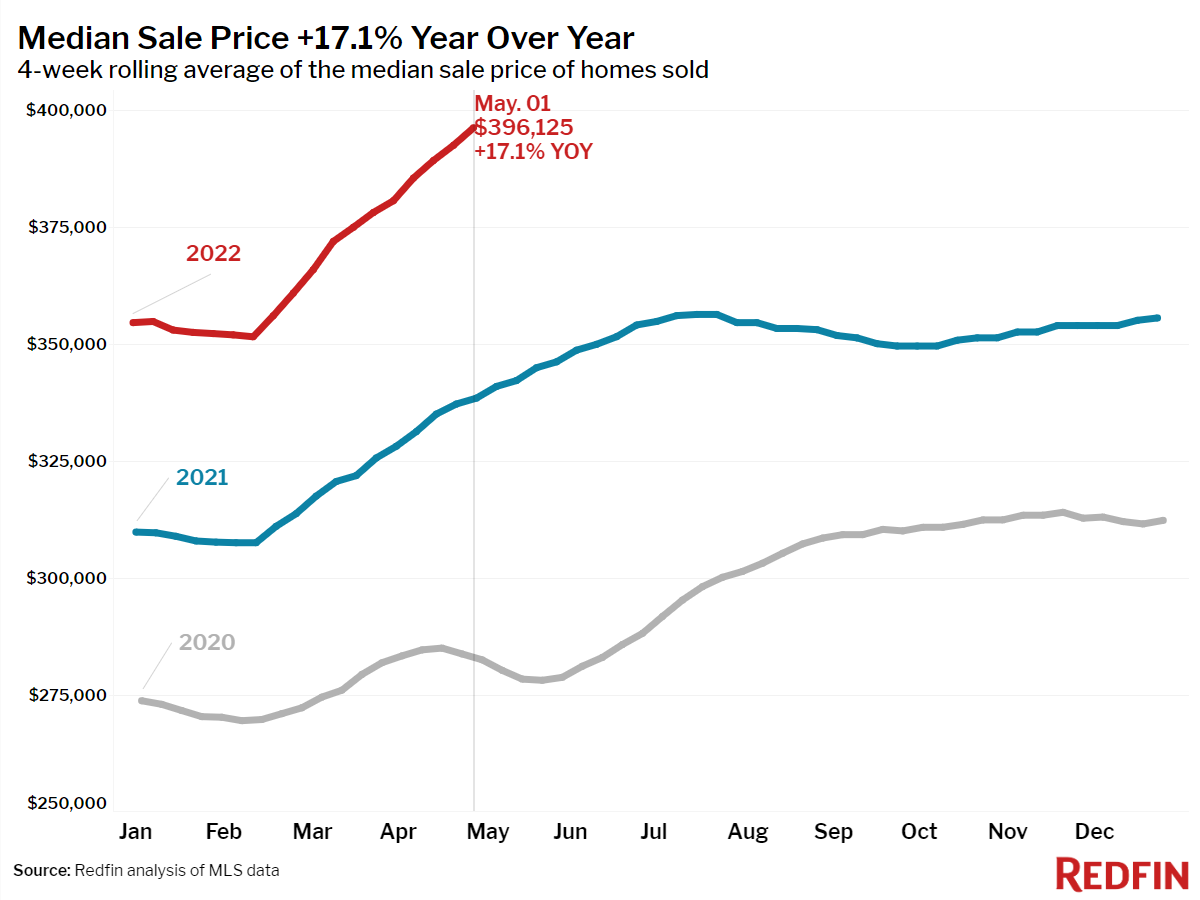

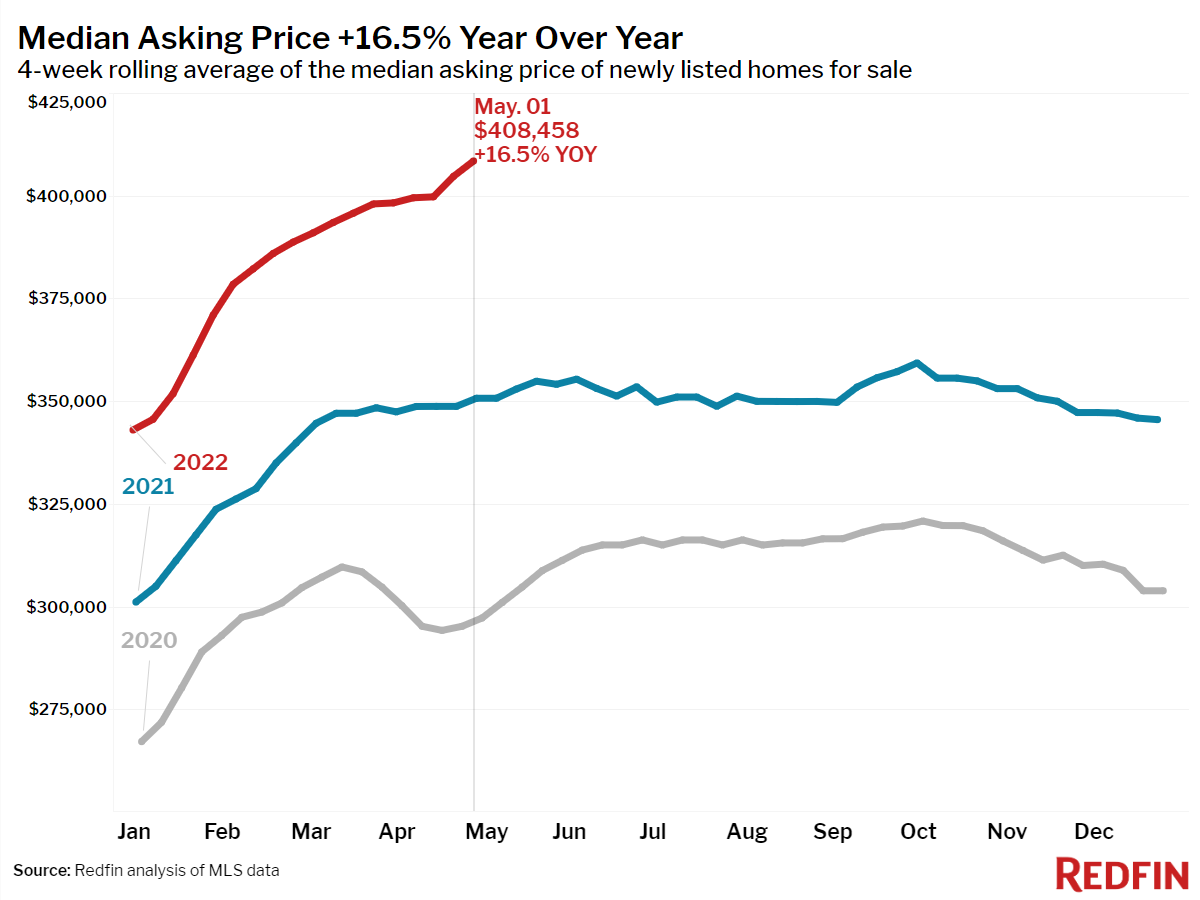

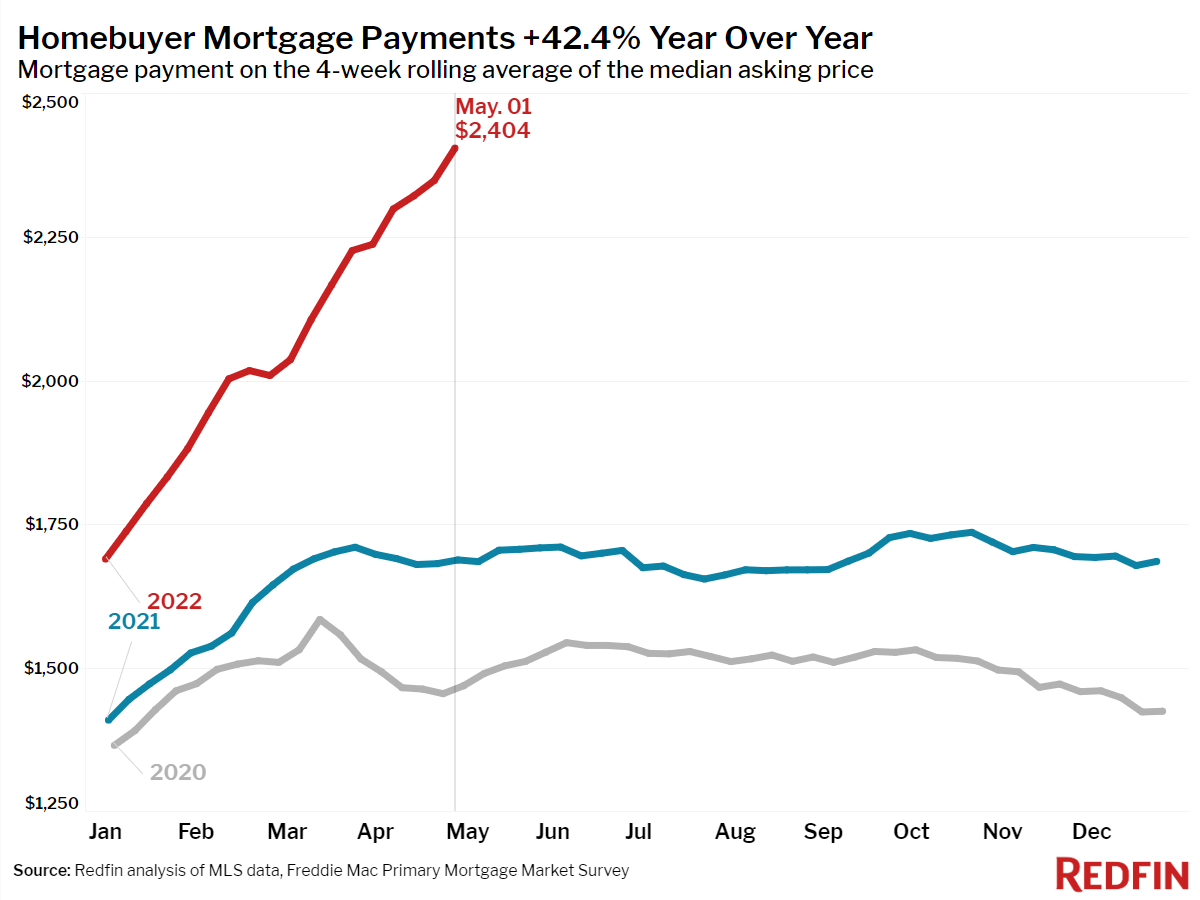

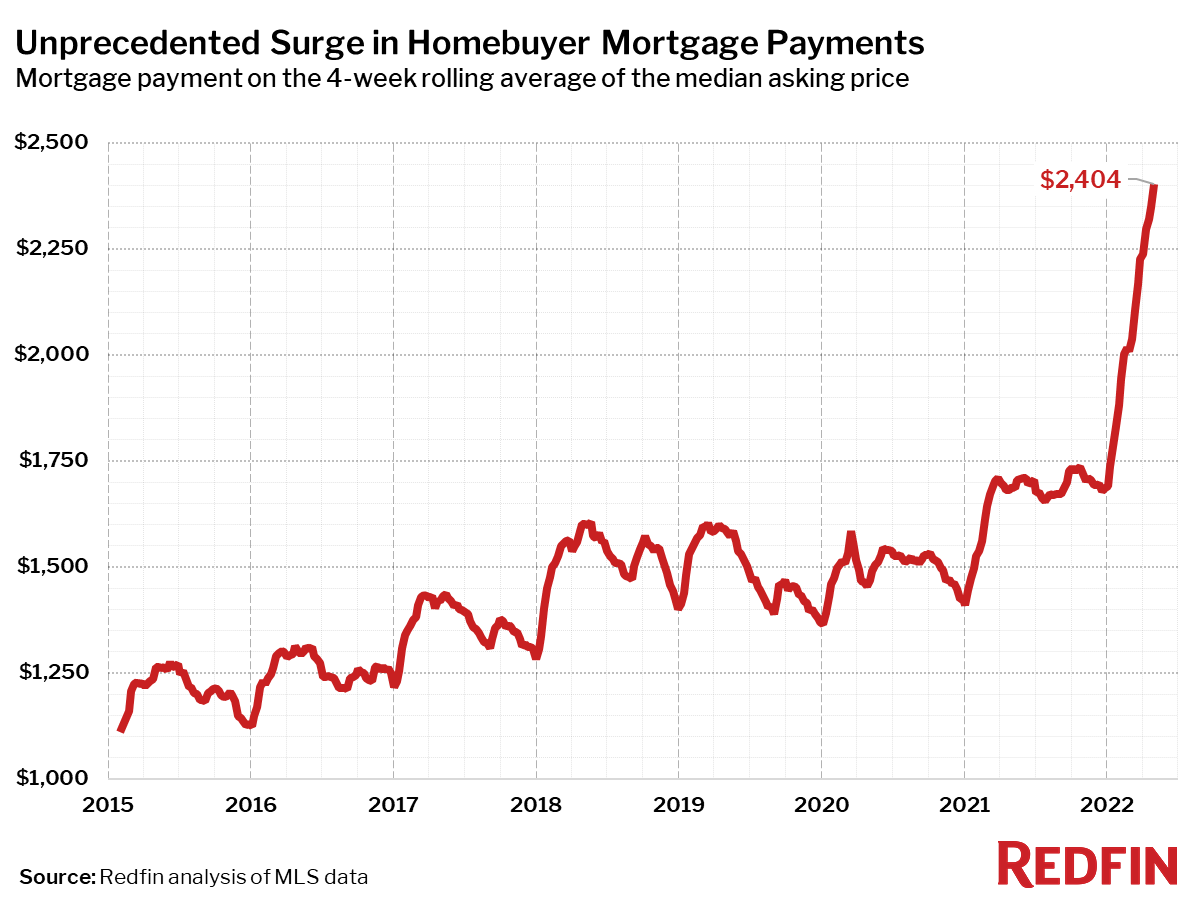

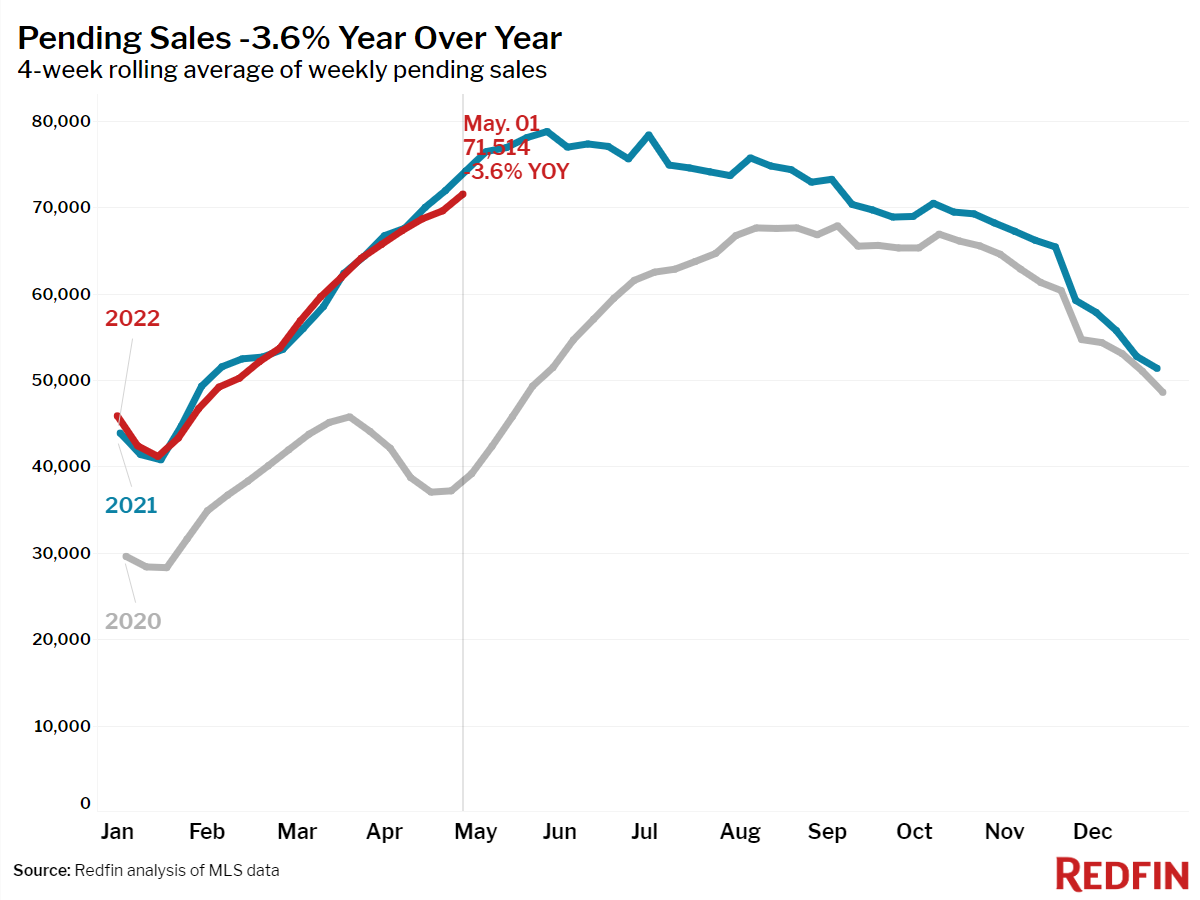

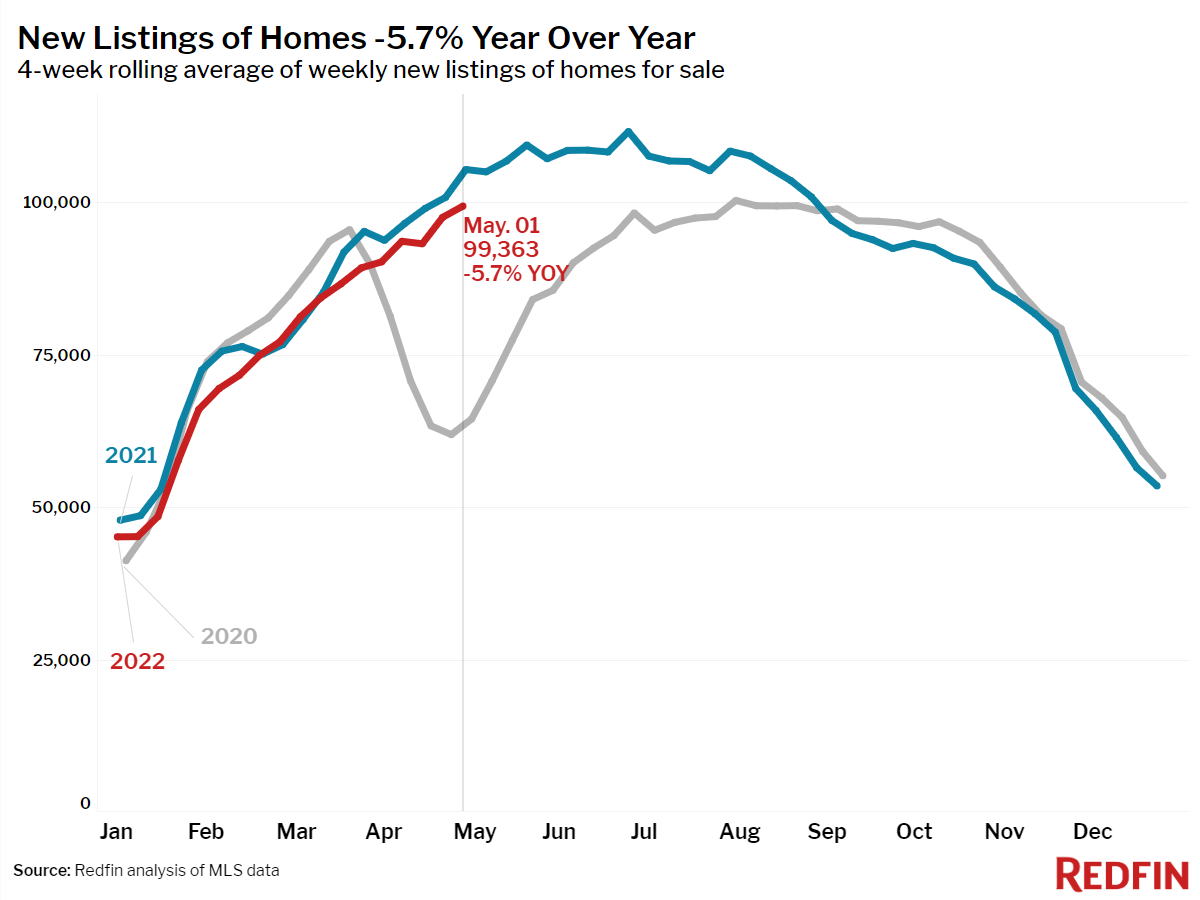

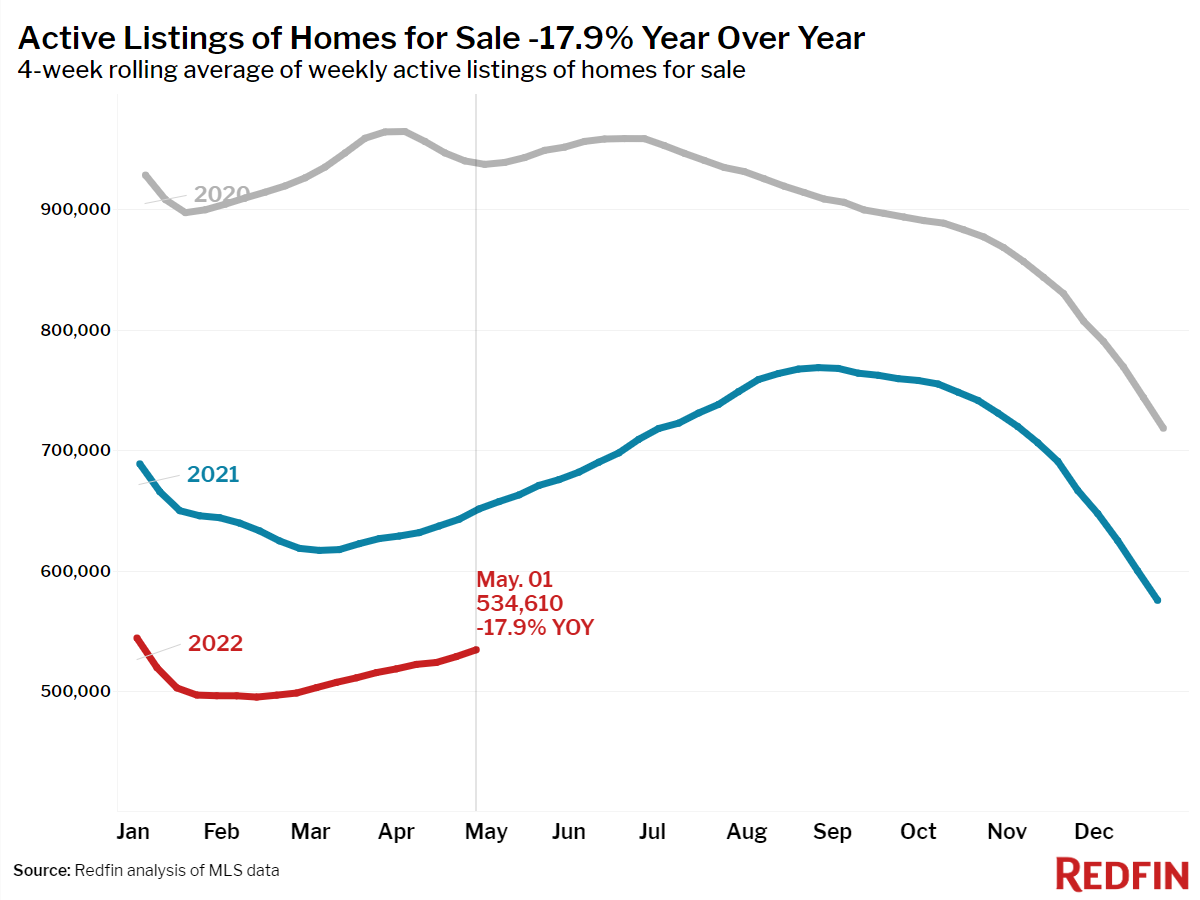

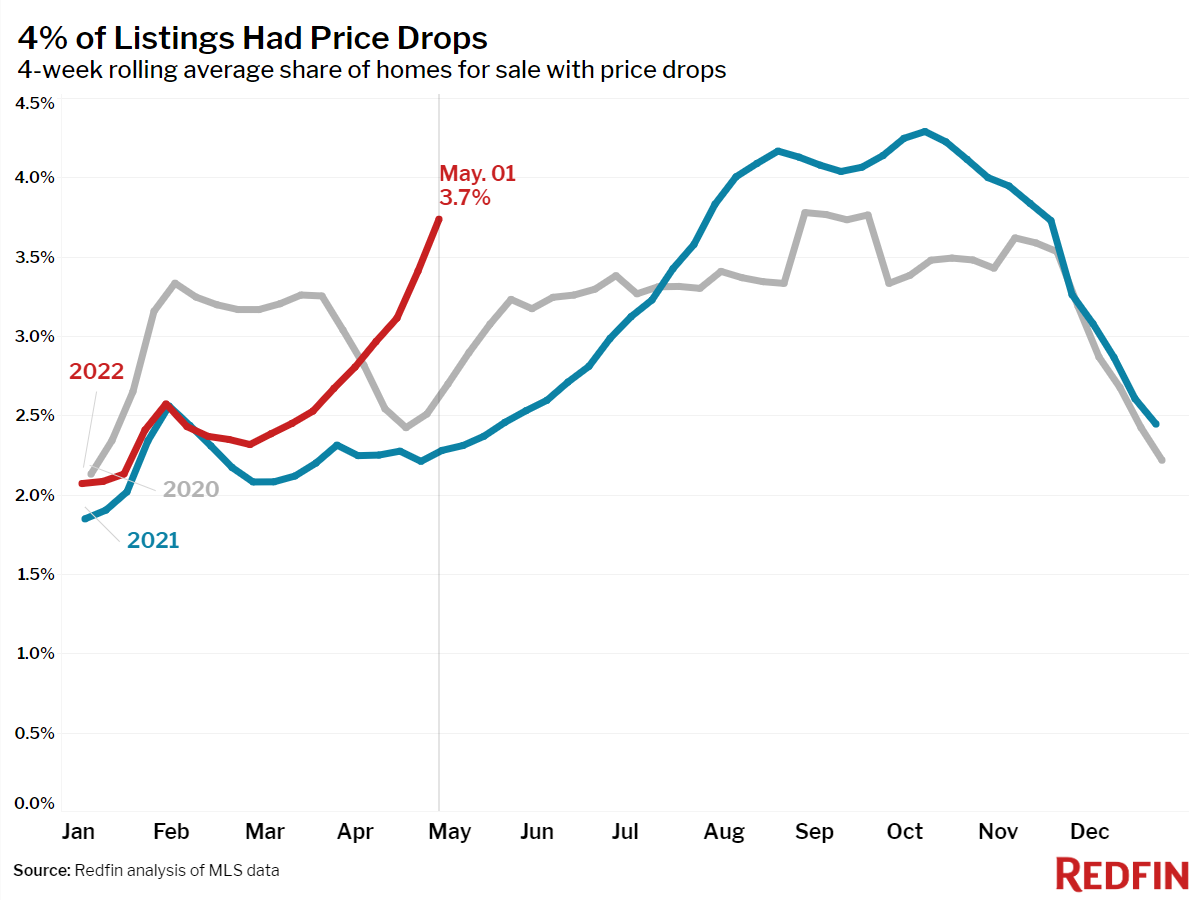

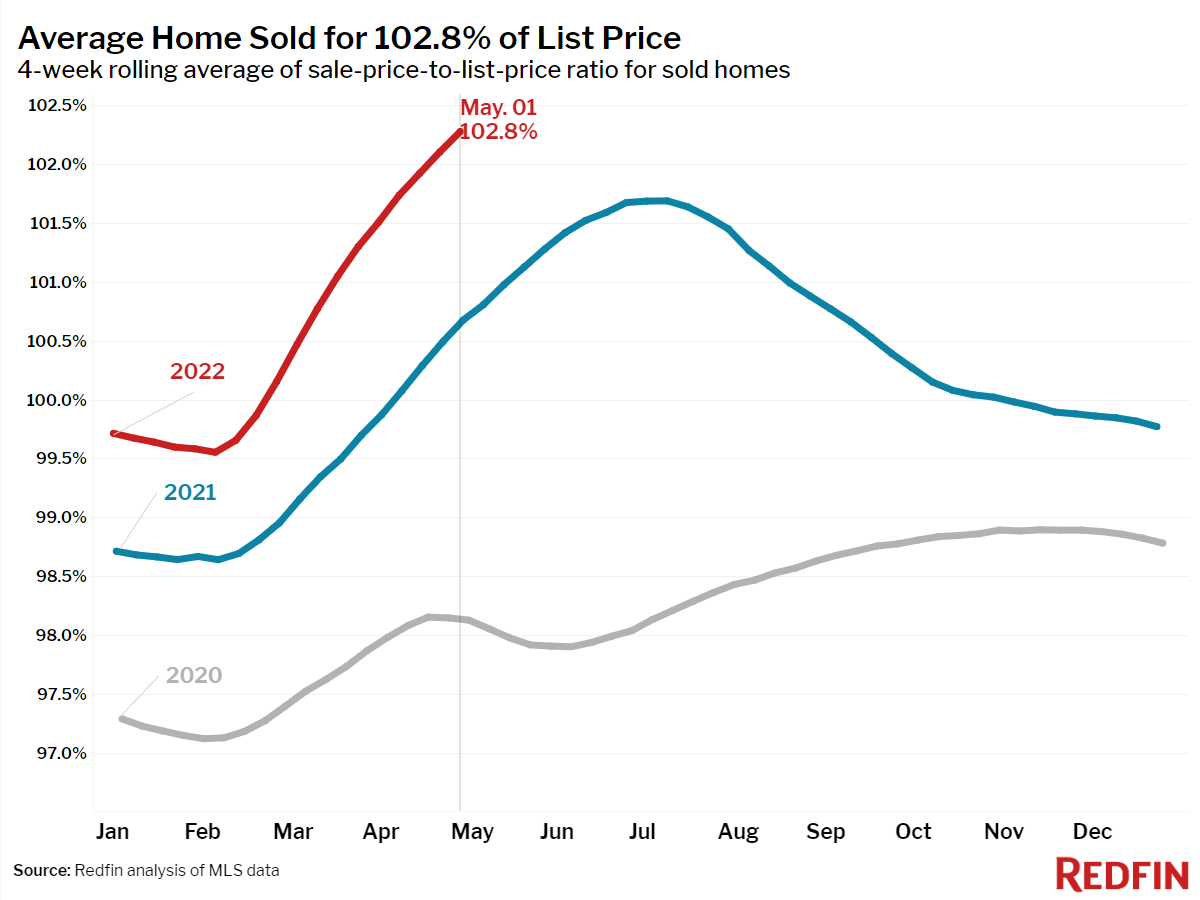

The share of home sellers who dropped their asking price shot up to a six-month-high of 15% for the four weeks ending May 1, up from 9% a year earlier. The 5.9% increase is the largest annual gain on record in Redfin’s weekly housing data back through 2015. For homebuyers, the typical monthly mortgage payment skyrocketed a record 42% to a new high during the same period. Although a growing share of sellers are responding to the palpable drop in homebuyer demand by lowering their prices, sellers remain far outnumbered by buyers, so the typical home flies off the market at the fastest pace on record and for more than its asking price.

“Homebuyers continue to be squeezed in nearly every way possible, which is causing some to take a step back from the market,” said Redfin Chief Economist Daryl Fairweather. “Unfortunately for buyers hoping to find a deal as competition cools, sellers are pulling back even faster, which is keeping the market deep in seller’s territory. So even though price drops are becoming more common, most homes are still selling above asking price and in record time.”

Unless otherwise noted, the data in this report covers the four-week period ending May 1. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.