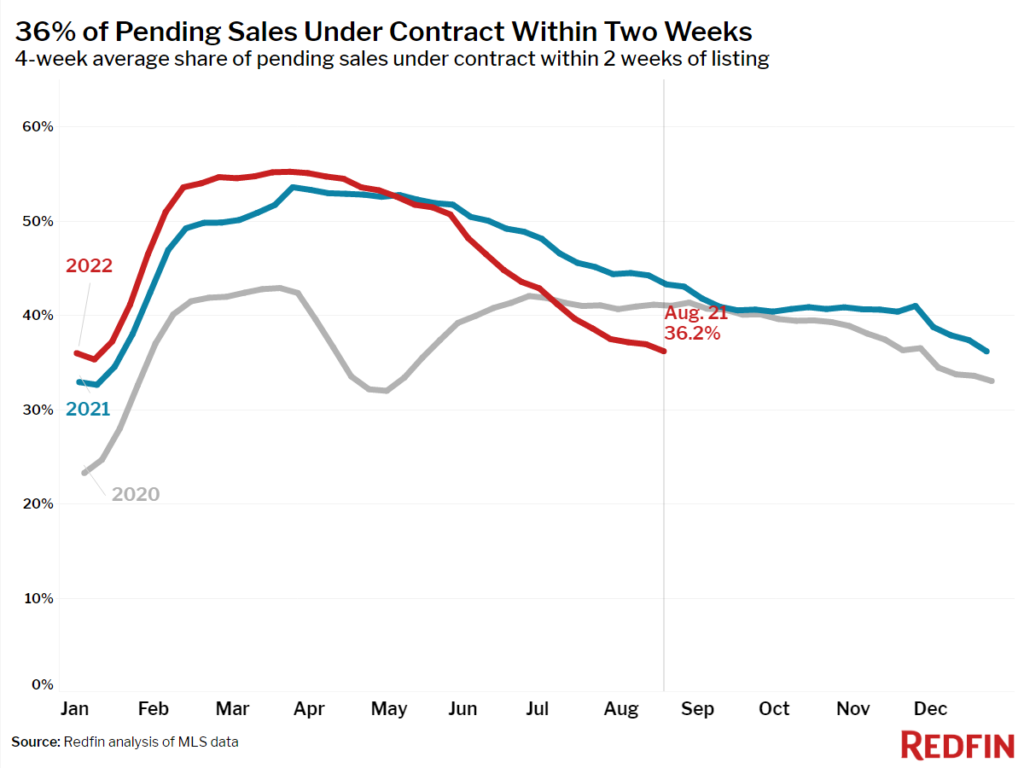

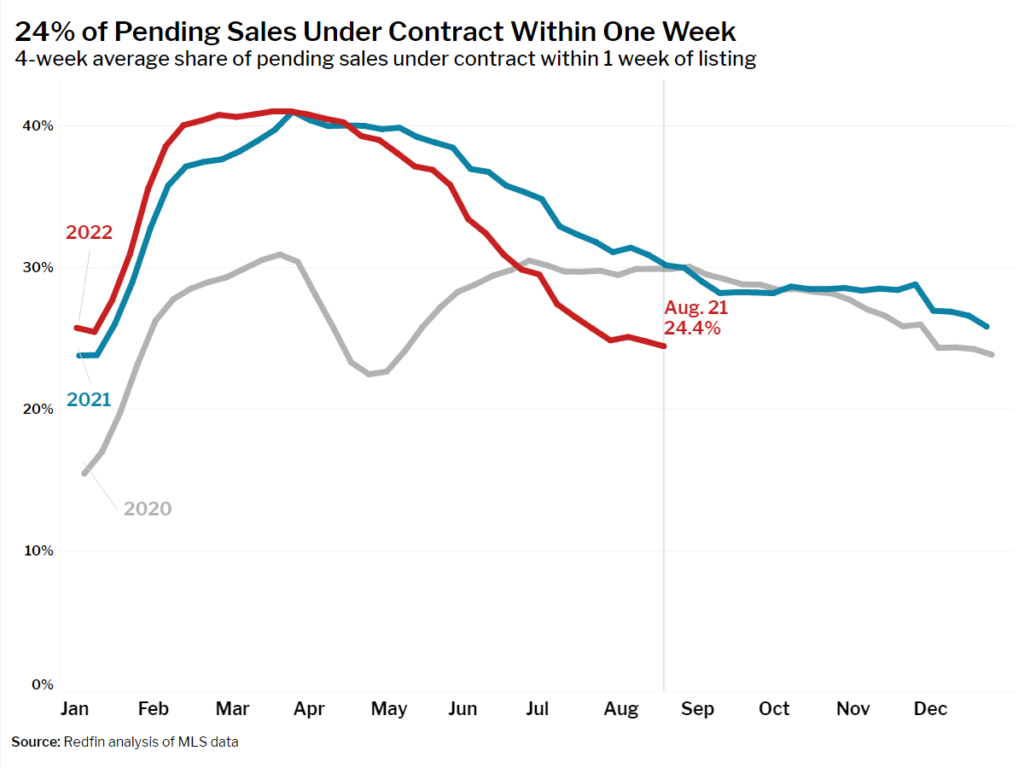

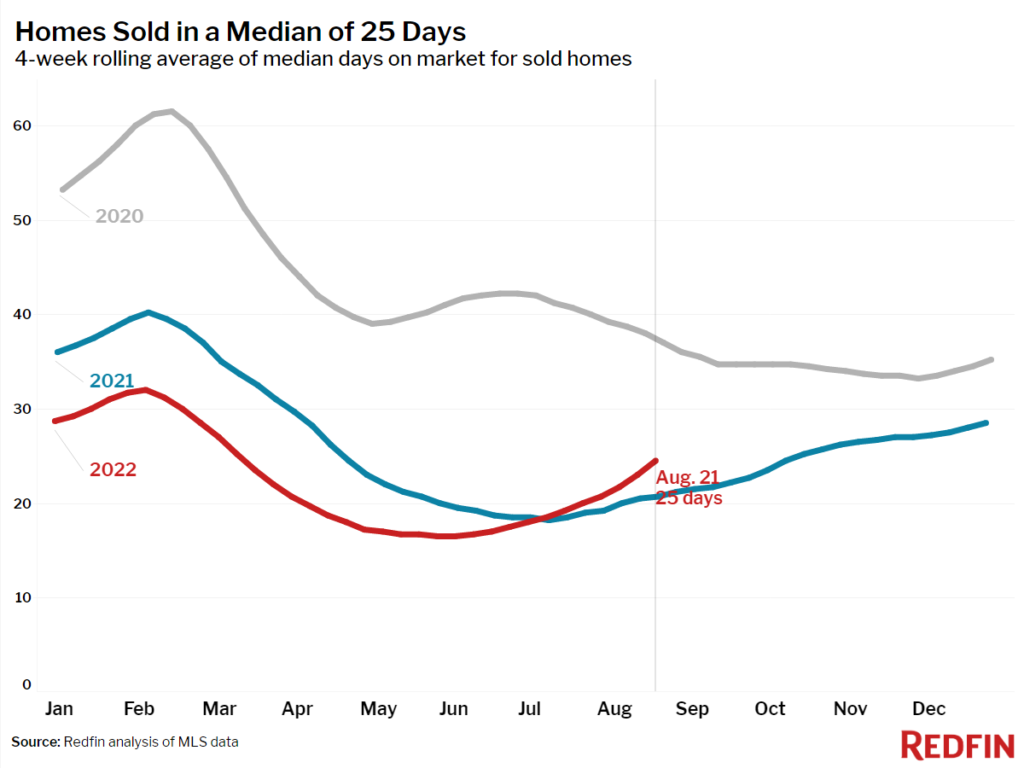

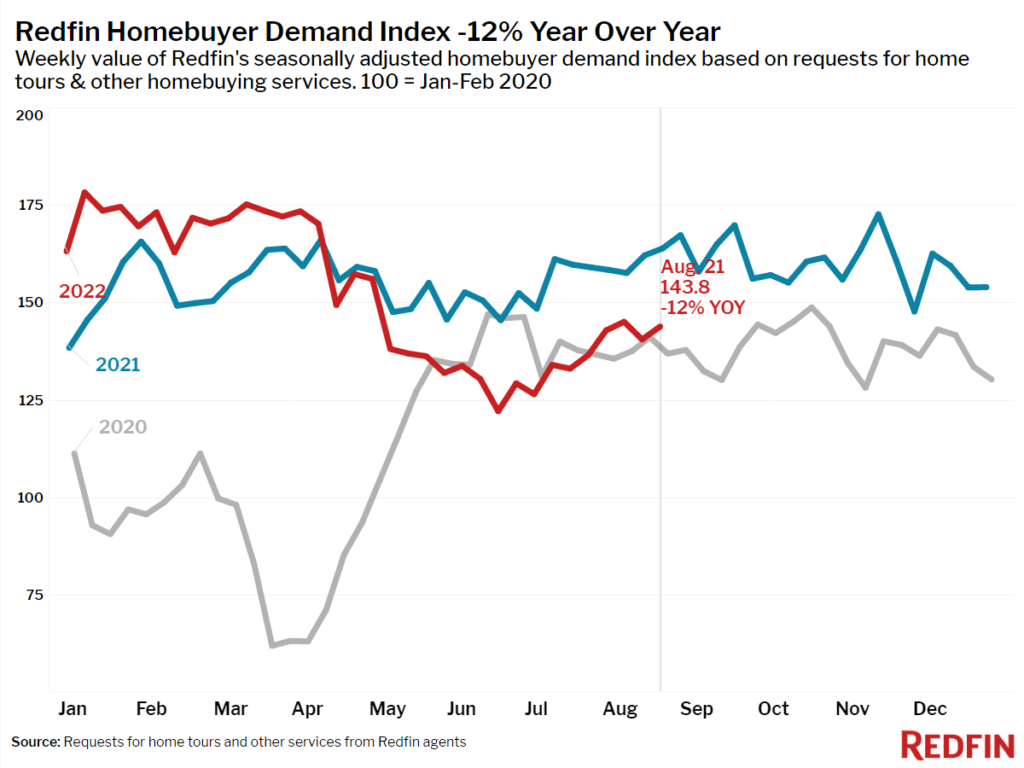

Would-be sellers are reluctant to list their homes as they have begun to see prices come down. With few new listings, buyers’ newfound bargaining power is reaching its limit, especially now that demand has stabilized. And homeowners who are choosing to list are increasingly pricing to meet buyers where they are.

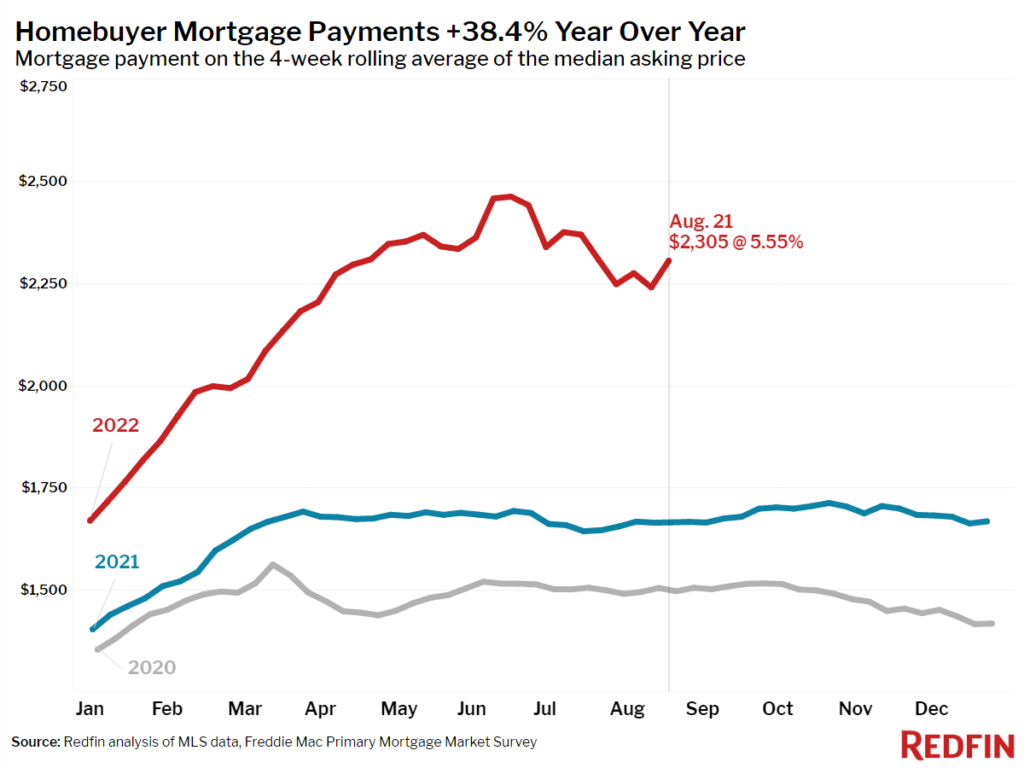

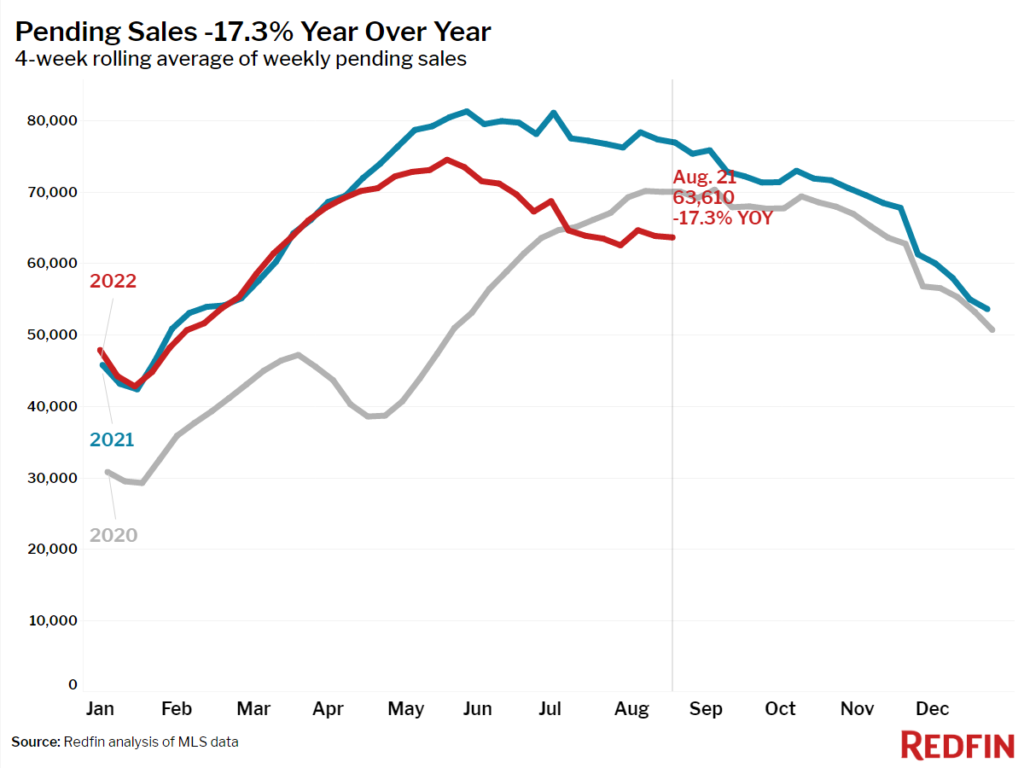

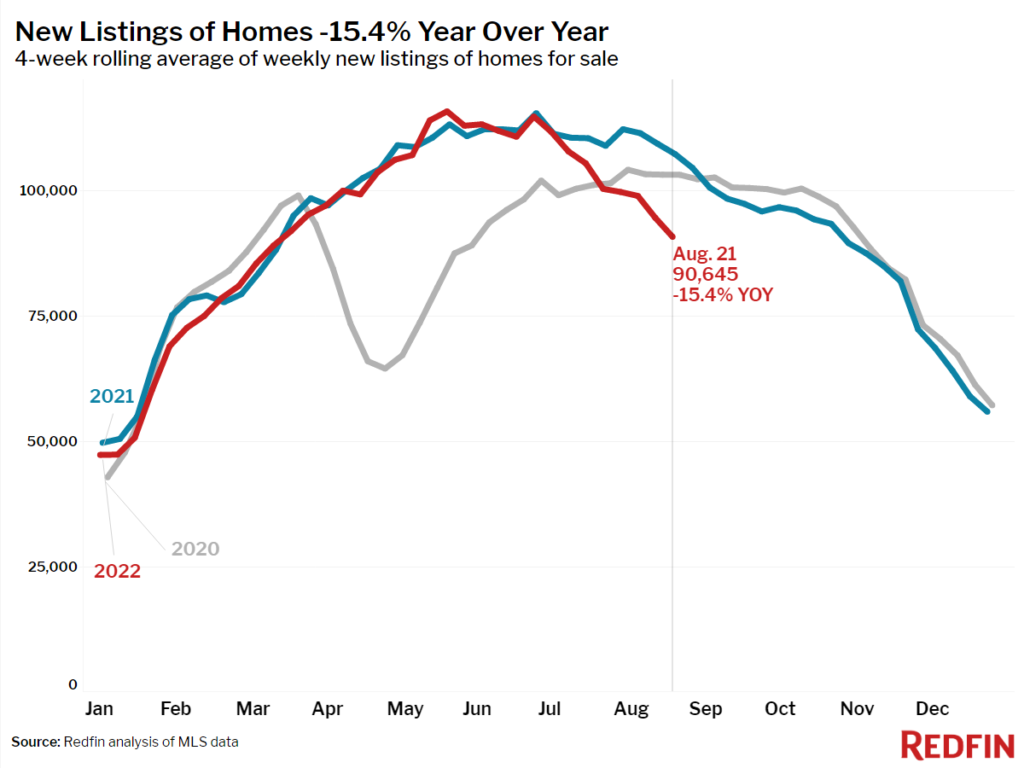

New listings of homes for sale fell 15% in the four weeks ending August 21, the biggest annual decline since the start of the pandemic, as there were fewer sellers and buyers in the market due to rising mortgage rates and economic uncertainty. As a result, the supply of for-sale homes fell 0.6% from the previous four-week period. Though that’s a slight decline, it’s only the second time total supply has dropped from the prior four-week period since February; the first time was last week. The dearth of homeowners putting their homes up for sale is partly a reaction to reduced demand and falling prices.

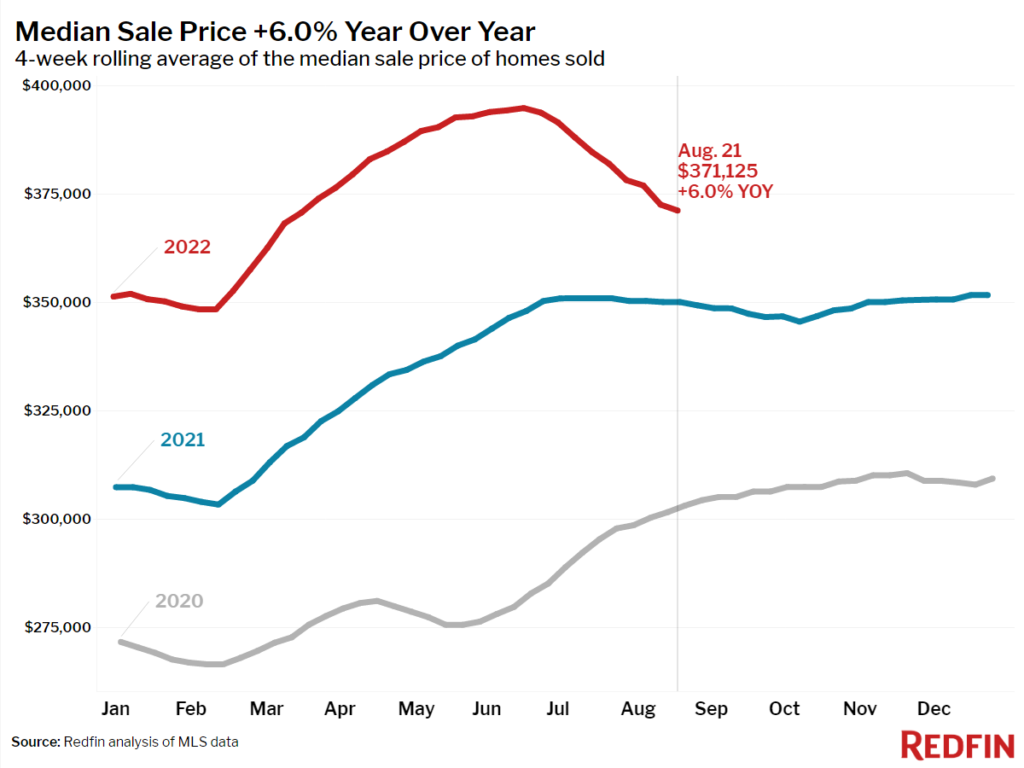

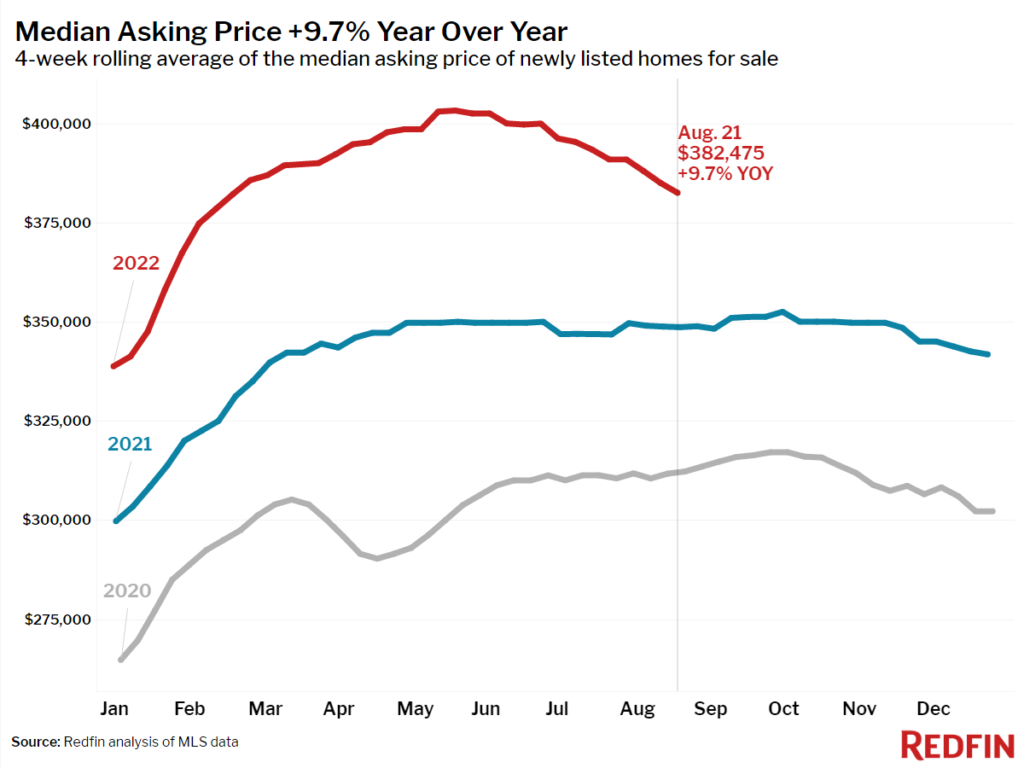

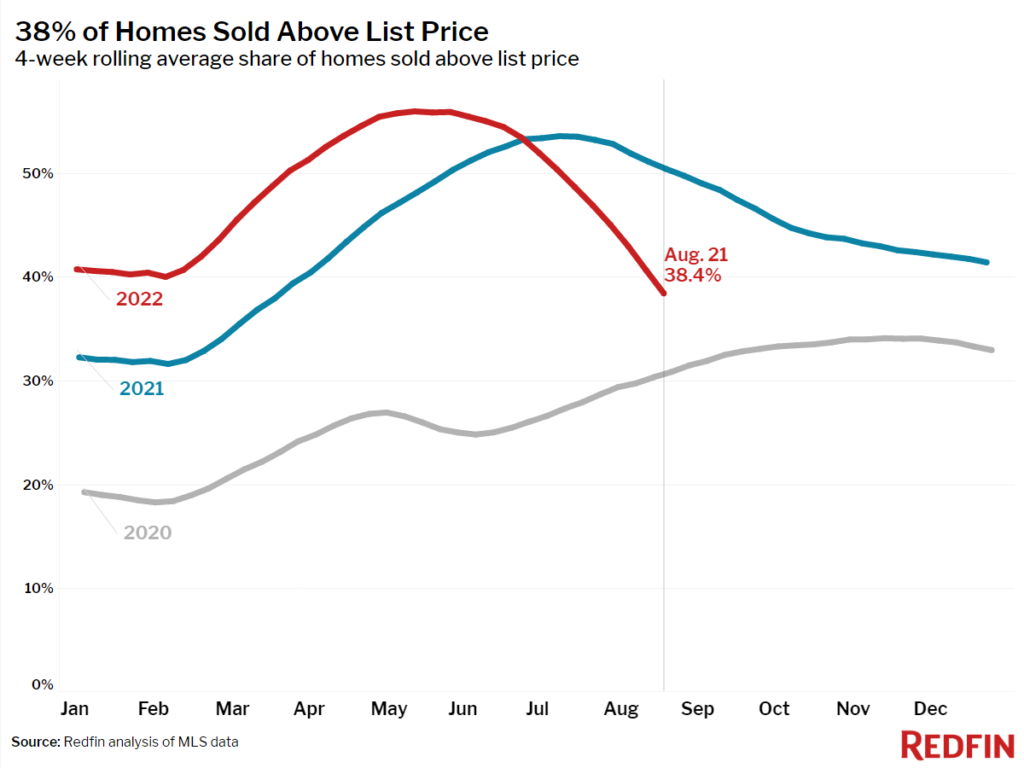

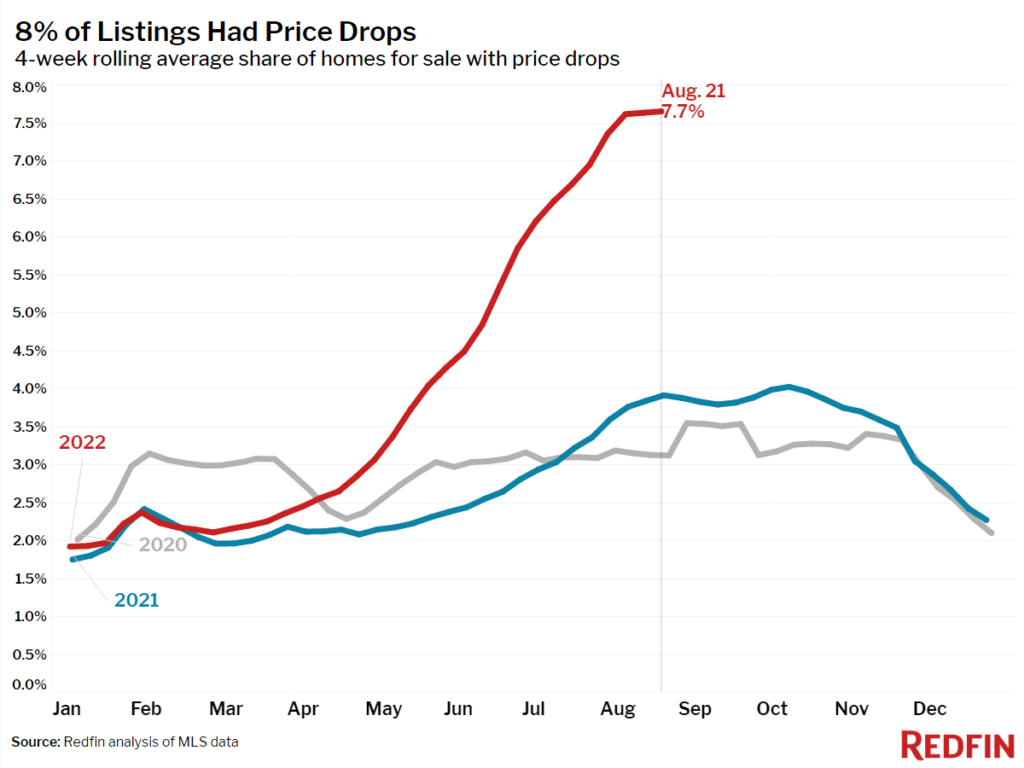

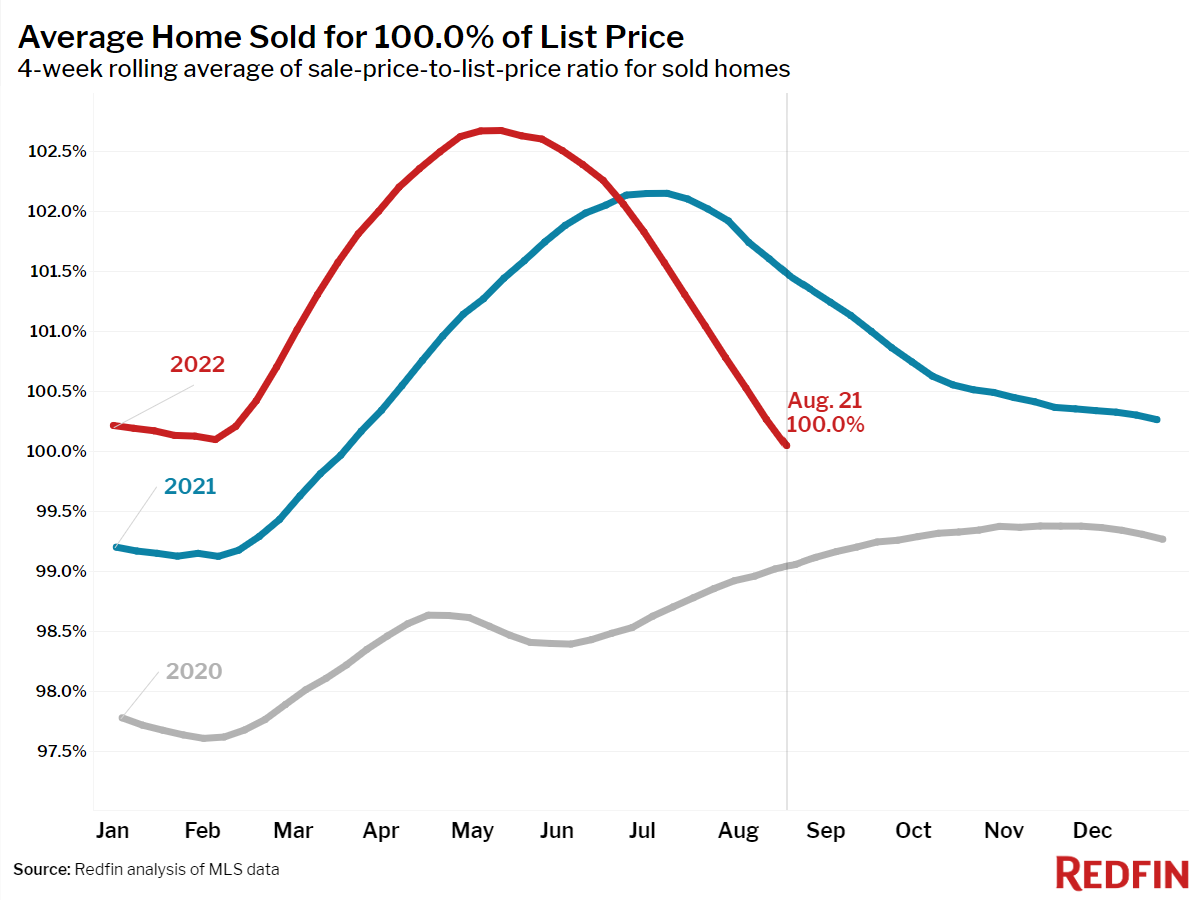

Those who are listing their homes are starting to price in line with lower demand. The median asking price of newly listed homes dropped 5% from the record high set in May, and sale prices dropped 6% from the record high set in June. The share of for-sale homes with a price drop leveled off after rising throughout the spring and early summer.

“Sellers are coming to terms with the fact that volatile mortgage rates have dampened demand. Some sellers are pricing lower, and some homeowners are staying put because they’re nervous they won’t get a good offer or they’re hesitant to give up their low mortgage rate,” said Redfin Economics Research Lead Chen Zhao. “Because the number of homes for sale is no longer rising, buyers’ newfound bargaining power is reaching its limit. It’s worth noting that early demand indicators such as tours and requests for help from agents are elevated from their June lows and remain steady. So there is a pool of interested buyers out there, but sellers need to price fairly to attract them. If more sellers and buyers find that middle ground on price, we could see sales strengthen a bit.”

Unless otherwise noted, the data in this report covers the four-week period ending August 21. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.