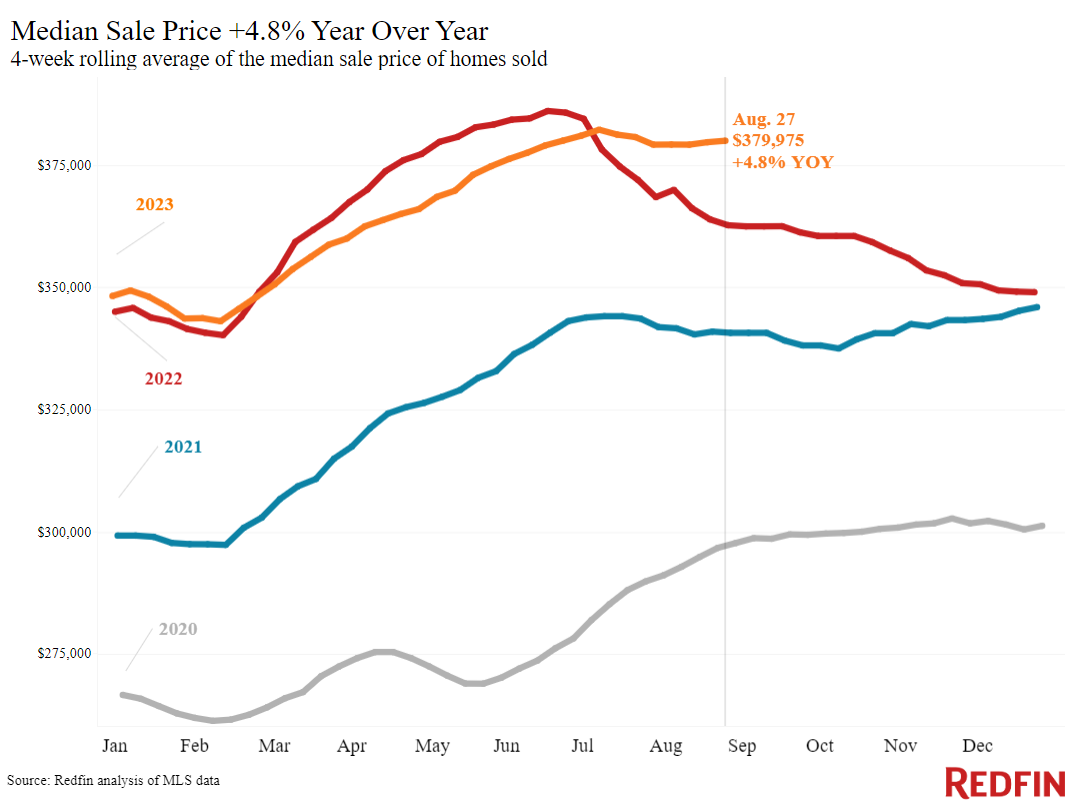

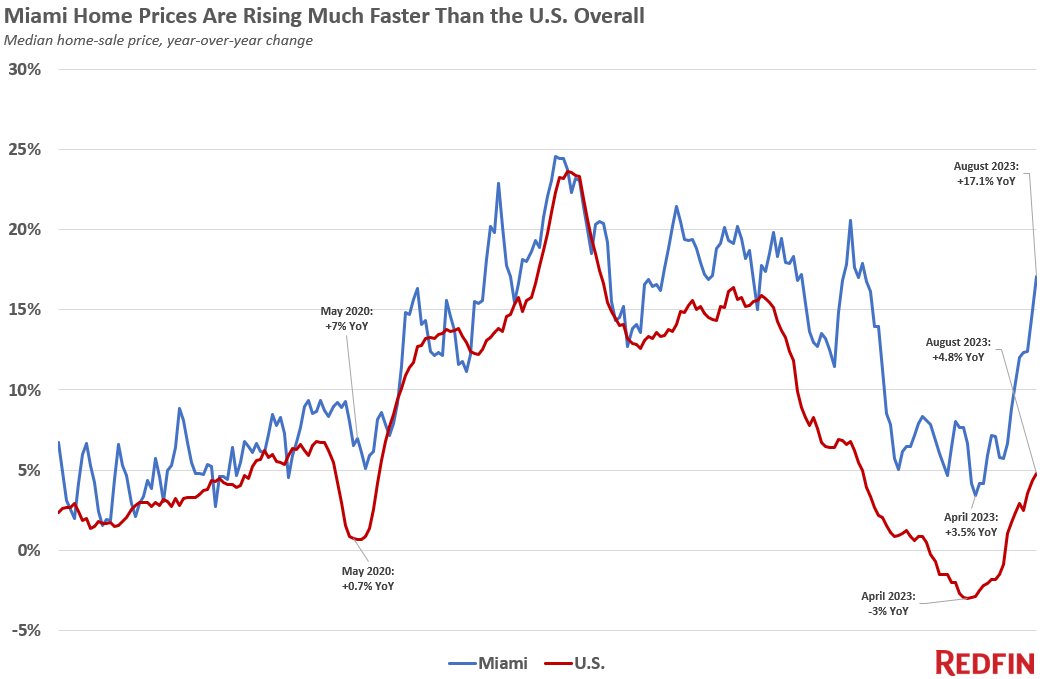

Nationwide, home prices are up 5% year over year–the biggest increase in 10 months–due to a severe lack of homes for sale.

The median home-sale price in Miami rose 17% from a year earlier during the four weeks ending August 27, the biggest increase the metro area has seen since October 2022. That’s also the biggest increase of the 50 most populous U.S. metros, though almost all of those metros posted year-over-year price gains in August. Prices declined in just six metros, half of them in Texas: Austin, Phoenix, Portland, OR, Fort Worth, Las Vegas and San Antonio.

Nationwide, the median home-sale price rose 5% year over year to $380,000, the biggest uptick in 10 months. The typical monthly mortgage payment hit an all-time high of $2,649.

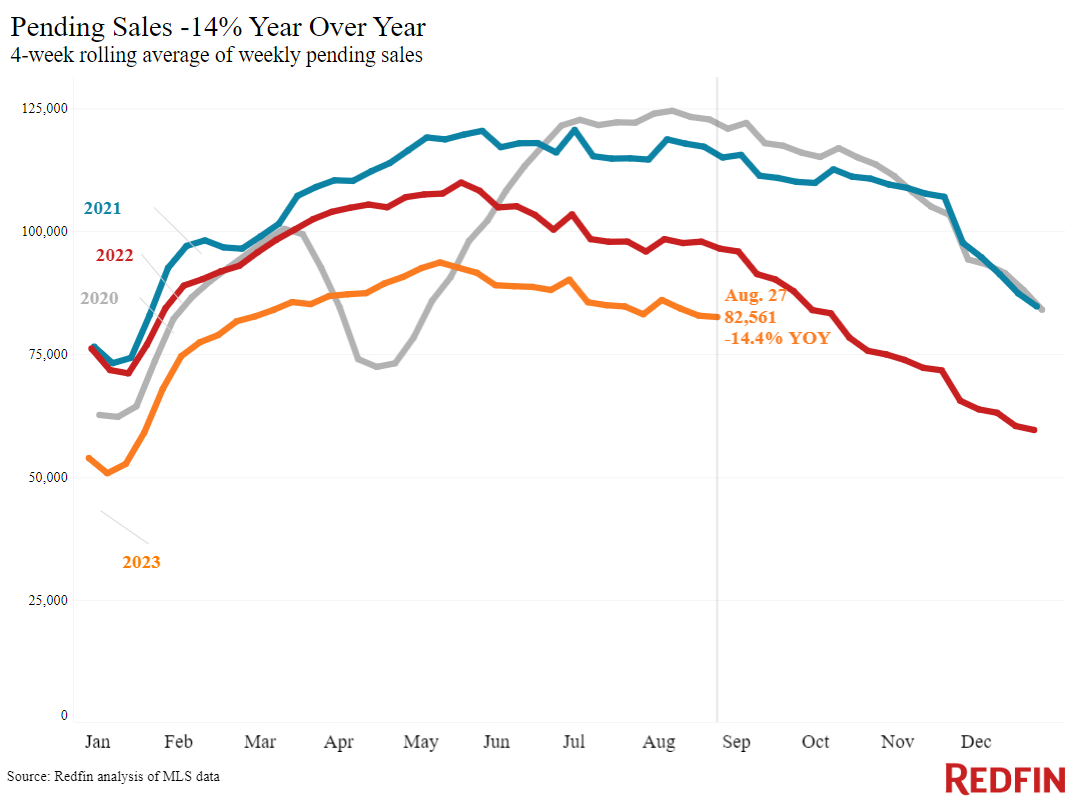

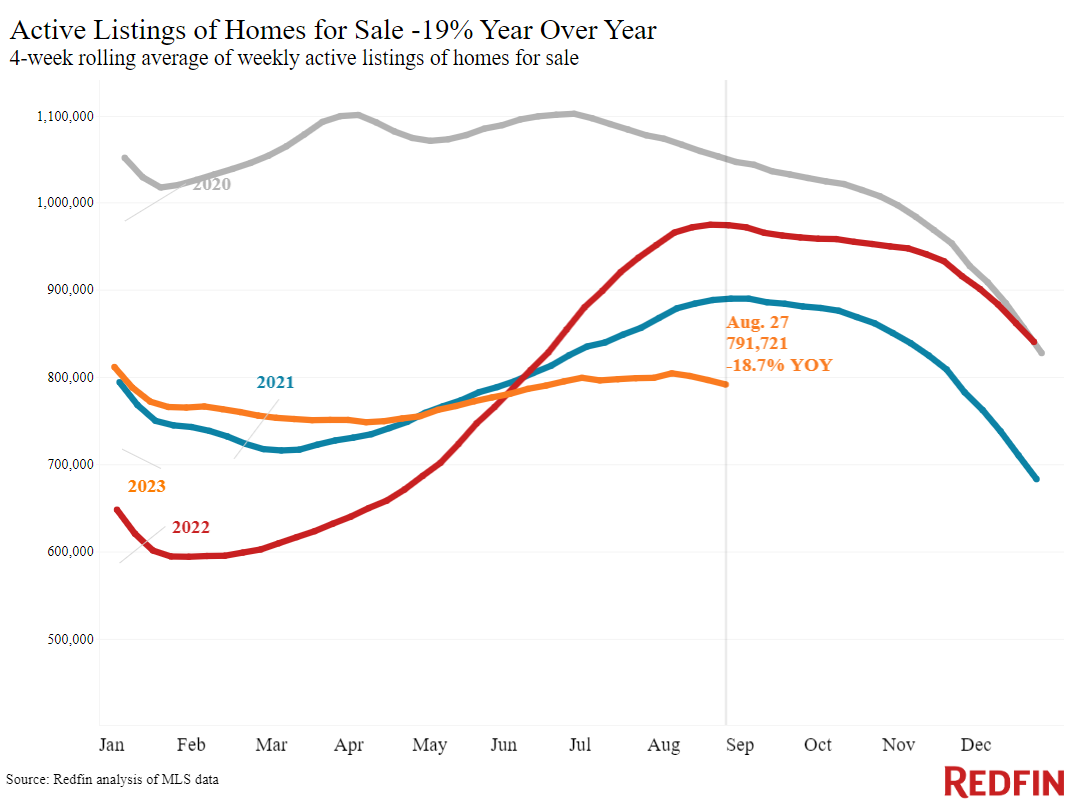

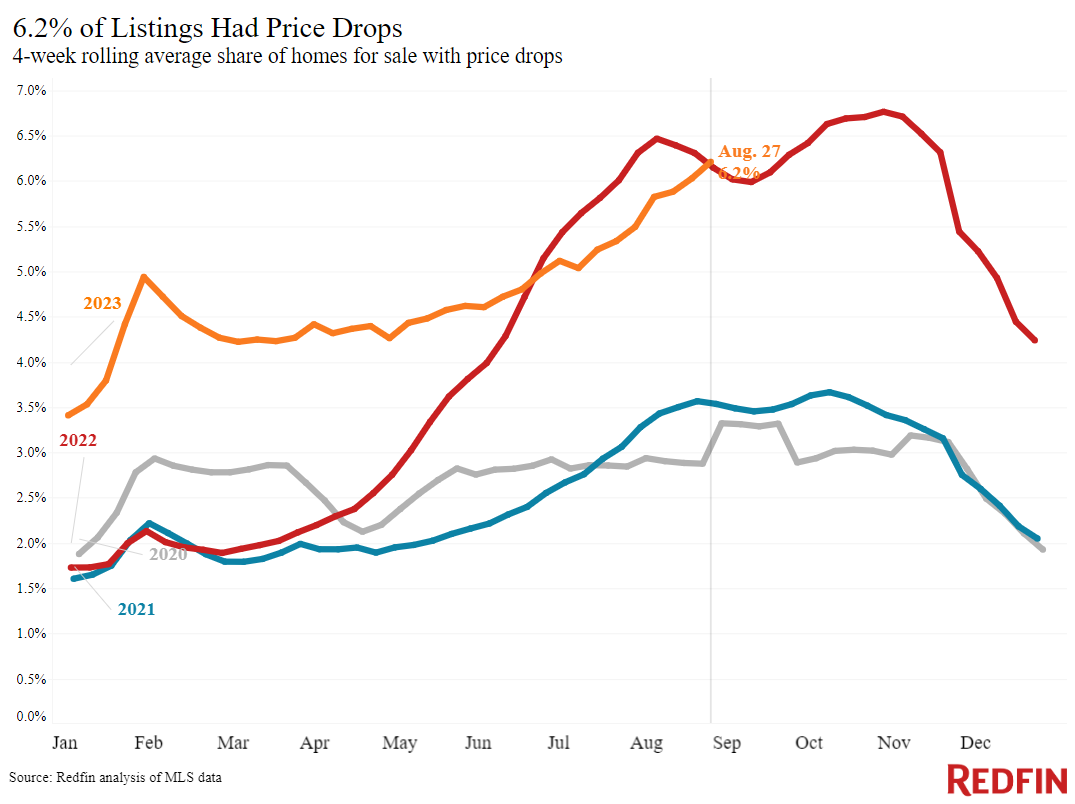

Home prices are rising due to a severe inventory shortage: The total number of U.S. homes for sale is down 19%, the biggest drop since February 2022, and new listings are down 10%. Supply is low because homeowners are hanging onto their low mortgage rates; nearly all homeowners have a rate below 6%, and rates are now hovering around 7%. The lack of homes for sale is causing competition for desirable homes despite high mortgage rates and a relatively small pool of buyers. Pending sales declined 14% year over year and mortgage-purchase applications declined 27%, hovering near their lowest level in about 30 years. Another reason for the big year-over-year price increase is that prices came down rapidly at this time last year, with rising mortgage rates sidelining buyers.

Miami’s outsized home-price increase is a slightly different story. Unlike most U.S. metros, Miami prices never posted an annual drop in the first half of 2023, as elevated mortgage rates were deterring many homebuyers. That’s partly because Miami has a supply shortage, like the rest of the country. But it’s also because Miami attracts an influx of out-of-town buyers and investors, despite increasing risk of climate-driven natural disasters such as hurricanes and flooding. Those buyers are often undeterred by high mortgage rates because they pay cash; two in five recent Miami homebuyers paid all cash.

Unless otherwise noted, the data in this report covers the four-week period ending August 27. Redfin’s weekly housing market data goes back through 2015. This data is subject to revision.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.