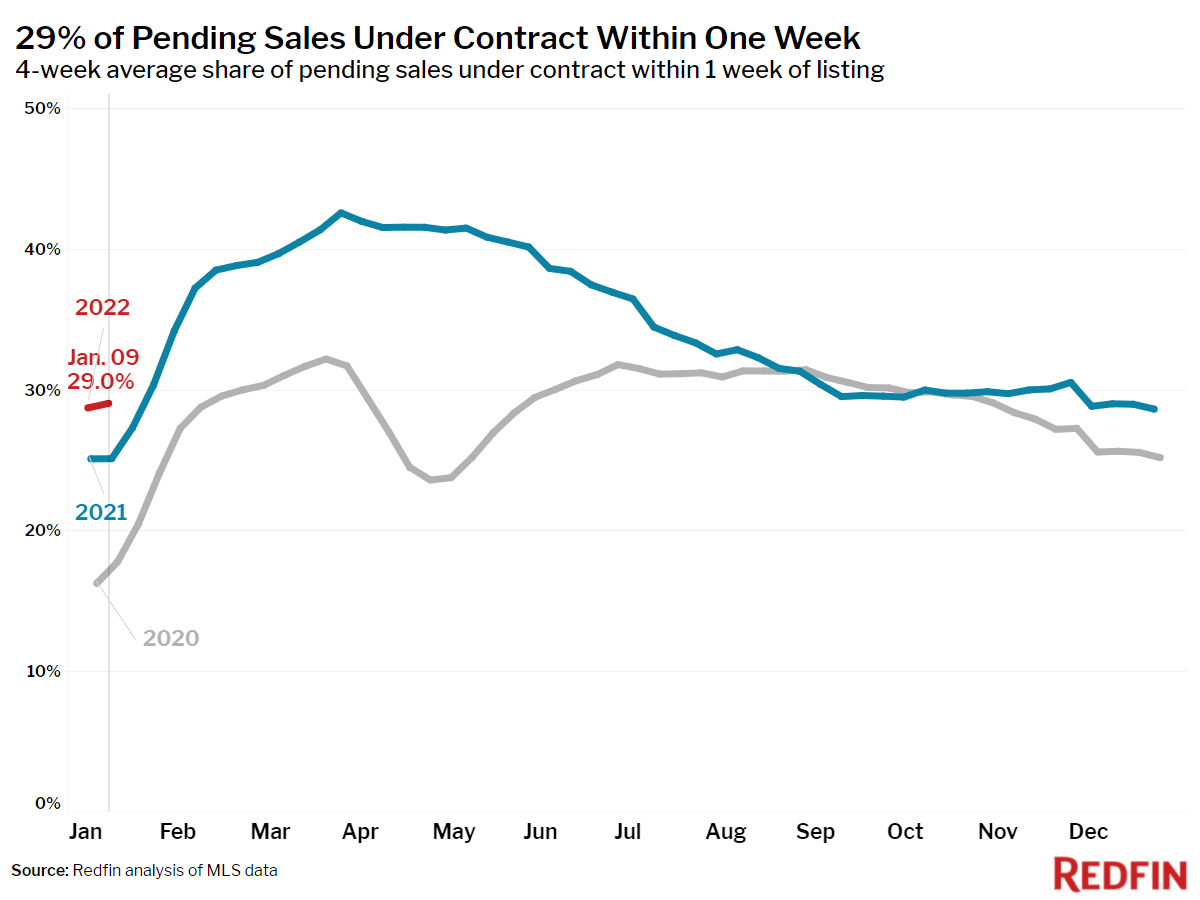

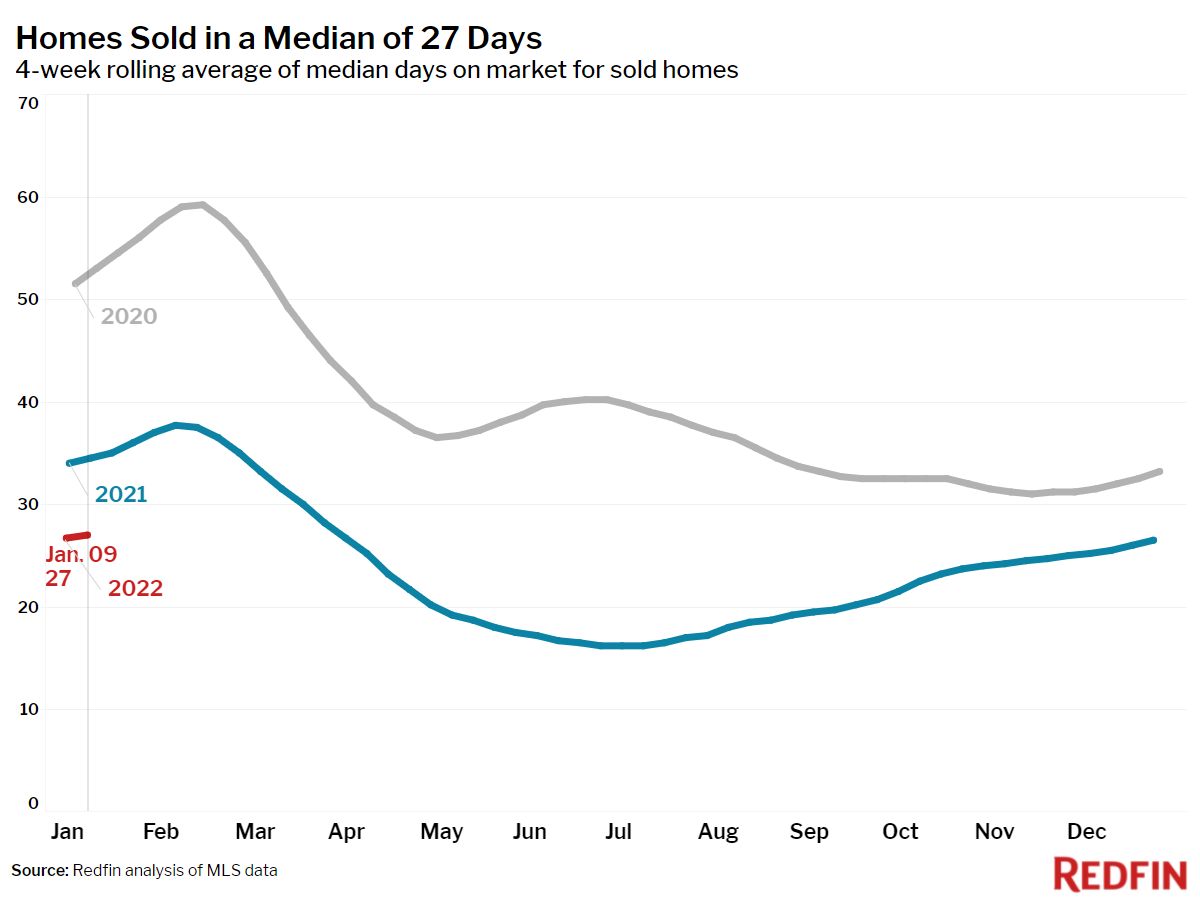

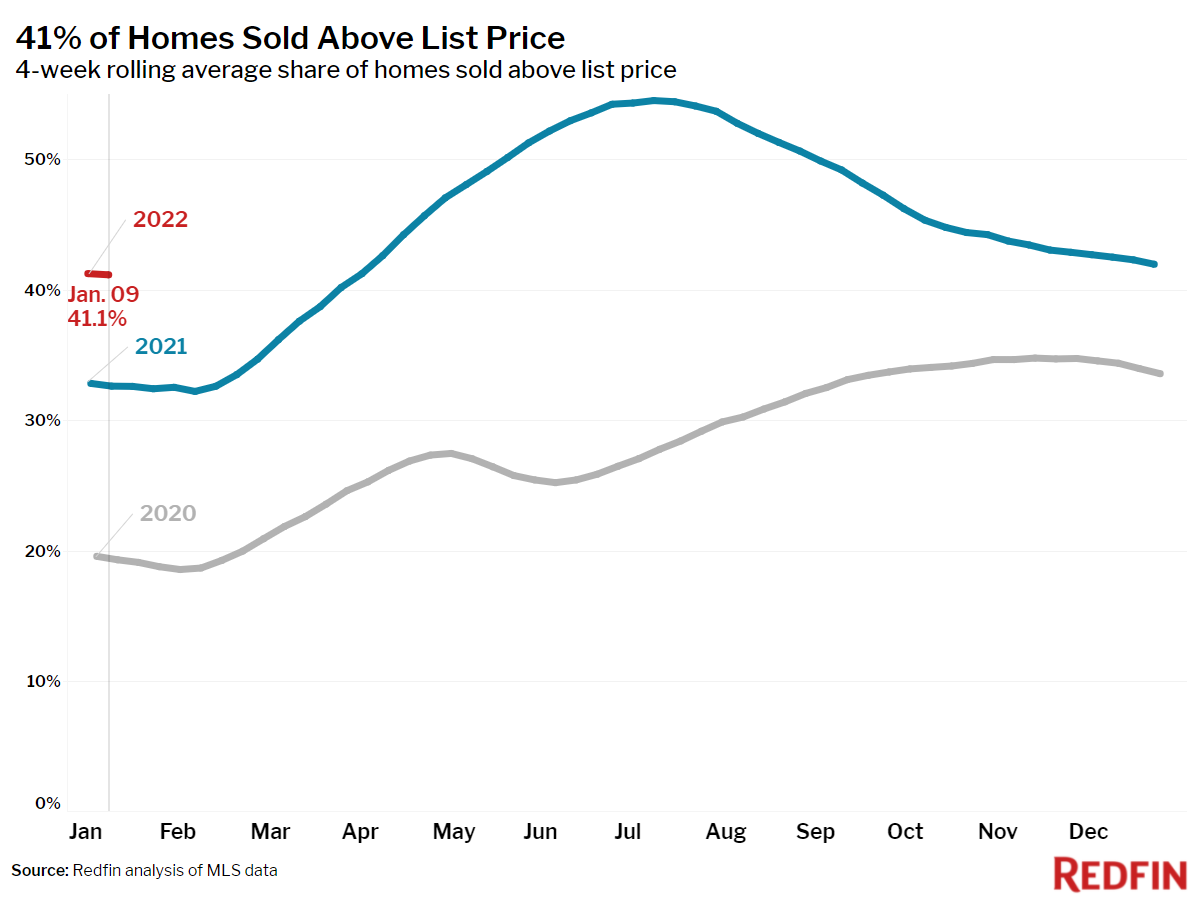

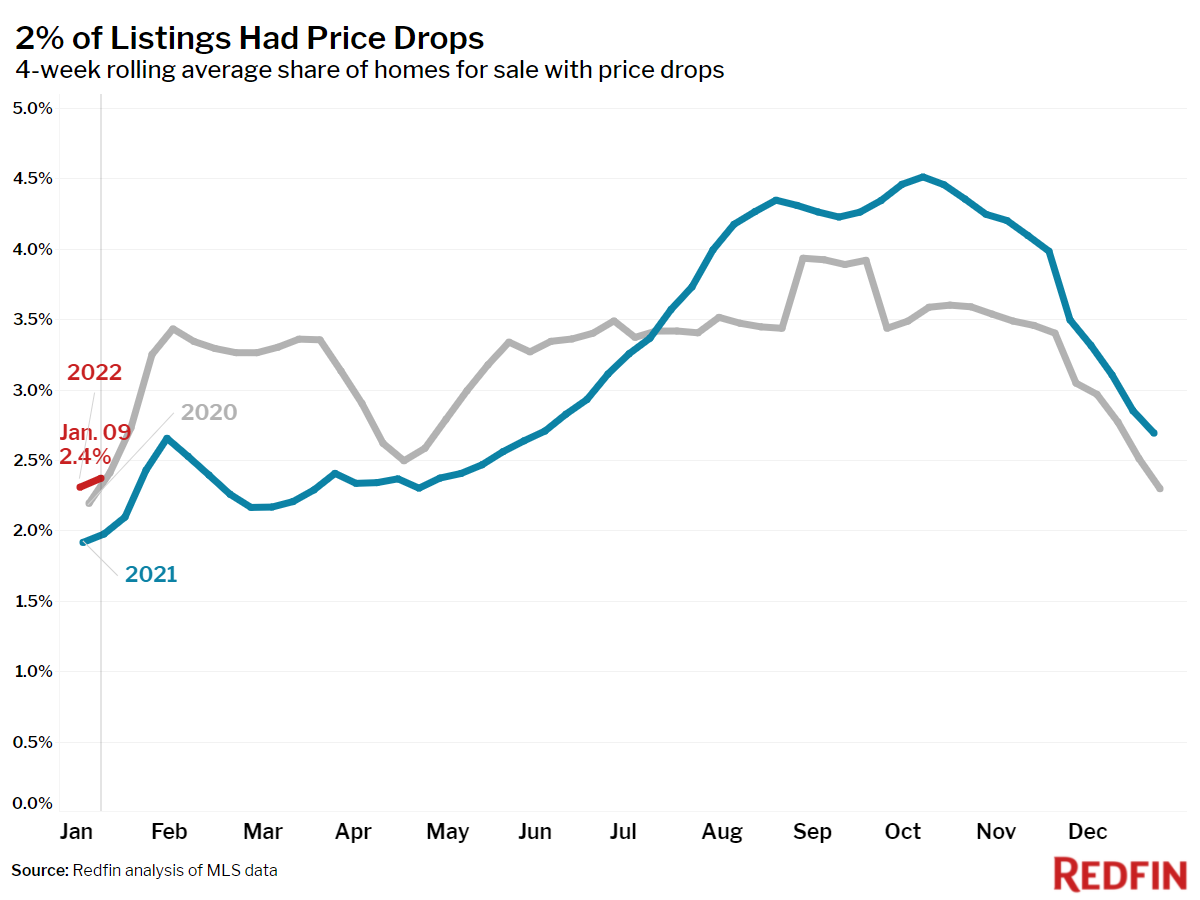

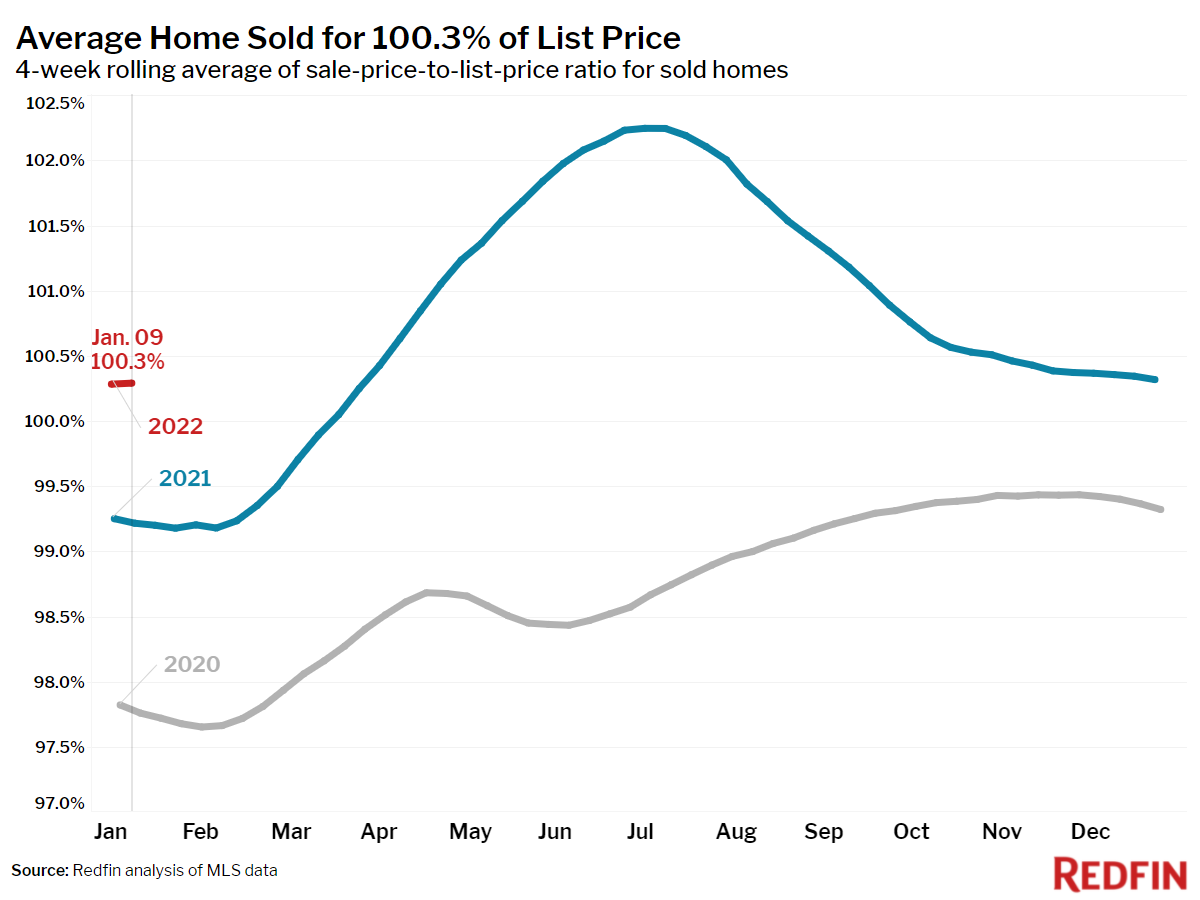

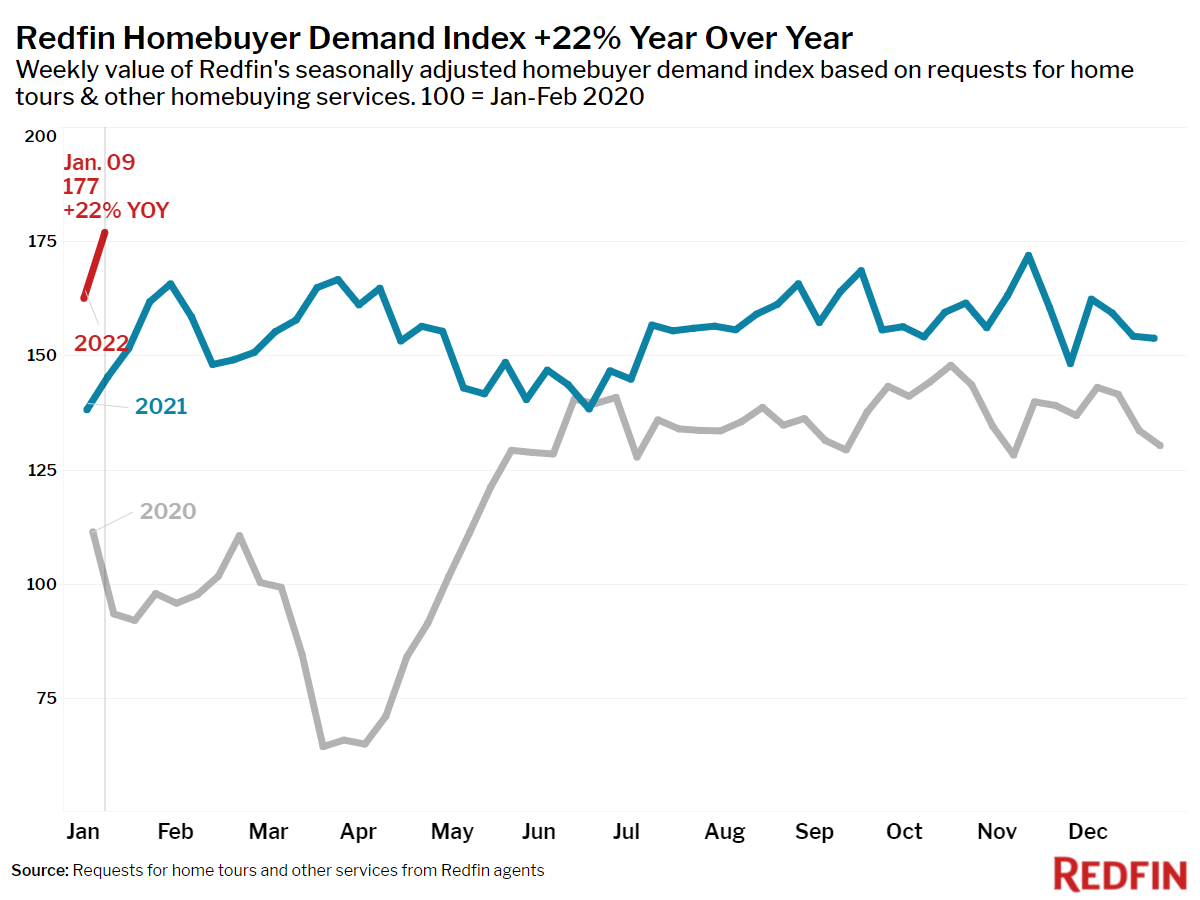

The median home sale price surged 16% year over year during the week ending January 9 to an all-time high of $365,000. Prices keep climbing because the supply drought keeps deepening while demand increases. The number of homes for sale fell to a new low as listings hit the market at a slower rate than they did early last year. Yet homebuyer activity–as measured by the Redfin Homebuyer Demand Index–jumped 9%. Mortgage rates rose to 3.45% during the seven days ending January 13, making homebuying more expensive as overall inflation hit a 40-year high.

“The stage is now set for the most competitive January housing market in recorded history,” said Redfin Chief Economist Daryl Fairweather. “Buyers are pouring into the market to claim a home before mortgage rates rise further as new listings slow to a trickle. The conditions are becoming increasingly challenging for first-time homebuyers, who will have to compete against more experienced buyers who are willing to do whatever it takes to win. But I expect that by the time mortgage rates increase to 3.6%, competition will settle down quickly to levels similar to late-2018.”

“Homebuyers are touring nearly every home that comes on the market, waiving every contingency, offering $100,000 over asking price, and still losing out to 9+ other offers,” said Portland Redfin real estate agent Jennifer Ciacci. “As competitive as the market is right now, I advise buyers not to write an offer on a home they don’t really like. The home needs to work for what they want and need, and if it checks off those boxes, that’s when you go all-in and take your best shot. But protect your heart; this isn’t an easy market.”

Unless otherwise noted, the data in this report covers the four-week period ending January 9. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.