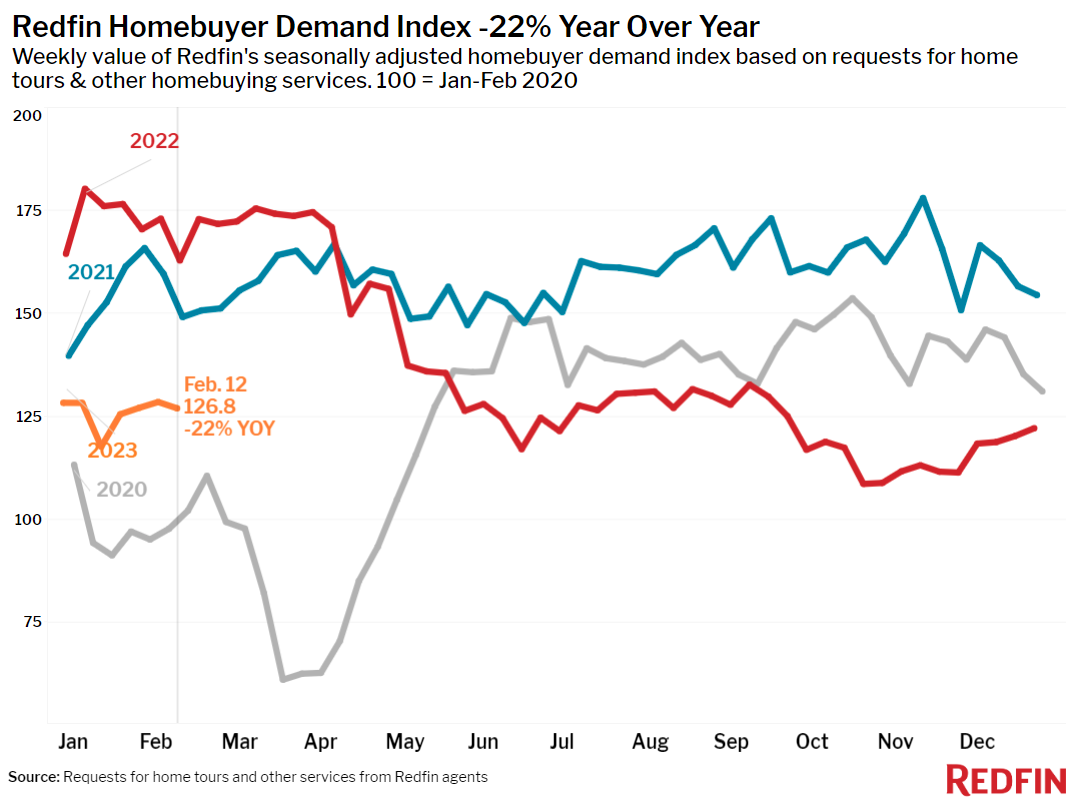

Redfin’s Homebuyer Demand Index is down slightly from last month as somewhat disappointing inflation and jobs reports cause mortgage rates to increase. But demand is still up from its November trough and pending home sales continue improving.

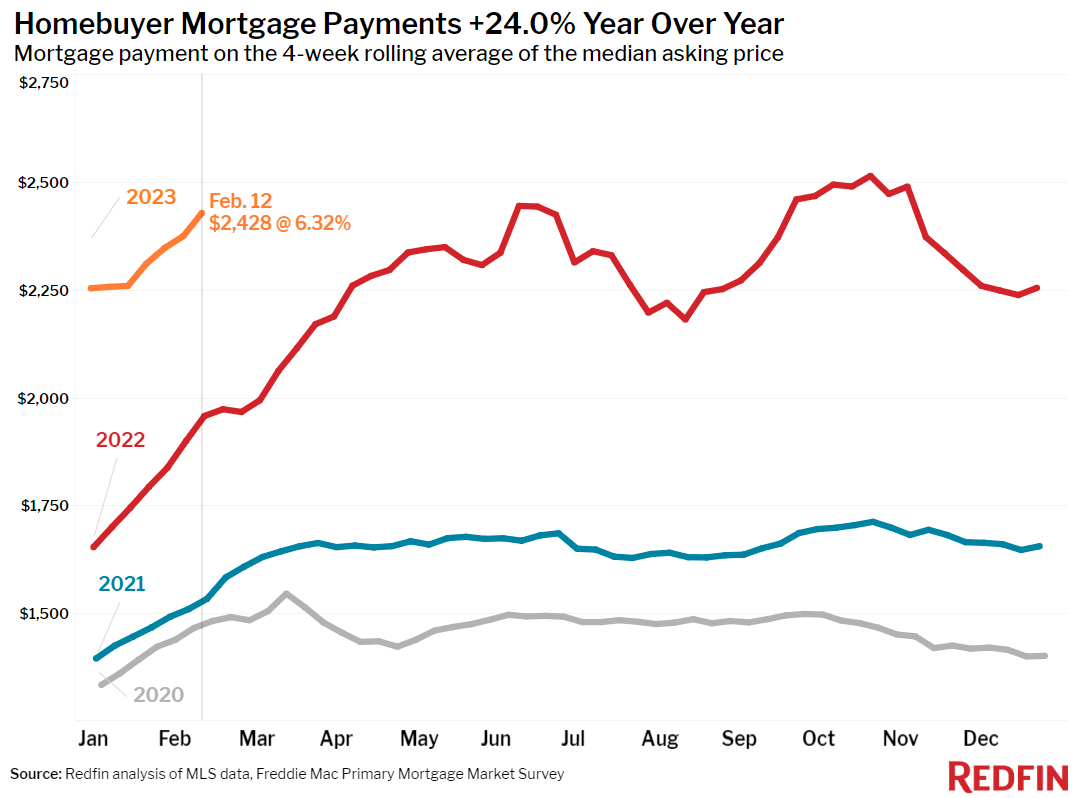

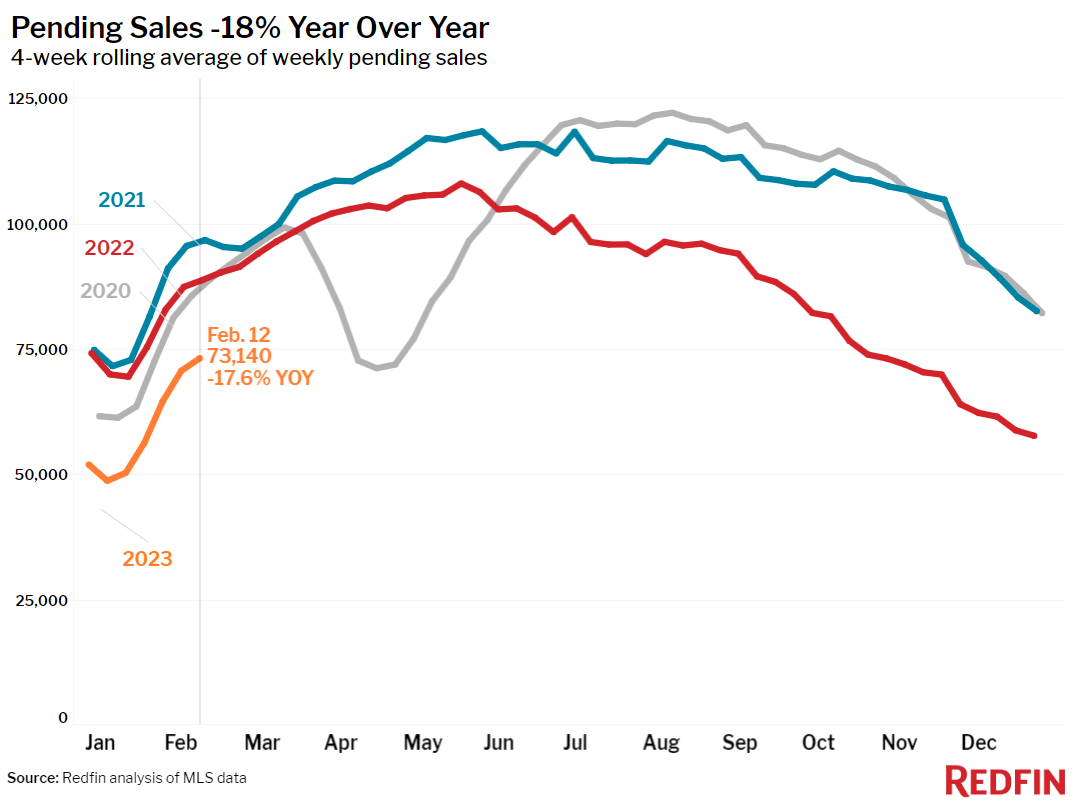

Some homebuyers are retreating back to the sidelines as mortgage rates ascend toward 7%. Redfin’s Homebuyer Demand Index–a measure of requests for tours and other services from Redfin agents–fell 1% from a week ago, the first decline after a month of increases, and mortgage-purchase applications dropped 6%.

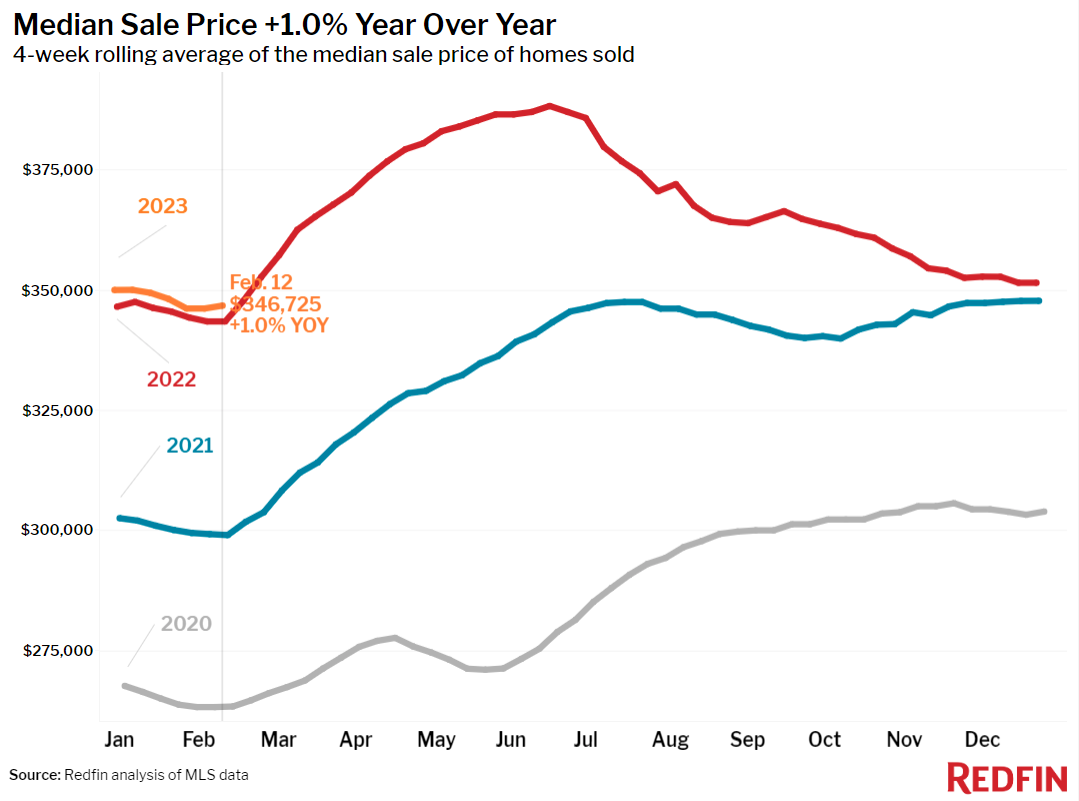

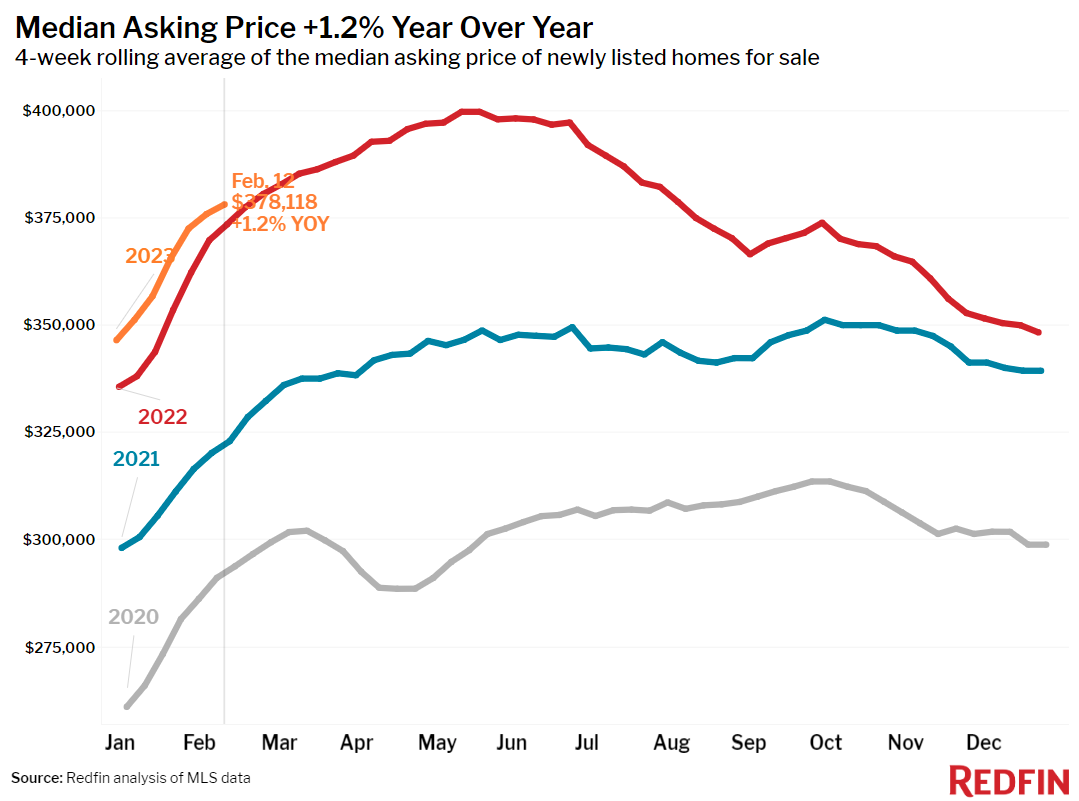

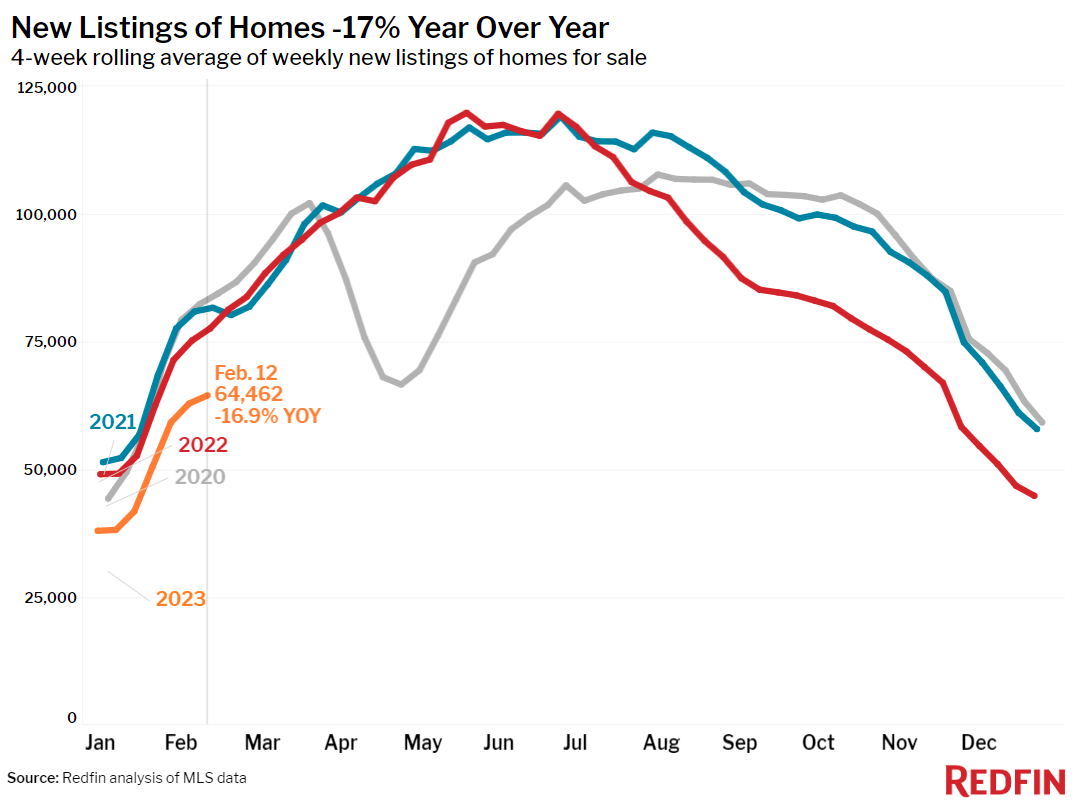

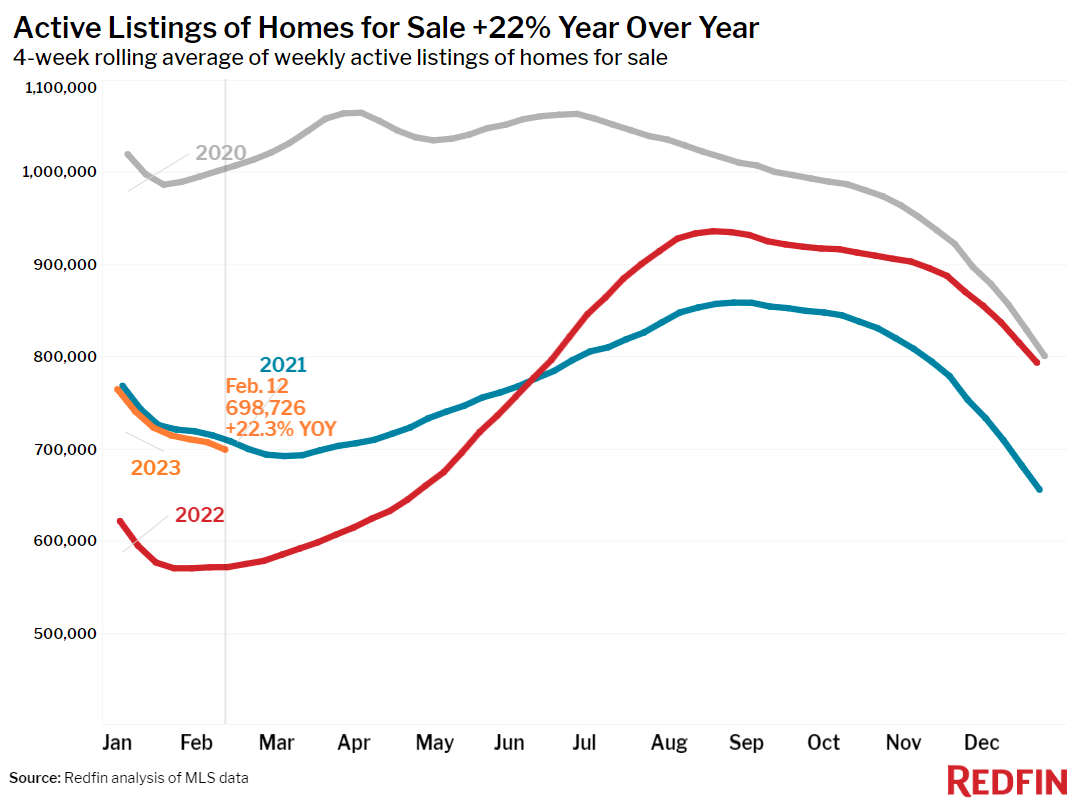

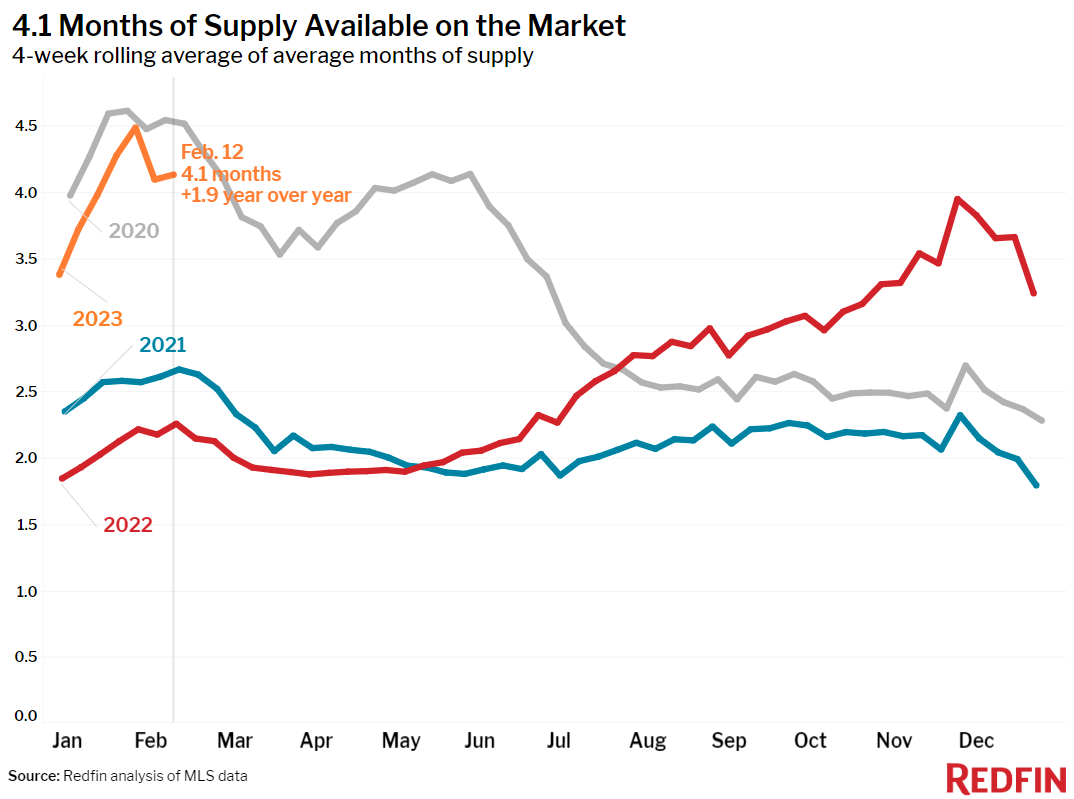

Persistently low inventory is also contributing to the slump in demand, as prospective sellers are also sensitive to rate hikes: 85% of mortgage holders have a rate far below 6% and many of them are eager to hold onto it. Although the decline in new listings of homes for sale has slowed since December, they were still down 17% from a year earlier during the four weeks ending February 12. Asking prices posted their smallest increase since the start of the pandemic (+1.2% year over year) as those who are selling homes attempt to attract buyers.

The bump in mortgage rates is largely due to this week’s inflation report, which was full of mixed signals. Inflation eased ever-so-slightly in January, but the overall price of goods and services is still much higher than a year ago and the pace of economic recovery has slowed.

“The somewhat disappointing inflation numbers put a wet blanket on homebuyers after sub-6% rates lit a fire under them a few weeks ago,” said Redfin Economics Research Lead Chen Zhao. “Inflation is cooling too slowly–and the job market and retail sales are too strong–for the Fed to ease up on interest-rate hikes, which means mortgage rates are unlikely to fall much in the next few months. That doesn’t erase the progress we’ve made and it doesn’t mean rates will soar past 7%. But it is a reminder that the housing-market recovery will remain touch-and-go until we see inflation and the overall economy improve for a longer duration.”

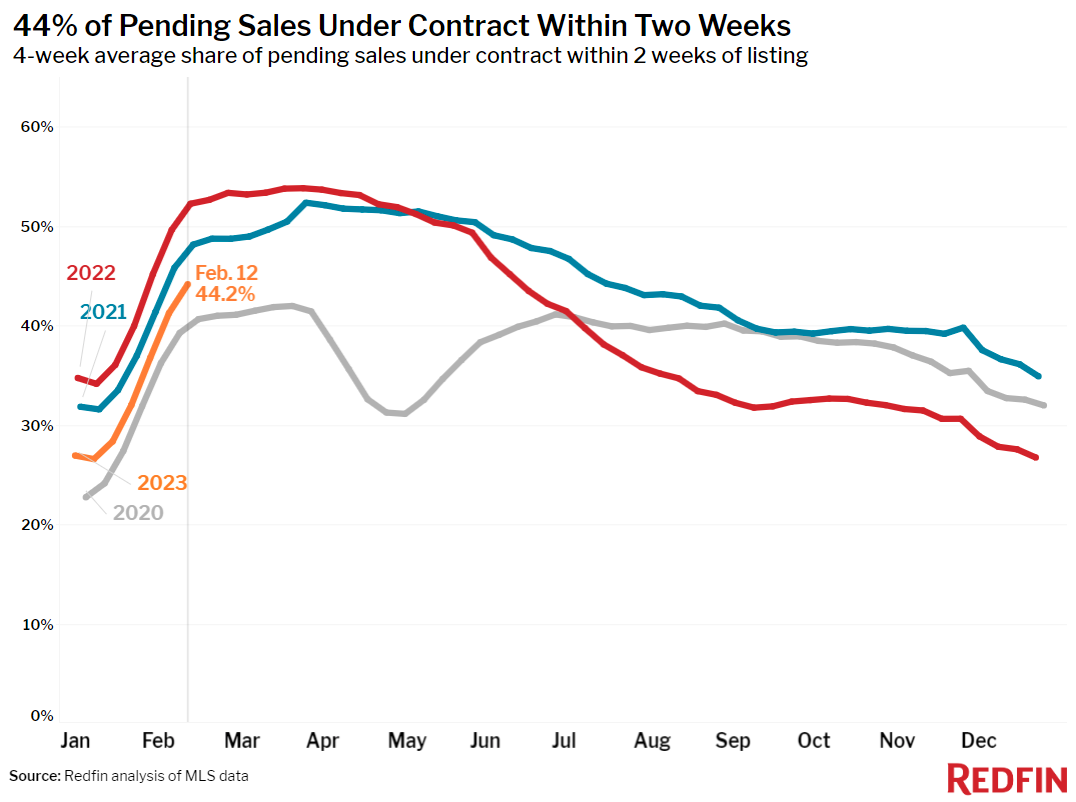

The inconsistent nature of the comeback is evident in this week’s data, which shows that although buyers have taken a step back, they’re still more active than they were last fall. Redfin’s Demand Index is up 17% from the low point it fell to this past fall when mortgage rates peaked at over 7%. Pending home sales also continue to improve; they’re down 18% year over year, but that’s roughly half of the 33% decline in November. Redfin agents report there’s strong demand for move-in ready, well-priced homes in desirable neighborhoods.

“Homes that are priced well are still getting multiple offers, but I did notice buyers making fewer offers this week as interest rates crept back up,” said Los Angeles Redfin agent Justin Vold. “Buyers have been hypersensitive to rates since the start of the pandemic. In today’s topsy-turvy market, I’m advising people to take a step back from day-to-day rate fluctuations and consider their long term needs. If someone is planning to stay in a home for many years and they can afford today’s interest rates, now is a perfectly good time to buy because there’s relatively little competition.”

“But it may not be the right time for someone who’s only looking for a short-term home and/or can barely afford to pay their mortgage with 6% or 7% interest,” Vold continued. “Buyers need to be ready to keep the original payment for all 30 years of their loan because although rates will inevitably come down, we don’t know when. When the opportunity to refinance does come around, shaving off part of the monthly payment will be a bonus.”

Unless otherwise noted, the data in this report covers the four-week period ending February 12. Redfin’s weekly housing market data goes back through 2015.

Refer to our metrics definition page for explanations of all the metrics used in this report.