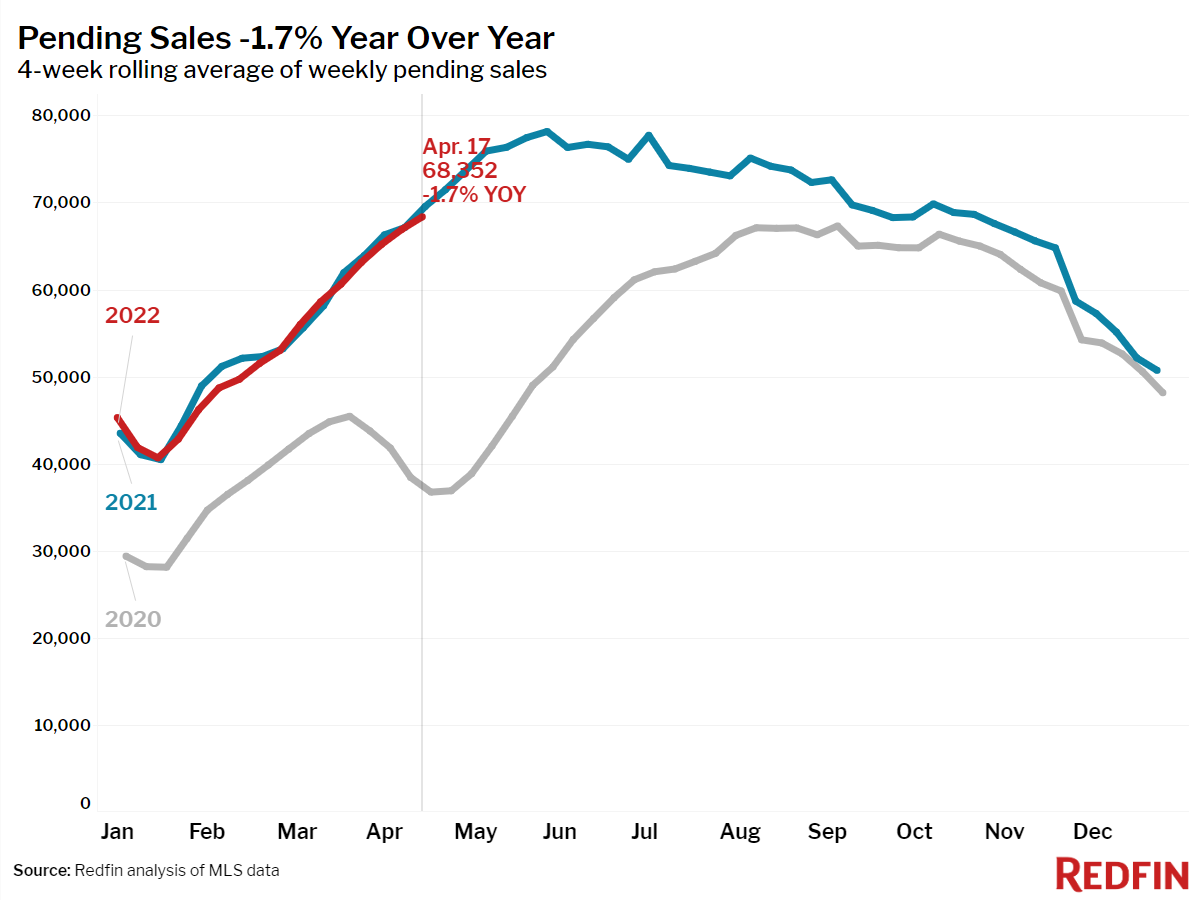

Homebuyer demand softened further over the last several weeks as a typical slump in buying and selling over Easter and Passover weekend amplified a recent slowdown triggered by surging mortgage rates and housing costs.

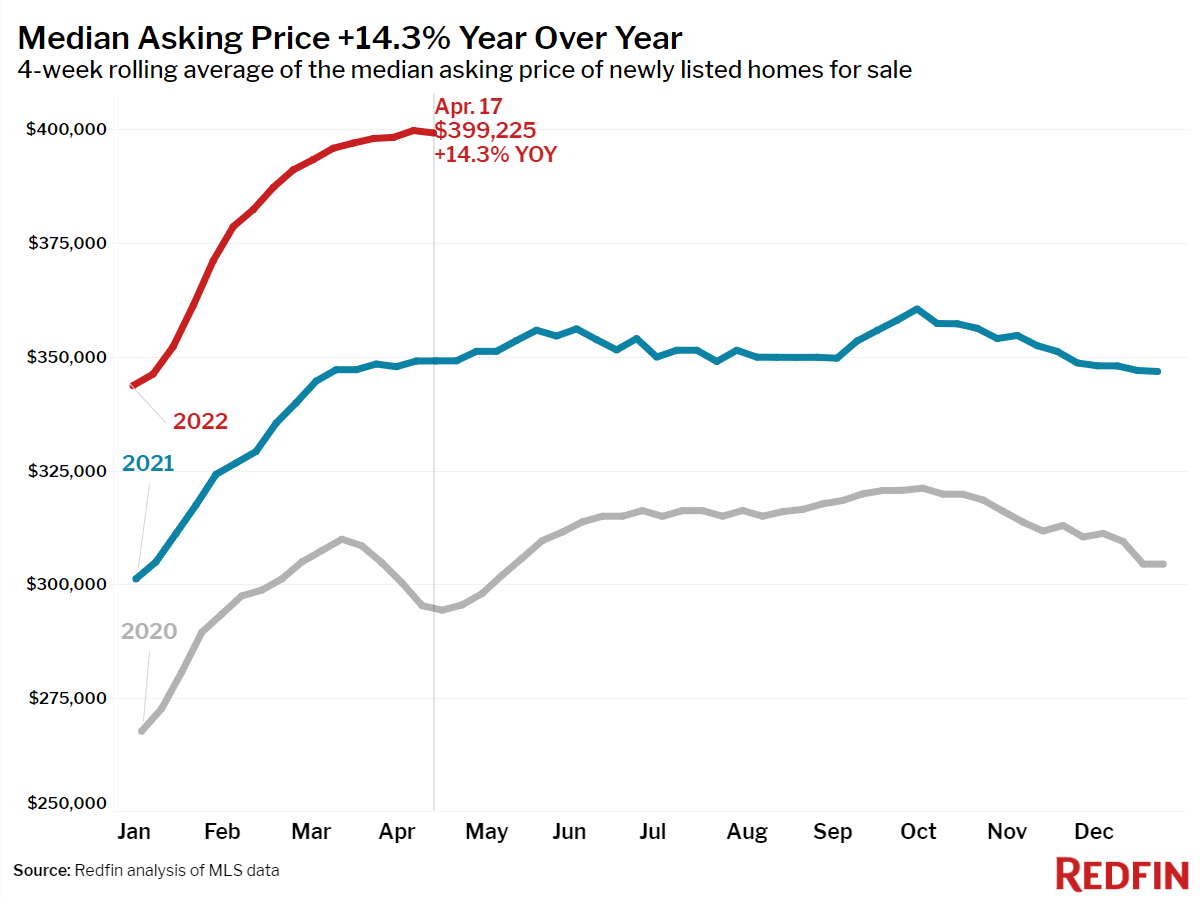

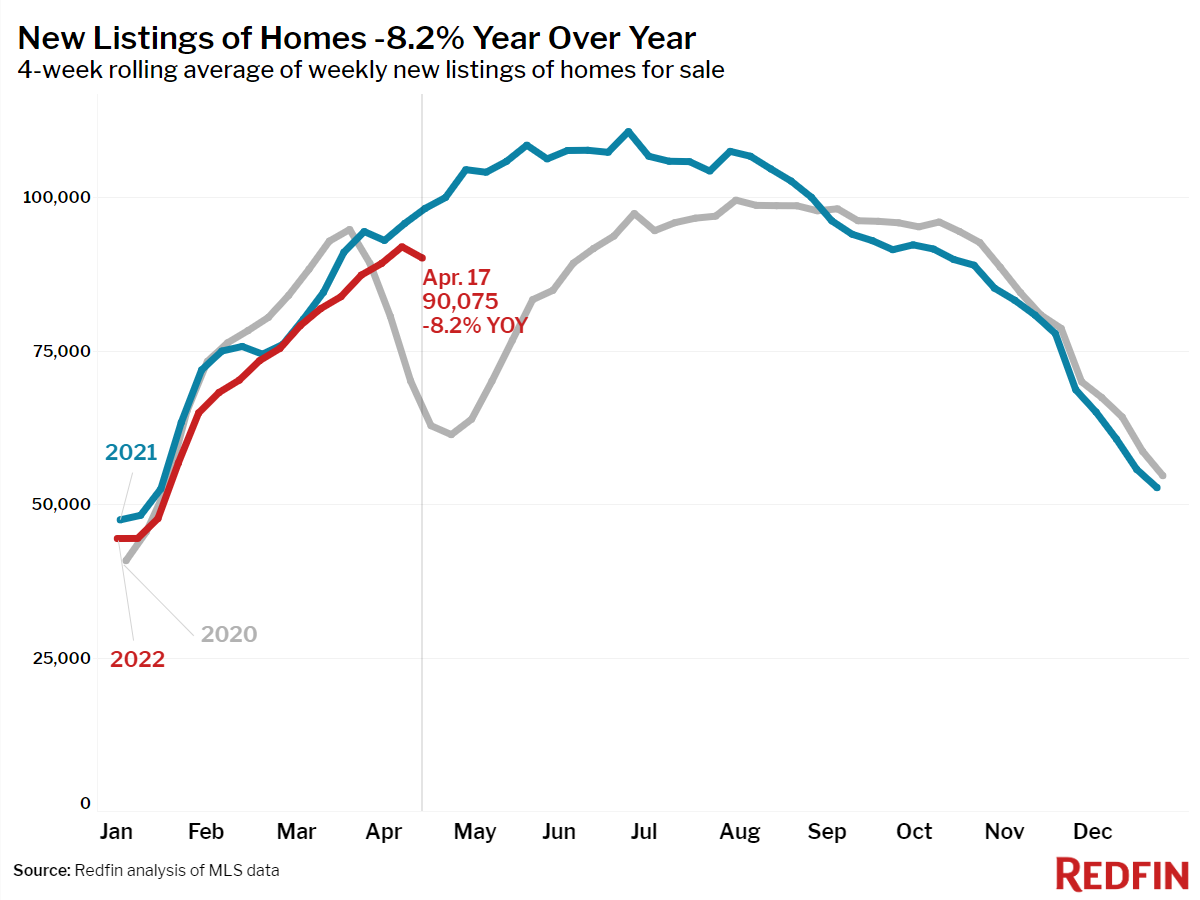

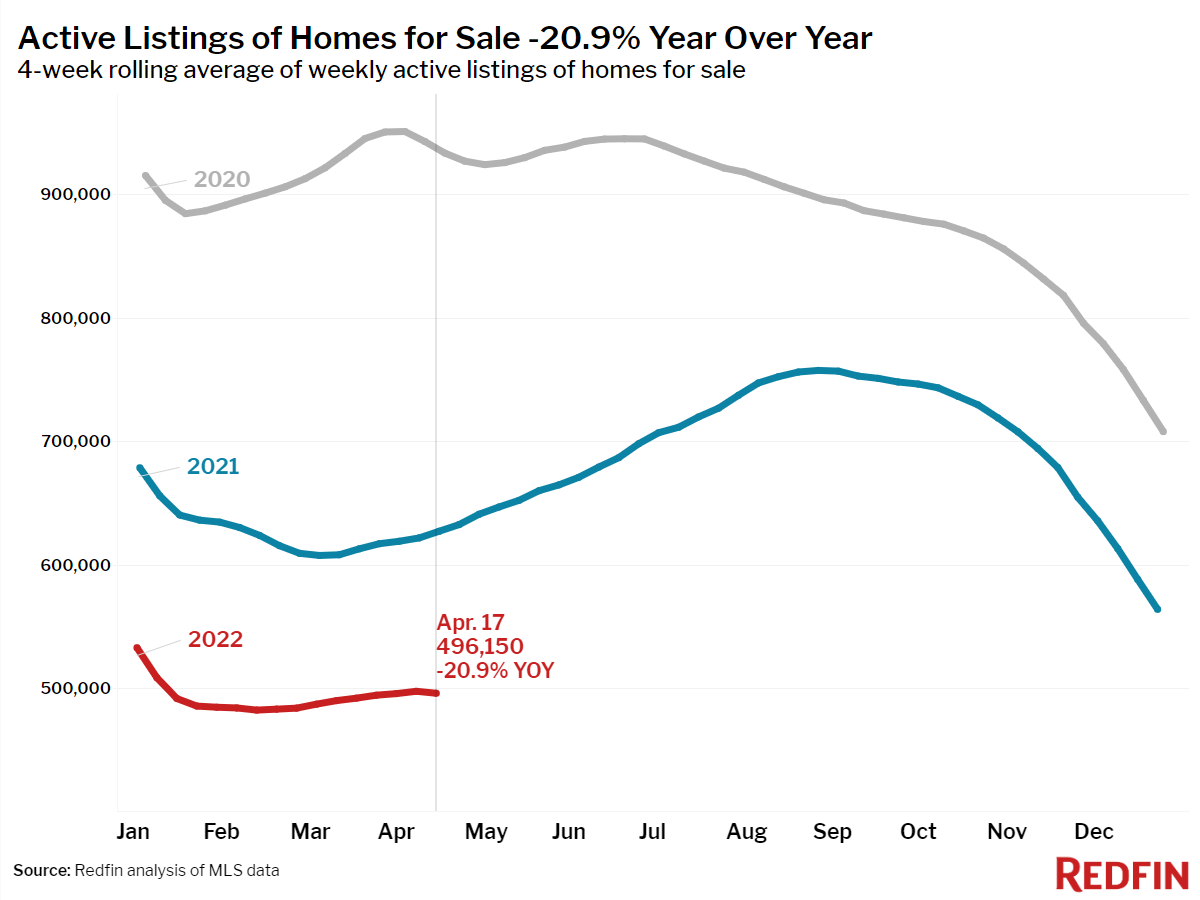

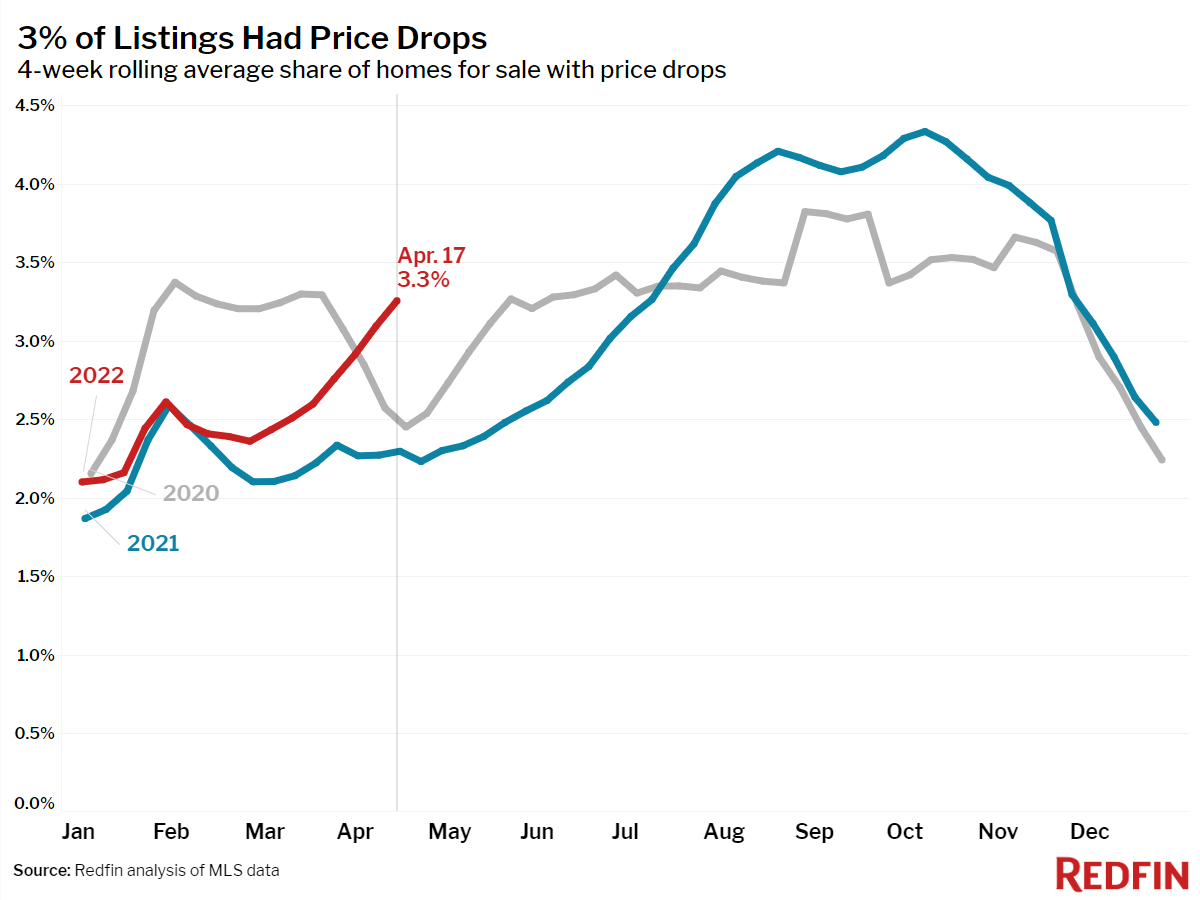

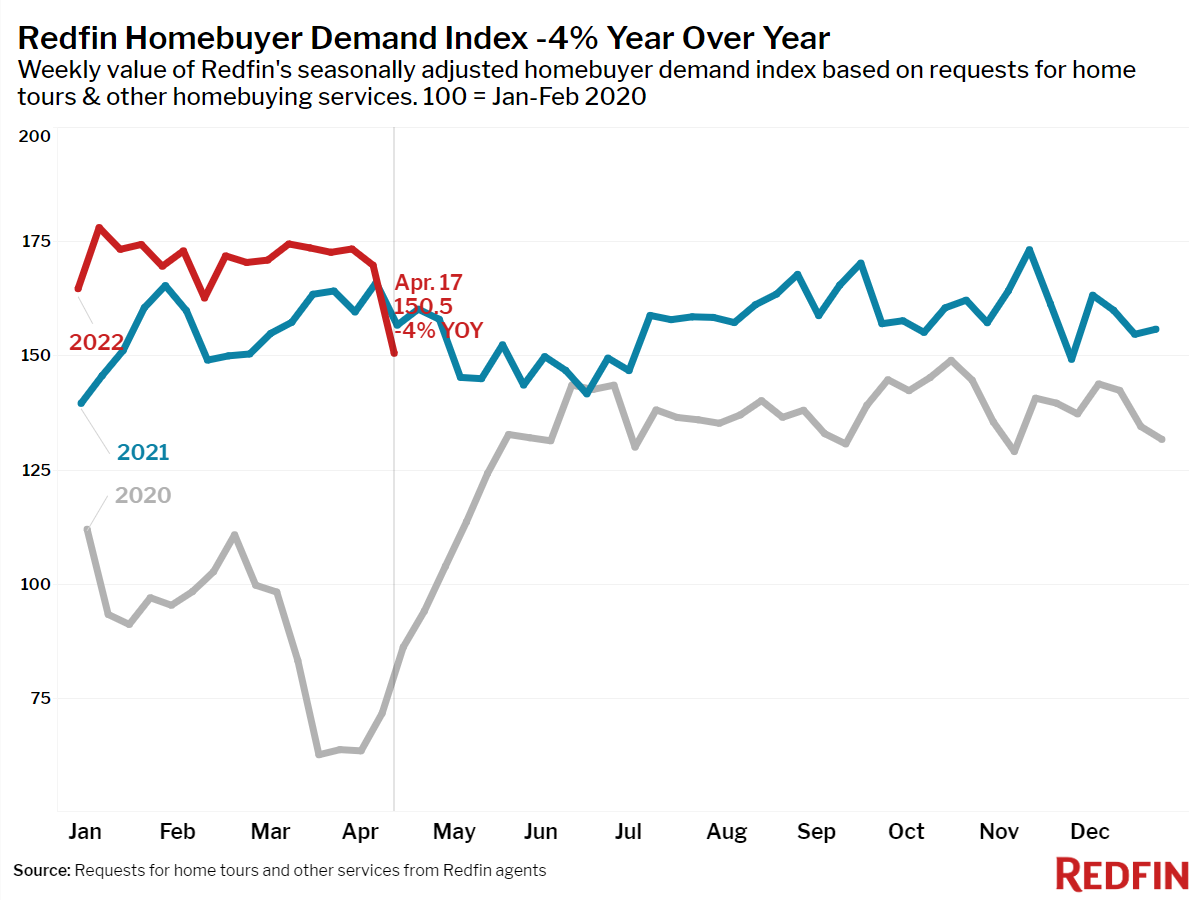

Roughly 1 in 8 sellers cut their list prices during the four weeks ending April 17—the highest share in five months—and asking prices declined slightly from the previous four-week period. Redfin’s Homebuyer Demand Index—a measure of requests for home tours and other home-buying services from Redfin agents—fell 4% year over year during the holiday week in its first drop since June. Mortgage applications and online searches for “homes for sale” also slumped.

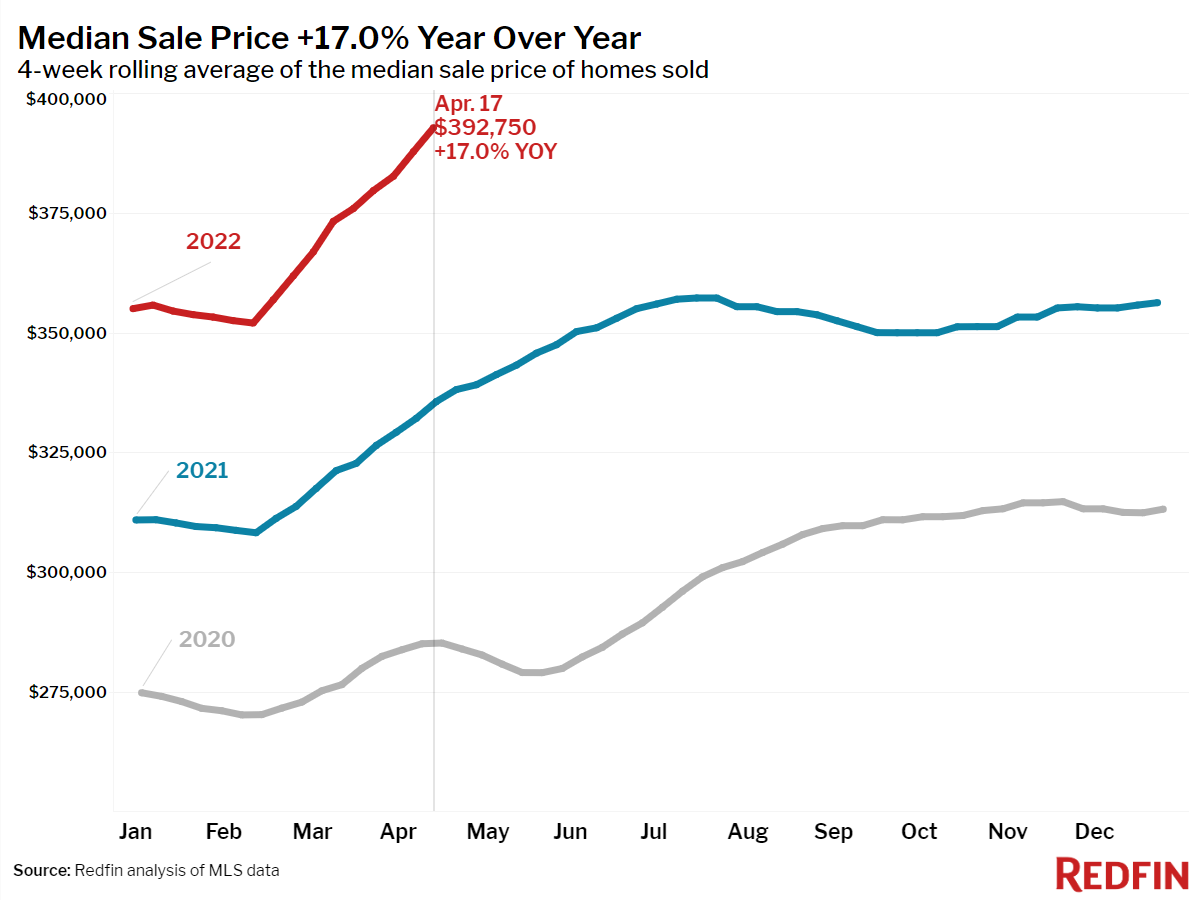

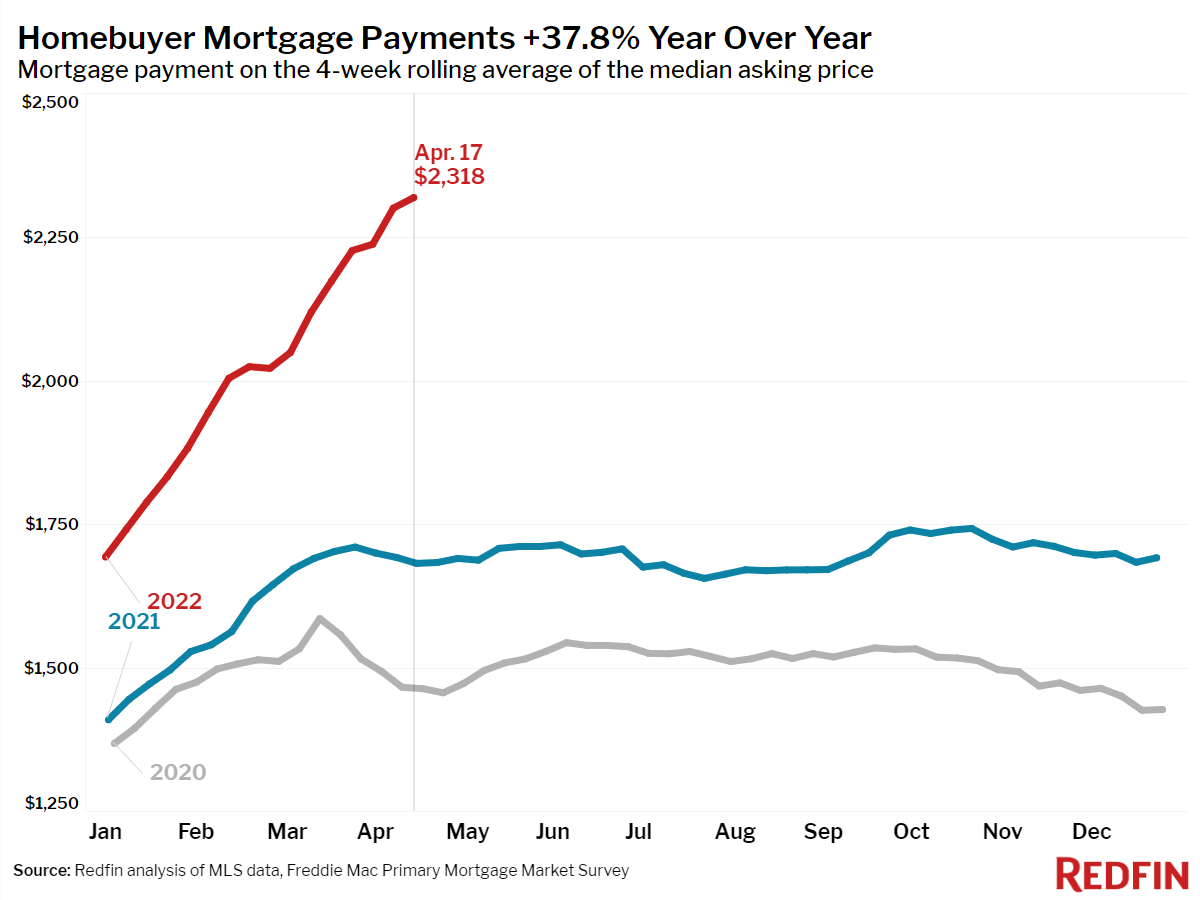

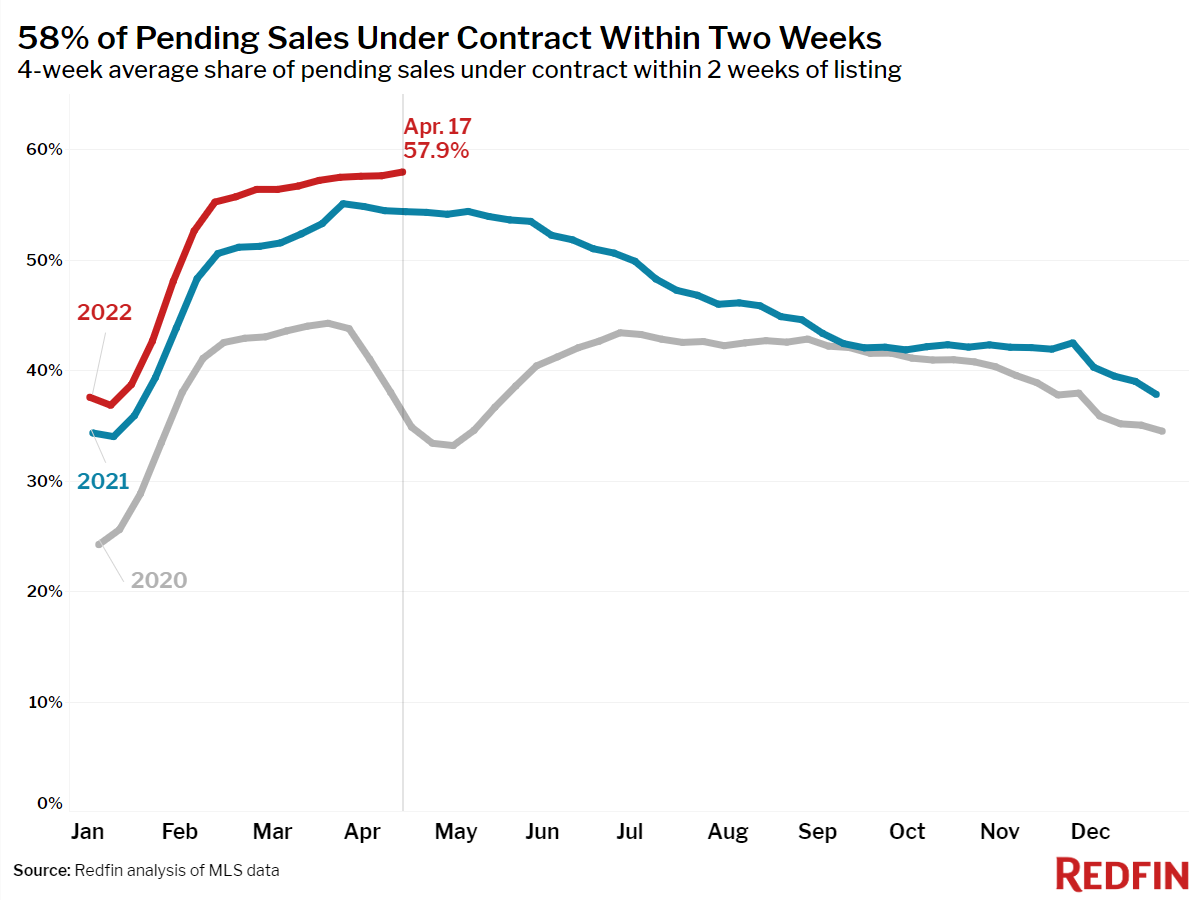

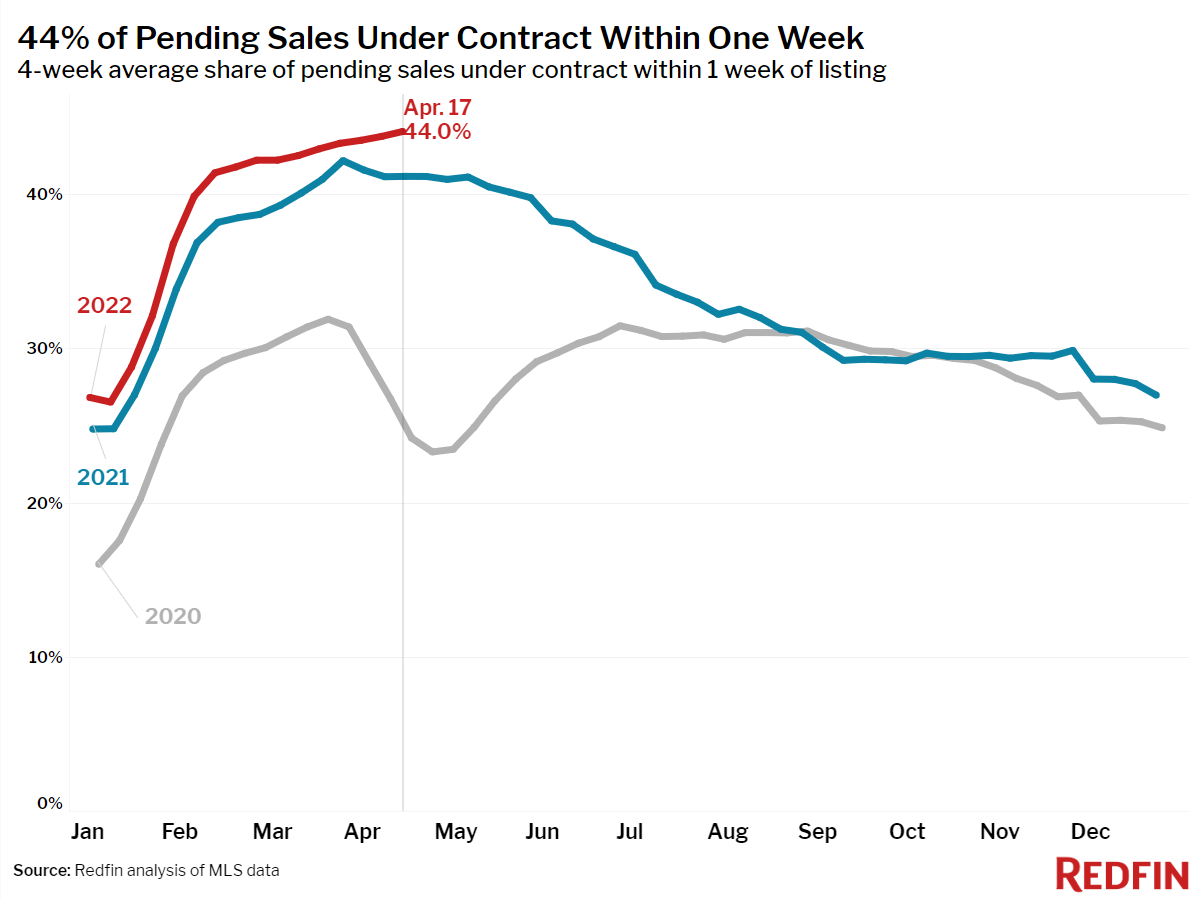

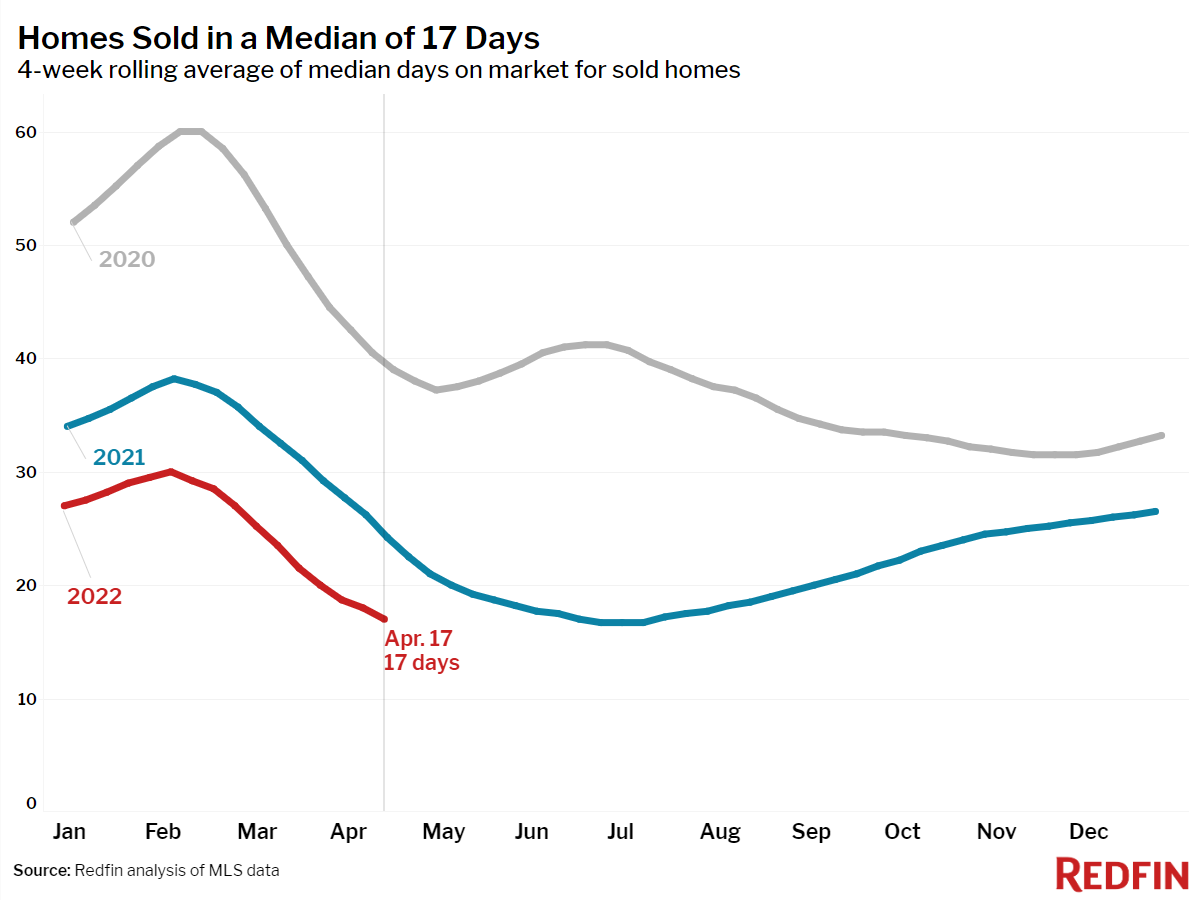

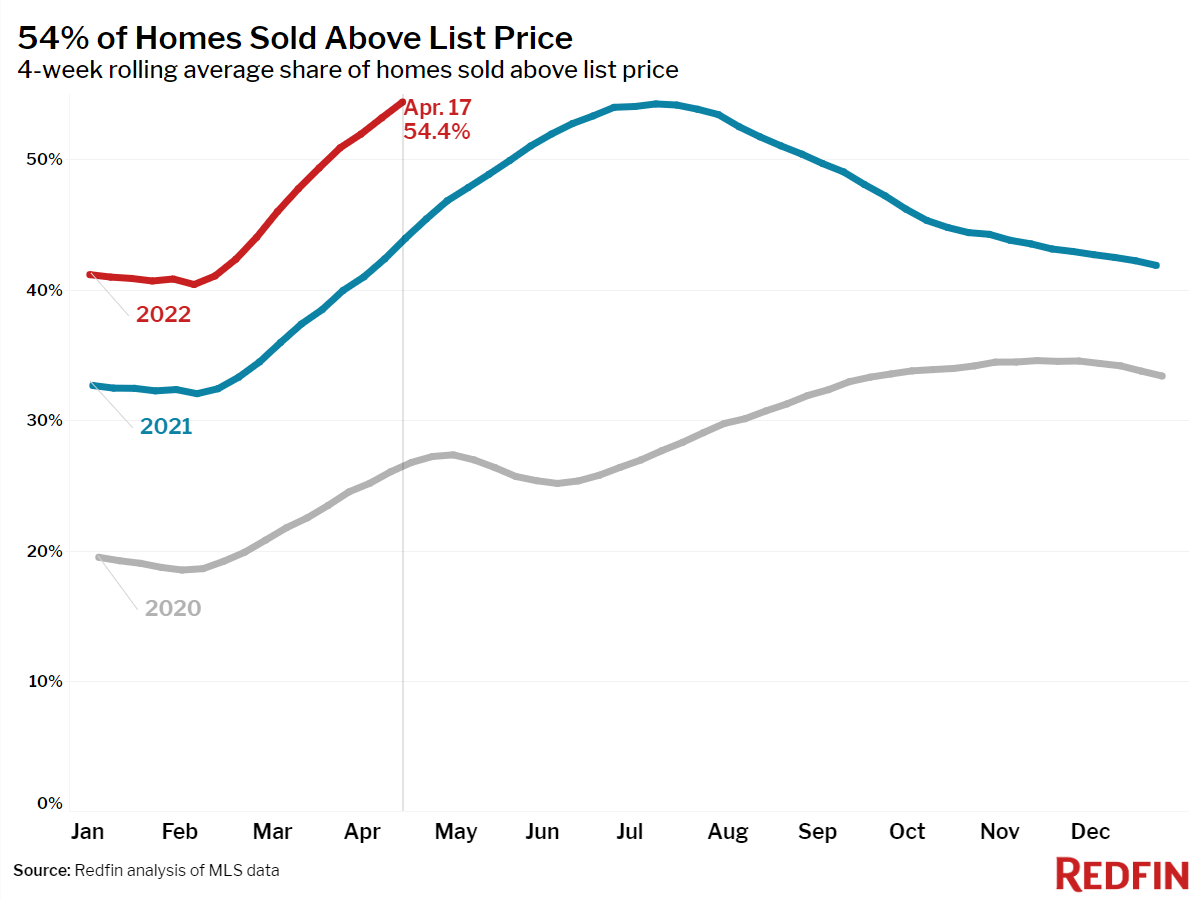

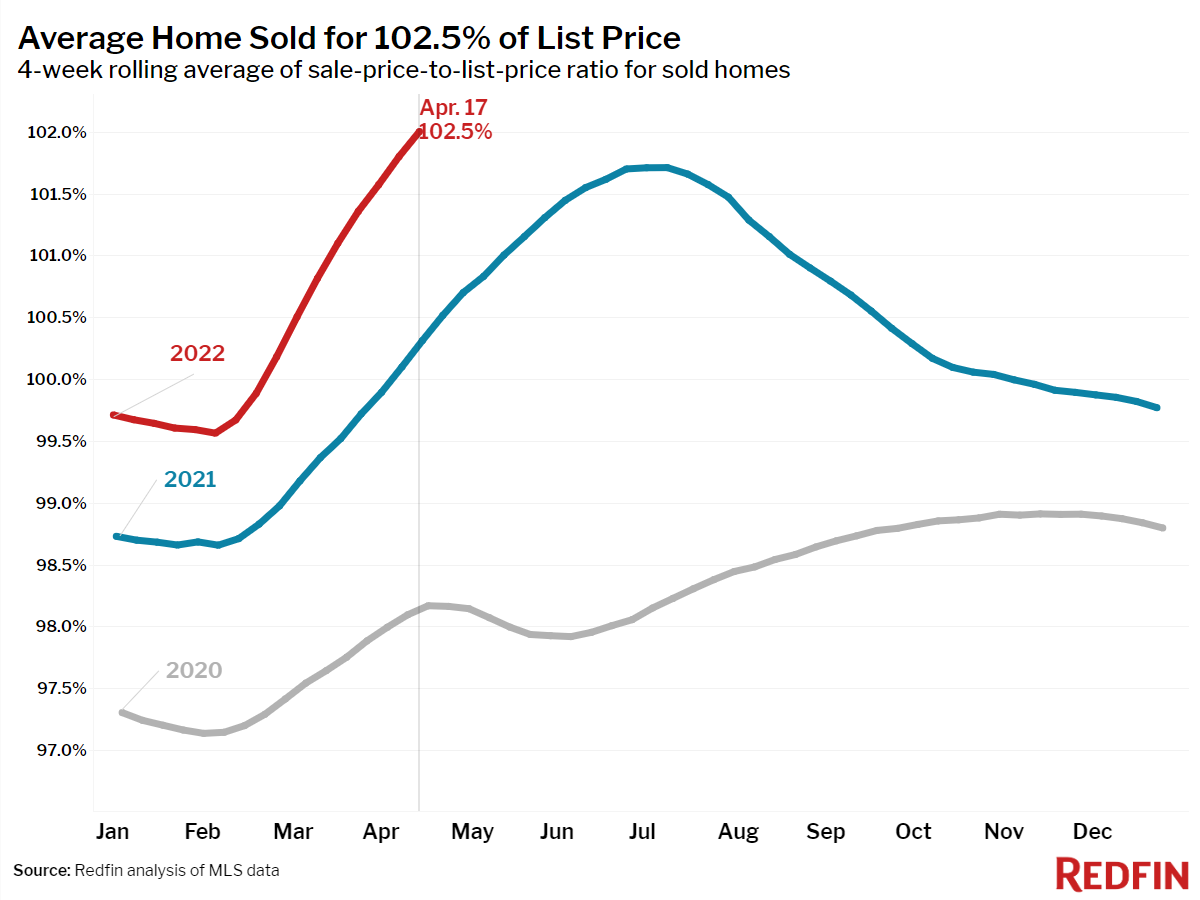

More buyers have moved to the sidelines as home prices have hit historic highs and mortgage rates have jumped past 5%. The median home-sale price is up 17% year over year to a record $392,750 and mortgage rates are now at the highest level since April 2010, sending the typical homebuyer’s monthly payment up 38% to an all-time high of $2,318. Still, some measures of competition, including the share of homes selling above list price and the share selling in one week, continue to hit new records.

“The lull in homebuying and selling activity that we saw over Easter and Passover is likely to continue well past the holiday weekend,” said Redfin Chief Economist Daryl Fairweather. “The forces causing many homebuyers to pump the brakes are still in place—increasing mortgage rates and record-high home prices. We expect price increases to slow and buyers in bidding wars to face fewer competing offers, but substantial relief for homebuyers is unfortunately still well beyond the horizon since the housing market is still tilted further in sellers’ favor than at any time in history.”

Most metrics in this section measure a one-week period that includes Easter and Passover. Year-over-year declines are amplified due to the fact that the same period one year earlier was a non-holiday week.

While sellers still have the upper hand, buyers are beginning to wield a bit more power, according to Redfin Los Angeles real estate agent Heidi Ludwig.

“Buyers are becoming more discerning. They’re less willing to overpay because now they’re only facing three or four competitive offers instead of dozens. Sellers may get frustrated if home-price growth starts to slow, but they should still be able to command excellent prices for their home as long as they price appropriately and put the work in to make their home as appealing as possible. This means staging, deep cleaning, a fresh paint job and landscaping—things that were not as necessary when the market was white-hot.”

Unless otherwise noted, the data in this report covers the four-week period ending April 17. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.