Fewer homes are selling than usual this spring–but the ones that are changing hands are going fast, with a small pool of buyers circling an even smaller pool of listings. This week’s inflation report, which shows slow but steady progress on easing price gains, confirms it’s likely the Fed will pause on interest-rate hikes next month.

Limited inventory and elevated mortgage rates continue to suppress U.S. home sales as we enter the heart of spring, typically a hot homebuying season. This week’s inflation report shows a slight slowdown in price gains, confirming that mortgage rates are likely to stay about where they are for the next several months. That’s because the Fed’s interest-rate hikes are working as intended to ease inflation, albeit slowly. That means they probably won’t hike or cut interest rates at their next meeting in June.

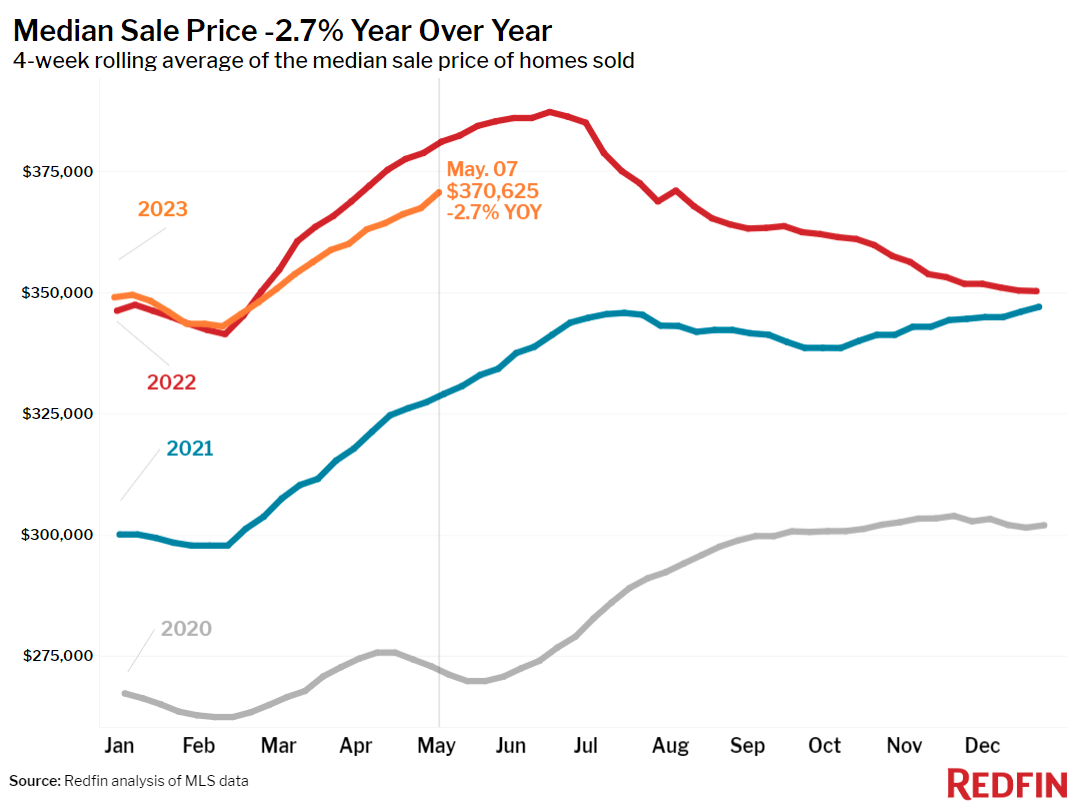

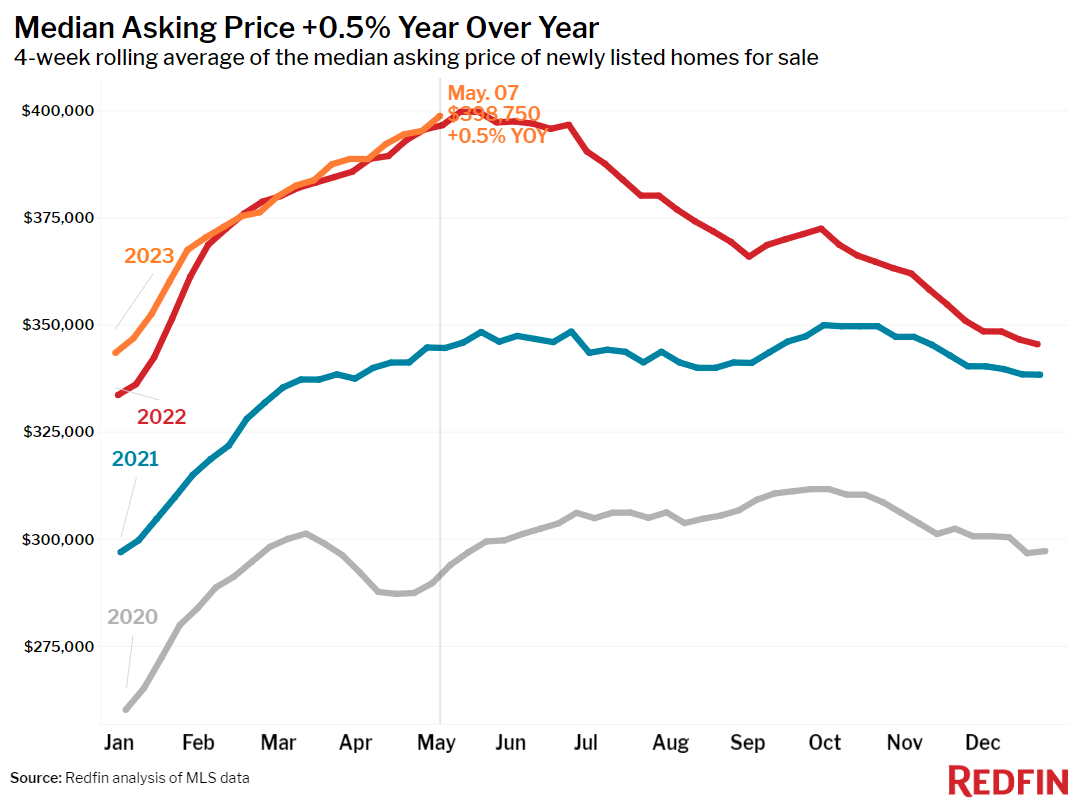

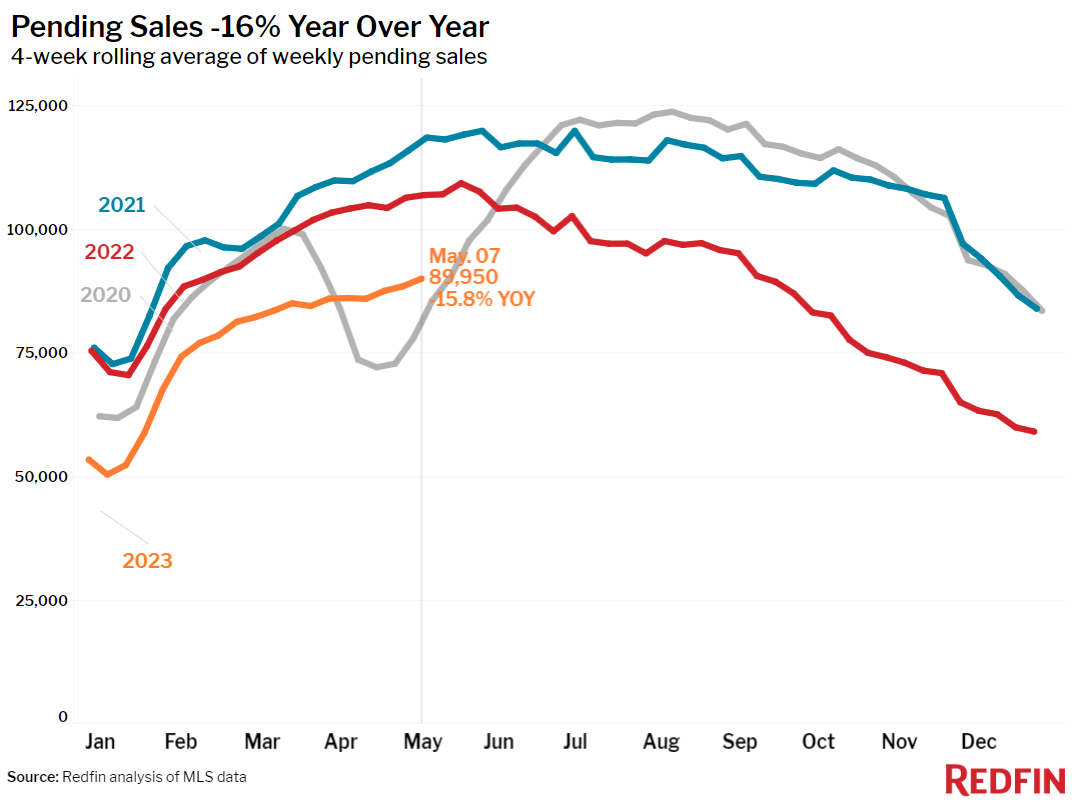

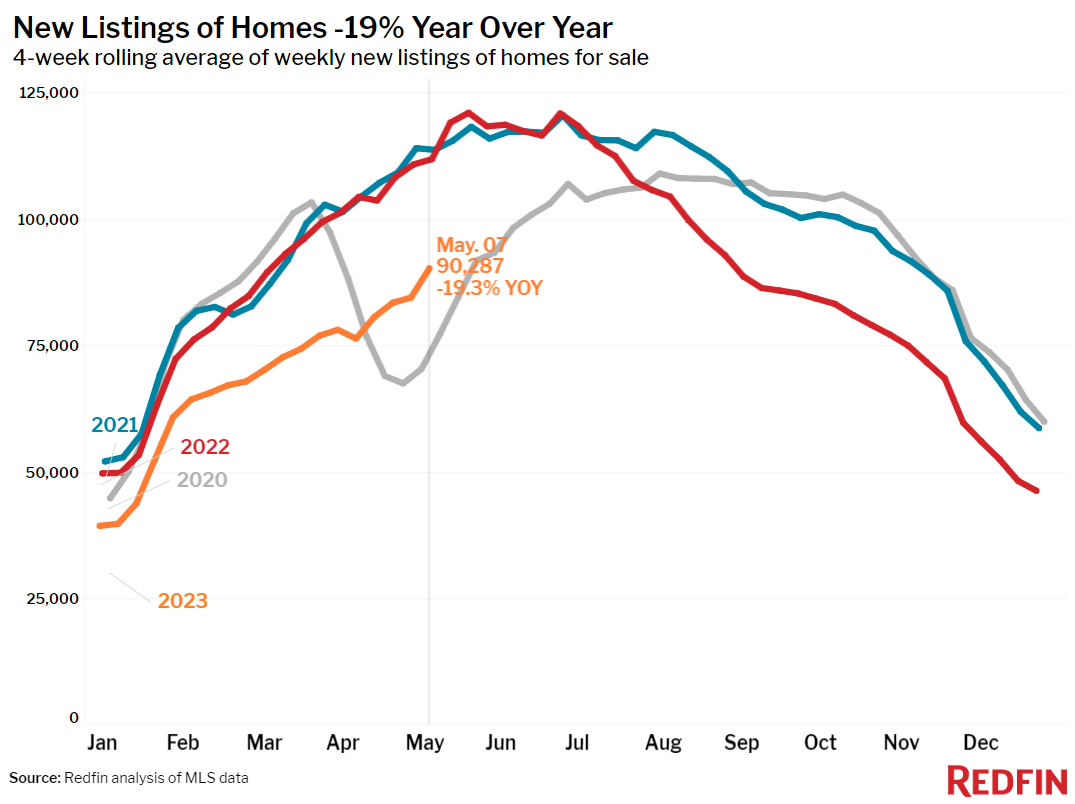

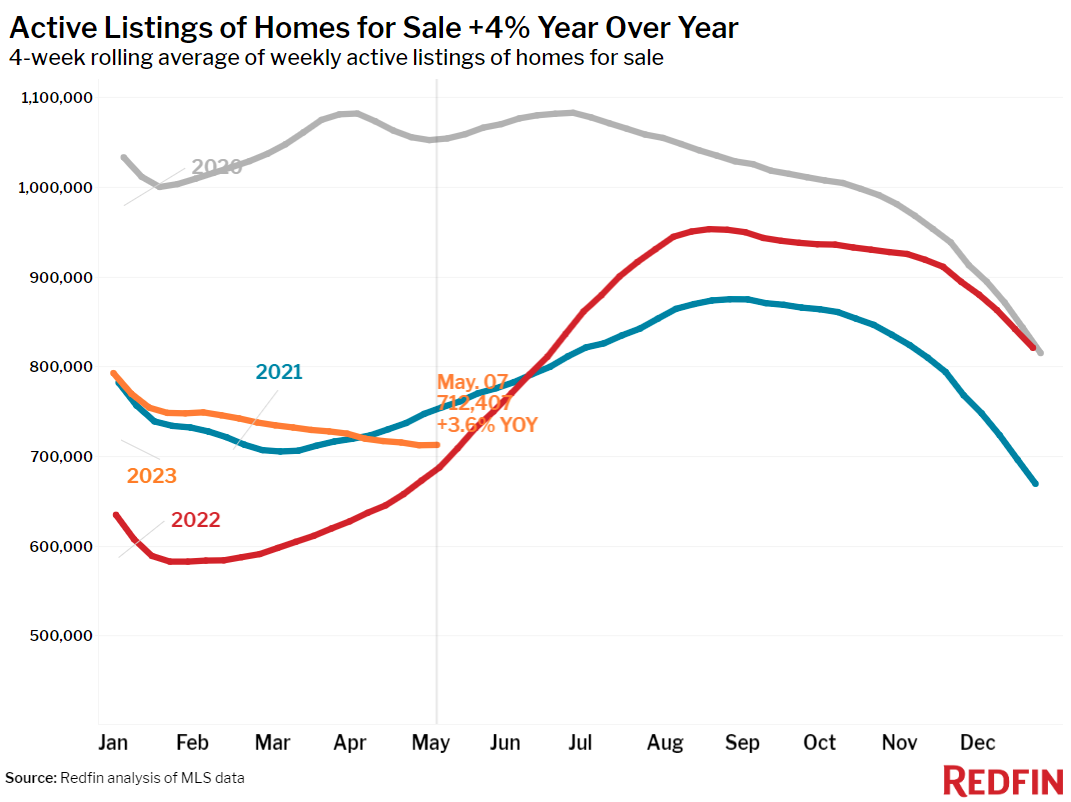

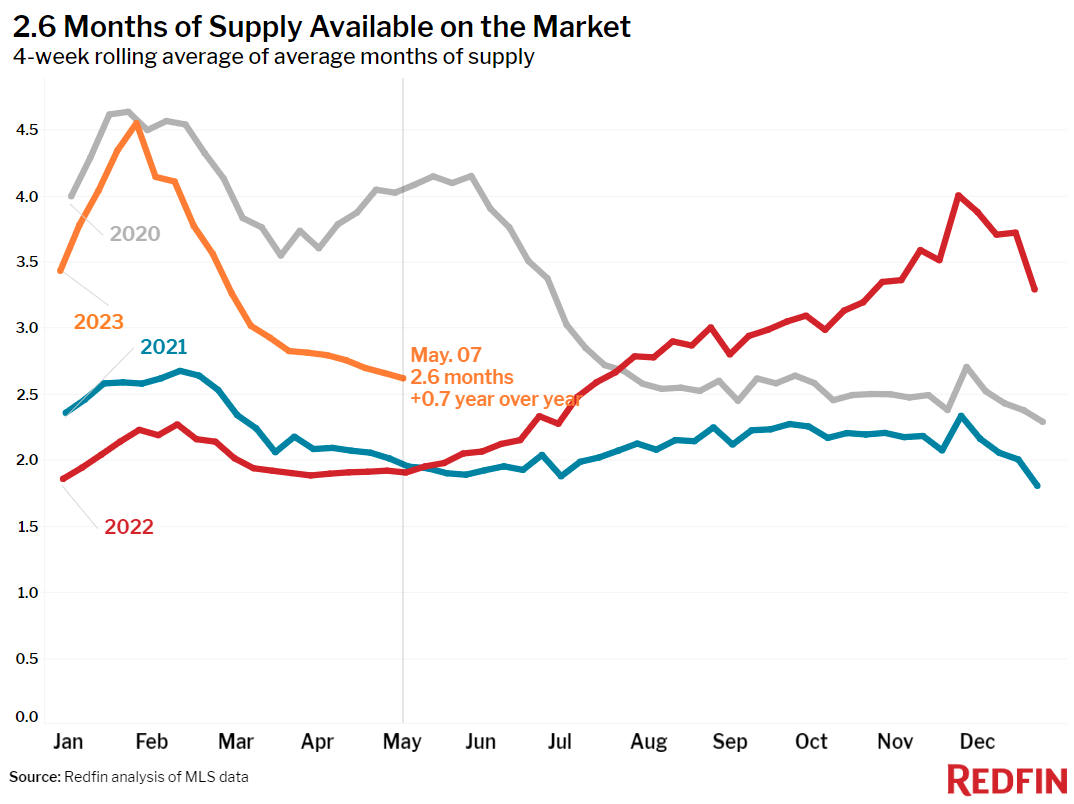

New listings of homes for sale dropped 19% year over year during the four weeks ending May 7, contributing to an unseasonal monthly decline in total inventory. There were 16% fewer pending home sales than a year earlier, reflecting the lack of listings and the group of would-be buyers who have been priced out by 6%-plus mortgage rates and record-high monthly payments.

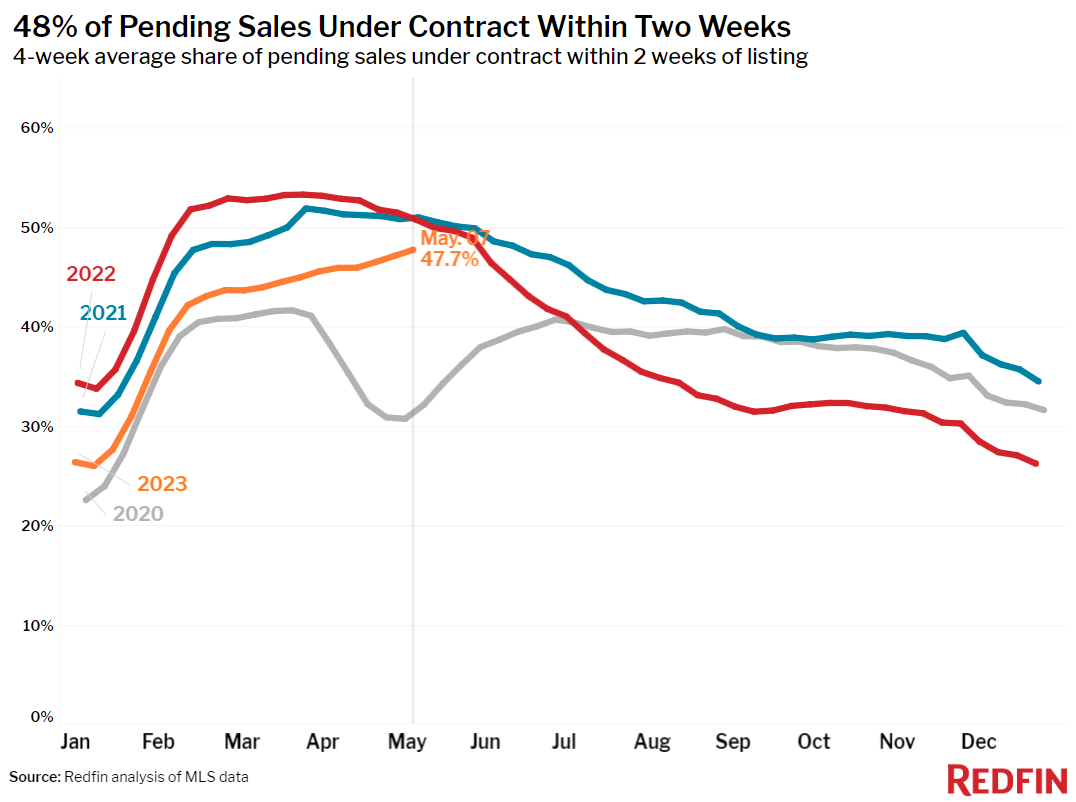

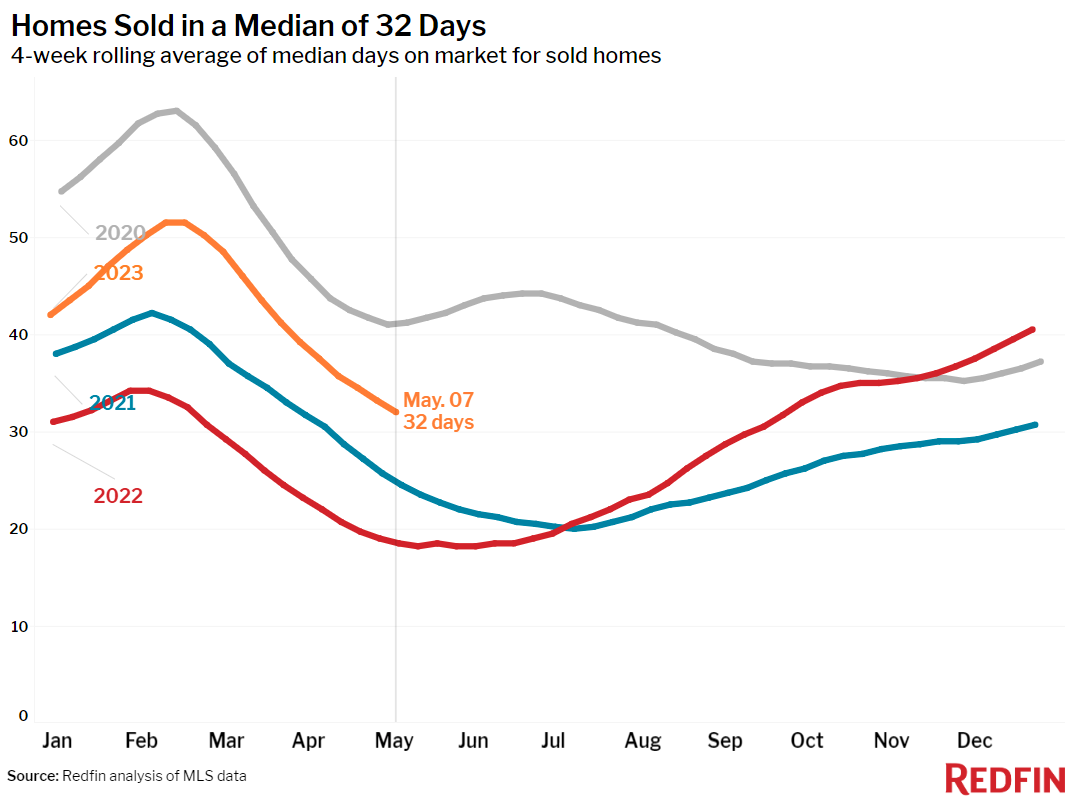

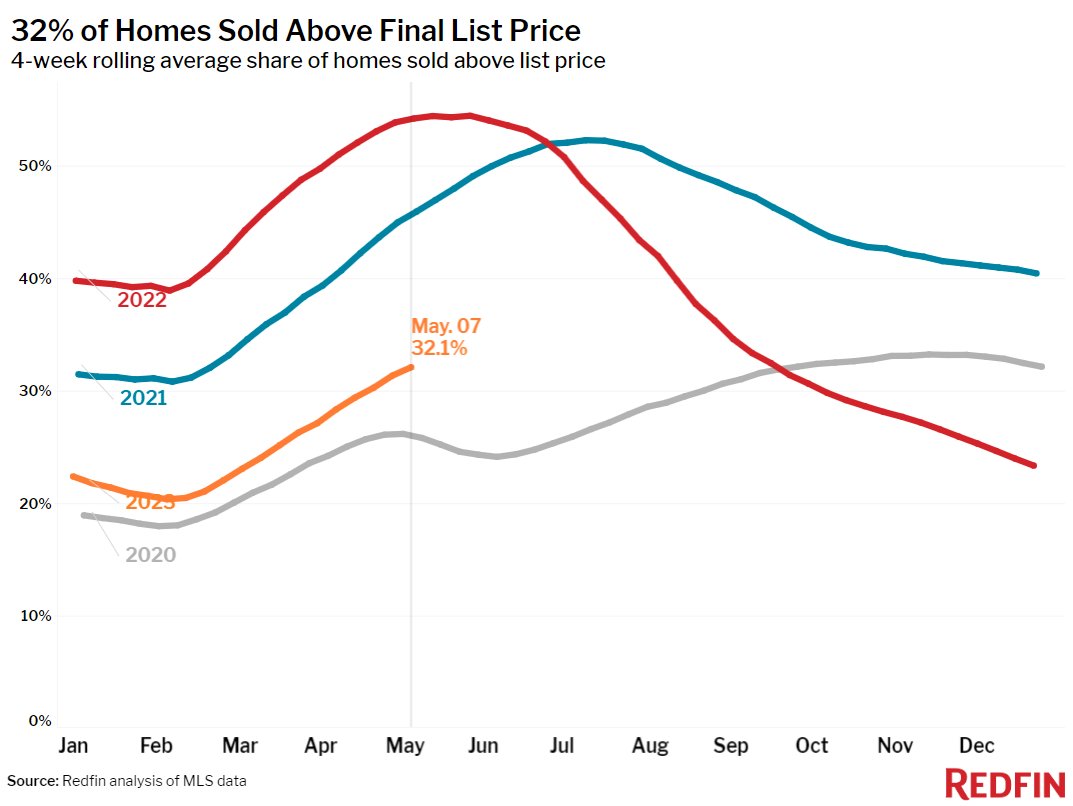

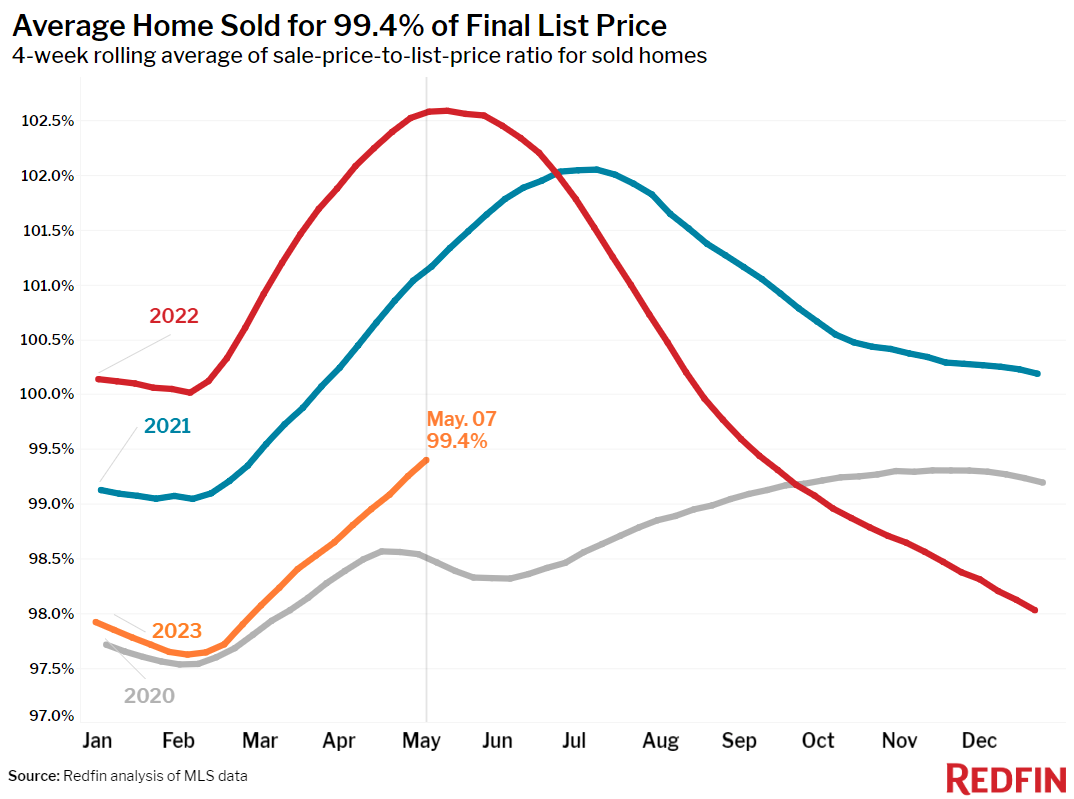

But despite the inventory crunch, pending sales have increased over the last week, as they typically do this time of year. Additionally, mortgage-purchase applications are up 5% on a seasonally adjusted basis. The pool of buyers is small but determined, with nearly half of the homes that do sell doing so within two weeks. That share has increased over the last month, which isn’t typical for this time of year.

“This spring’s housing market is hot but cold, with scant listings making it less active than usual but fast and competitive at the same time. The good news is that buyers are out there, trying to find a seat in a game of musical chairs. The bad news is there aren’t enough chairs,” said Redfin Deputy Chief Economist Taylor Marr. “A lot of potential home sales are locked up until mortgage rates come down to a level for which current owners would be willing to trade in their 3% rate. The problem is that’s unlikely to happen anytime soon, as although inflation is steadily coming down from last year’s record-high levels, it’s still above target.”

While a shortage of listings and few but fast-moving sales characterize the U.S. housing market as a whole, each metro area is unique.

Austin, TX Redfin Premier agent Gabriel Recio reports that homebuying demand has picked up this spring, but there are enough homes for sale that he’s not seeing much competition. Pending sales and new listings are each down about 9% from a year earlier in Austin, smaller declines than most metros, and prices are down the most in the country (-18% YoY).

“I’ve seen an influx of homebuyers enter the market over the last month,” Recio said. “The rejuvenation is partly because people got tired of waiting for mortgage rates to come down and partly because they feel it’s a good time to get a home without much competition. Many of today’s buyers are people moving in from other states and some are investors.”

In Jacksonville, FL, Redfin Premier agent Heather Kruayai says sellers are subdued–and so are a lot of prospective buyers. “Homeowners are locked in by low mortgage rates. They’re not selling unless they need to move for something like a new job or another major life change,” she said. “Homes that do go on the market are selling quickly if they’re low-priced starter homes, but middle-of-the-road and expensive homes are sitting.”

Unless otherwise noted, the data in this report covers the four-week period ending May 7. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.