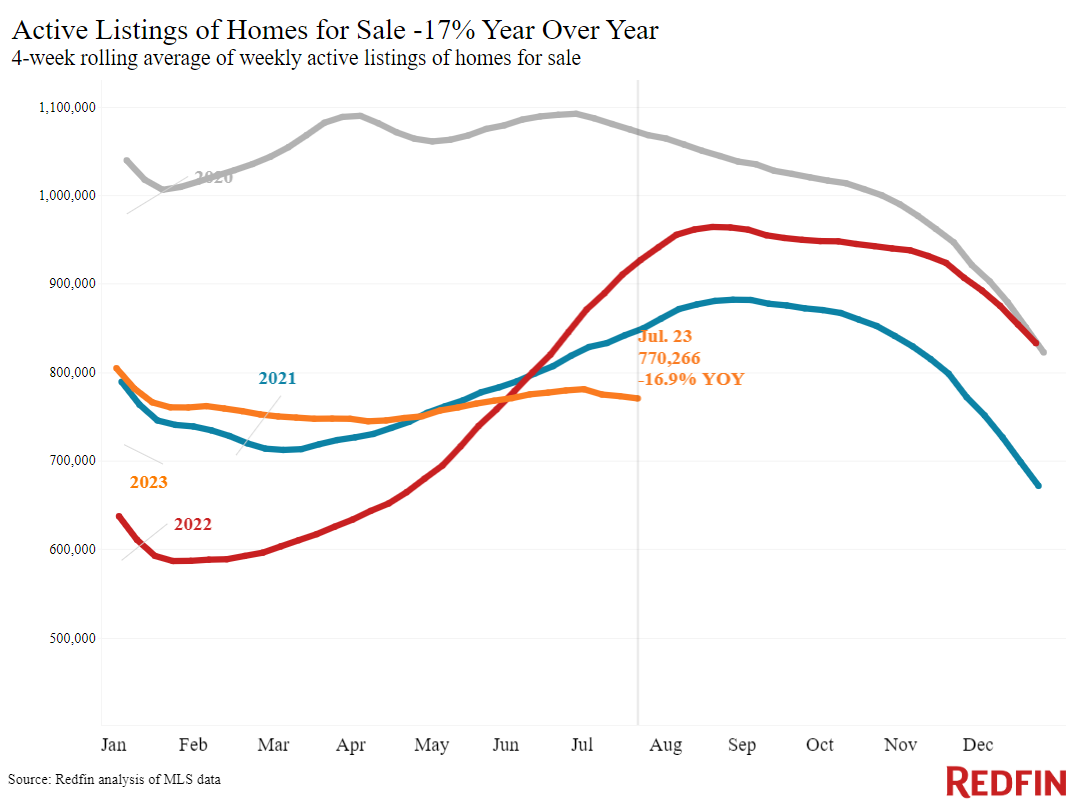

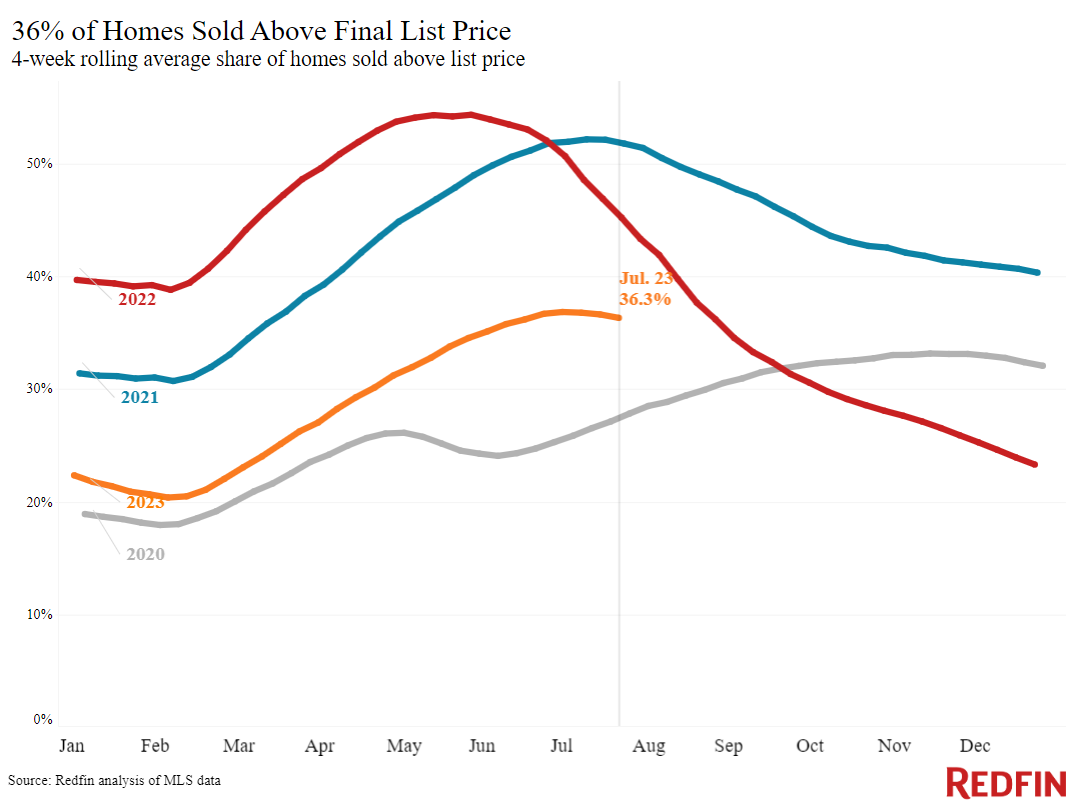

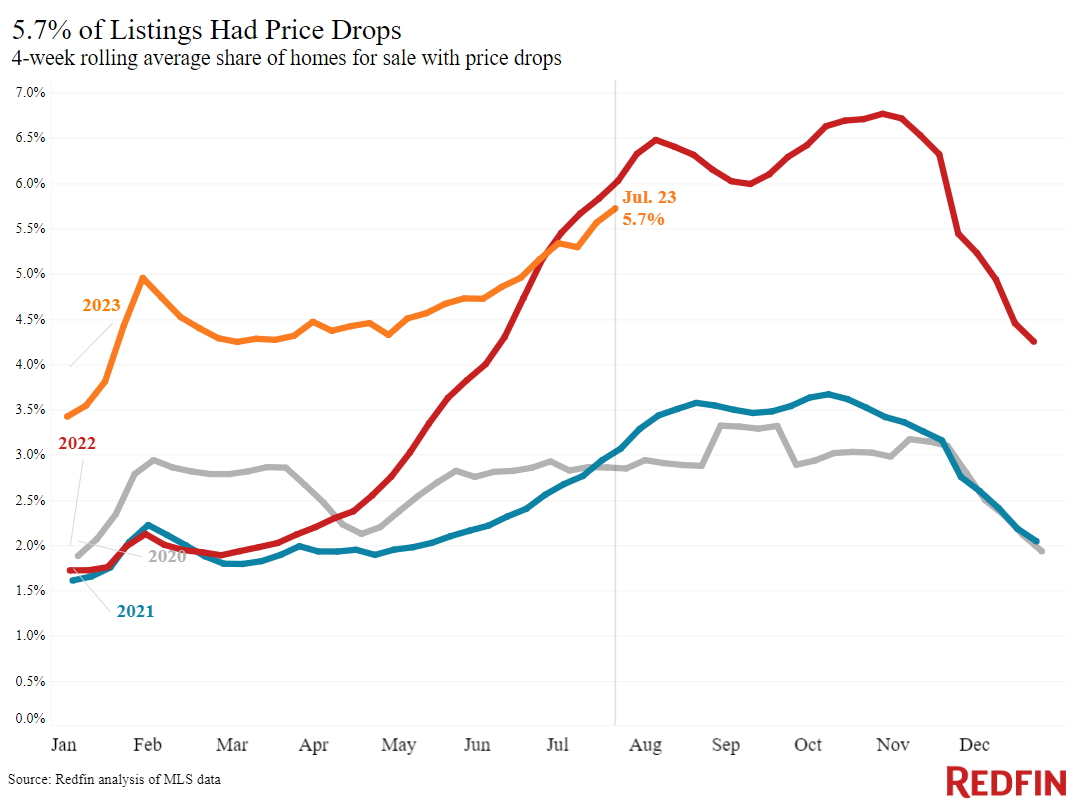

A lack of homes for sale is pushing prices up. Inventory posted its biggest decline in 18 months as homeowners cling to relatively low mortgage rates.

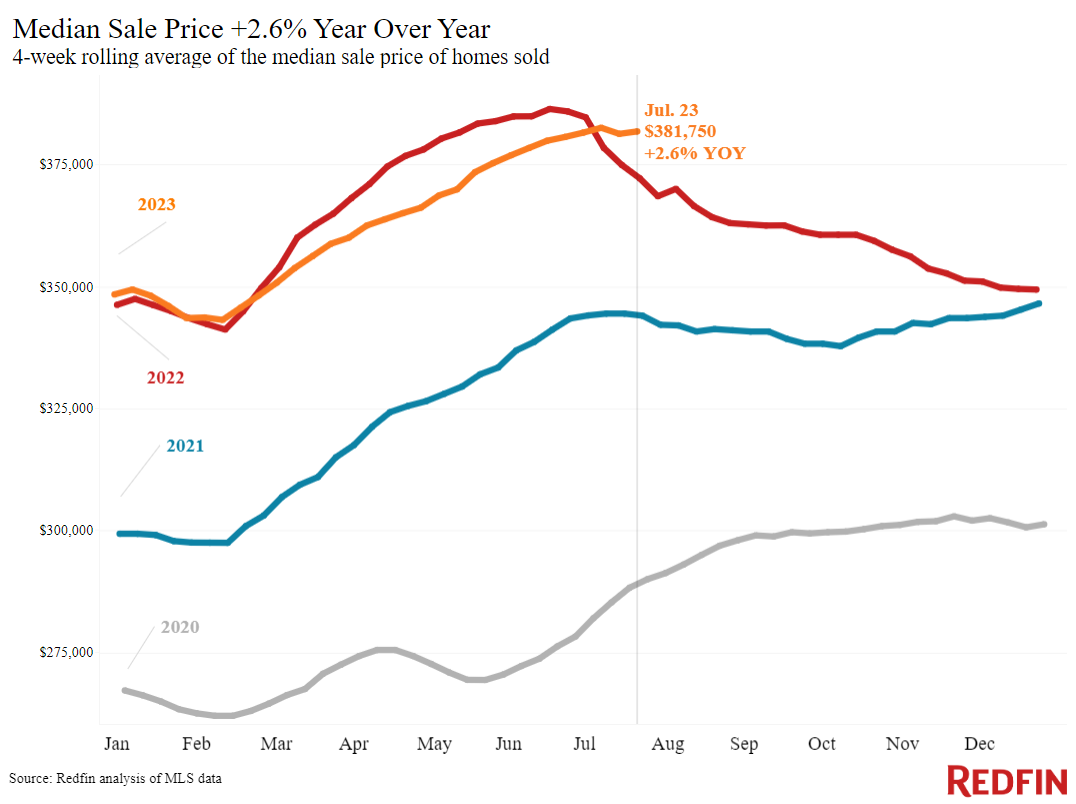

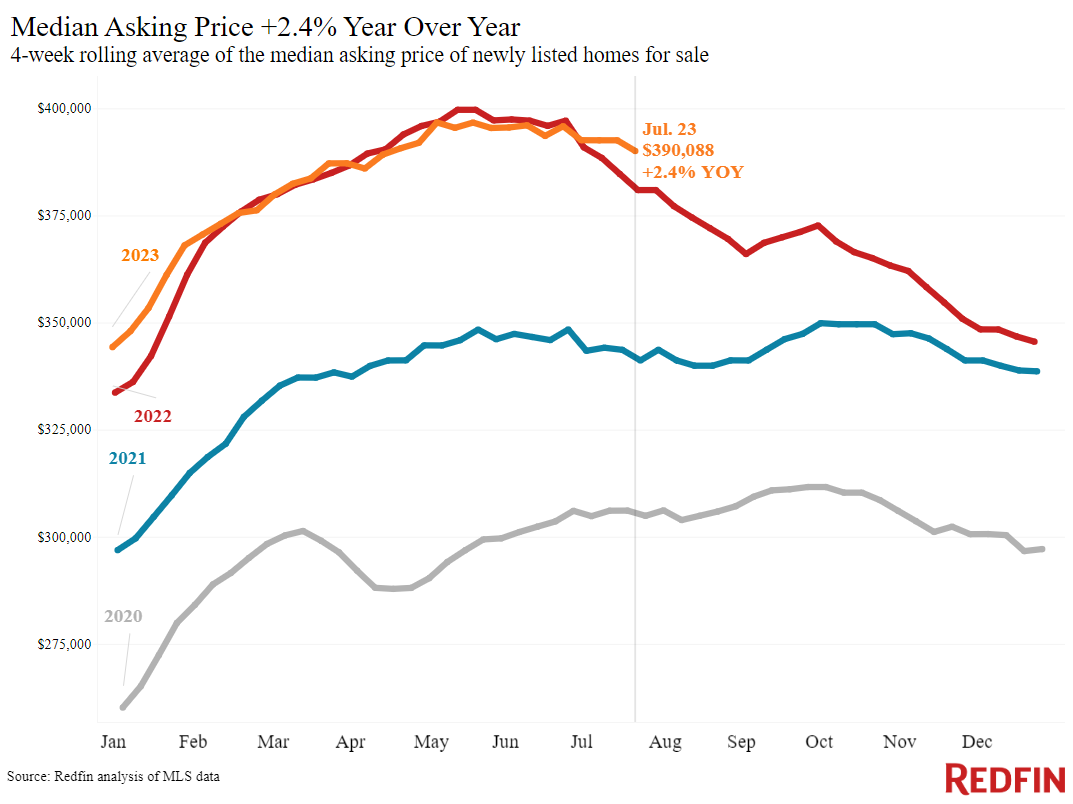

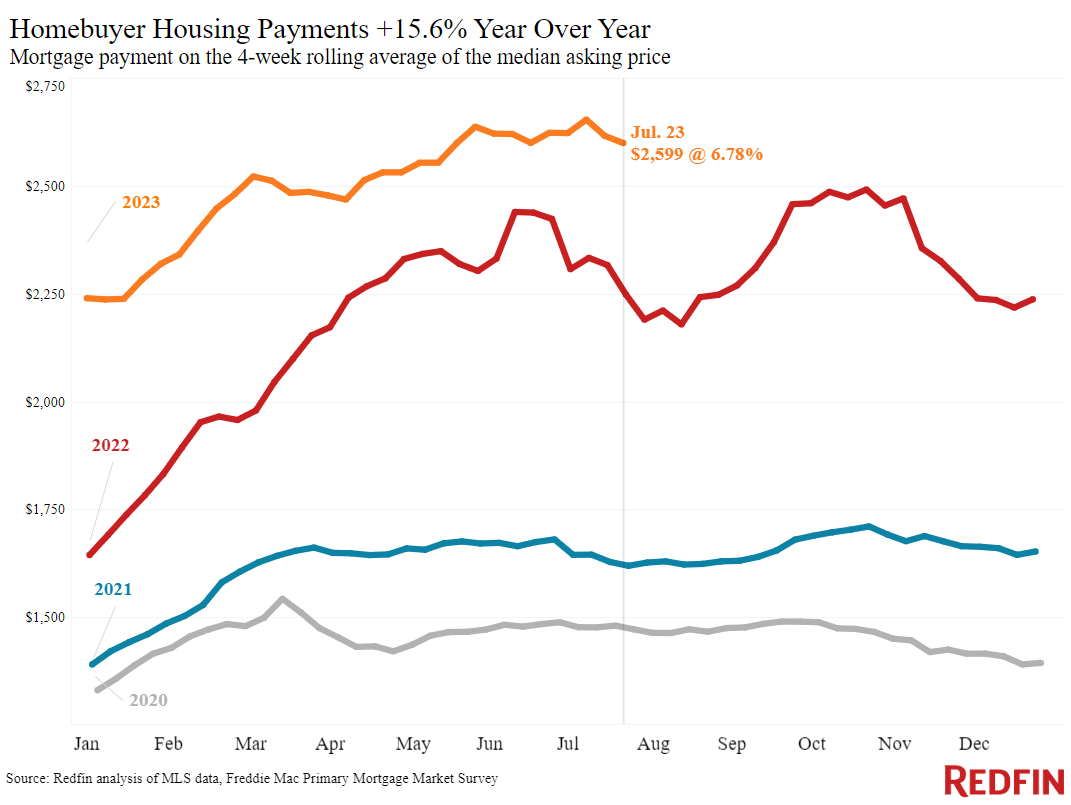

The typical U.S. home sold for roughly $382,000 during the four weeks ending July 23, up 2.6% from a year earlier, the biggest increase since November. Still, homebuyers are getting a modicum of relief as mortgage rates inch down from the eight-month high hit a few weeks ago. The typical monthly mortgage payment is $2,599 at today’s average weekly rate, down $55 from the all-time high of $2,654 in early July.

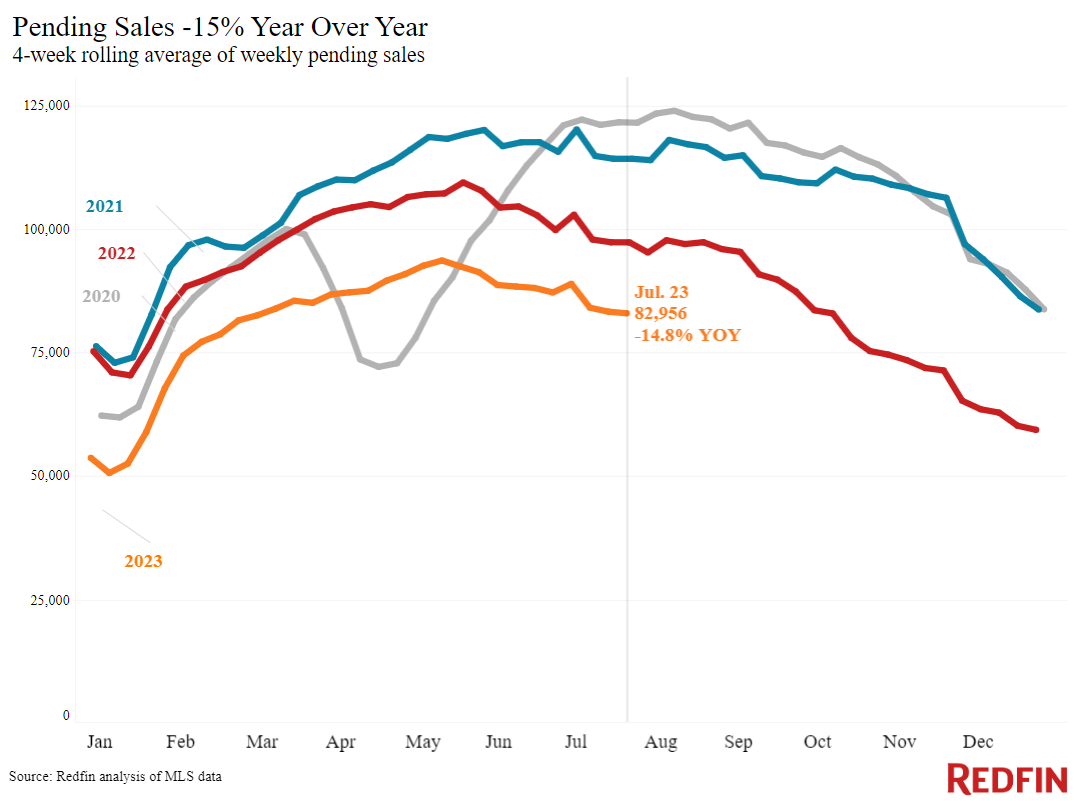

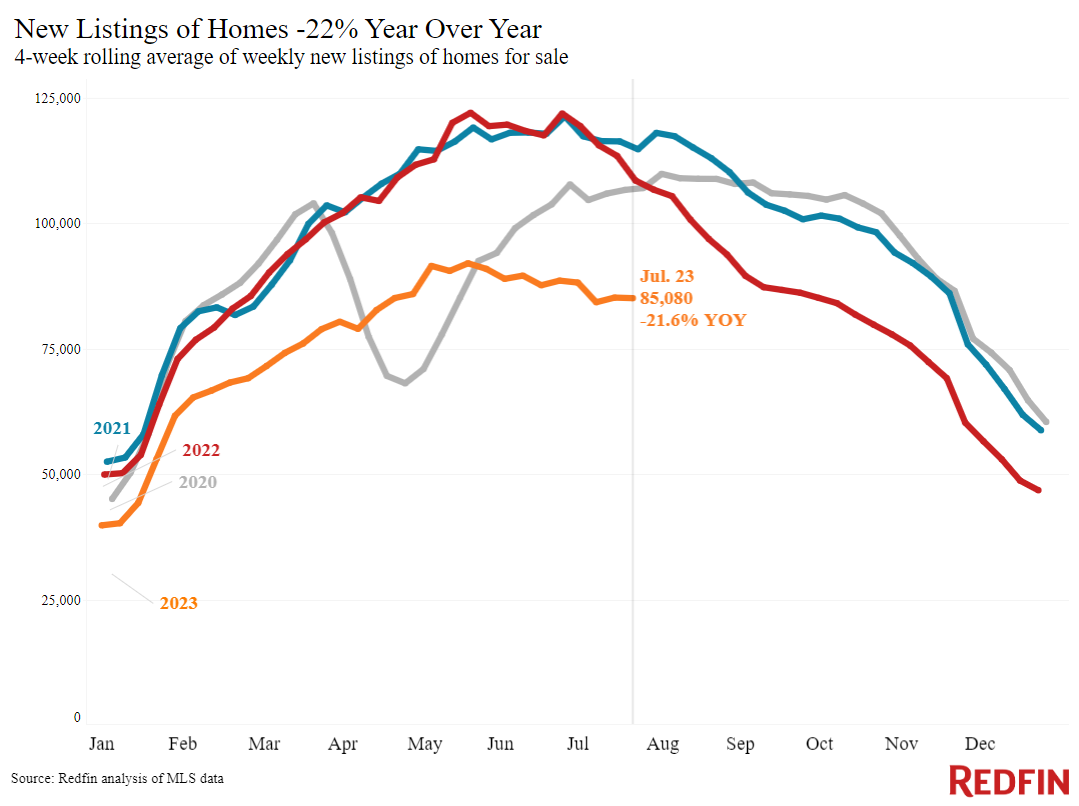

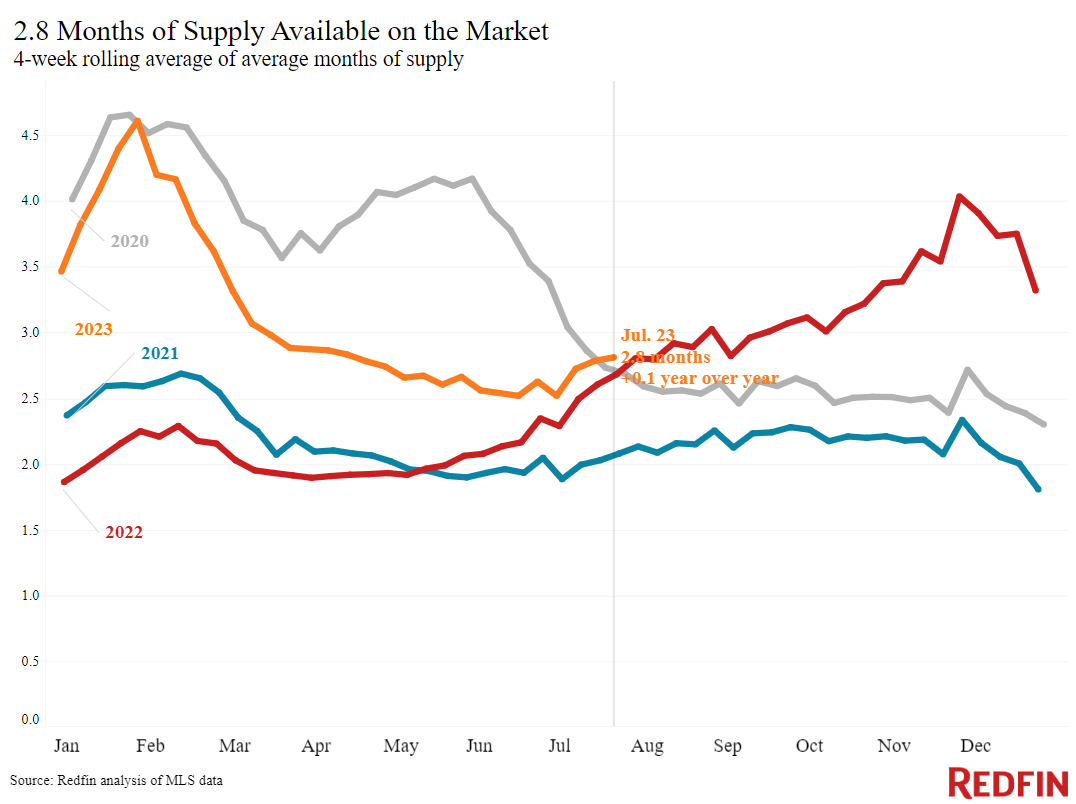

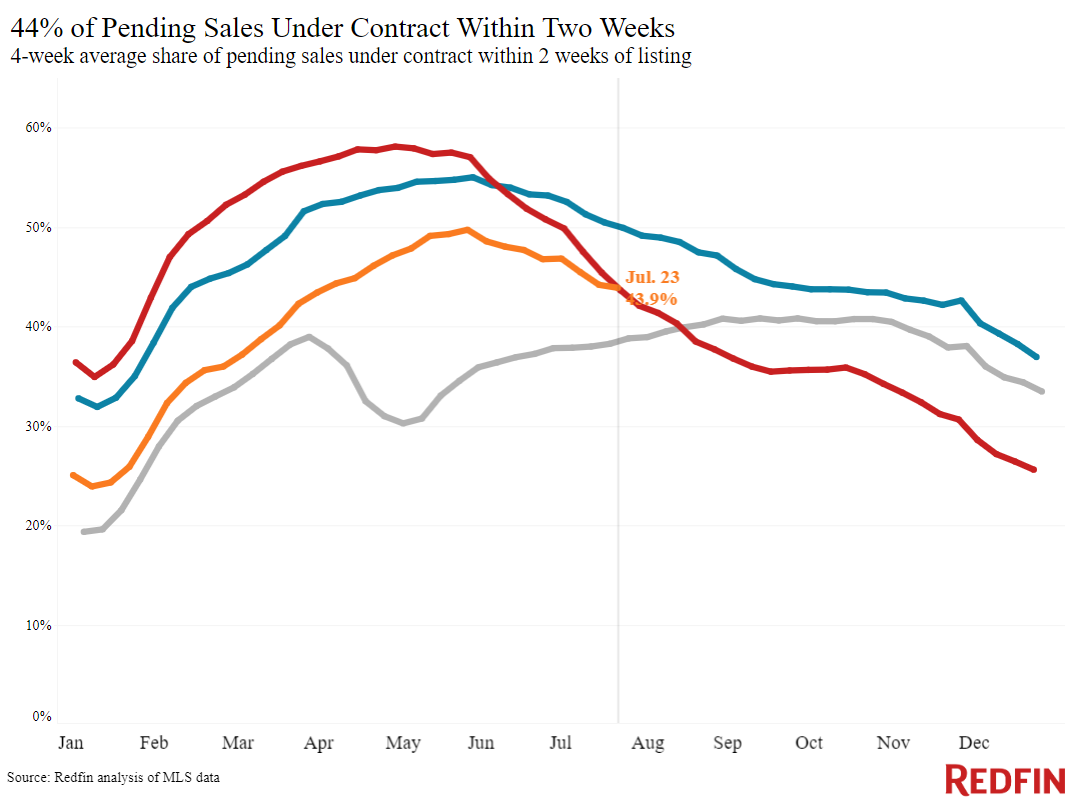

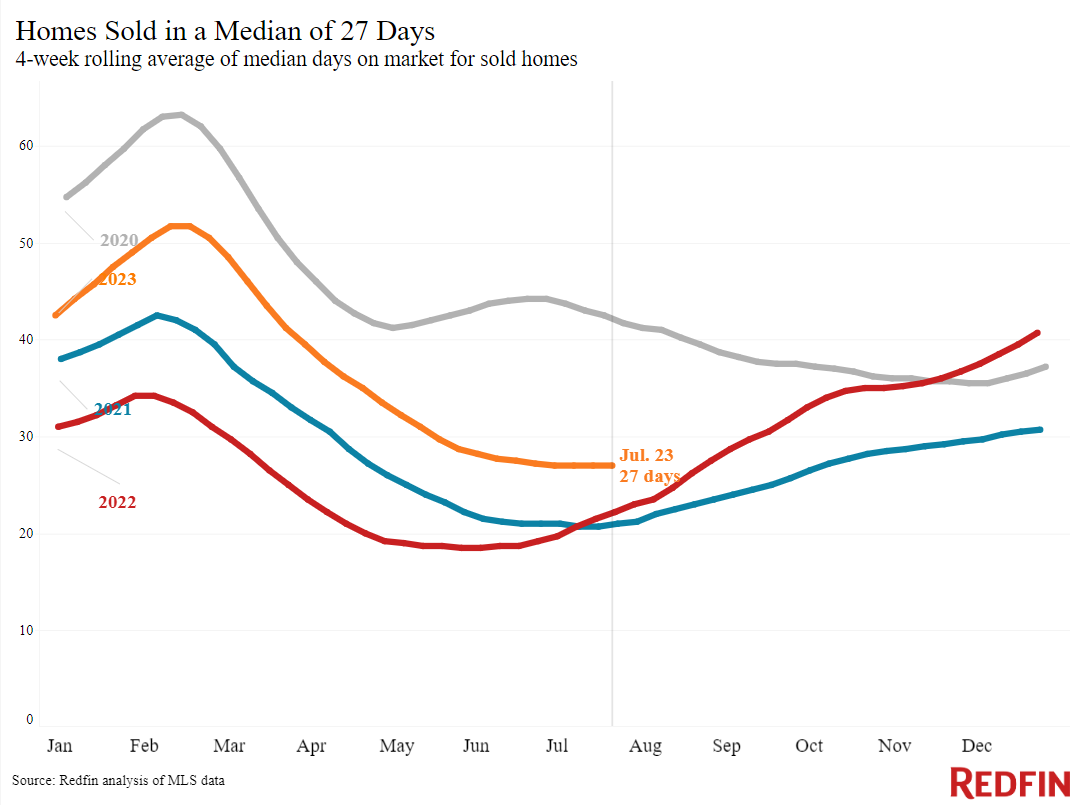

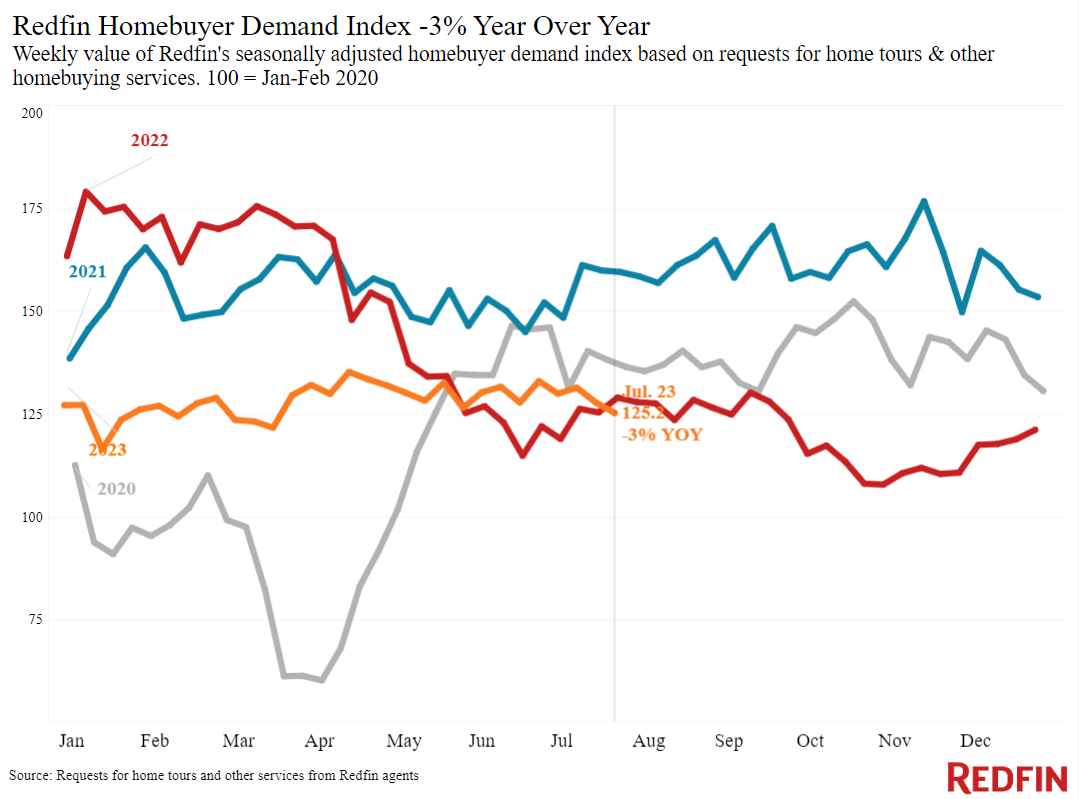

Today’s housing market is unusual because prices are increasing despite lukewarm demand. Redfin’s Homebuyer Demand Index–a measure of requests for tours and other homebuying services from Redfin agents–is down 3% from a year ago, and mortgage-purchase applications are down about 23%. But inventory has dropped more than demand, with homeowners hanging onto their comparatively low mortgage rates, which is sending prices up. New listings are down 22% from a year ago, and the total number of homes for sale is down 17%, the biggest decline in a year and a half. Pending sales are down 15%, partly because the lack of inventory is tying potential homebuyers’ hands.

This week’s news that the Fed is no longer forecasting a broad economic recession is hopeful for the housing market, despite the simultaneous interest-rate hike. The Fed indicated that a soft landing is more likely than they had previously thought, which would mean interest rates went high enough to tame inflation but not enough to cause a surge in unemployment and send the economy into a recession.

“This is hopeful news for the housing market in a few ways,” said Redfin Economic Research Lead Chen Zhao. “Avoiding a recession means Americans will hold onto their jobs, for the most part, and feel more confident about purchasing big-ticket items like a house. Steady progress on taming inflation means that while mortgage rates will probably stay elevated for at least a few months, they’re likely to start coming down before the end of the year. That should encourage some sellers and buyers to jump into the market.”

Unless otherwise noted, the data in this report covers the four-week period ending July 23. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.