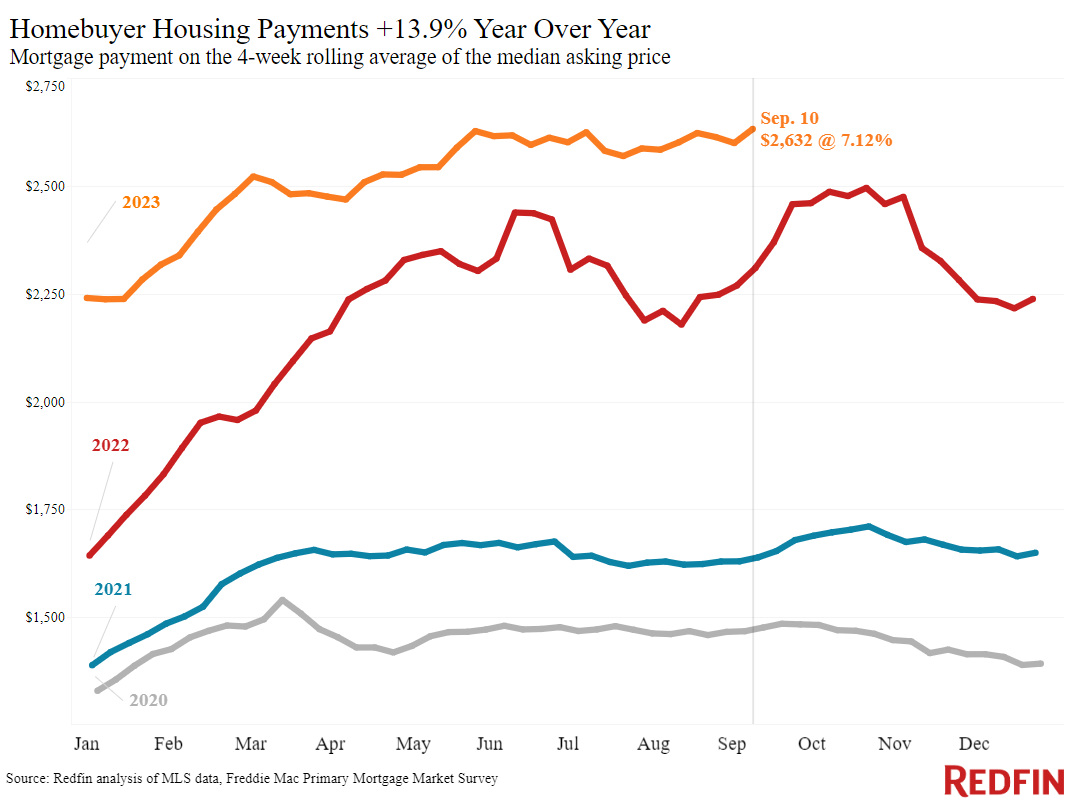

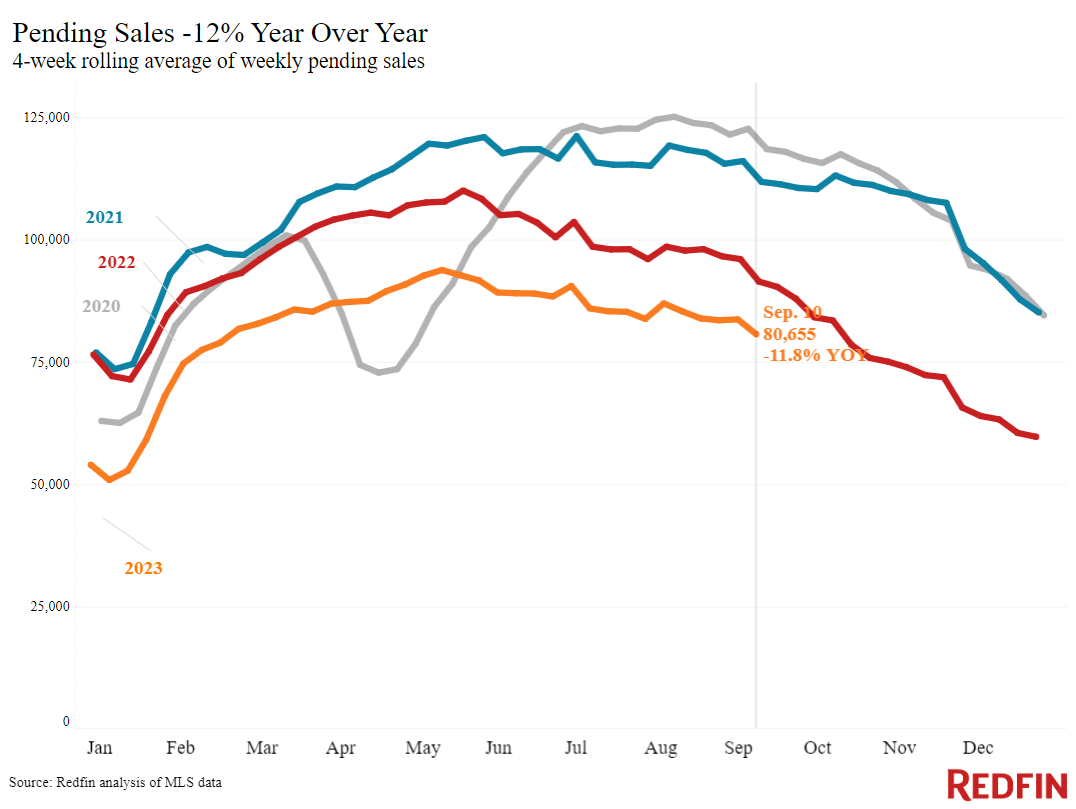

7%-plus mortgage rates and increasing home prices have pushed the typical U.S. monthly mortgage payment to a record high, and sent pending home sales down 12% year over year.

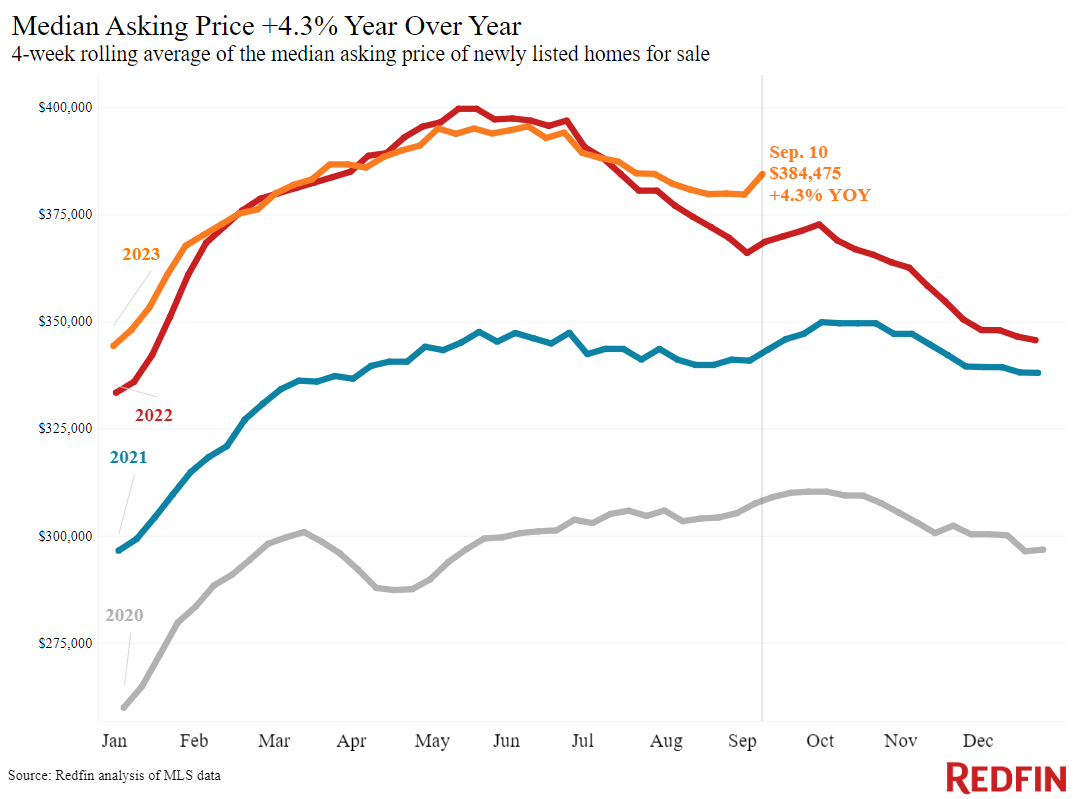

What homebuyers need to know: It’s more expensive than ever to buy a home. The median monthly mortgage payment hit an all-time high of $2,632 during the four weeks ending September 10. Although the weekly average mortgage rate has declined slightly from August’s two-decade high, it’s still sitting above 7%. Prices are up, too, increasing 4% year over year.

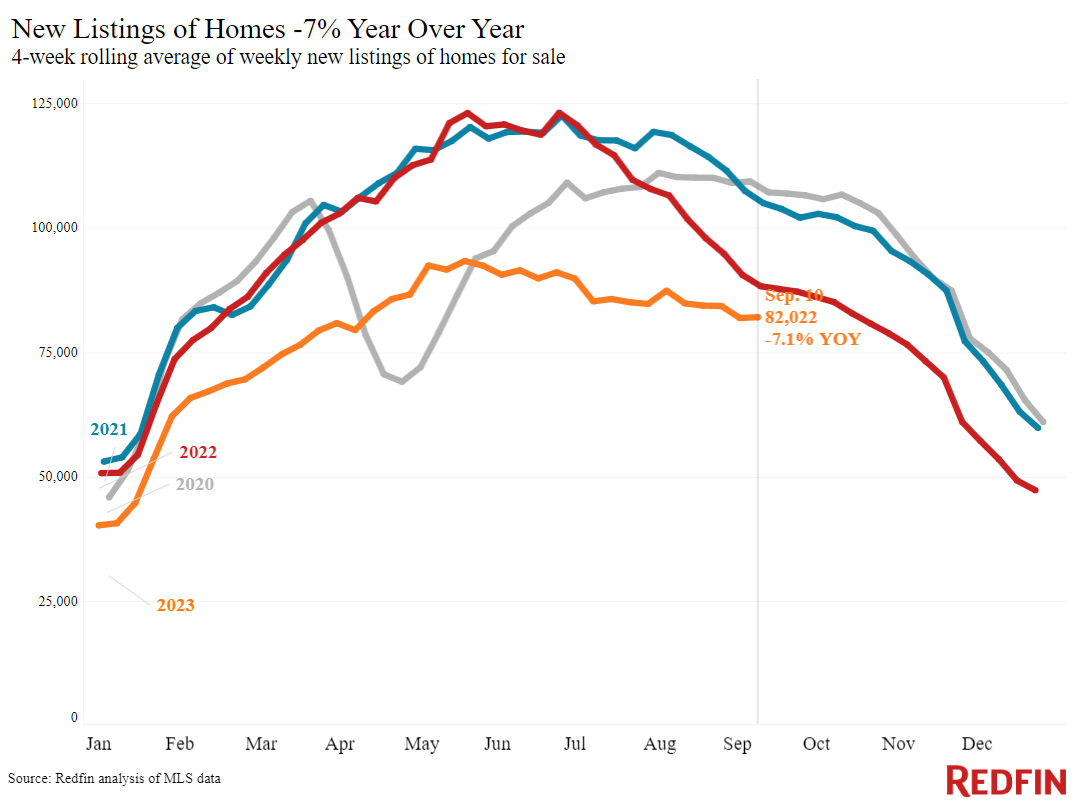

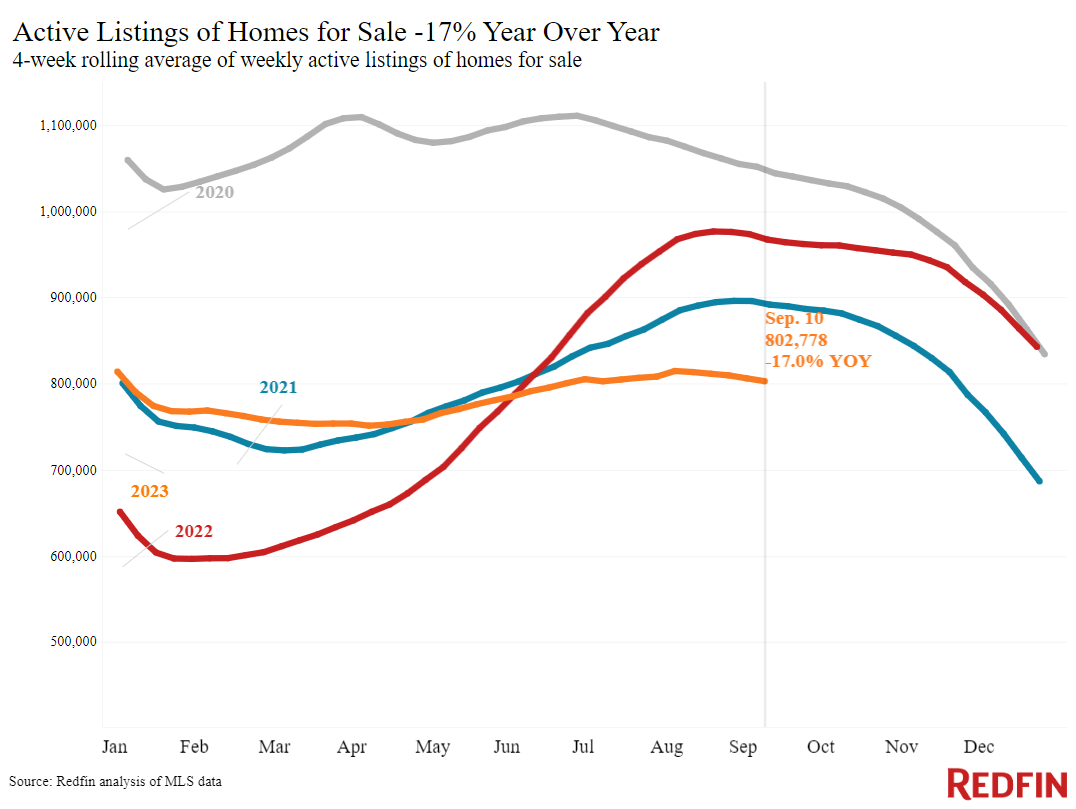

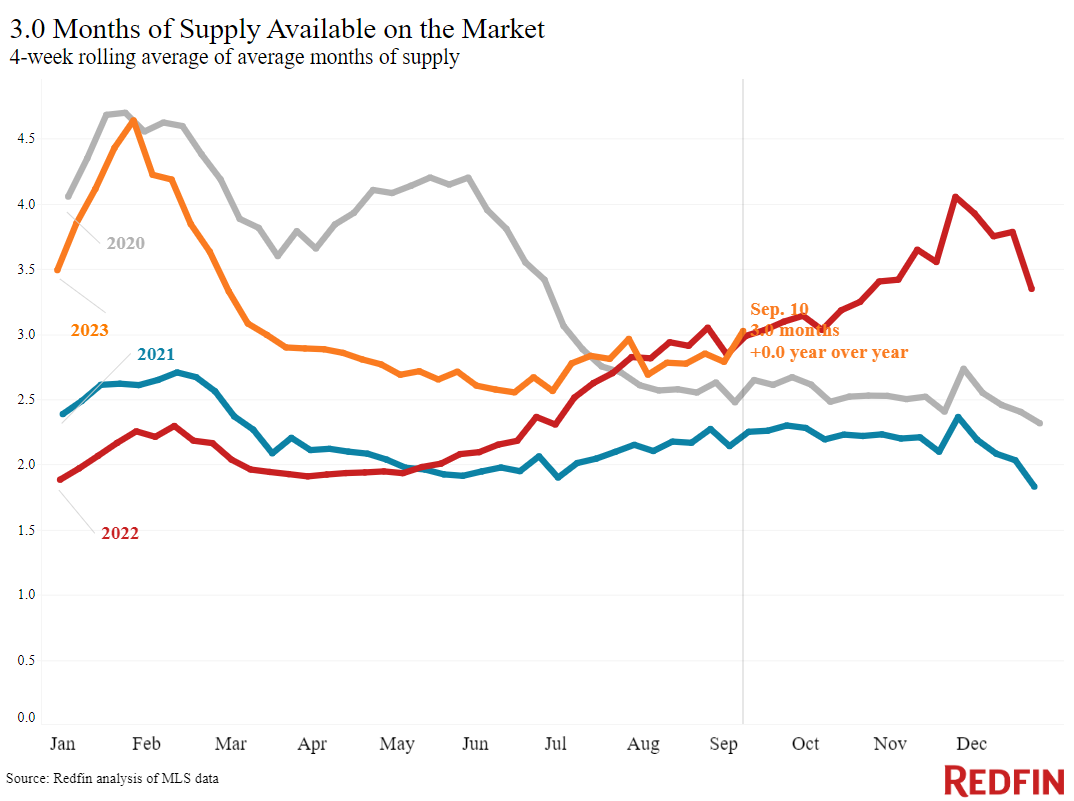

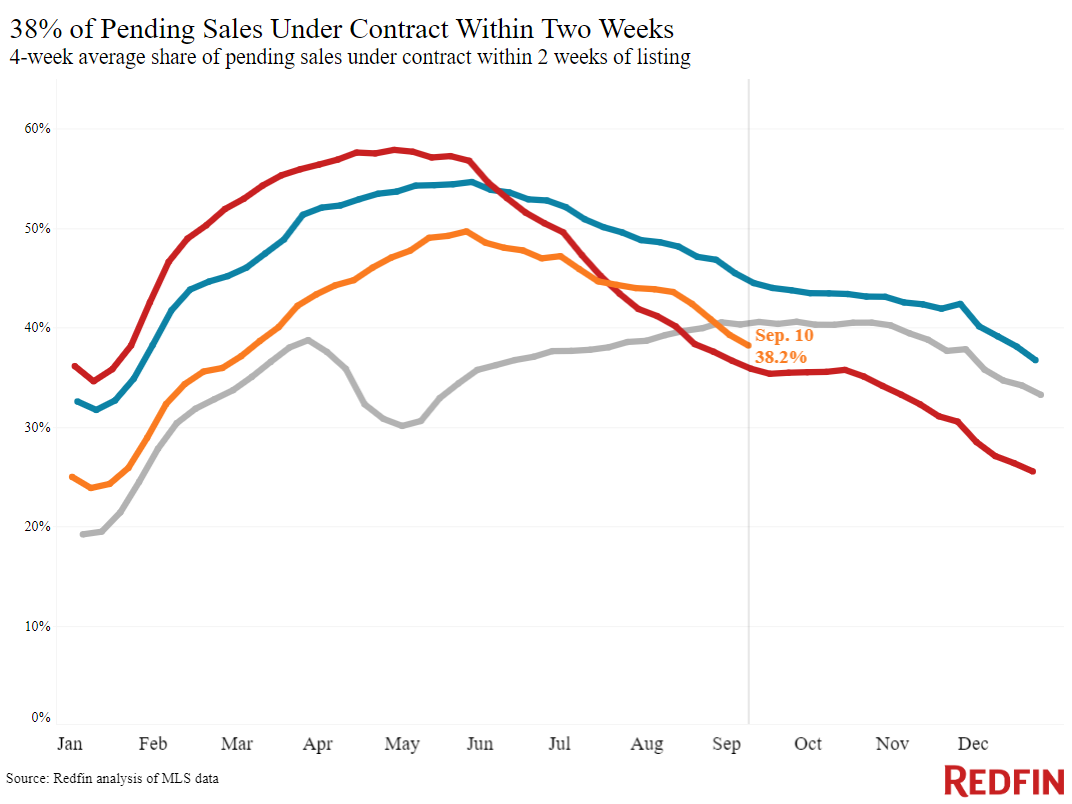

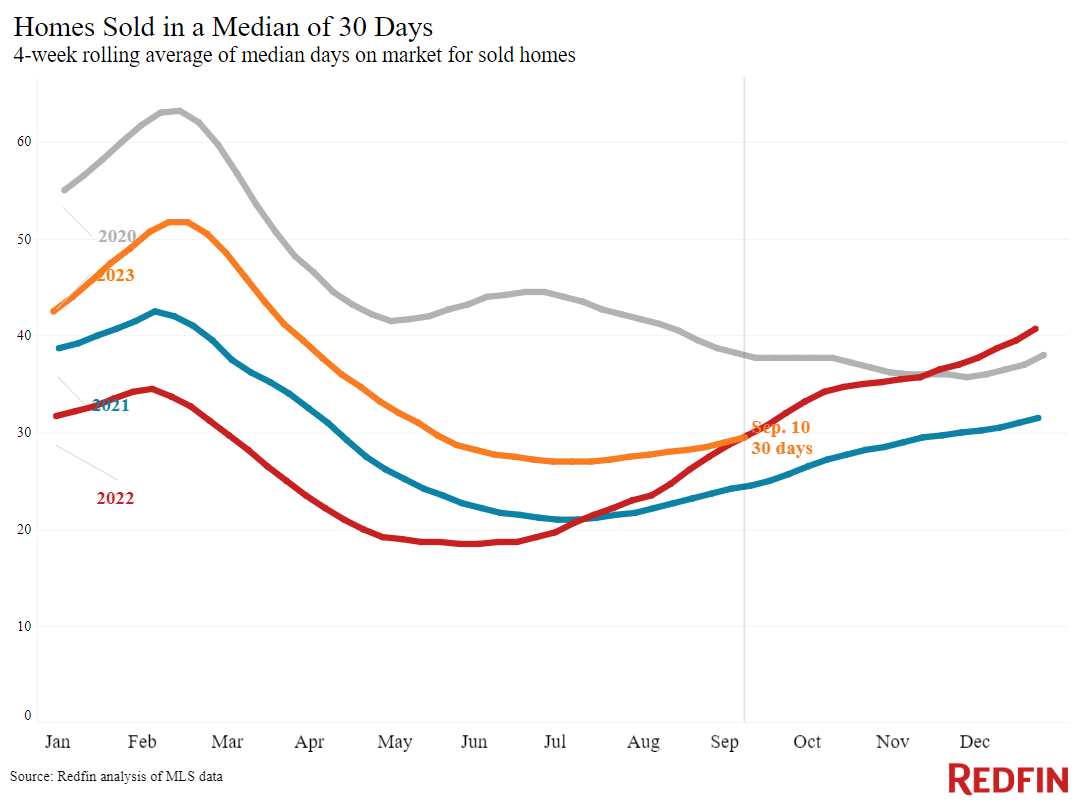

What home sellers need to know: Prices continue to rise because inventory is so low, posting one of its biggest declines in 19 months this week. In much of the country, you’re likely to get a fair price for your home–it’ll help if it’s move-in ready and in a desirable neighborhood. But keep in mind that high prices, elevated rates and the lack of inventory is sending some buyers to the sidelines; mortgage-purchase applications are hovering near a three-decade low and pending home sales are down 12% year over year.

Looking forward: This week’s CPI report shows that inflation came in a touch higher than anticipated. That doesn’t change the expectation that the Fed is highly unlikely to hike interest rates next week, but it does make a rate hike in November or December appear more likely. That could mean mortgage rates stay high through the end of the year–or rates could come down if economic data looks promising over the next few months.

Refer to our metrics definition page for explanations of all the metrics used in this report.