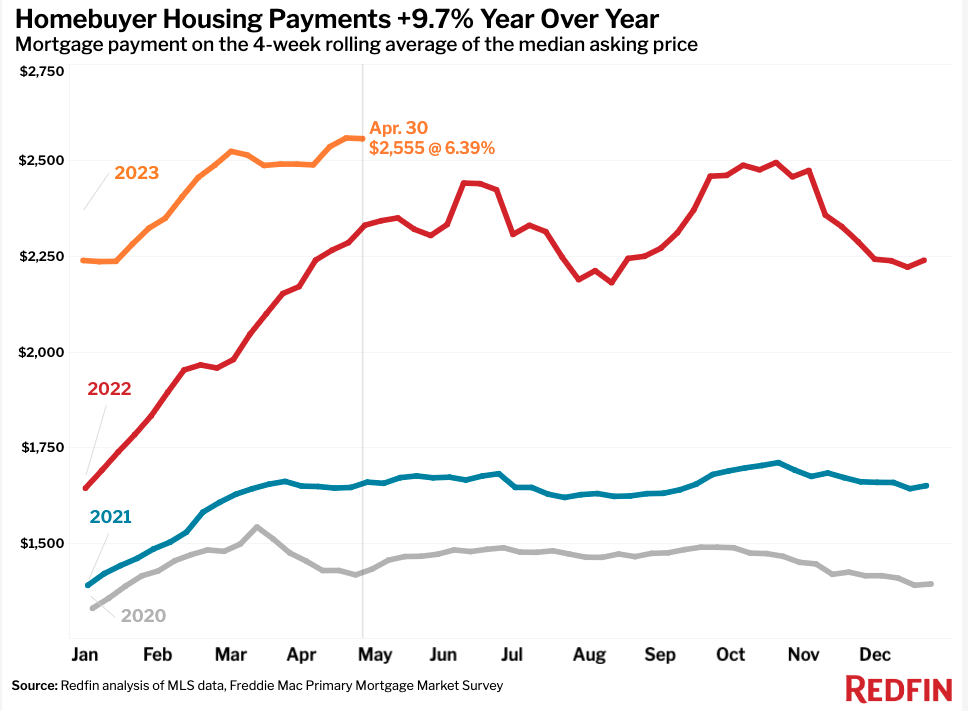

Elevated mortgage rates are prompting many homeowners to stay put, resulting in bidding wars as buyers compete for a small pool of homes. But buyers and sellers can at least take a little comfort in knowing the Federal Reserve probably won’t raise interest rates again anytime soon.

“While a pause in Fed rate hikes doesn’t mean a significant drop in mortgage rates is coming, it does at least alleviate one layer of uncertainty in the housing market,” said Redfin Economics Research Lead Chen Zhao. “Unexpectedly bad inflation data, more banking turmoil or failure to raise the U.S. debt ceiling could throw a wrench in the Fed’s plans, but homebuyers and sellers can feel a little more confident that mortgage rates won’t skyrocket again.”

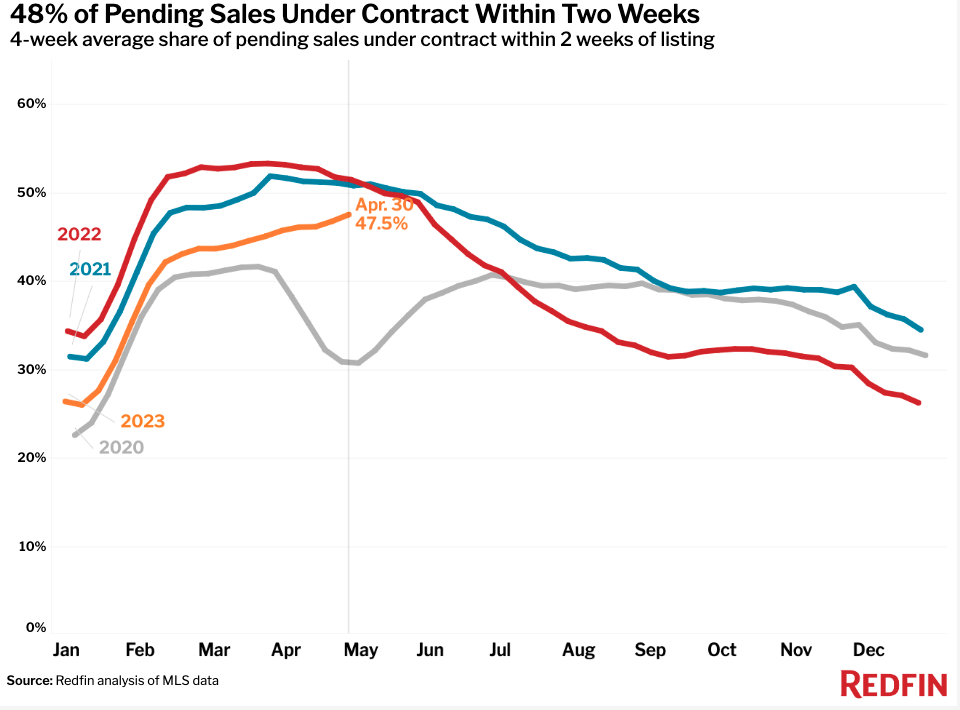

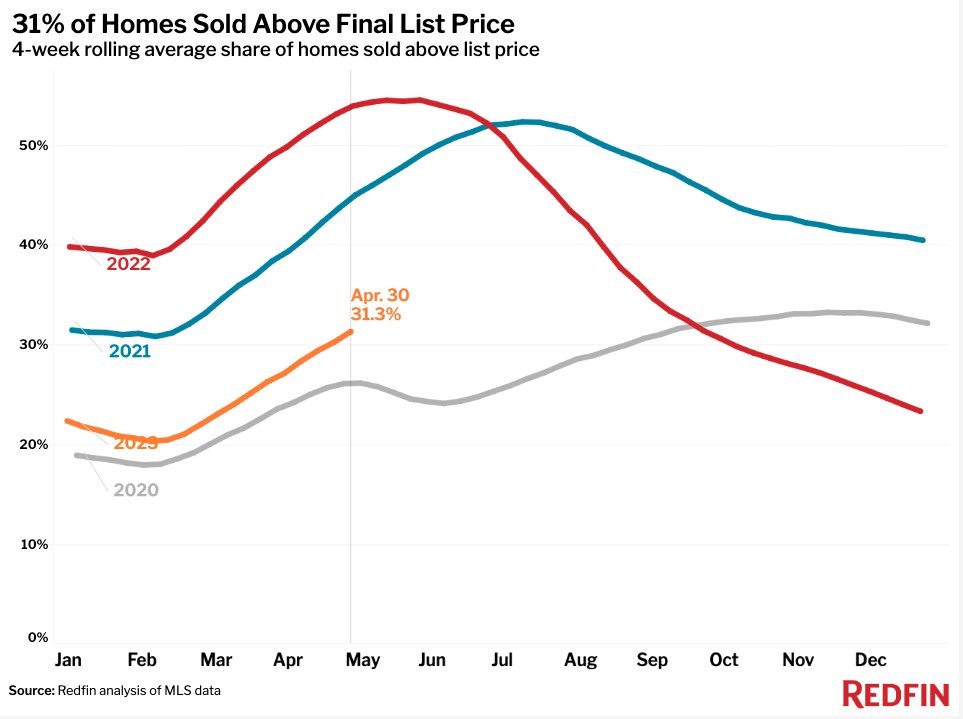

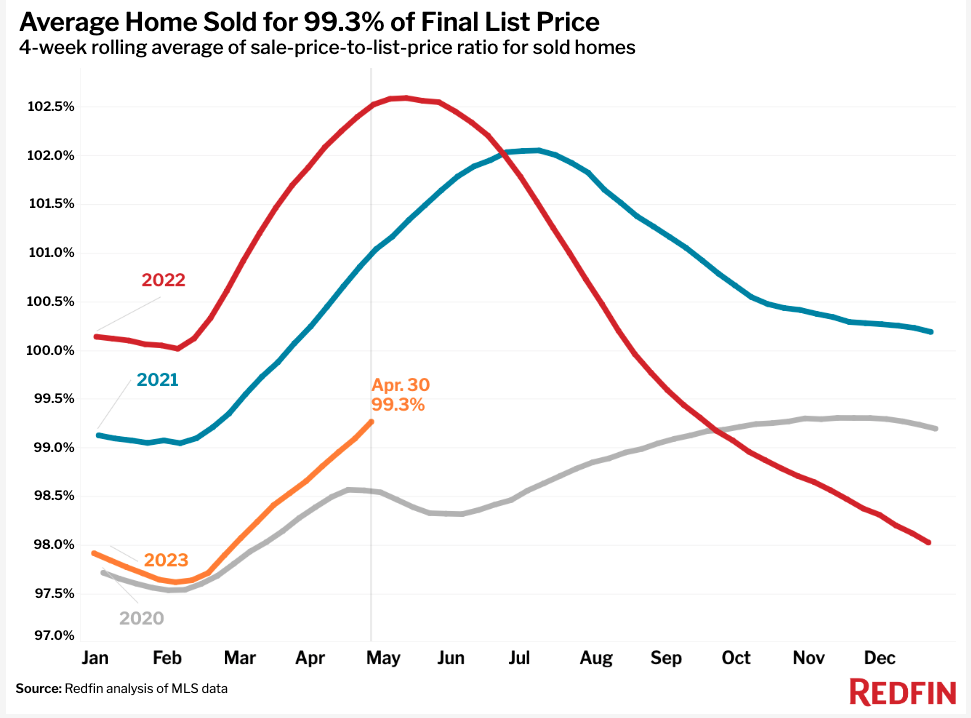

For now, homes are getting snatched up quickly as a shortage of listings sparks bidding wars between the buyers who remain in the market despite elevated mortgage rates.

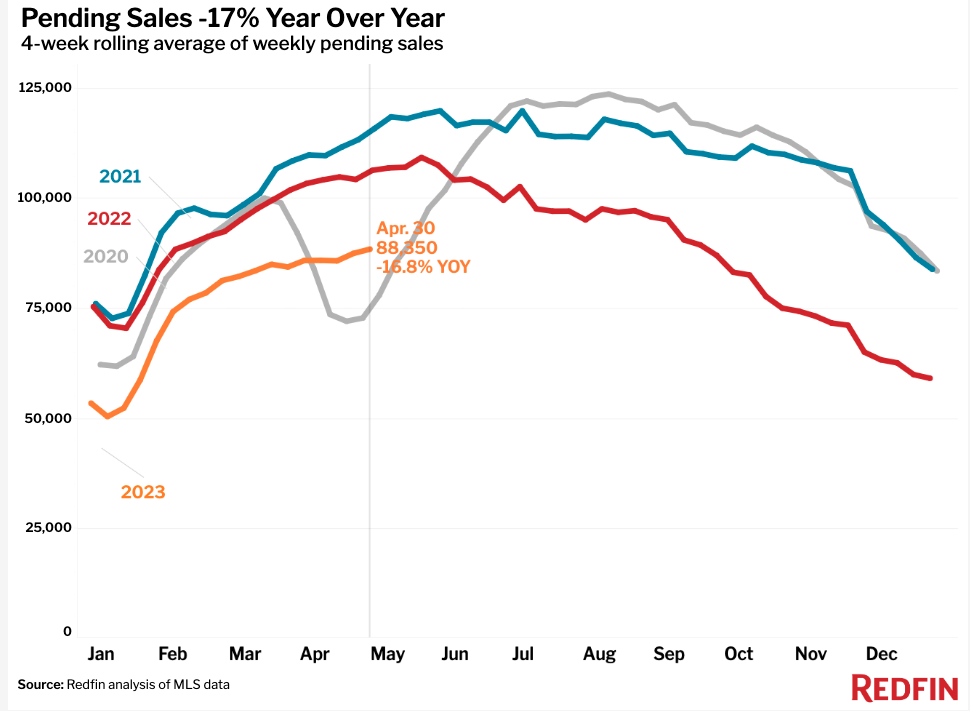

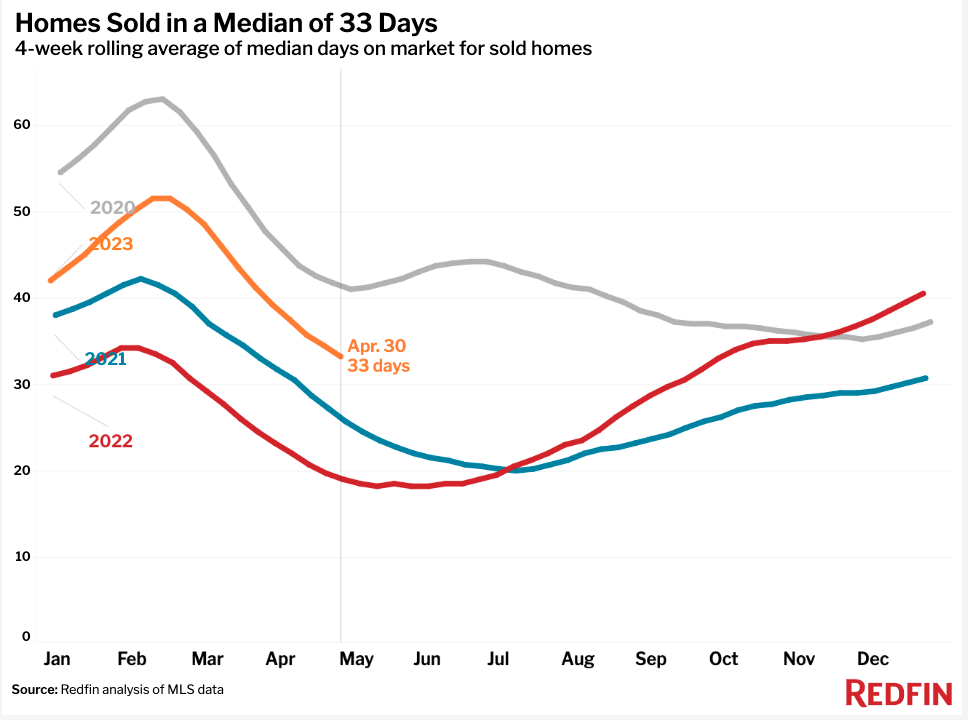

Nearly half (48%) of homes that sold during the four weeks ending April 30 went under contract within two weeks, down from 51% a year earlier but up from 46% a month earlier. While that jump may seem small, it’s notable because the share of homes selling in two weeks typically falls in April after peaking in March. We haven’t yet seen signs of a peak this year.

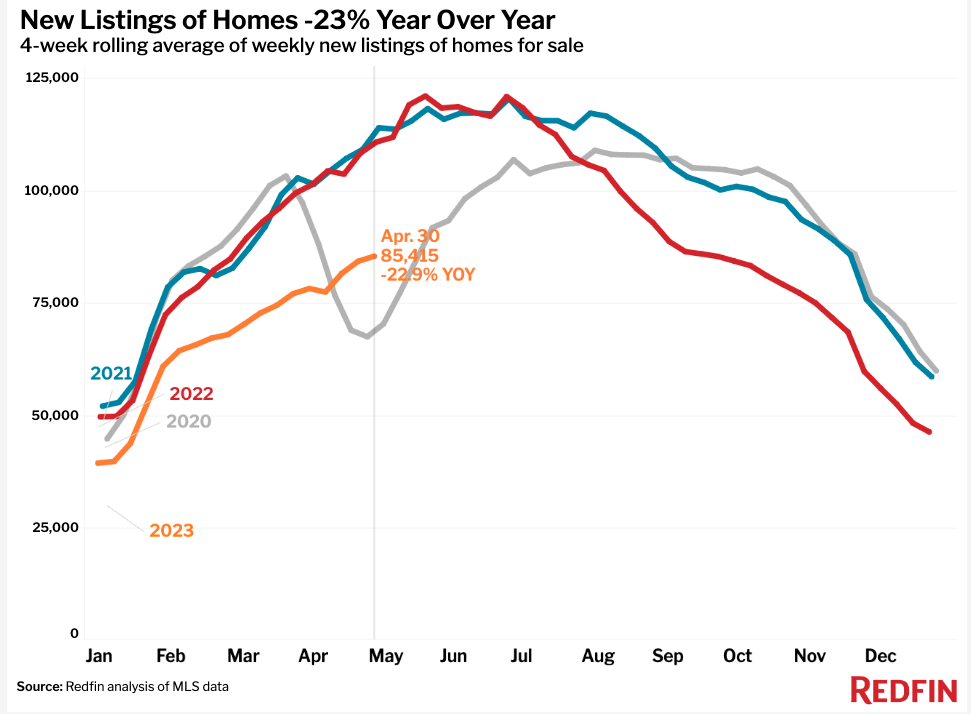

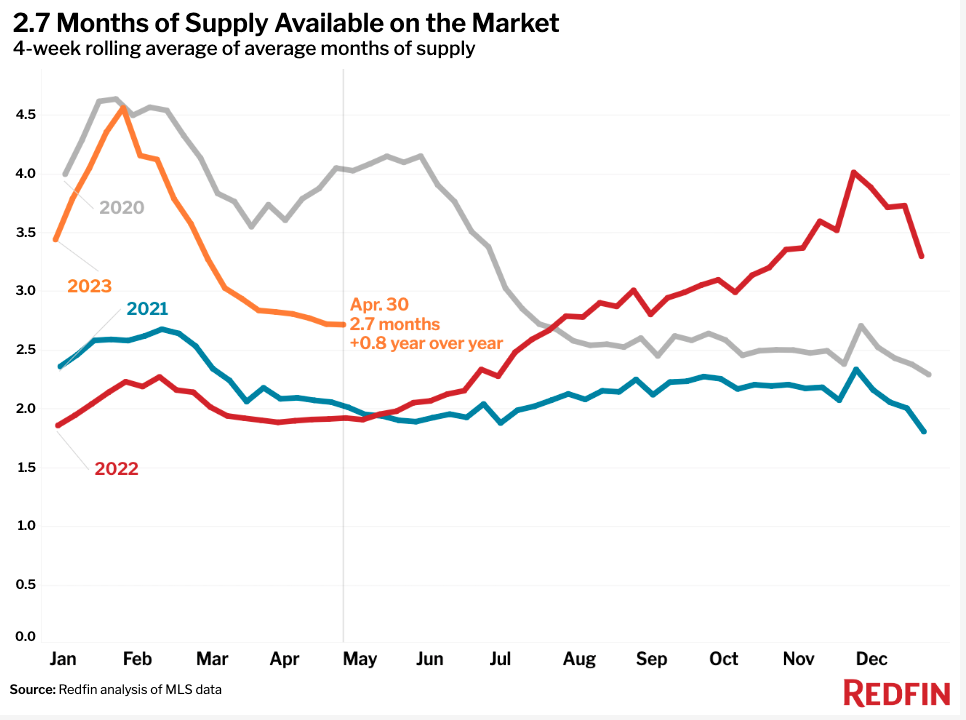

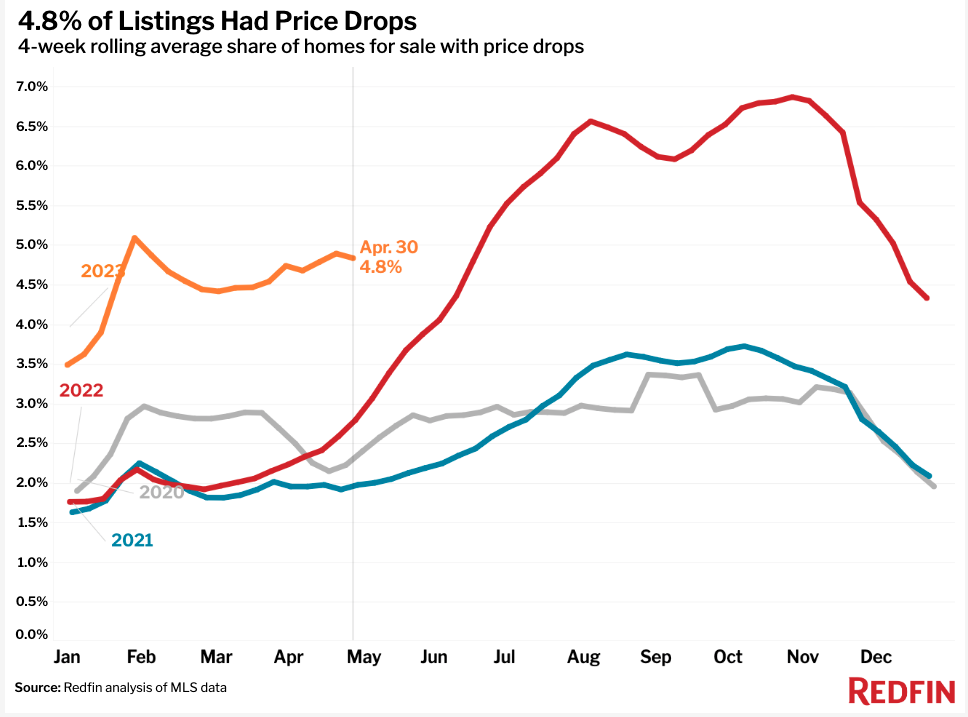

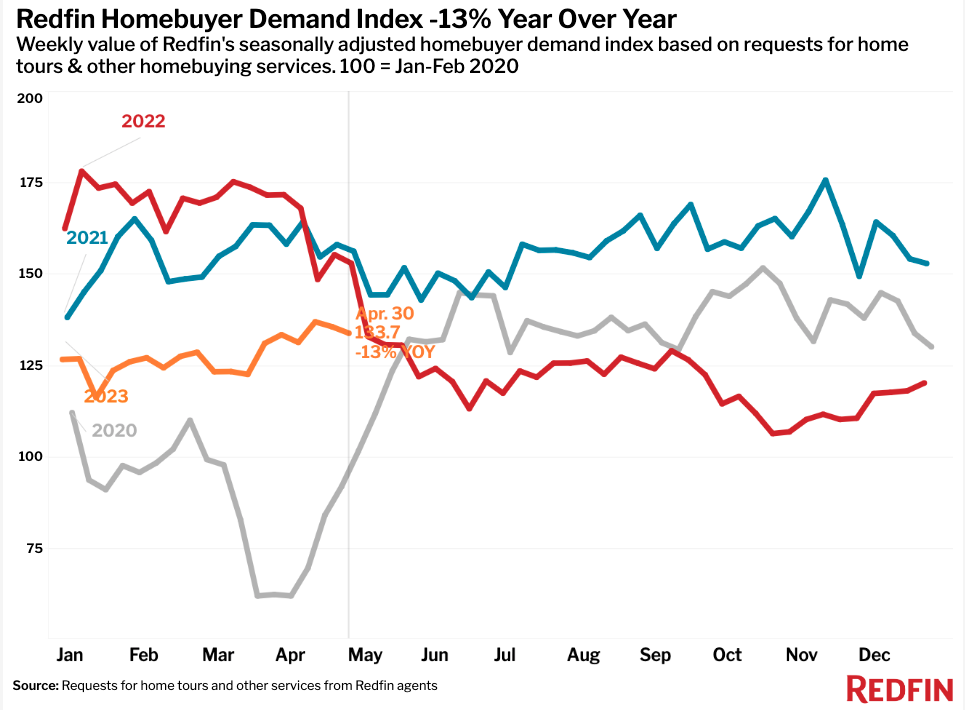

Redfin agents say reasonably priced homes in desirable areas are selling especially quickly as buyers compete for a limited number of homes for sale. New listings in April were down 23% from a year earlier, the second biggest decline since the start of the pandemic. That outpaced the 17% year-over-year decline in pending sales, a gauge of how many buyers are in the market.

“I received five offers on a house that I listed on Thursday,” said Lindsay Katz, a Redfin Premier real estate agent in Los Angeles. “One of my other sellers got a full-price offer on her $1.15 million home, but had to cancel the listing because with prices and rates so high and inventory so low, she couldn’t find another home she could afford. She wouldn’t even qualify to buy her own home anymore.”

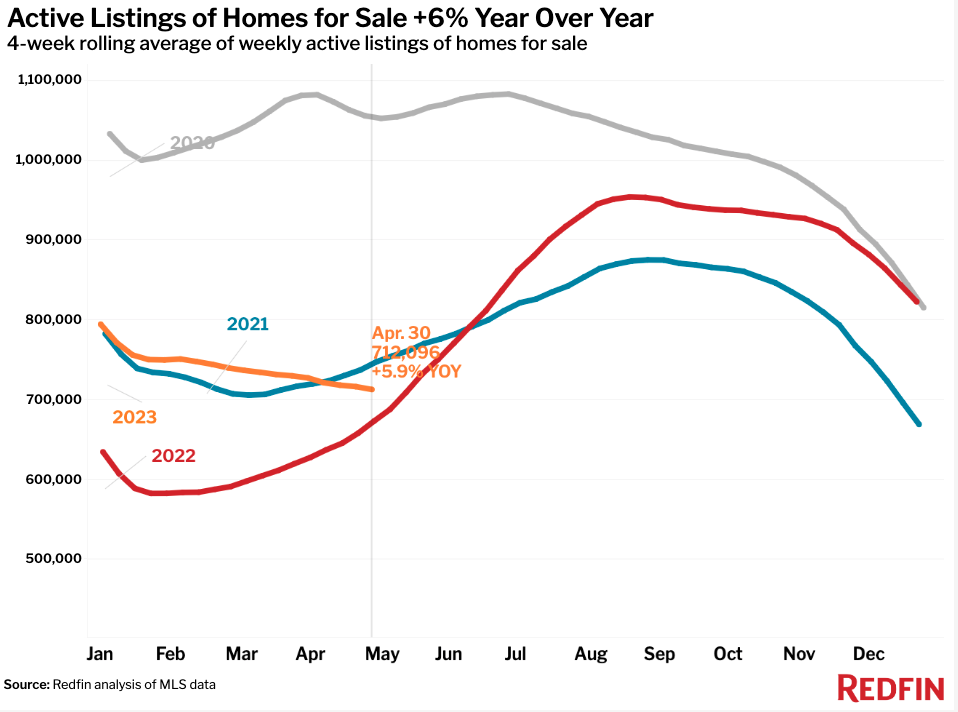

The total number of homes for sale has steadily declined over the last month, going against the typical spring inventory bump. That’s because buyers are draining the supply of homes for sale faster than sellers are filling the sink with new listings. New listings and pending sales did both rise on a month-over-month basis in April, which is typical for springtime.

“A lot of homeowners are just now expressing interest in selling, whereas in a typical year that would have happened a month or two ago,” said Steve Centrella, a Redfin Premier agent in Washington, D.C. “Some sellers are coming forward because they’re noticing there are buyers out there, in spite of high rates. A lot of them are sellers who aren’t also buyers, like people listing a second home or rental property. They’re not as hesitant to give up a low mortgage rate because they’re not turning around and taking on a higher one.”

Unless otherwise noted, the data in this report covers the four-week period ending April 30. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.