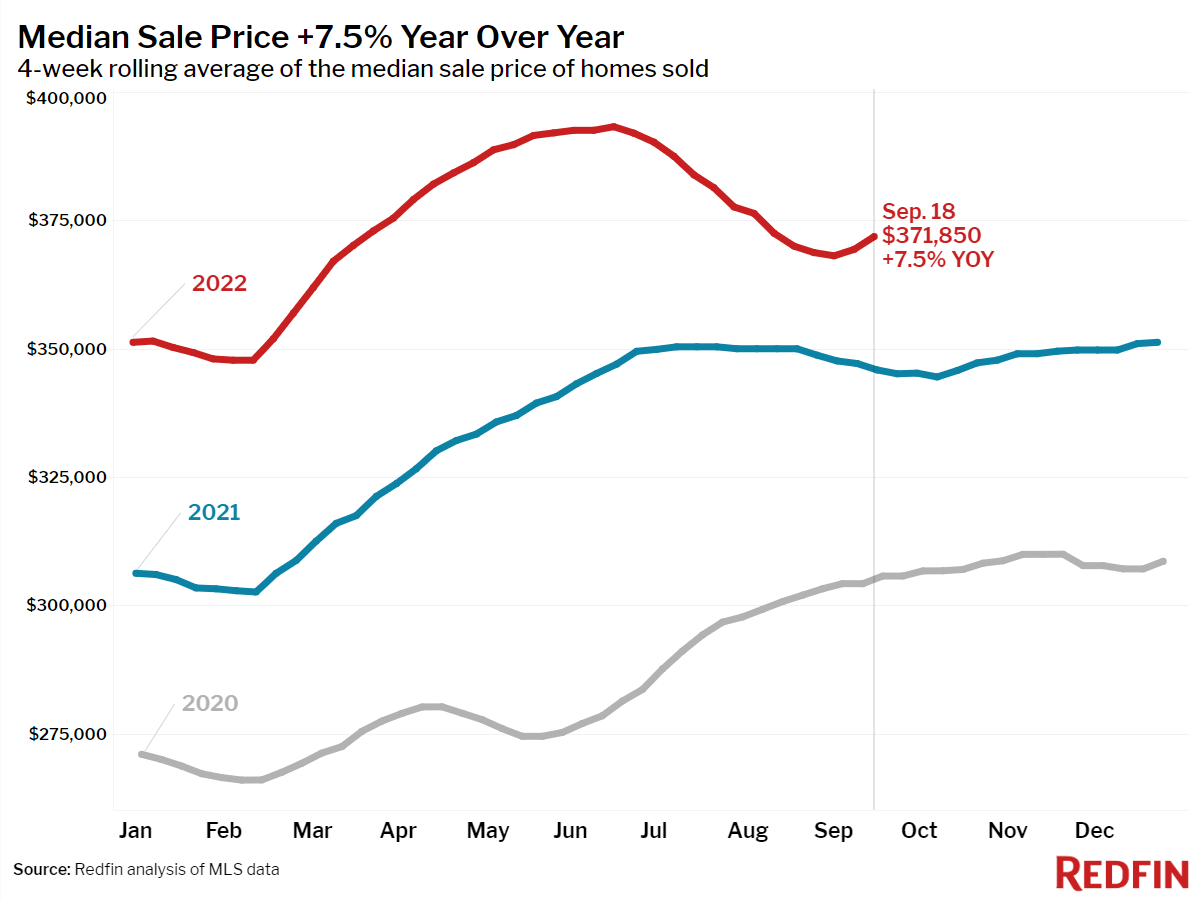

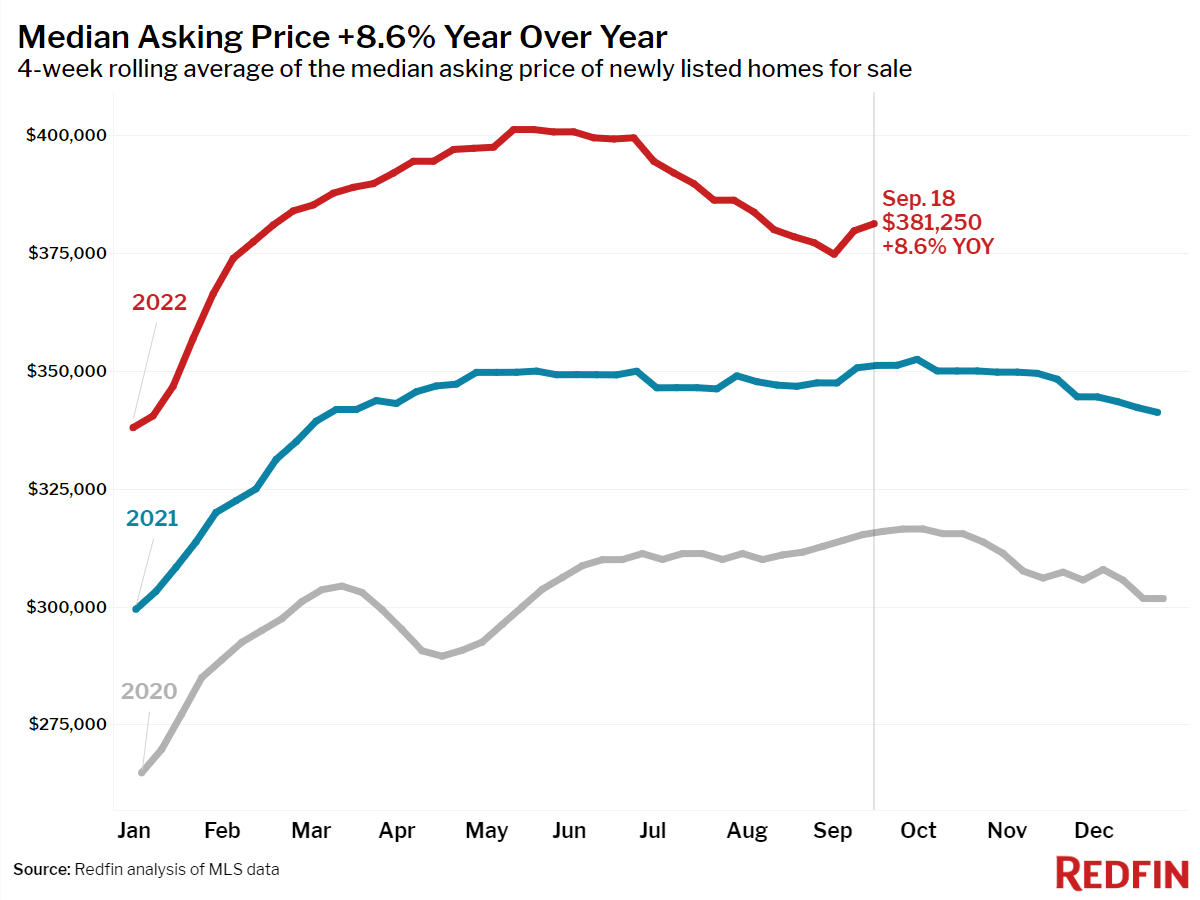

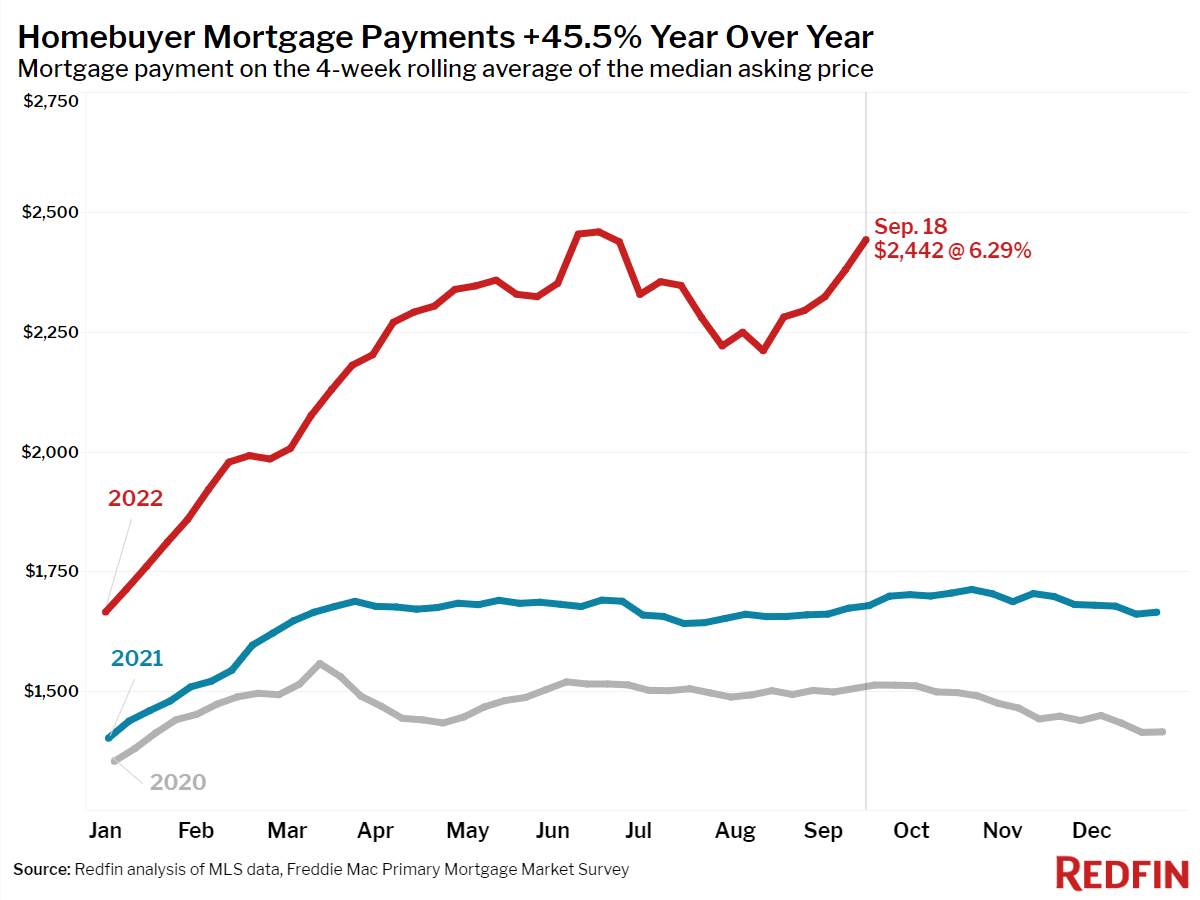

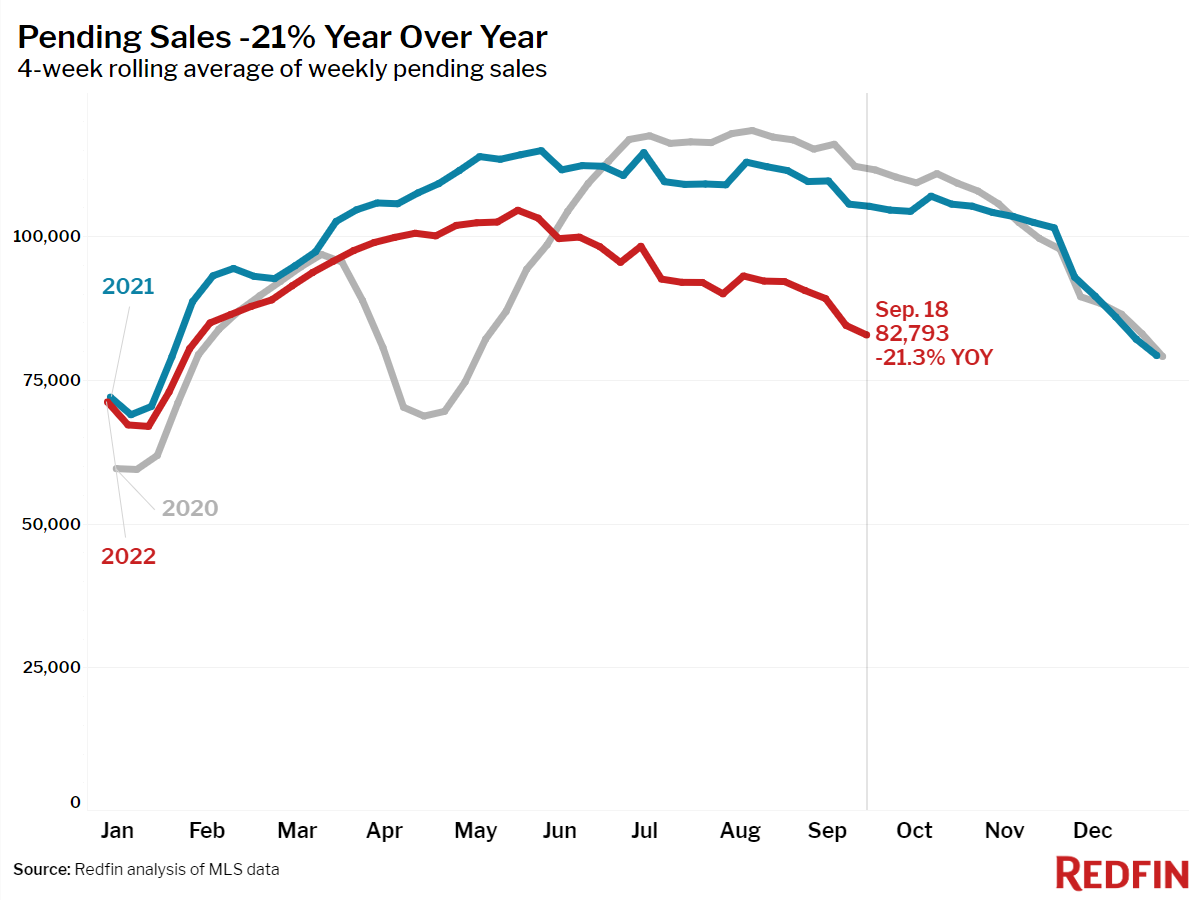

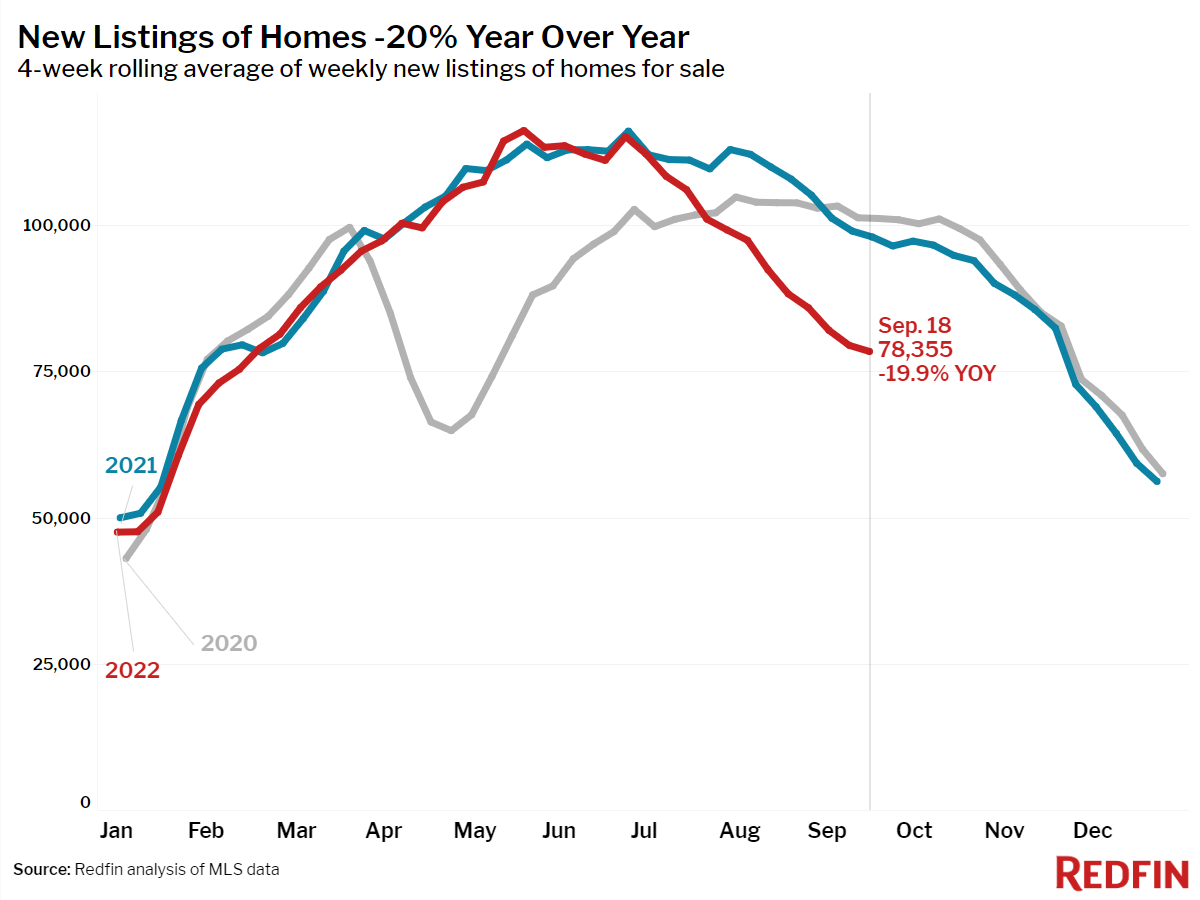

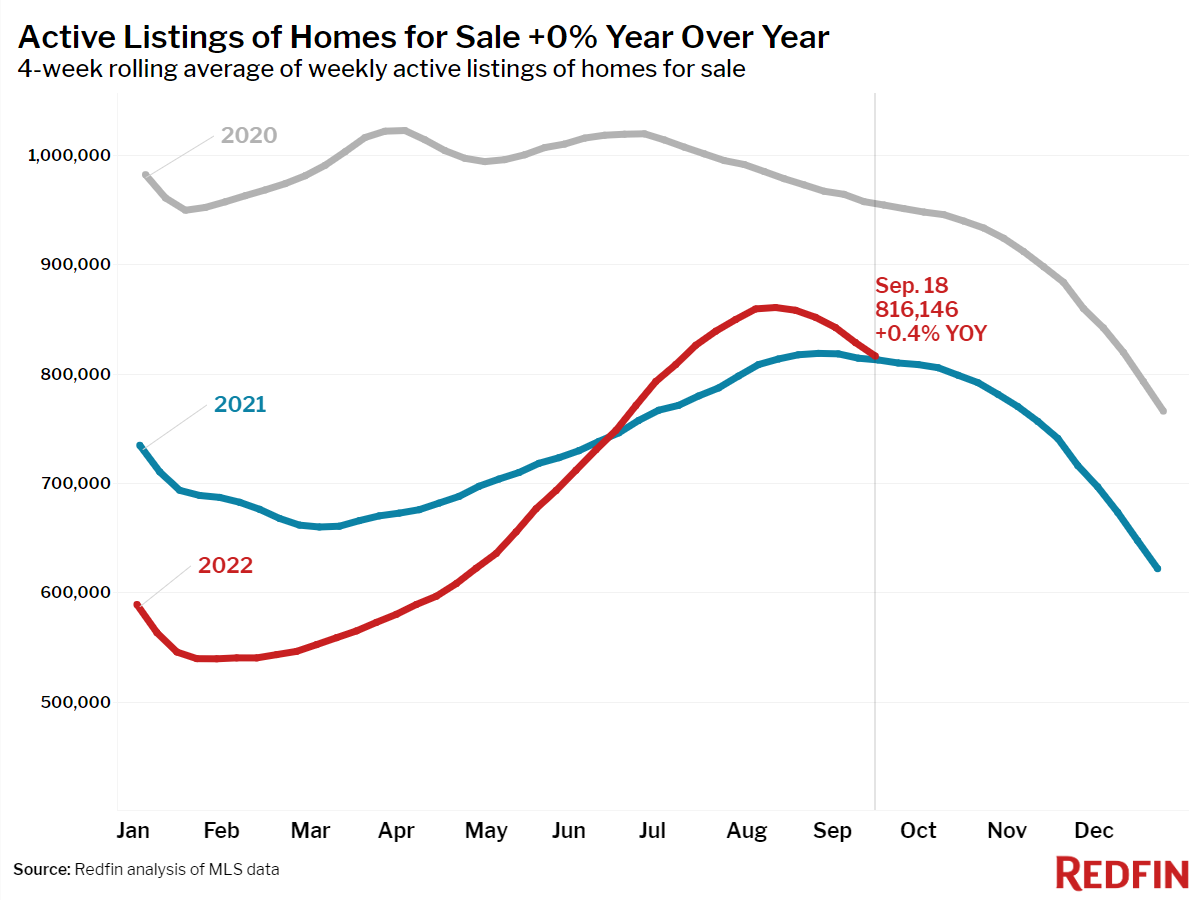

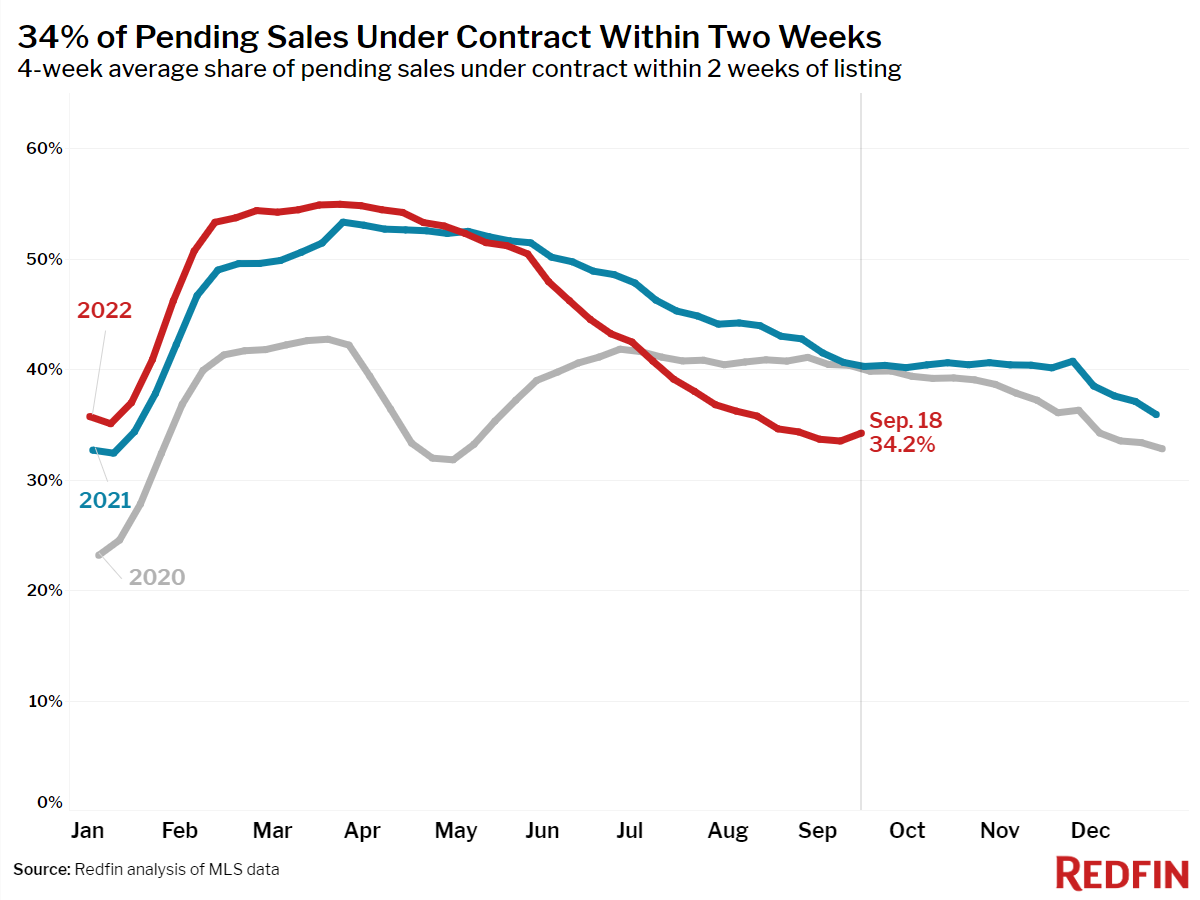

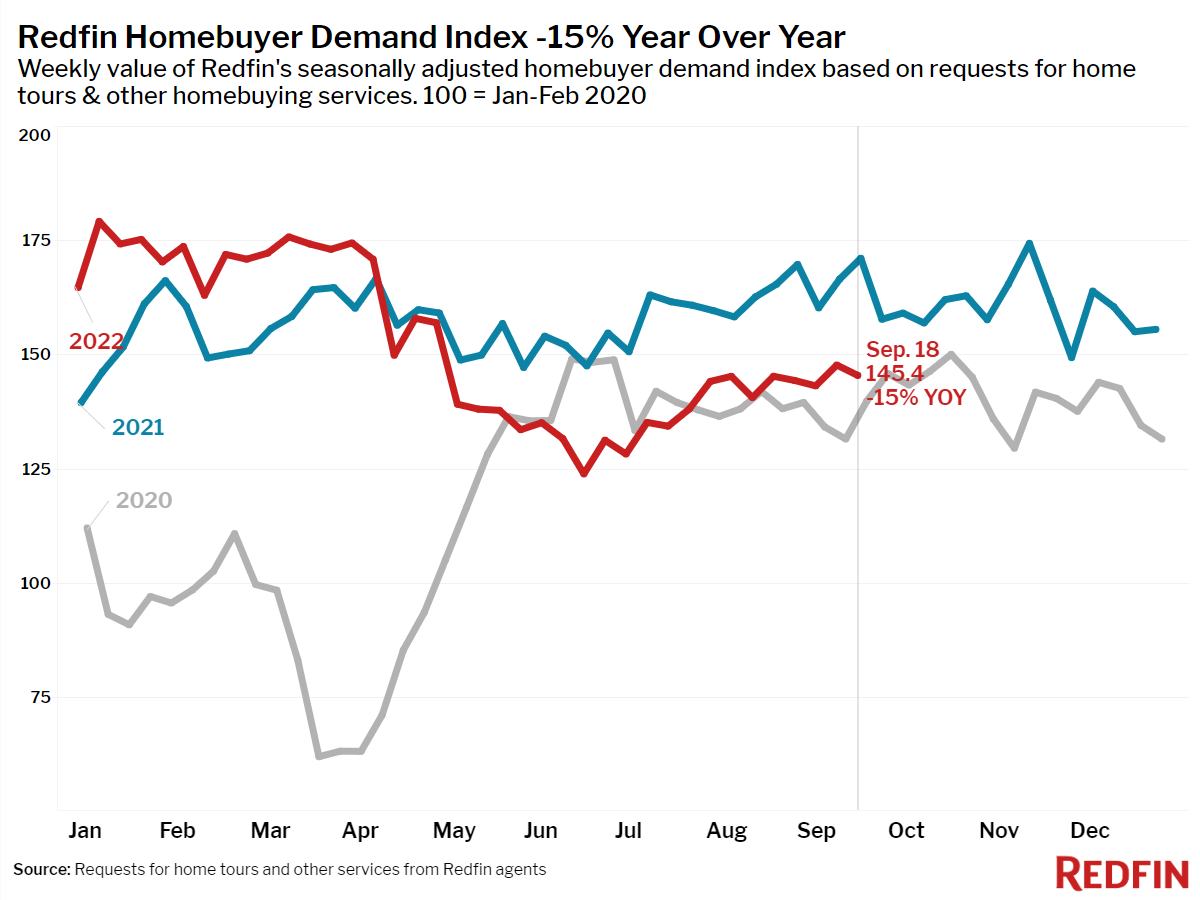

Home prices increased 1% in the last two weeks after 11 weeks of declines as mortgage rates soared past 6%. The Federal Reserve’s aggressive interest rate hikes have successfully cooled off homebuying demand by dramatically reducing buyers’ spending power, but new listings have also taken a huge hit. Typically, when mortgage rates shoot up, we’d expect prices to come down in turn, but with so few desirable homes coming on the market, buyers are not getting much relief.

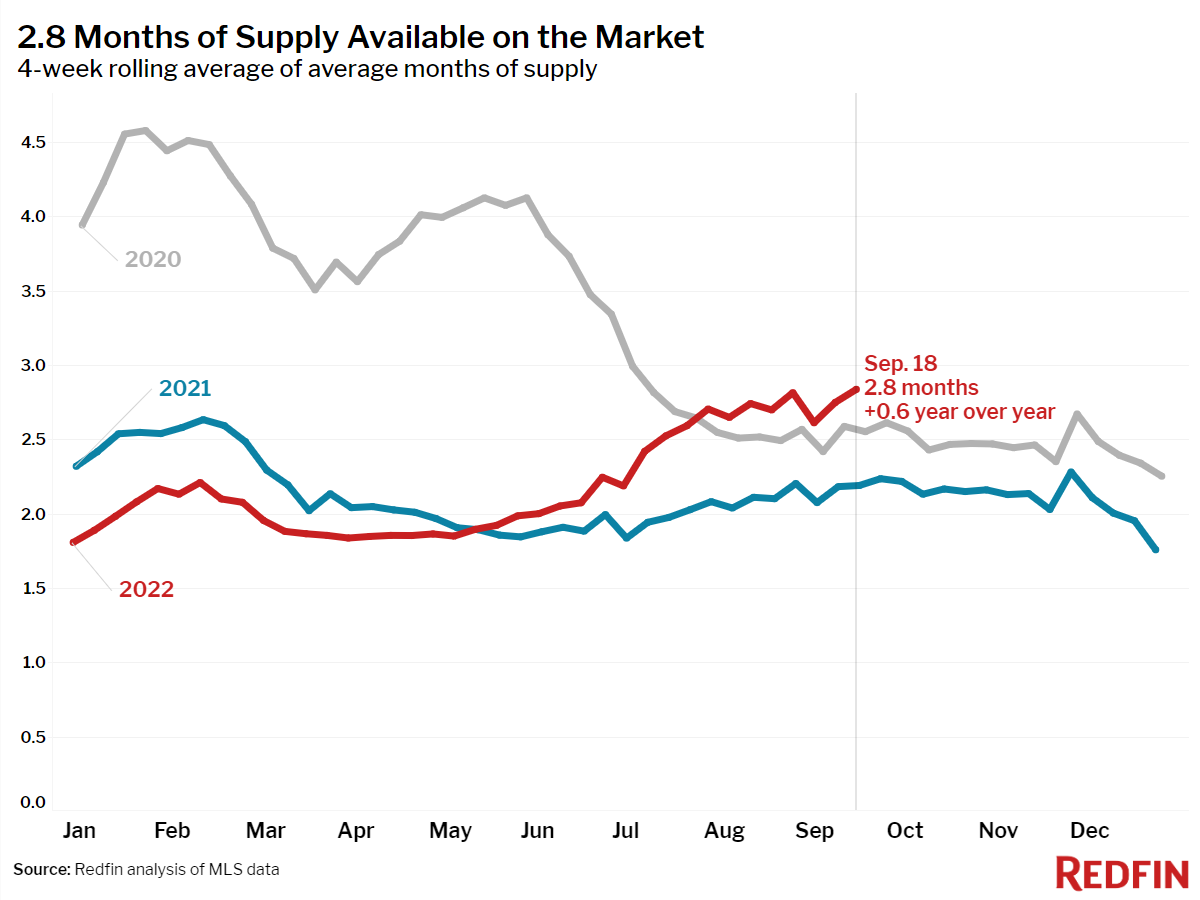

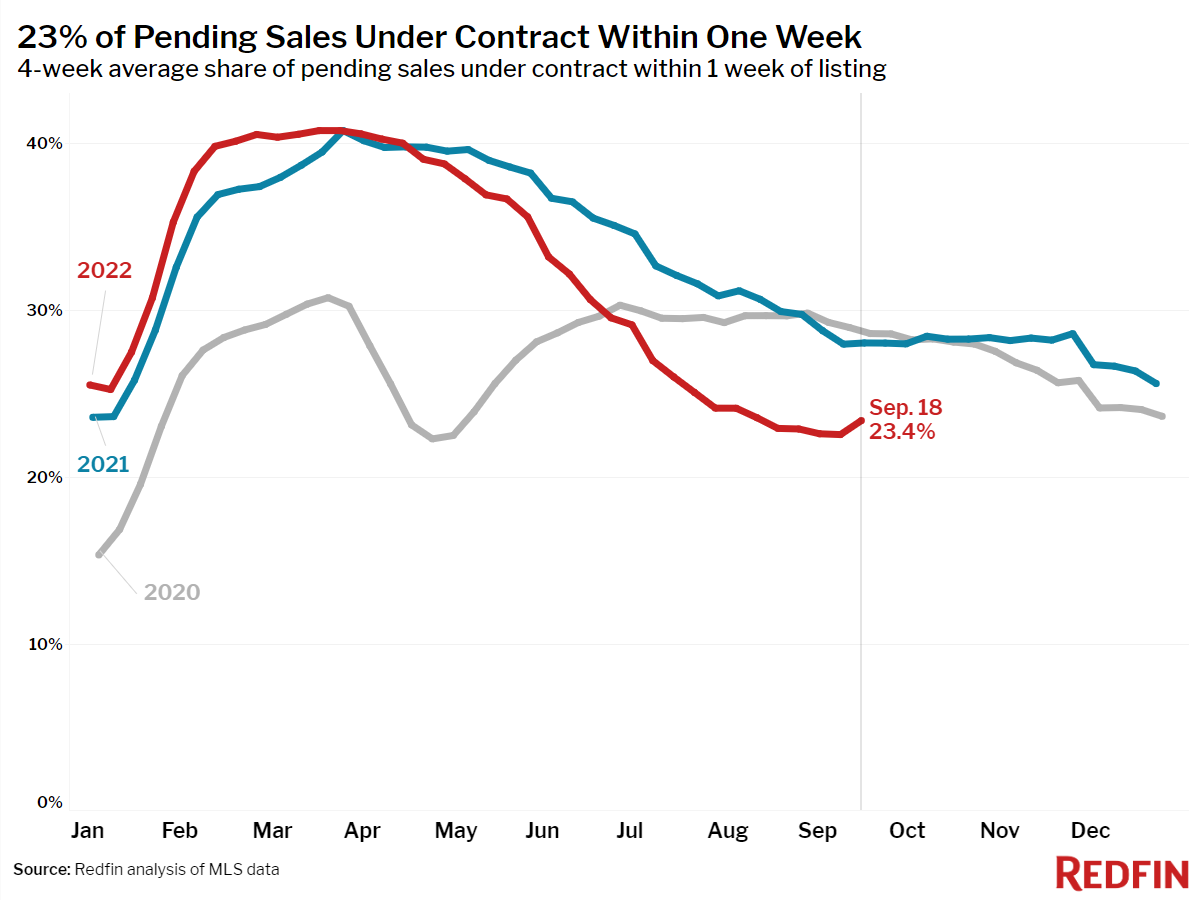

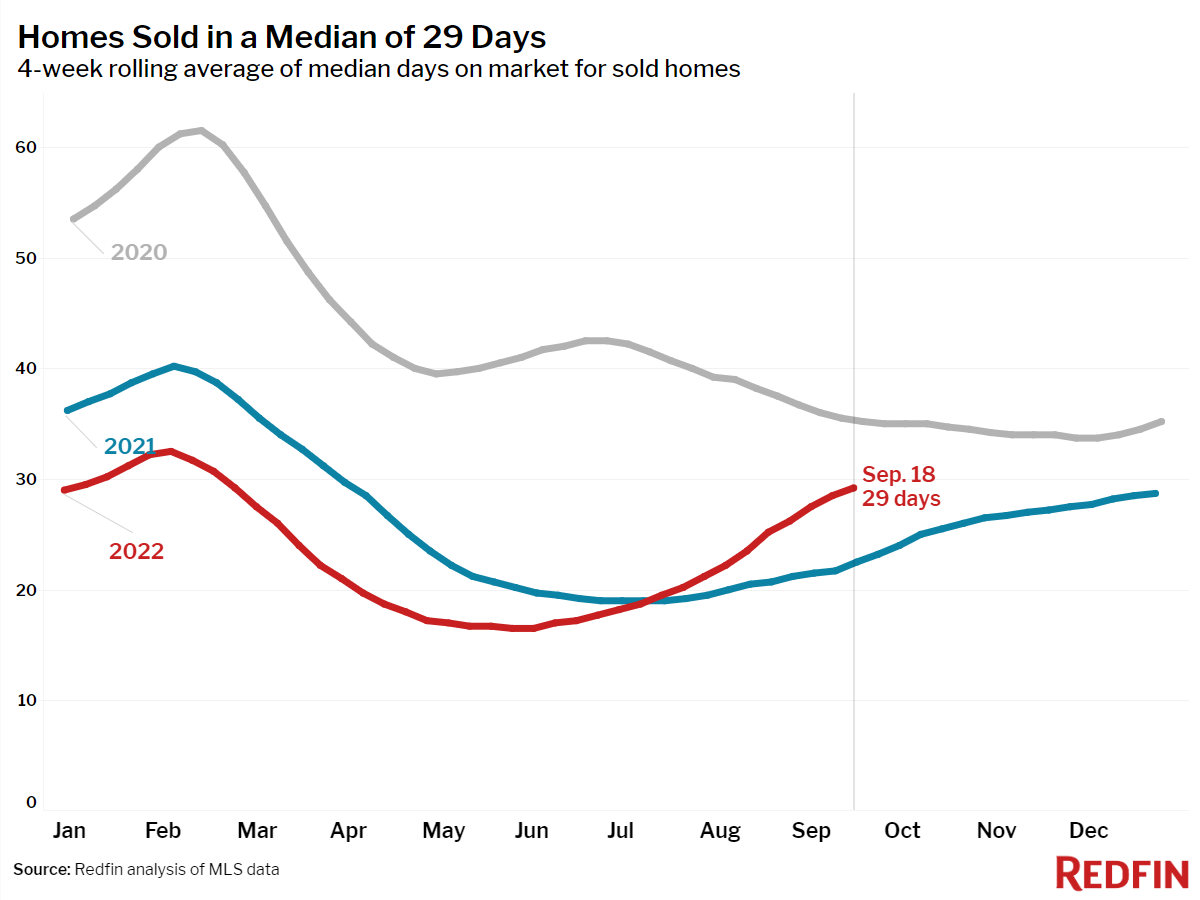

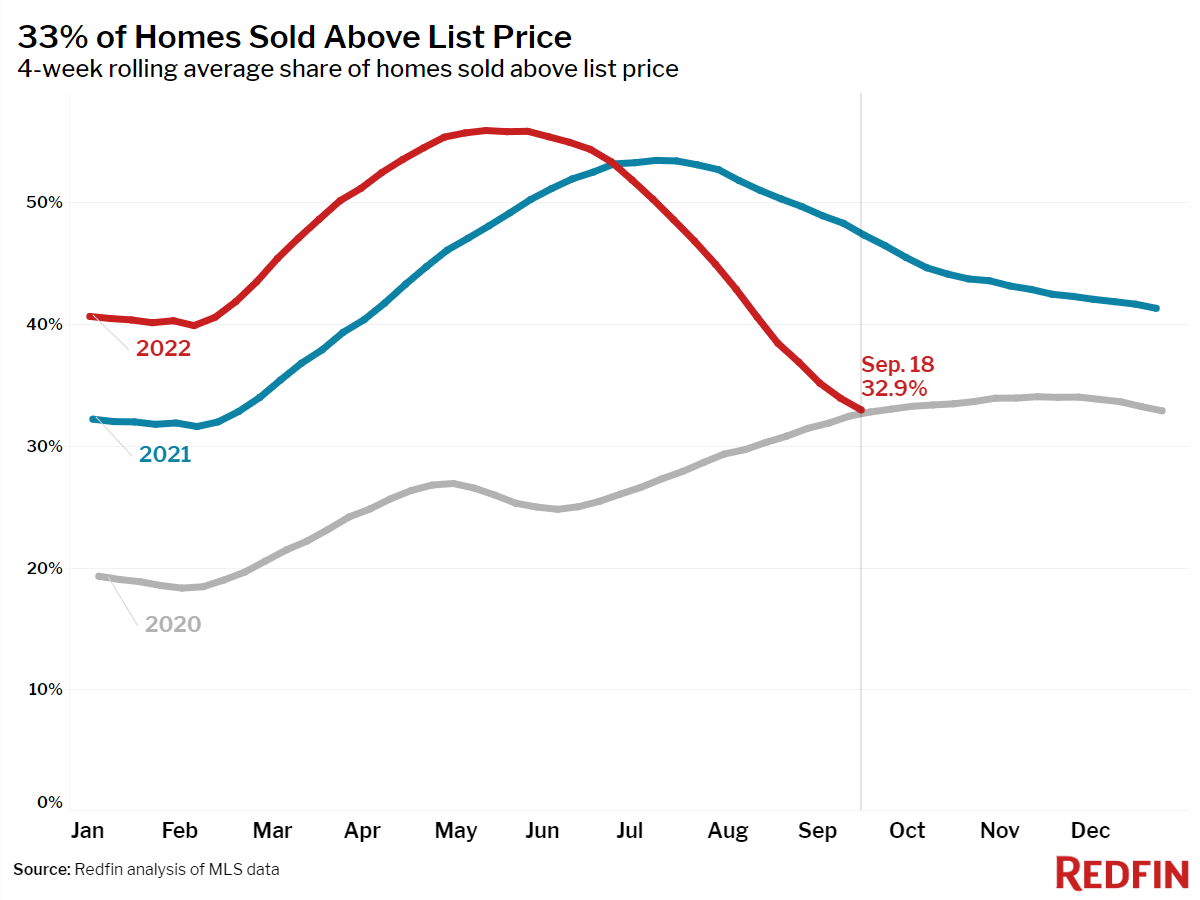

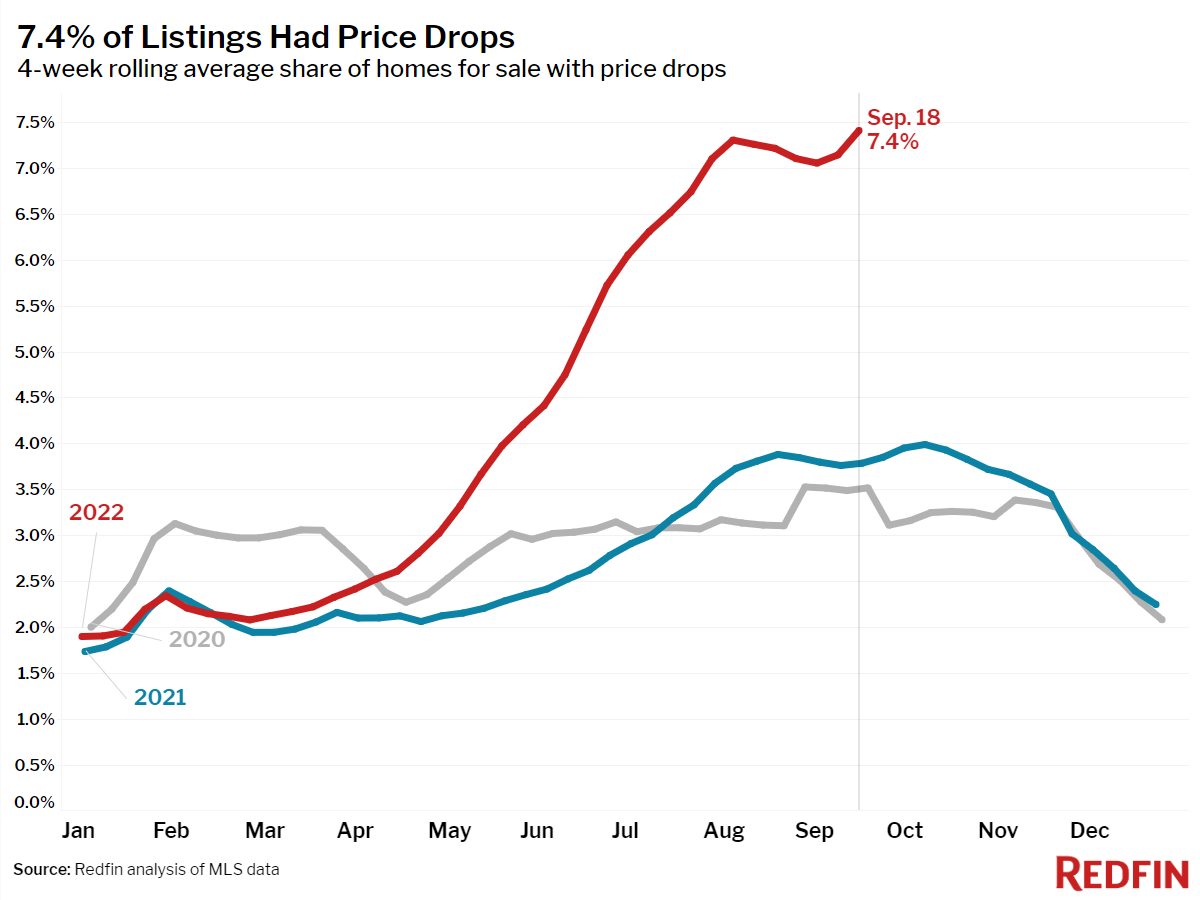

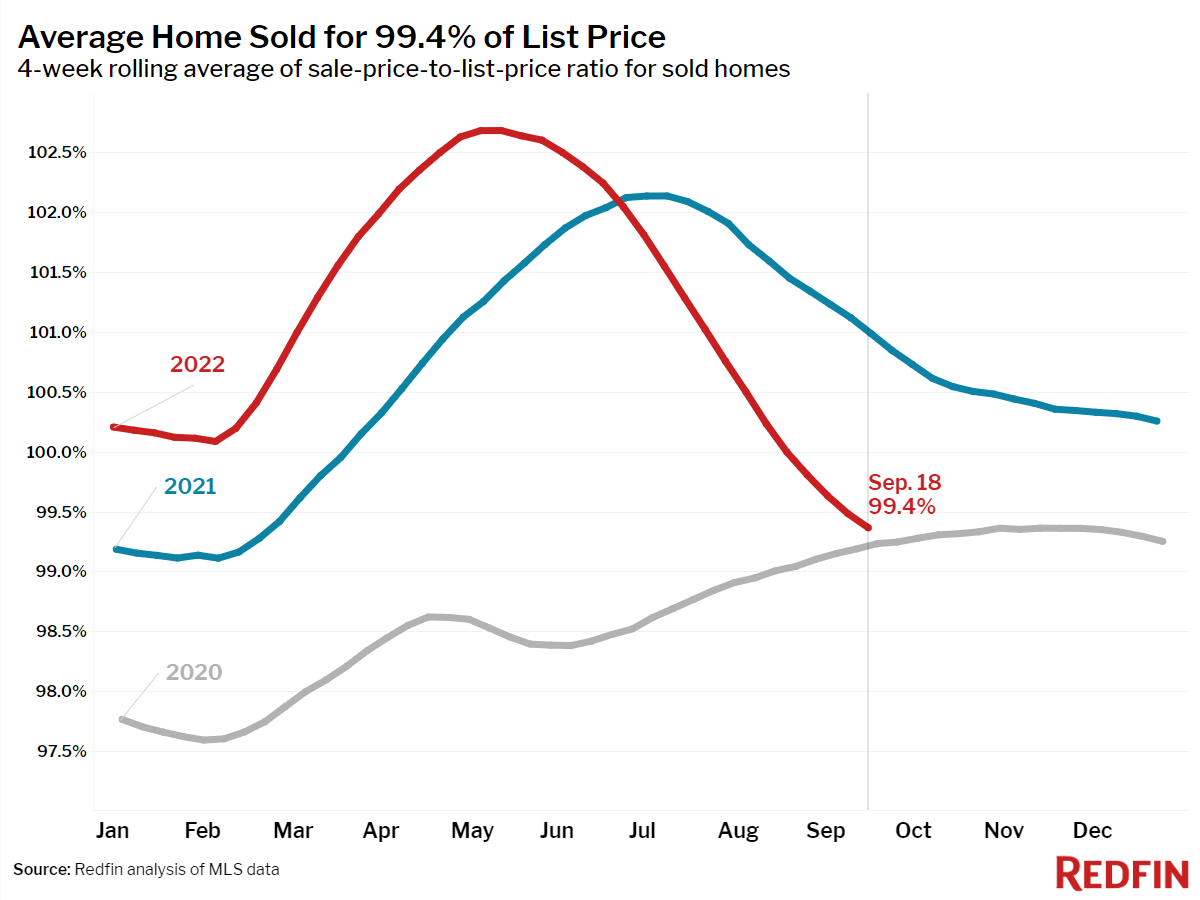

Those who do choose to list their homes have lost the upper hand their neighbors enjoyed when they sold last spring and should price accordingly. The share of home listings with a price drop reached a new high and months of supply (active listings divided by closed sales—the lower the level, the stronger the seller’s market) climbed to a 27-month high.

“There has been a lot of talk of a ‘new normal,’ but what’s happening in the housing market feels more like a ‘new weird,’” said Redfin Deputy Chief Economist Taylor Marr. “The impact of the Fed’s inflation-curbing strategy is seen clearest in the housing market as prospective buyers take a big step back, slowing sales. But since the vast majority of homeowners who might consider moving have a mortgage rate far below current levels, there’s very little new supply hitting the market. As a result, home sale prices have picked up in recent weeks, and the typical buyer’s monthly mortgage payment is just a few pumpkin spice lattes shy of its all-time high. The irony is that it may take renewed fears of a recession to bring some relief to buyers in the form of lower prices.”

Unless otherwise noted, the data in this report covers the four-week period ending September 18. Redfin’s housing market data goes back through 2012.

Refer to our metrics definition page for explanations of all the metrics used in this report.