New listings posted their biggest increase in two months this week, but mortgage applications and pending sales declined as mortgage rates stay stubbornly high.

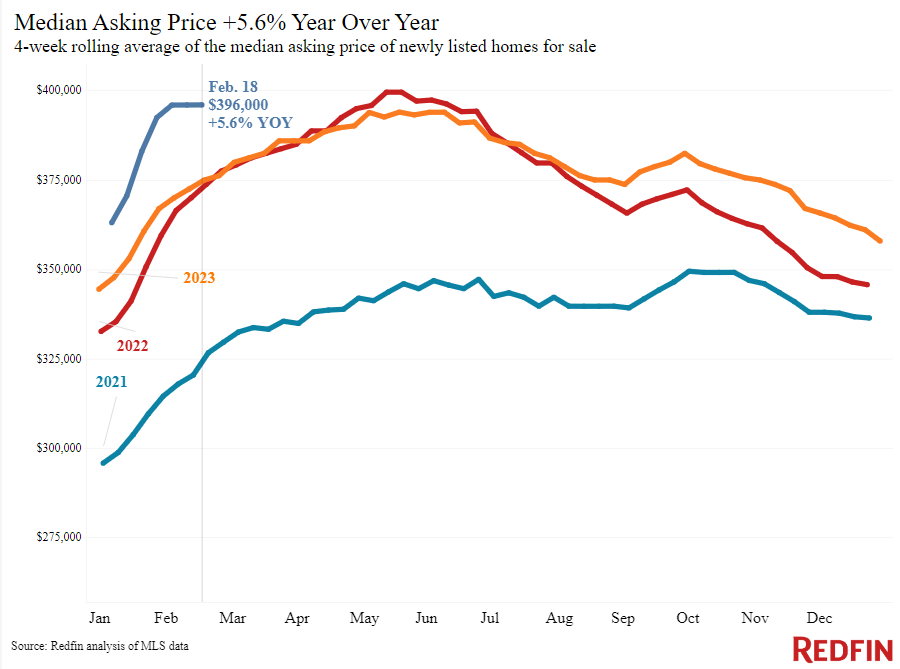

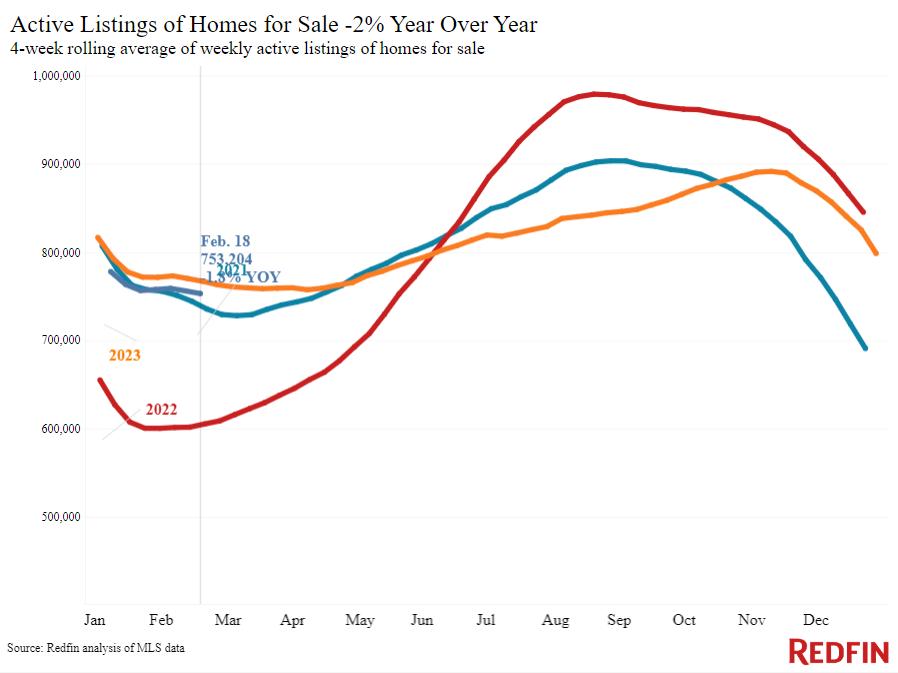

More sellers are listing their homes as spring draws nearer. New listings rose 10% year over year during the four weeks ending February 18, the biggest increase in two months. Sellers are hoping to take advantage of high prices: Sale prices are up 6% year over year, the biggest increase since October 2022.

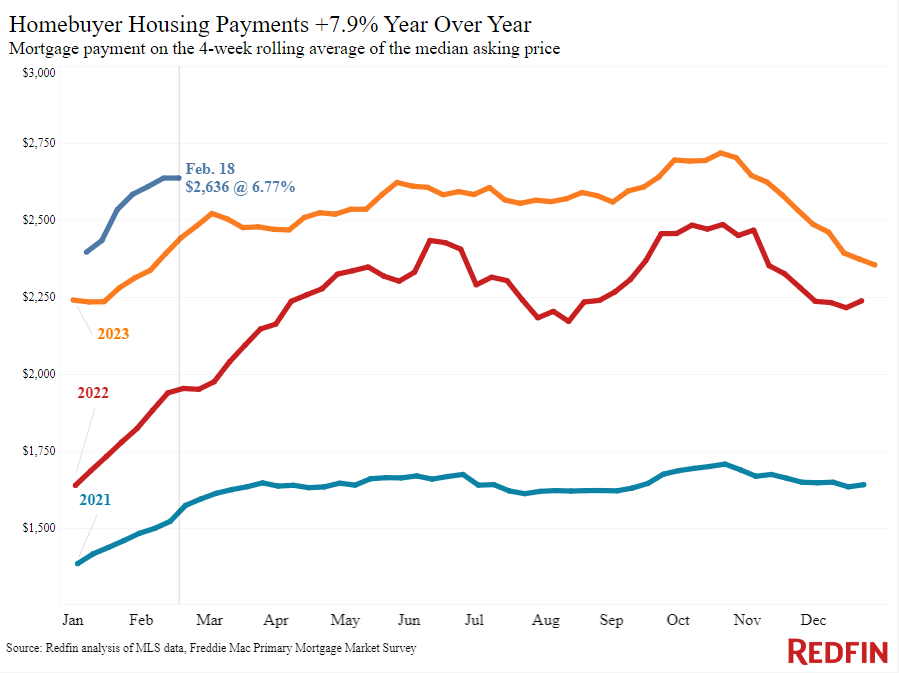

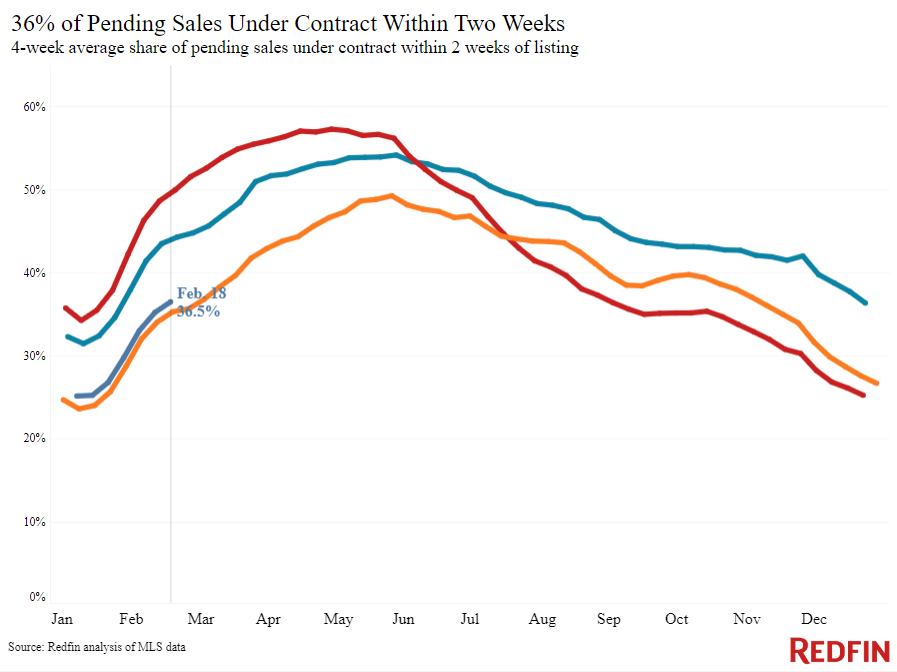

But many buyers are still sitting on the sidelines. Mortgage-purchase applications dropped 10% from a week earlier as daily average mortgage rates surpassed 7% for the first time since mid-December, and pending home sales are down 7% year over year, similar to the declines we’ve seen since mid-January.

Redfin agents report that the buyers who are out there are mostly interested in move-in ready homes because they don’t want to spend money on repairs and renovations in addition to high monthly payments. Agents also recommend that sellers are open to providing some sort of financial concession to buyers to help ease the pain of 7% rates.

“I tell every one of my sellers to have an open mind and put on their buyer’s hat. Nine times out of 10, buyers are asking for a concession in their initial offer right now–and usually the seller needs to accept it to seal the deal,” said Shauna Pendleton, a Redfin Premier agent in Boise, ID. “The most common concession buyers are asking for is a mortgage-rate buydown. Requests for sellers to cover the closing costs are also common. I most often see buyers ask for concessions for more affordable homes–anything under $500,000 here in Boise–but I see some concessions on expensive homes, too.”

Refer to our metrics definition page for explanations of all the metrics used in this report.