Mortgage rates hitting a 7-month high and limited listings are sidelining homebuyers, but many are ready to pounce when rates decline and more homes hit the market. The silver lining of low inventory is that it’s propping up prices for the sellers who do list their homes.

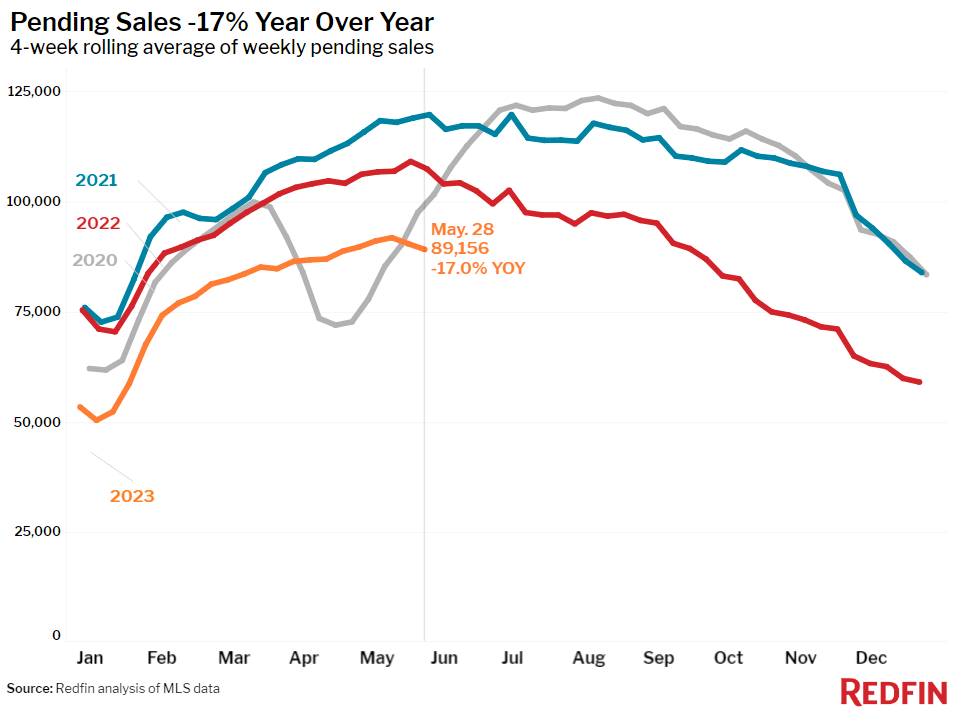

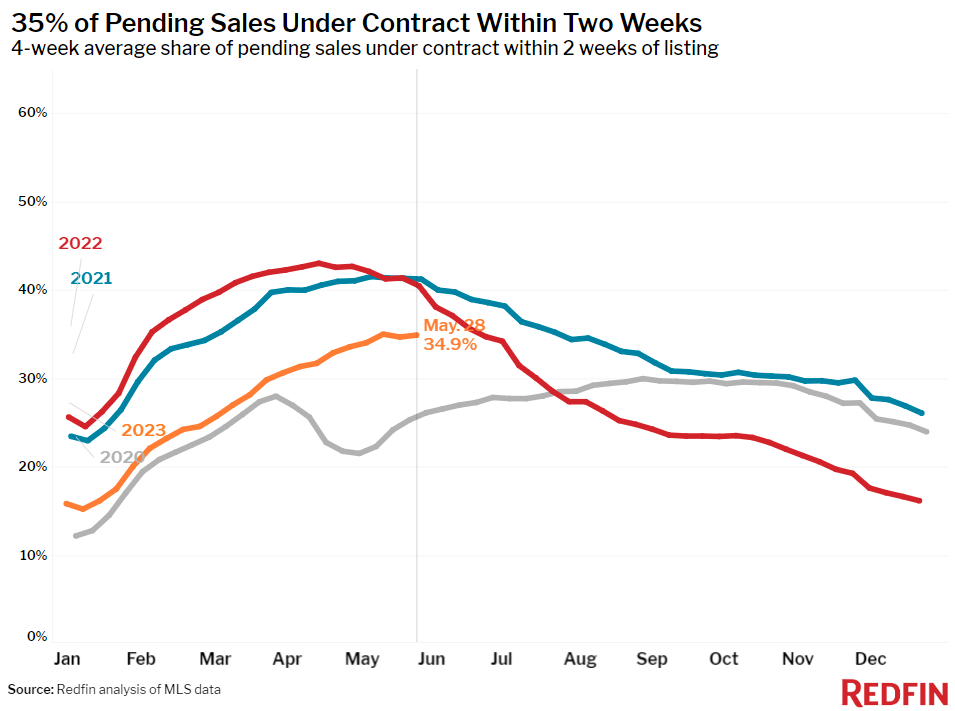

Pending home sales fell 17% from a year earlier during the four weeks ending May 28, one of the biggest declines since the start of the year. That year-over-year drop is especially notable because pending sales had already started falling at this time last year as mortgage rates shot up past 5%.

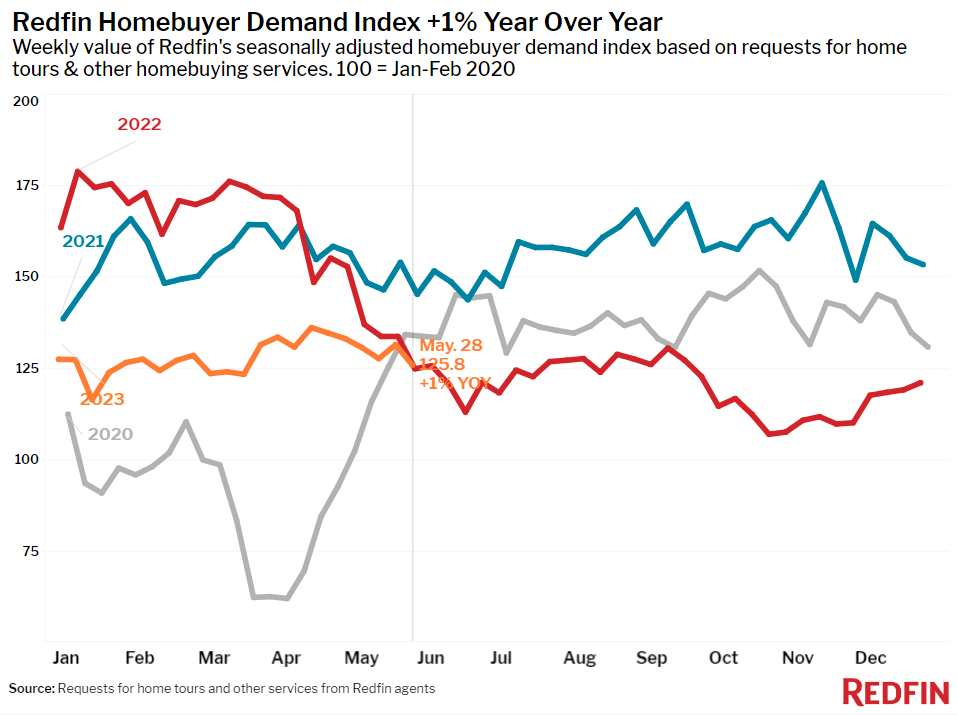

Seasonally adjusted measures of homebuying demand show that it has also dipped in earlier stages of the house hunting journey. Mortgage-purchase applications and Redfin’s Homebuyer Demand Index–a measure of home tours and other service requests from Redfin agents–are both down about 7% from a month ago. The Demand Index was up 1% from a year earlier, its first annual increase in more than 12 months. It’s worth noting this measure was dropping quickly a year ago due to rising rates.

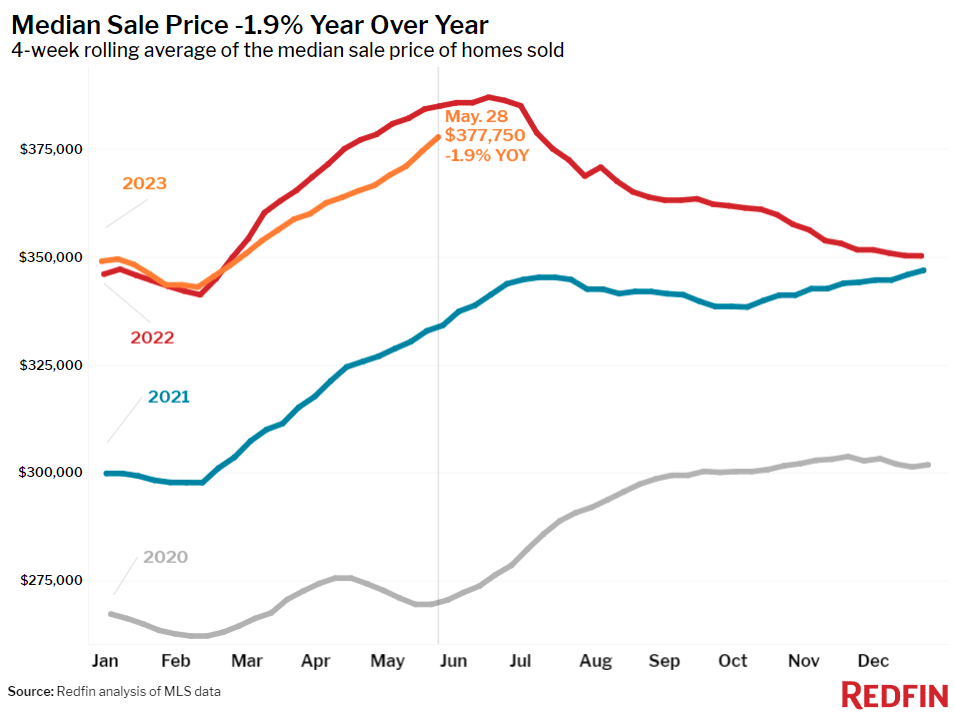

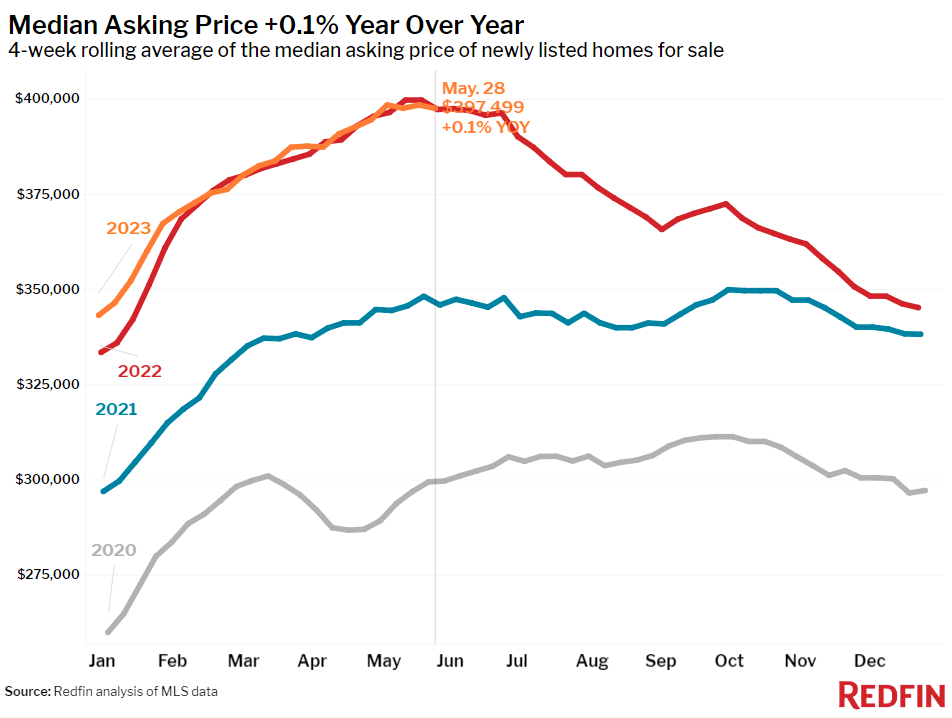

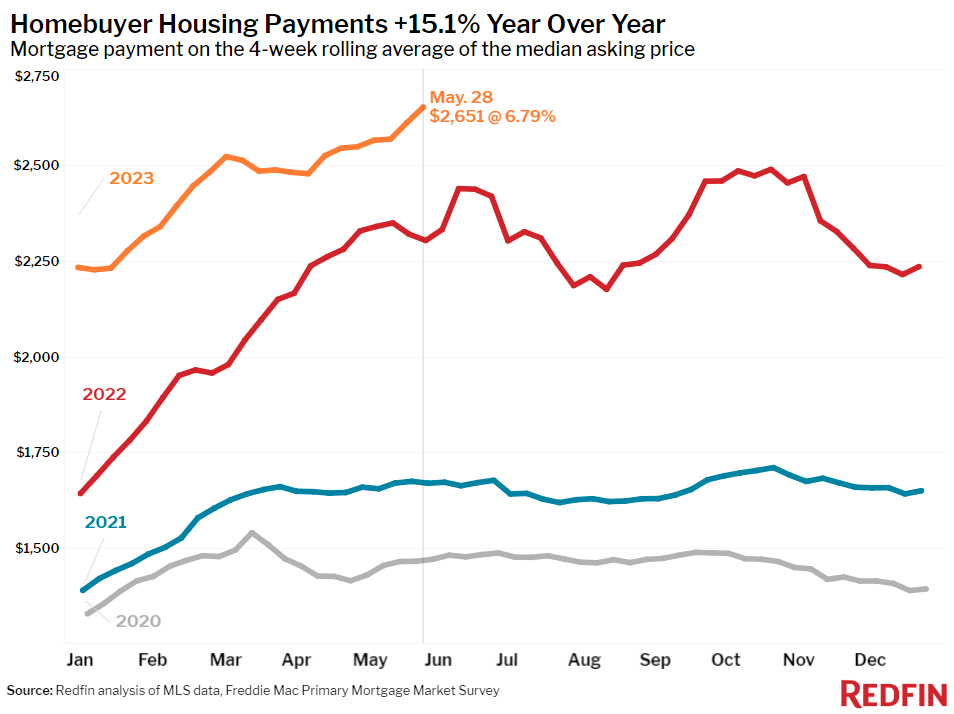

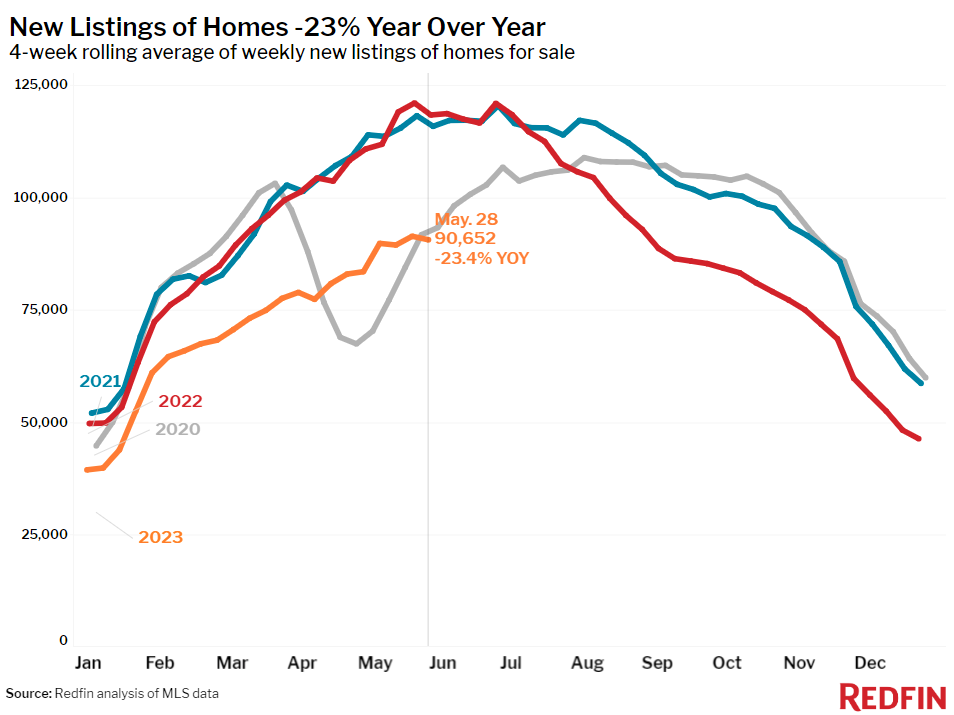

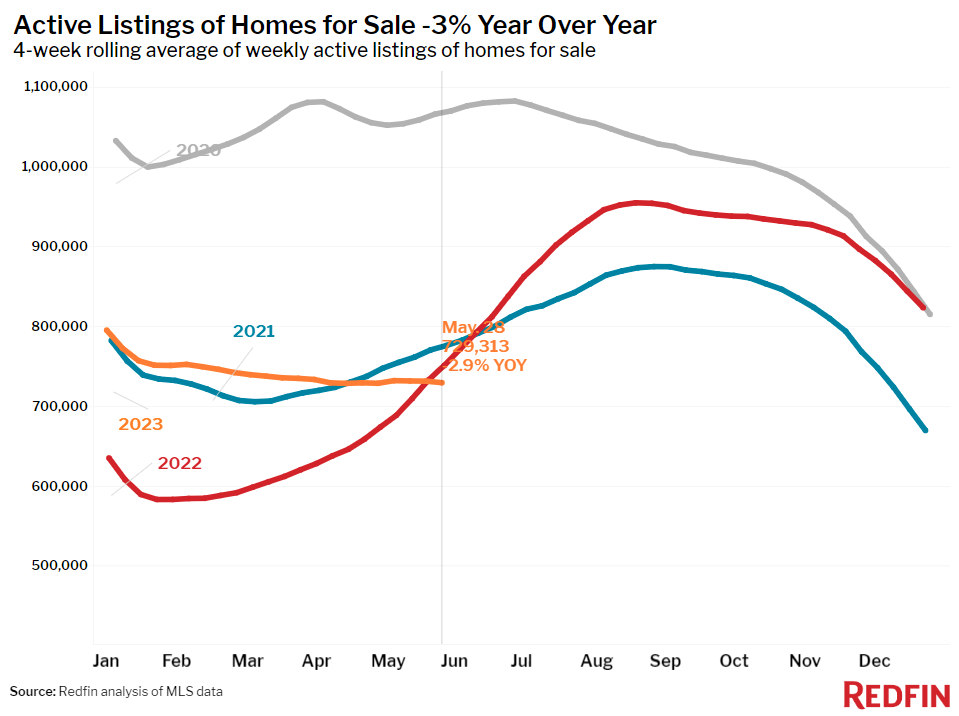

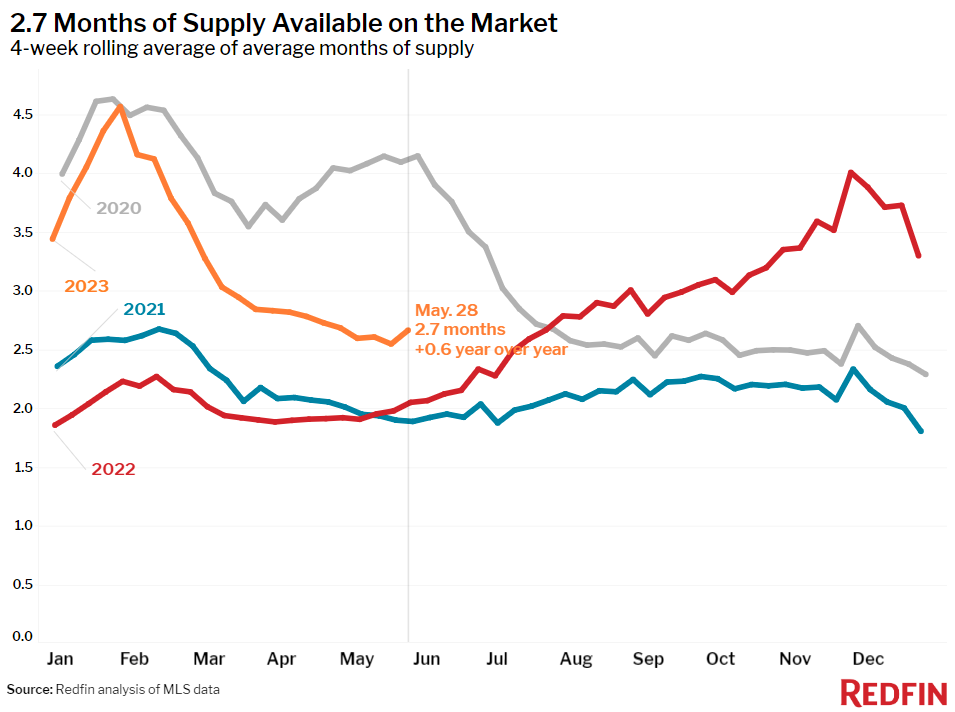

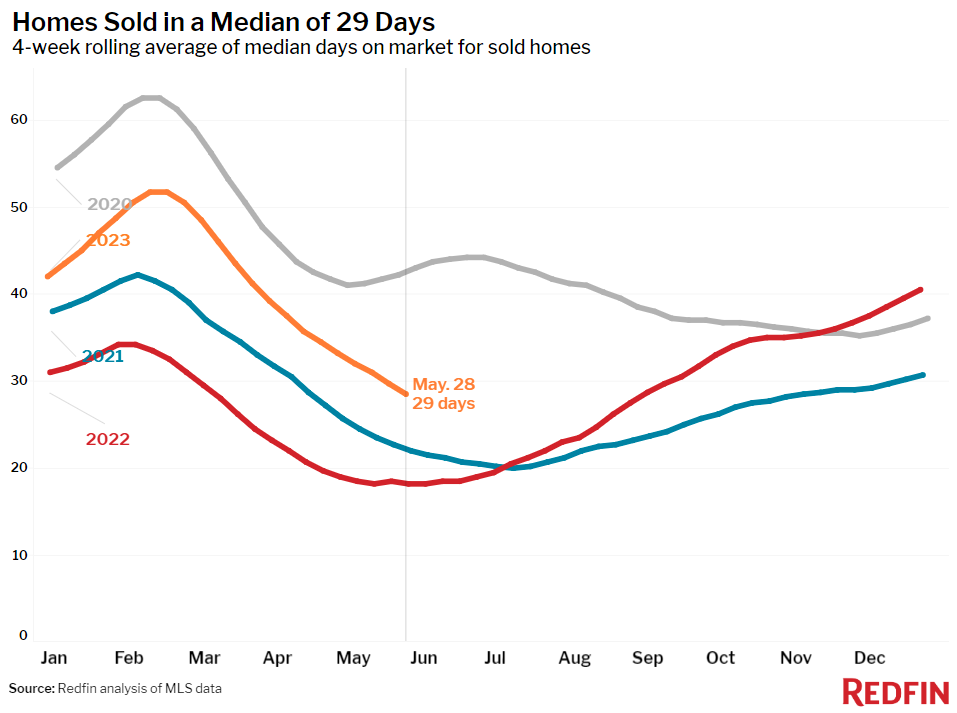

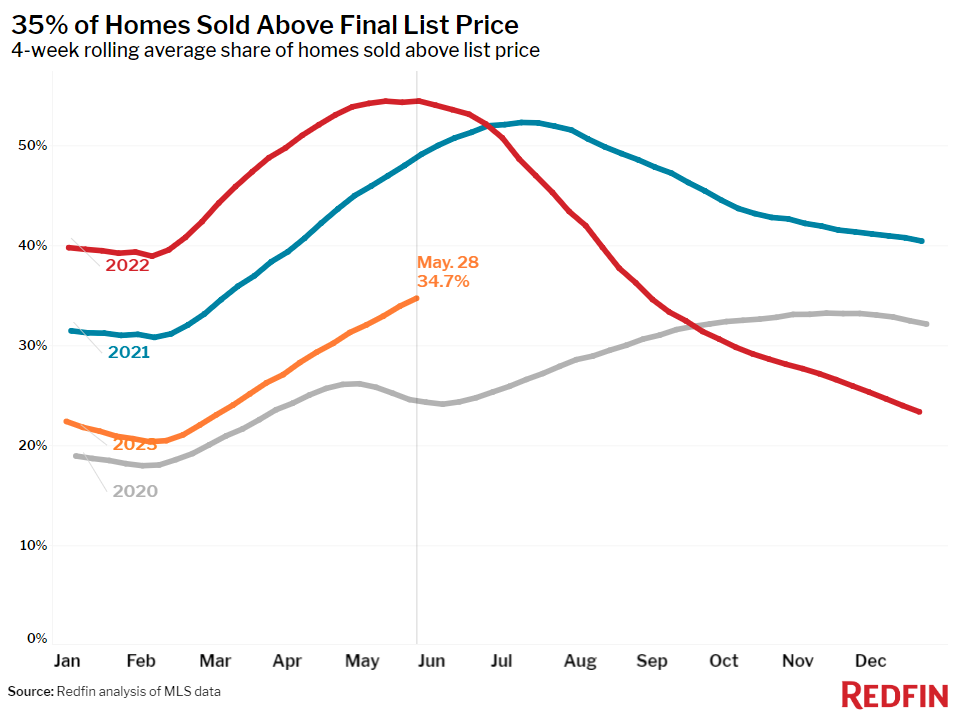

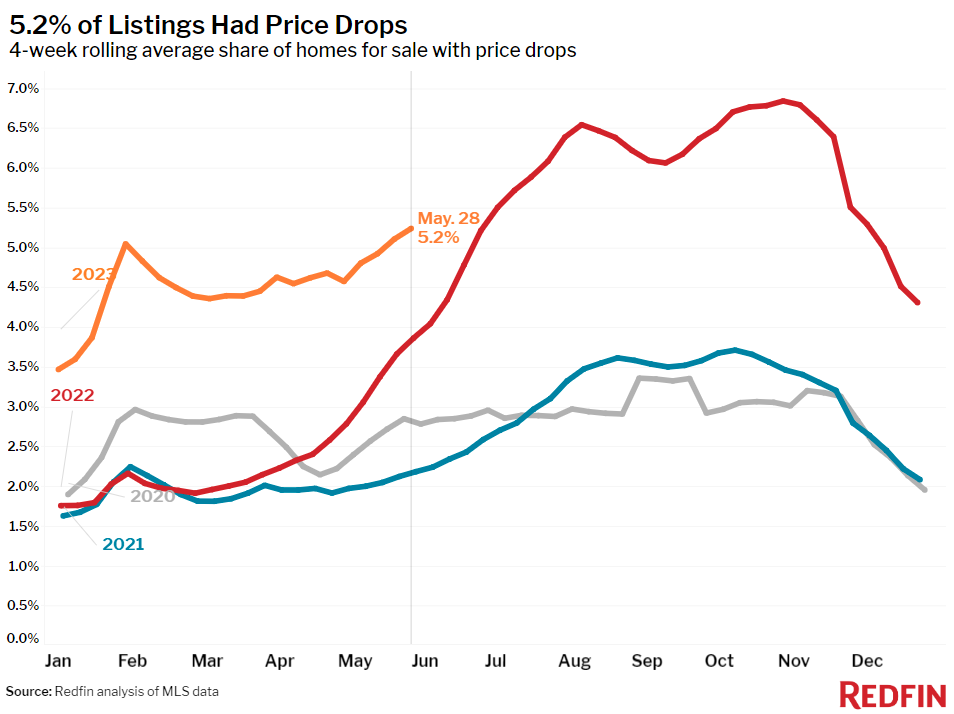

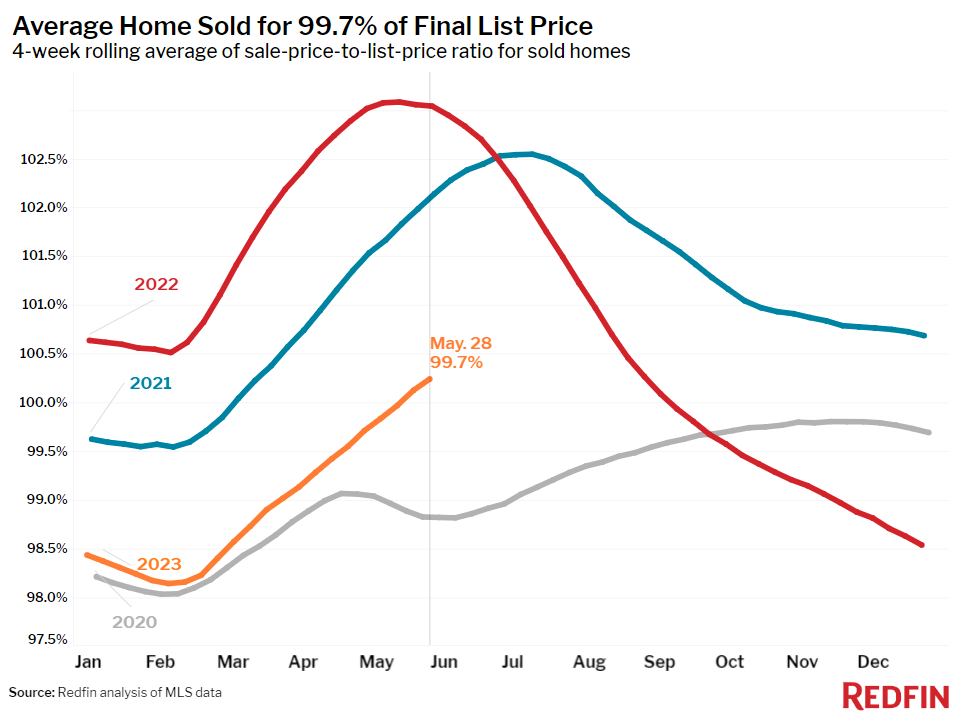

Homebuying demand has dipped over the last month due to elevated mortgage rates and a scarcity of homes for sale. Average weekly rates hit 6.79% this week, their highest level since November. That has priced many people out of the housing market; the typical U.S. homebuyer’s monthly housing payment hit a record high of $2,651 this week, up roughly $350 from a year ago. Limited inventory is also a major factor holding back sales: New listings dropped 23% year over year, and the total number of homes for sale fell 3%, the second annual decline in 12 months (the first was during the prior four-week period, when they fell 0.2%). The lack of homes on the market is propping up prices, with the median U.S. sale price down 1.9% year over year, the smallest decline in two months.

Our colleagues at Bay Equity, Redfin’s mortgage company, report that many prospective buyers haven’t bowed out entirely. They’re ready to make offers and lock in mortgages when rates drop down closer to 6% and more listings hit the market.

“It’s been a weird week,” said Heather Mahmood-Corley, a Redfin Premier agent in Phoenix. “Some buyers are putting in all-cash offers. Other house hunters have put their search on hold, waiting for mortgage rates to come down and more listings to come on the market, and some of the more financially savvy buyers are moving forward with mortgage-rate buydowns or plans to refinance in the future. The silver lining of today’s housing market is that limited listings are propping up prices, making it so sellers are still able to get a favorable price.”

Unless otherwise noted, the data in this report covers the four-week period ending May 28. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.