There are more homes for sale as spring approaches, and house hunters are hitting the pavement. Home touring activity is rising, and mortgage-purchase applications are up 11% this week.

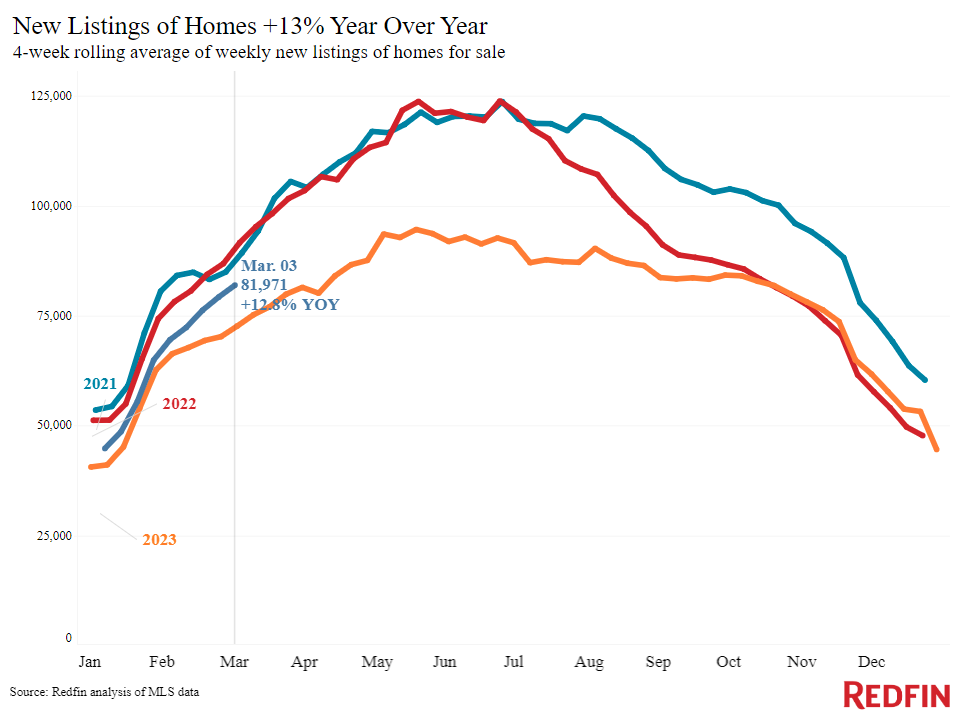

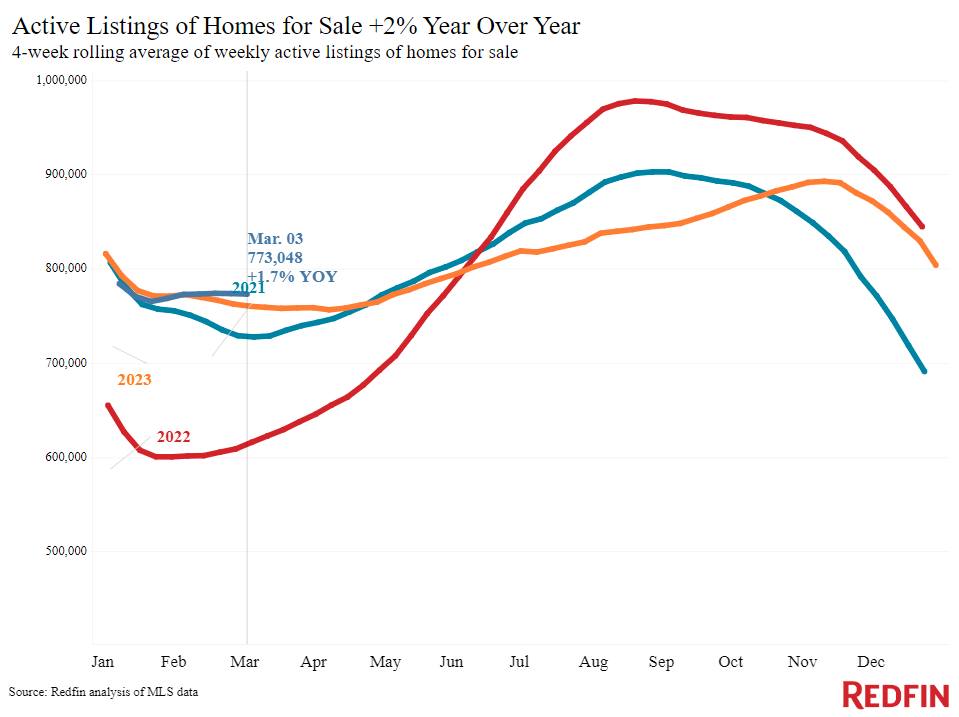

New listings rose 13% from a year earlier nationwide during the four weeks ending March 3, the biggest increase in nearly three years. The boost in new listings helped bring the total number of homes for sale up 1.7%. Following eight months of declines, February is the first month the number of homes for sale has increased on an annual basis.

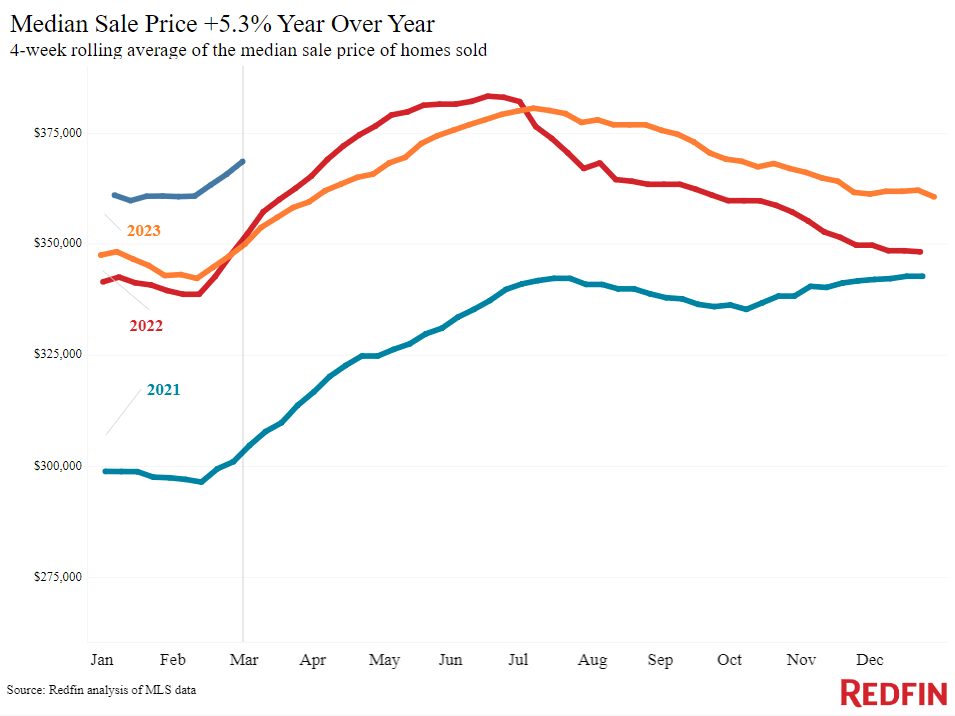

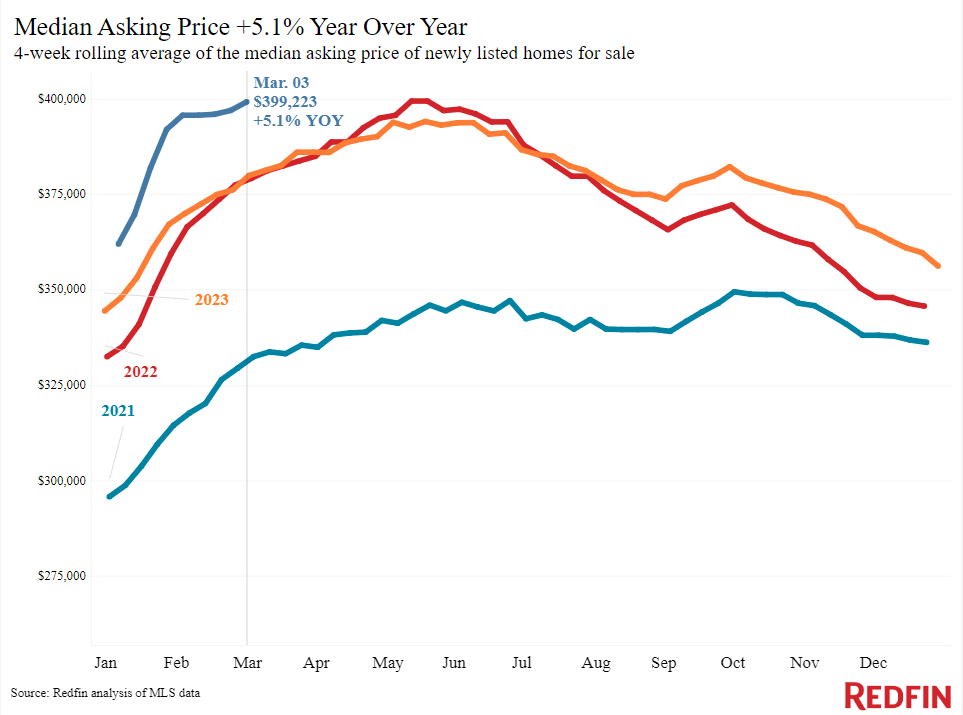

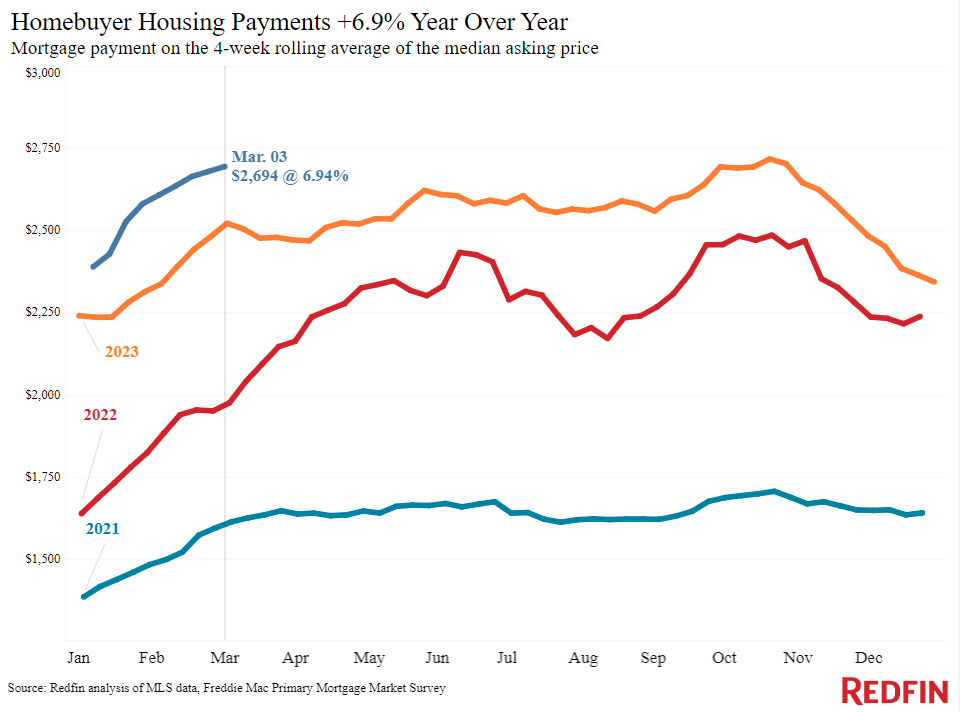

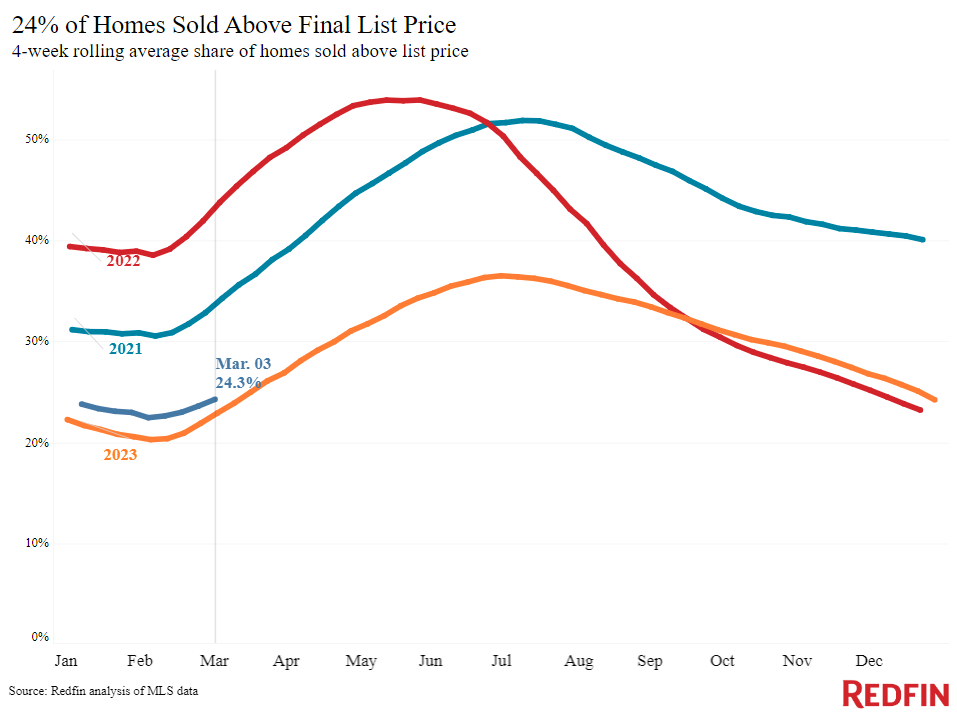

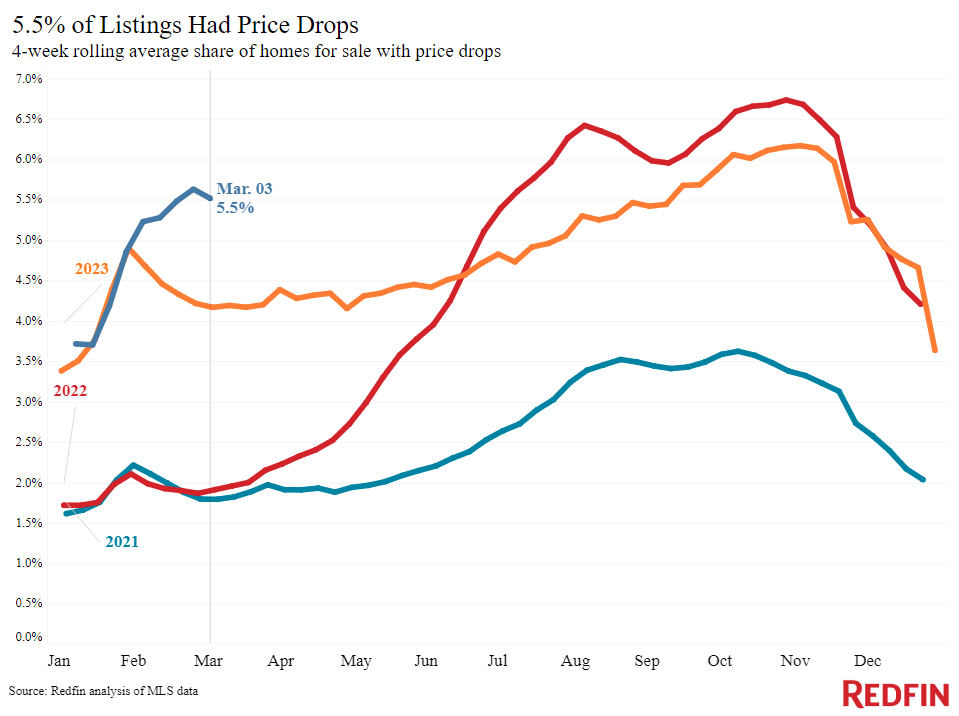

This week’s pricing data also brings a few glimmers of hope for house hunters. Asking prices of new listings posted their smallest increase in roughly two months; additionally, 5.5% of home sellers dropped their asking price, on average, the highest share of any February since at least 2015. High mortgage rates pushed the median monthly housing payment to $2,694 this week, just $23 shy of the all-time high. But final sale prices, which rose 5.3% year over year, one of the biggest increases in a year and a half, should start declining soon as price growth for new listings loses some momentum.

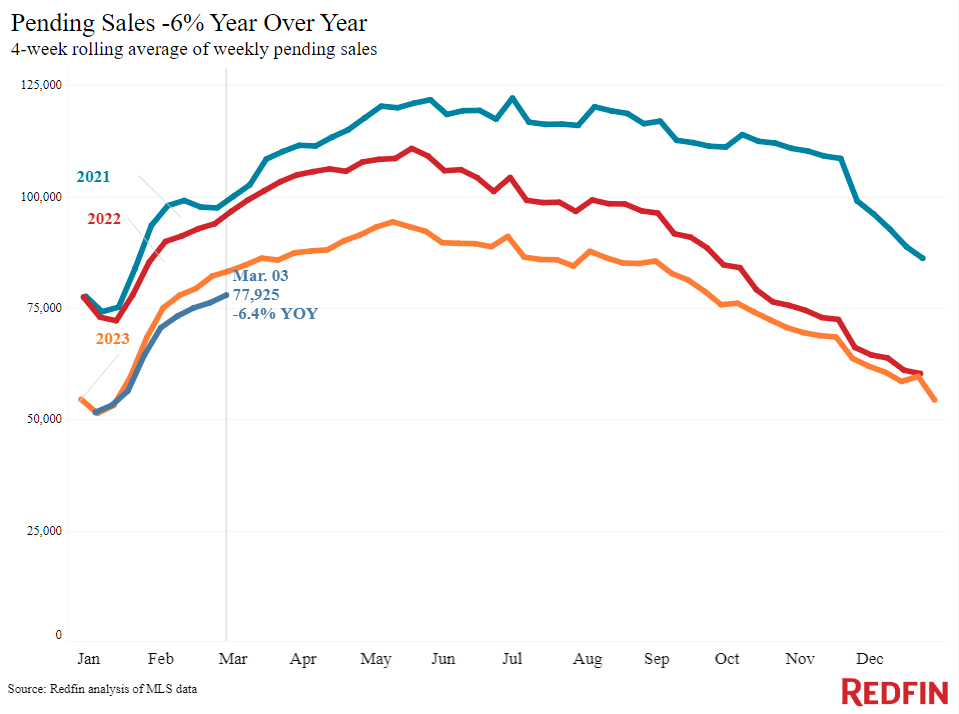

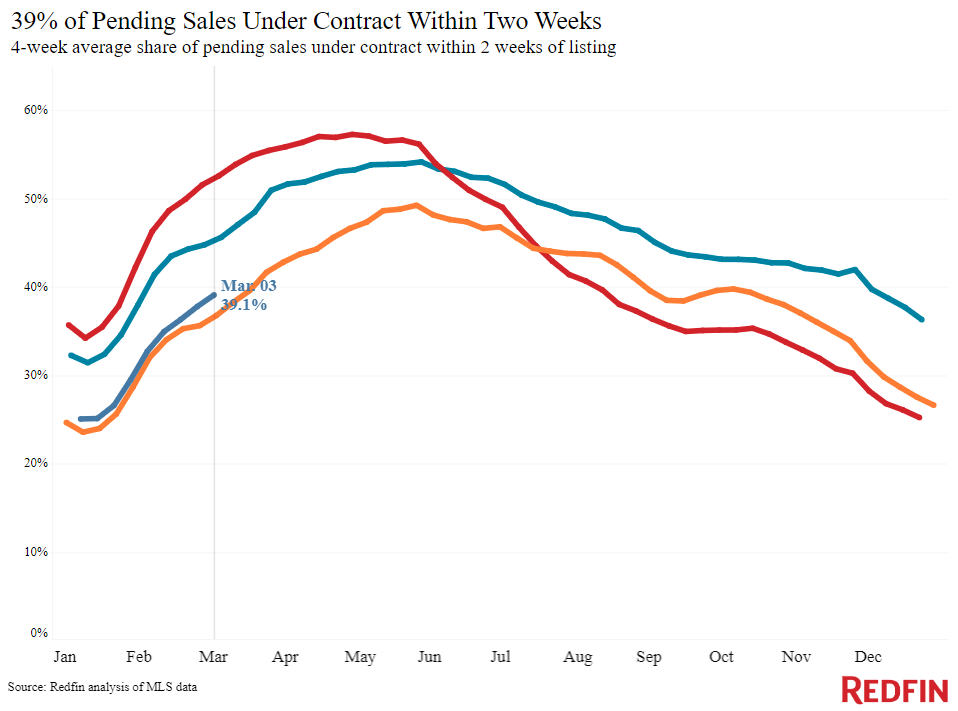

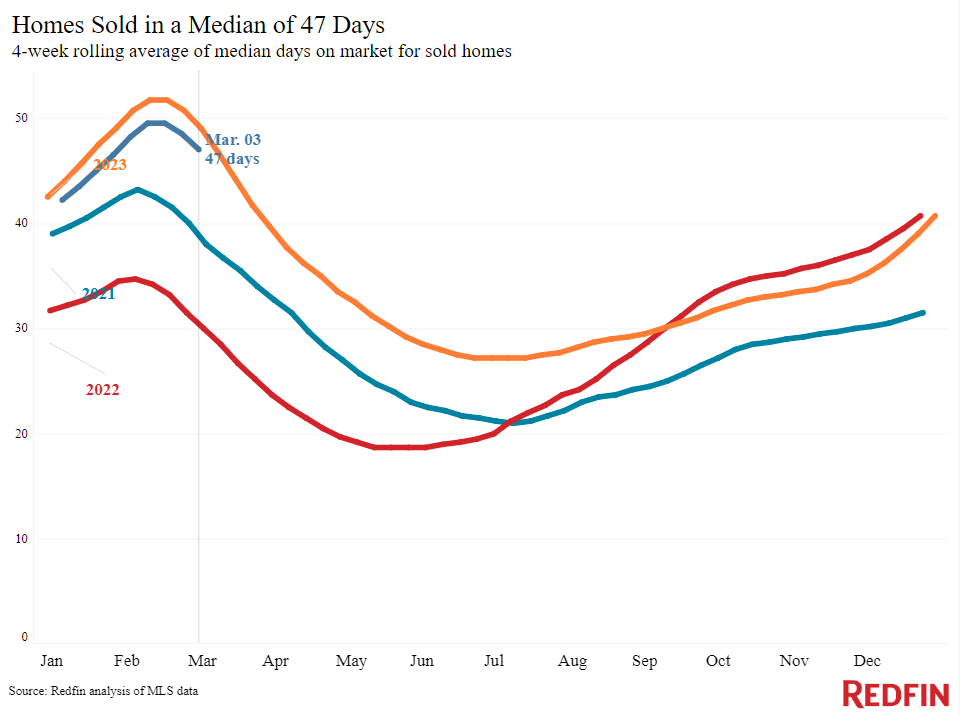

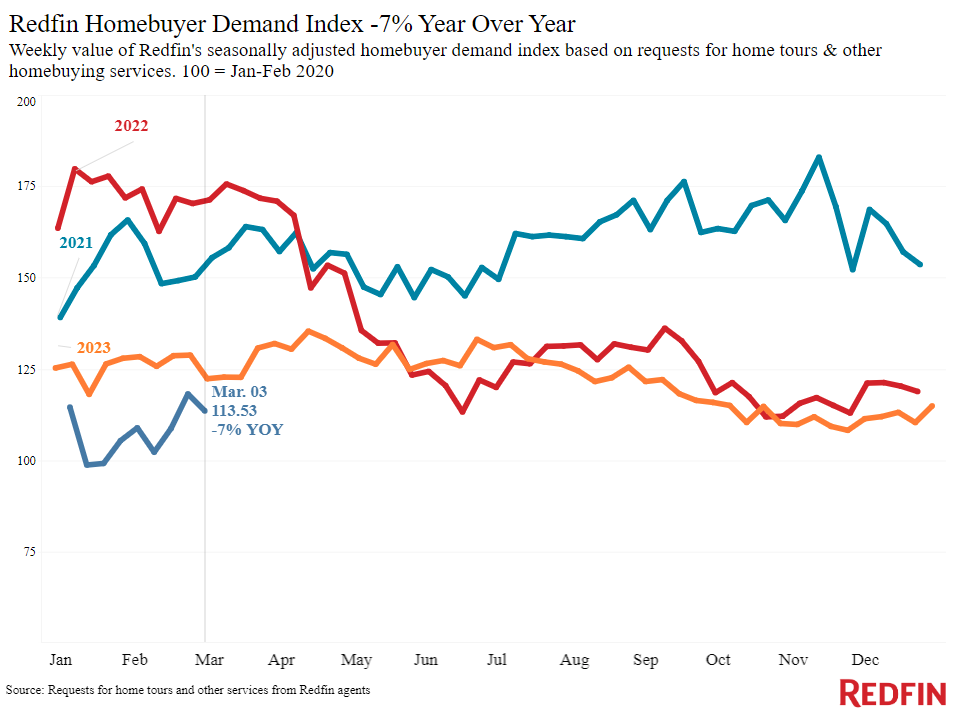

House hunters are looking at homes and applying for mortgages as we approach spring. Touring activity is up 23% from the start of the year, compared to a 14% increase during the same period last year, and mortgage-purchase applications are up 11% week over week. That early-stage buying activity hasn’t yet translated to a boost in sales, with pending sales down 6% year over year.

“There have been two major obstacles for homebuyers over the last year: Low inventory and high housing costs,” said Redfin Economic Research Lead Chen Zhao. “Now, the first barrier is starting to come down as more supply comes on the market. Housing costs are still high, but they’re likely to come down a bit as mortgage rates gradually decline through the year and price growth loses some steam. Buyers who can afford today’s mortgage rates may have better luck finding a home now than they have in the past several months, and they also may be less likely to face competition because inventory is improving.”

For more on Redfin economists’ takes on the housing market, including how current financial events are impacting mortgage rates, please visit our “From Our Economists” page.

Refer to our metrics definition page for explanations of all the metrics used in this report.