Mortgage-purchase applications are sitting at their lowest level in nearly three decades. But there are so few homes for sale that prices are up 4.5% annually, the biggest increase in nearly a year.

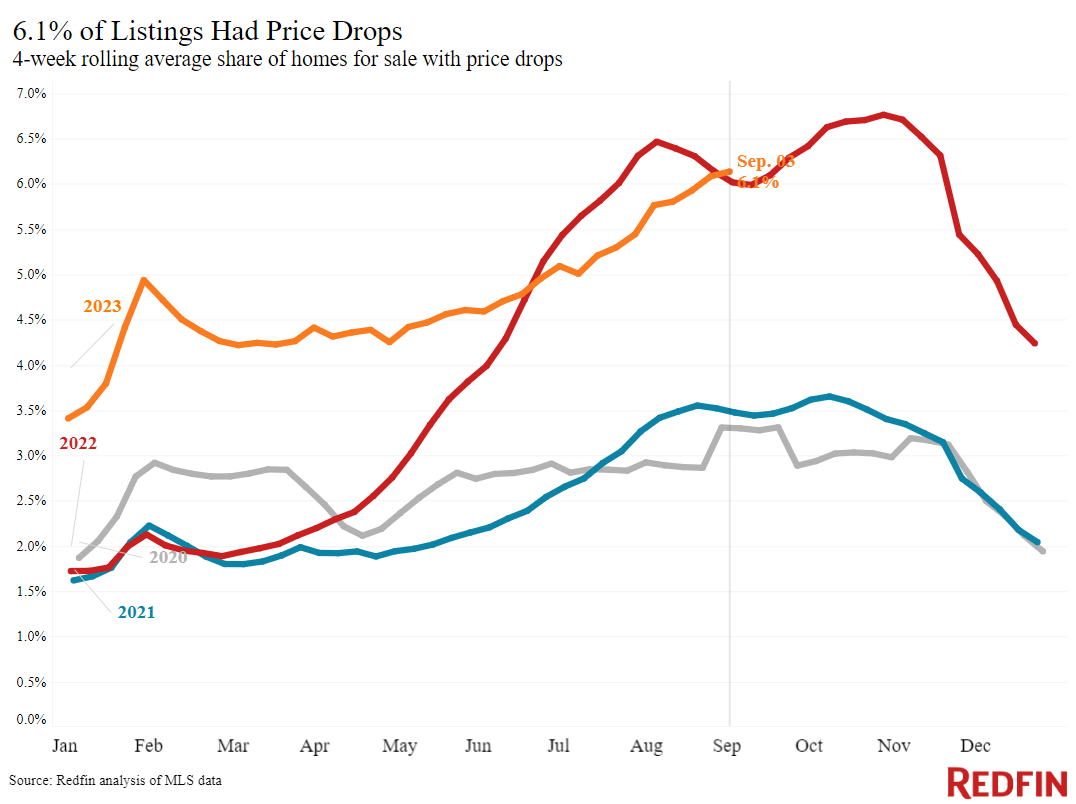

Although mortgage rates are inching down from their recent peak, housing affordability isn’t improving much. With the median U.S. home-sale price up 4.5% year over year during the four weeks ending September 3 and mortgage rates remaining above 7%, the typical monthly mortgage payment is $2,612, just $18 shy of the all-time high set in May. High housing costs are dampening homebuying demand, with mortgage-purchase applications falling to a 28-year low.

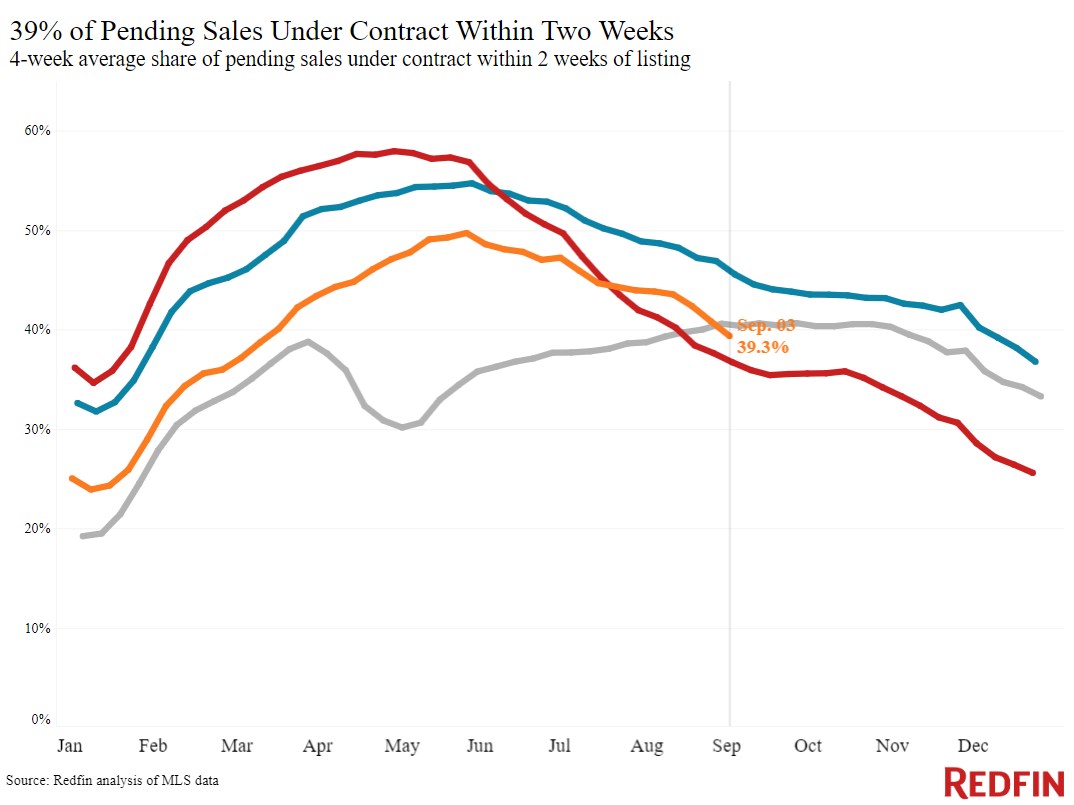

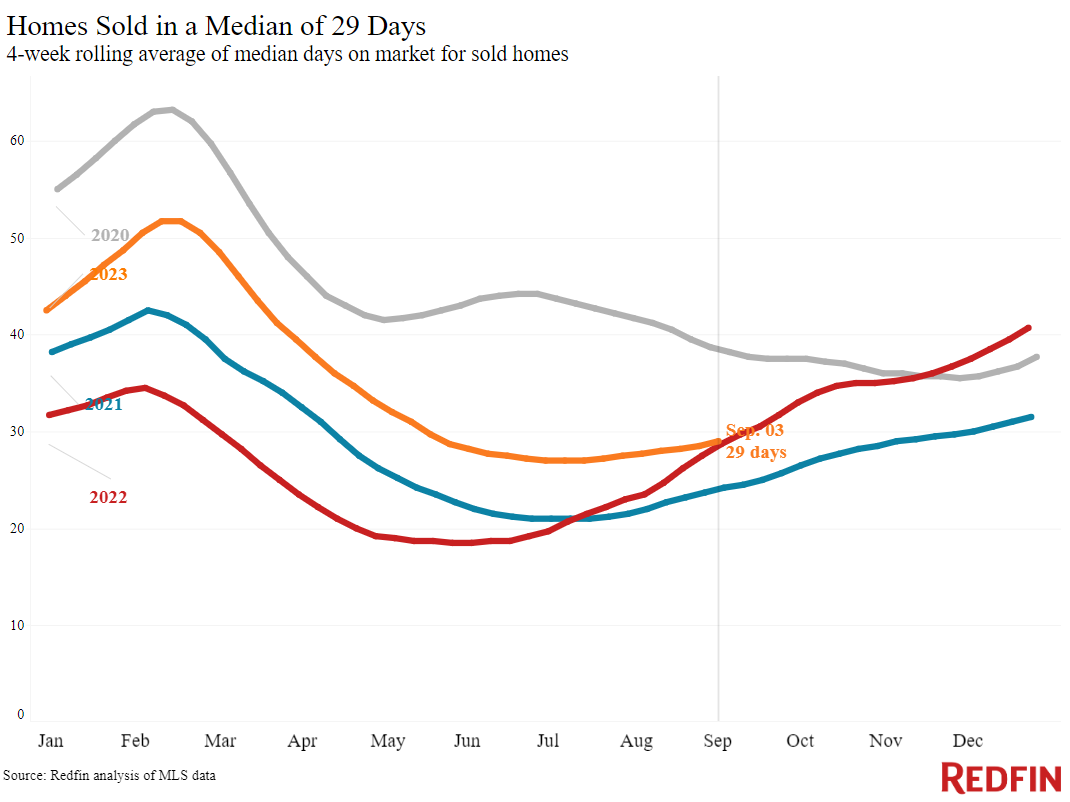

Prices are rising due to a supply shortage: The total number of homes on the market is down 18% year over year, the biggest decline since February 2022. New listings are down 9% as many homeowners refuse to part with relatively low mortgage rates. But there are still more buyers than sellers in much of the country.

“The market is marching on, especially for turnkey homes,” said Chicago Redfin Premier agent Niko Voutsinas. “If folks can figure out a way to buy instead of rent, they will. Some buyers are cutting back on other expenses to up their housing budgets because they believe home prices are only going to increase. They’re nervous that the minute rates come down, a flood of competition will edge them out. Those buyers typically need to move quickly and offer at or above the asking price if they love a home, because so few listings are hitting the market.”

Refer to our metrics definition page for explanations of all the metrics used in this report.