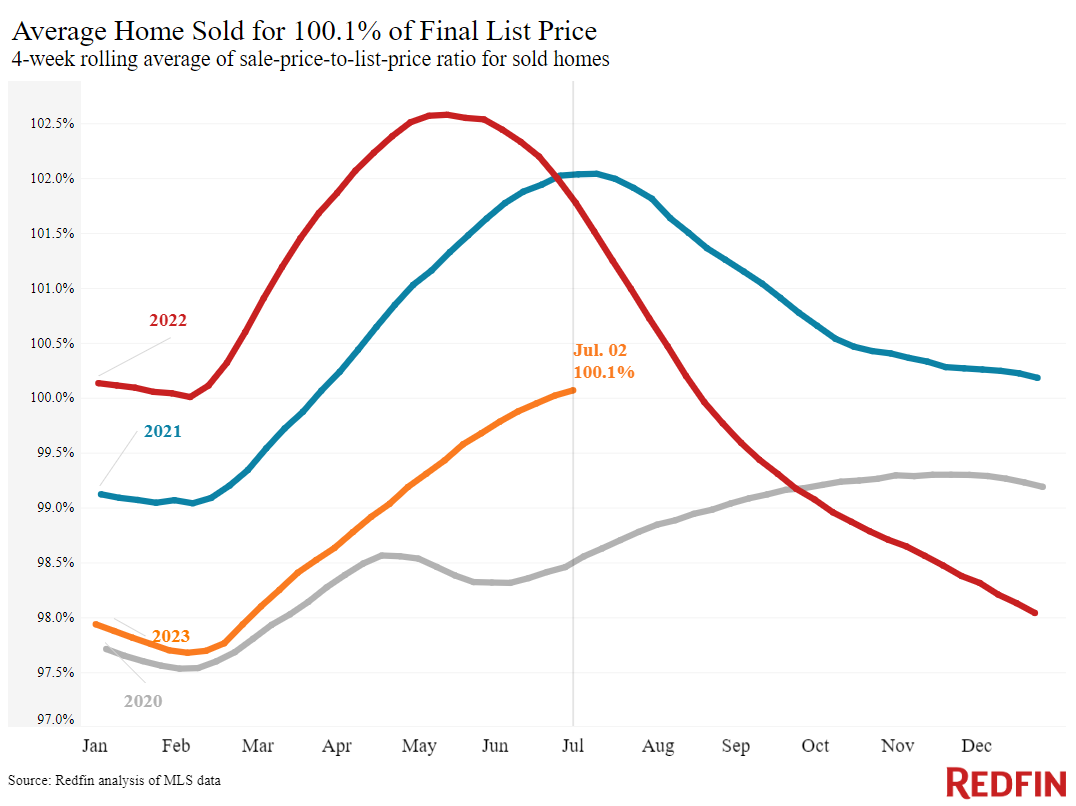

This is the first time since last August the average sale-to-list price ratio has surpassed 100%. Low inventory and steady demand are buoying home prices.

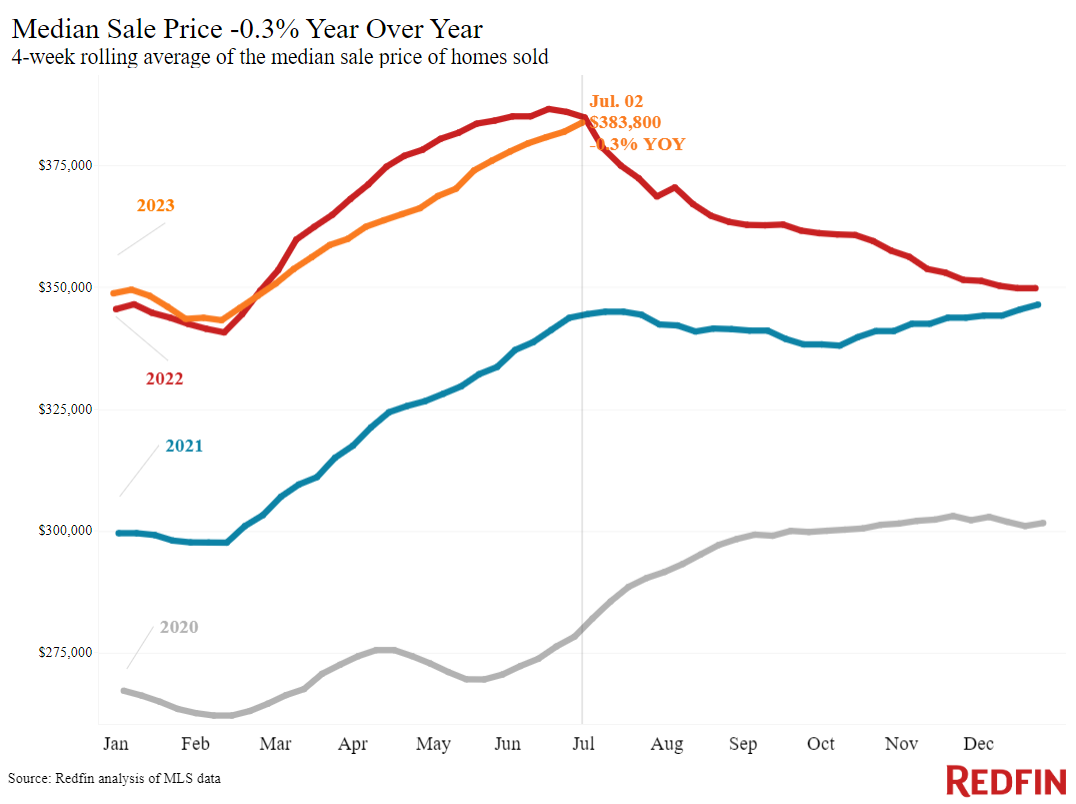

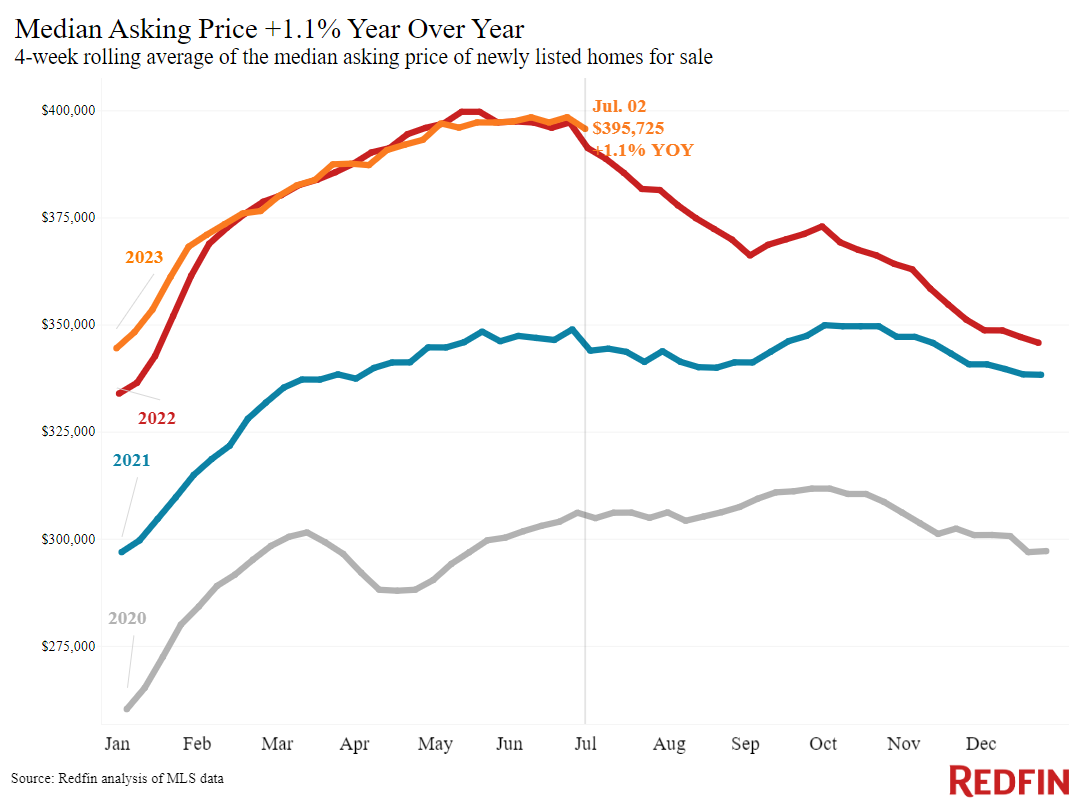

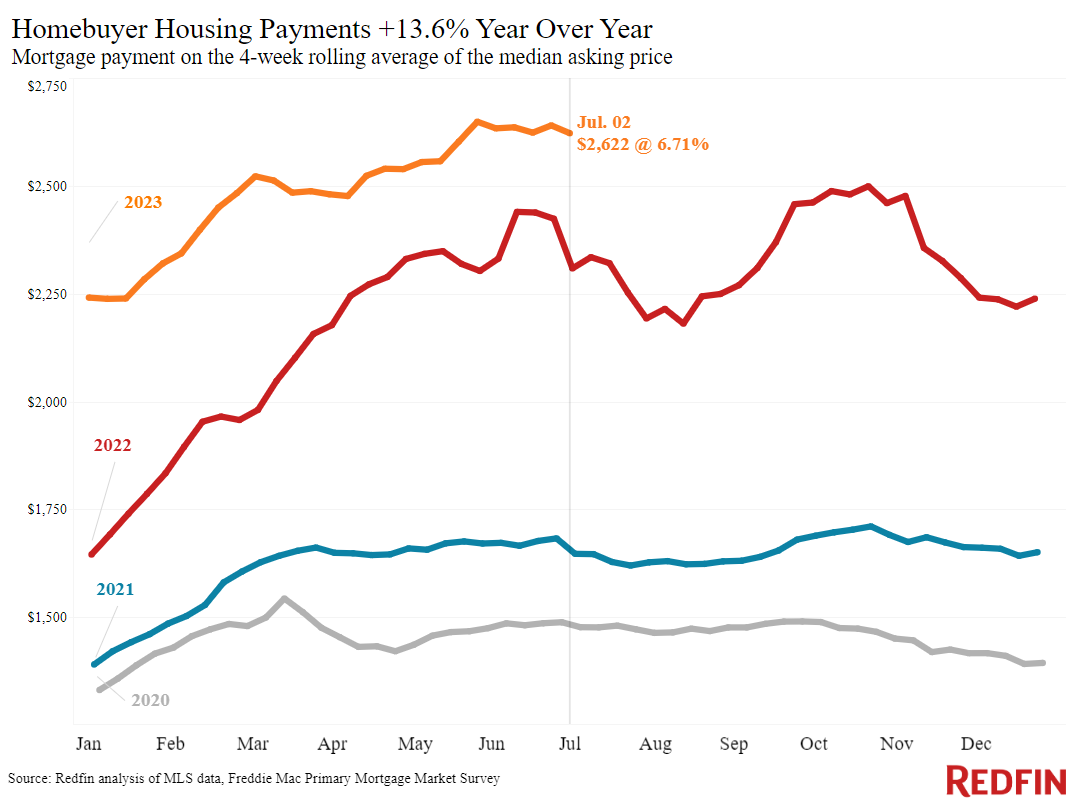

The average sale-to-list price ratio hit 100.1% during the four weeks ending July 2, marking the first time in nearly a year the average U.S. home is selling for more than its asking price. Additionally, the median home-sale price was down just $1,000 (-0.3%) from a year ago, when prices were near record highs. Stubbornly high home prices, combined with near-7% mortgage rates, are standing in the way of homebuyers, who are faced with near-record-high monthly housing payments.

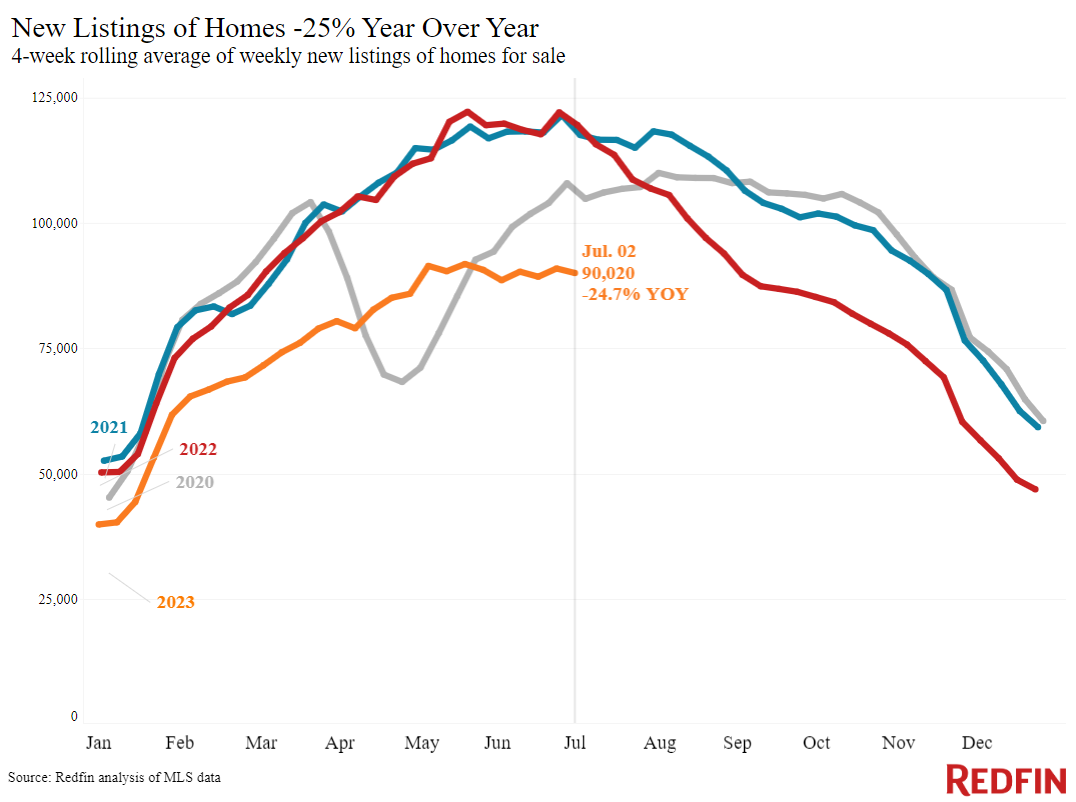

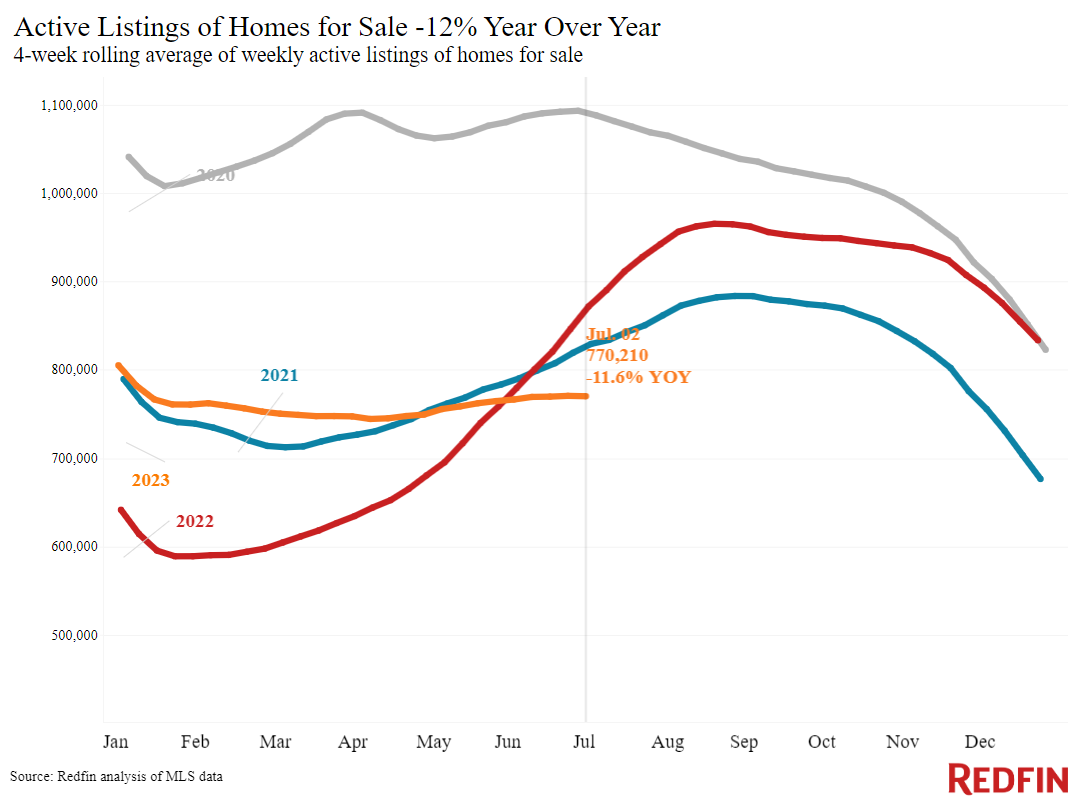

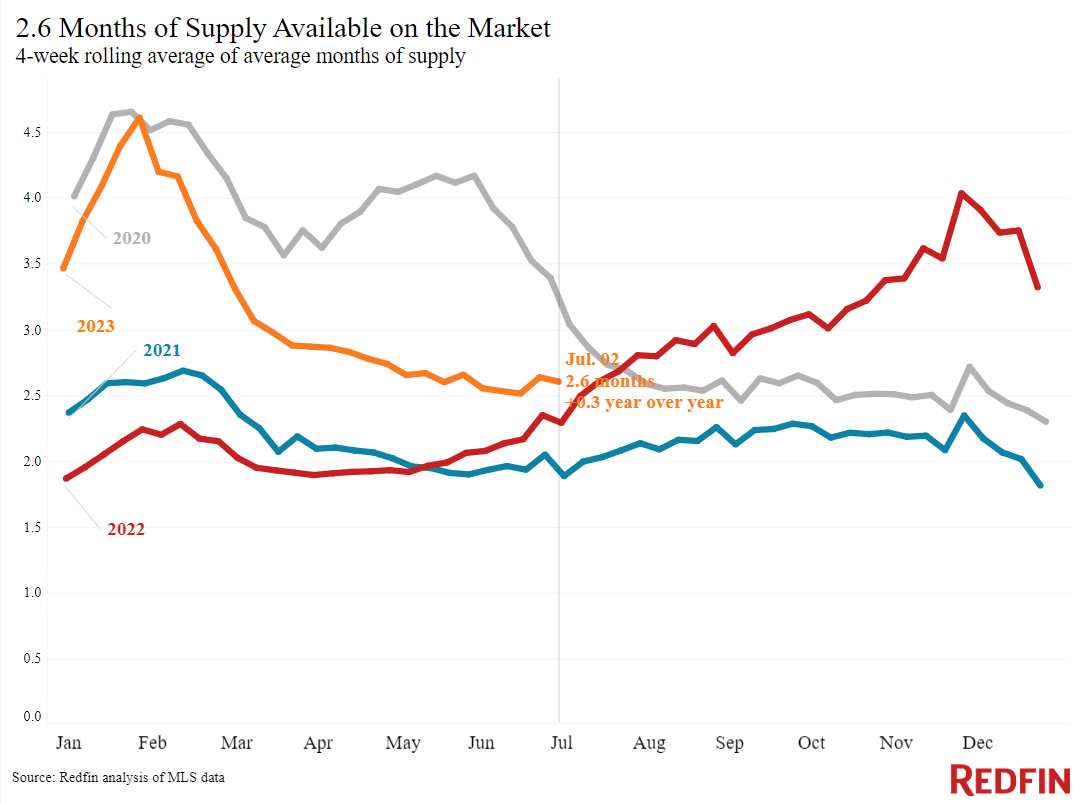

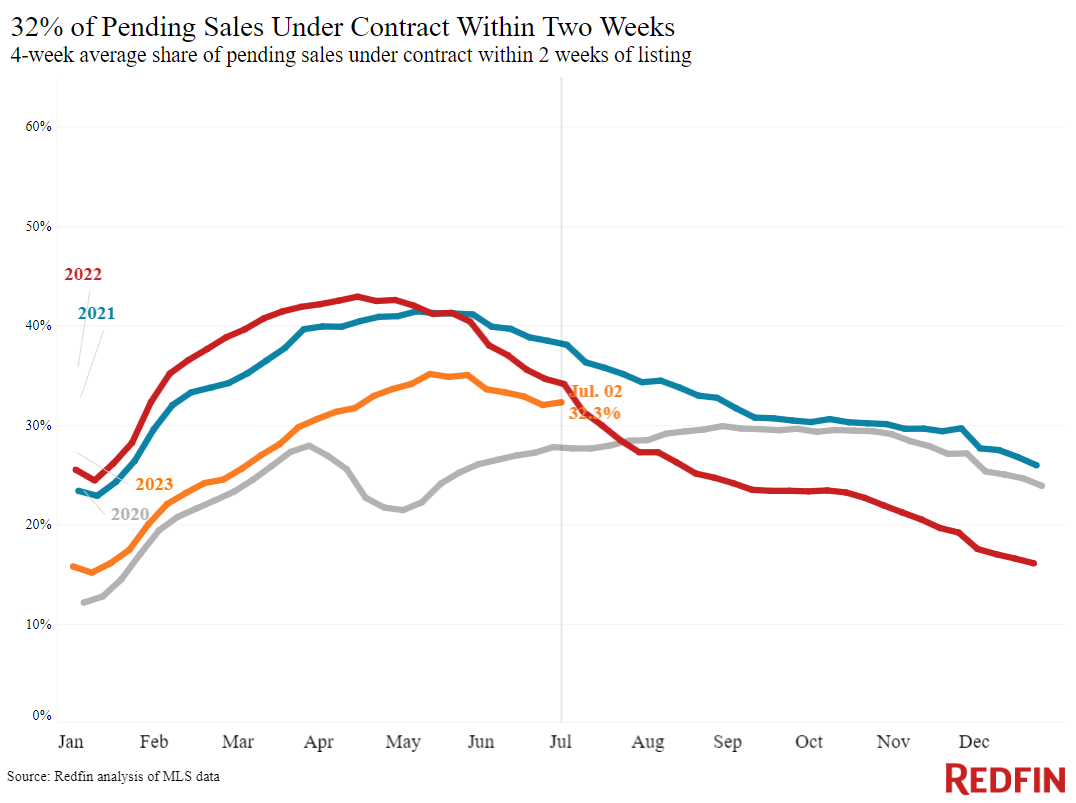

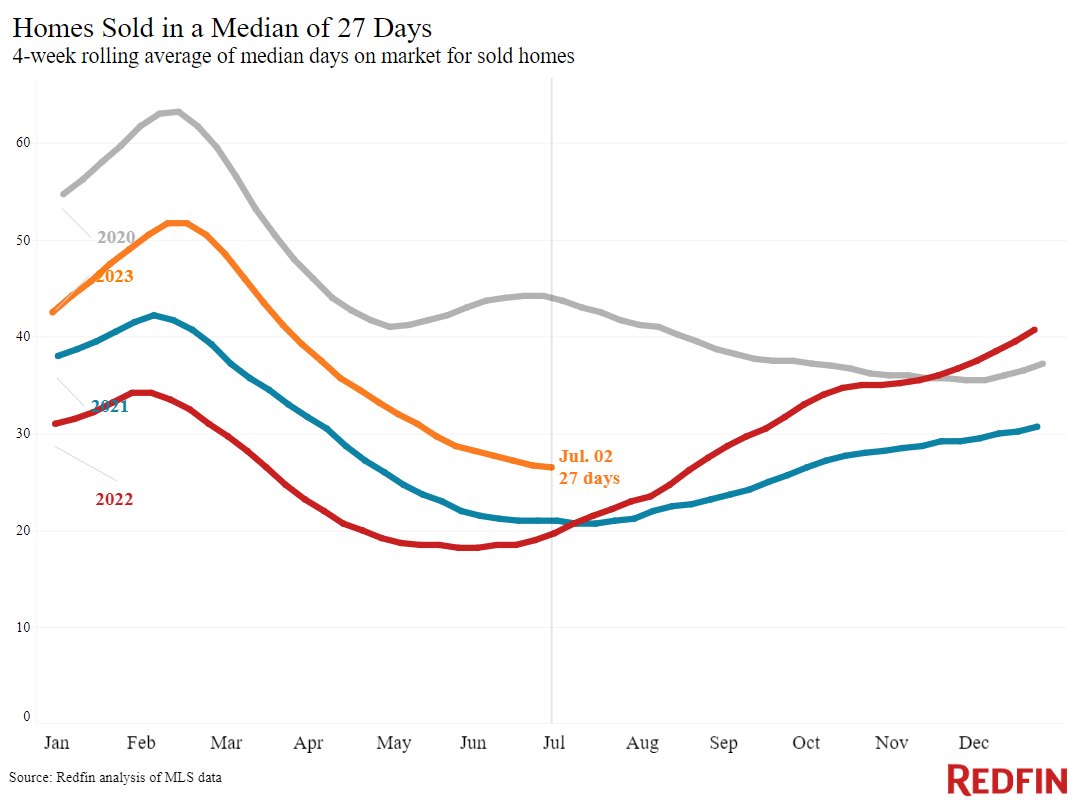

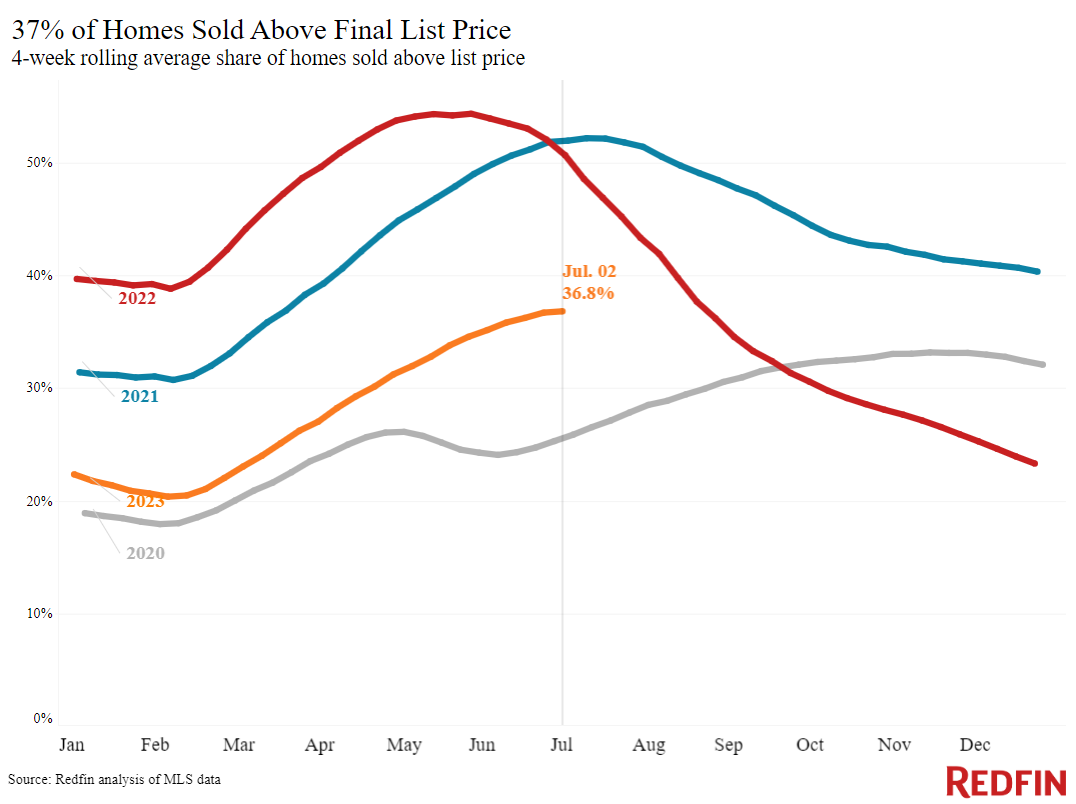

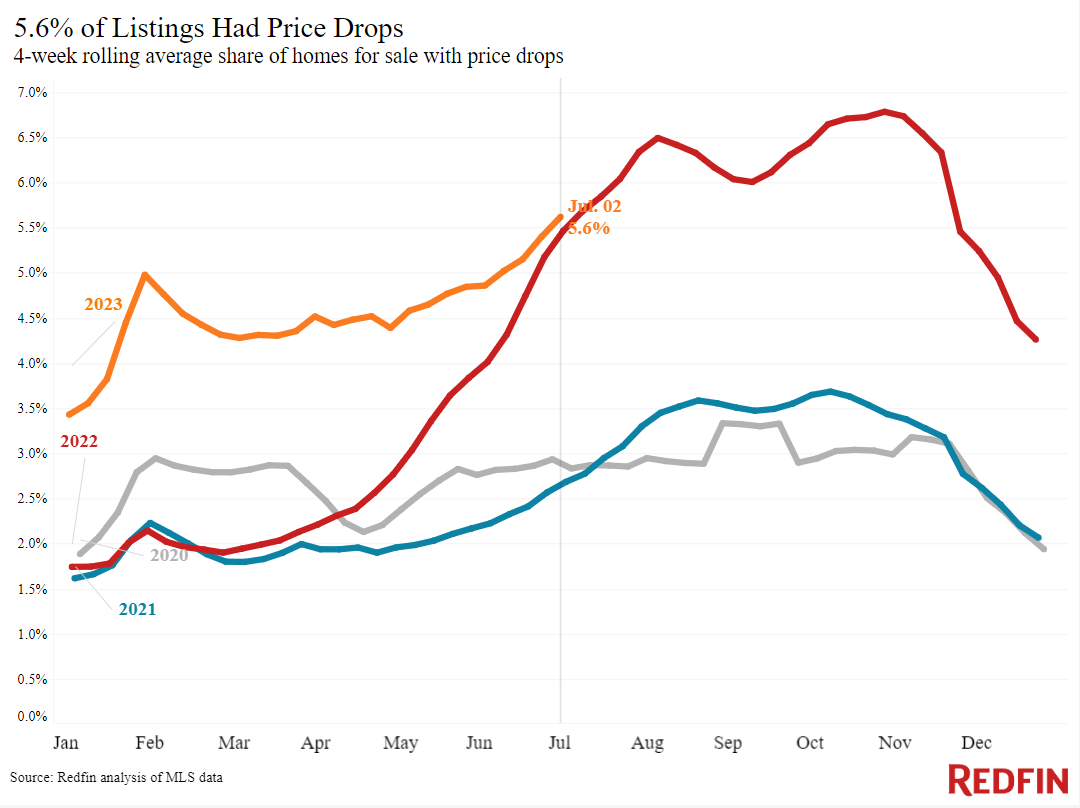

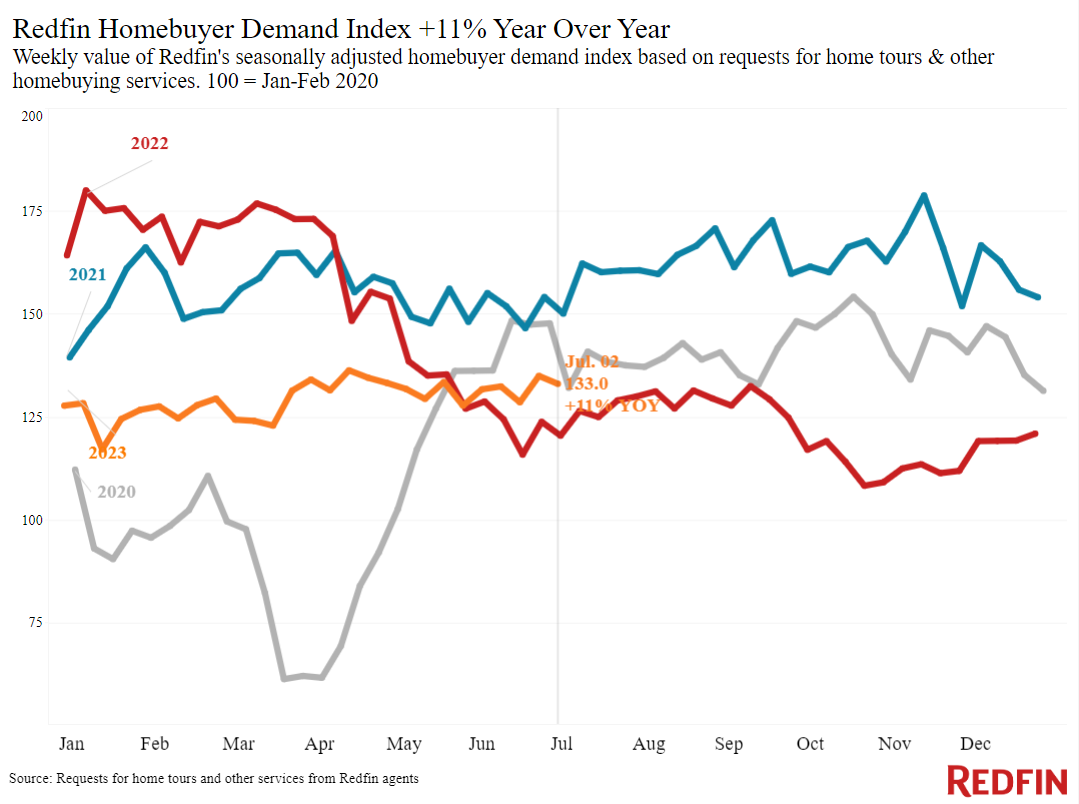

A lack of homes for sale is the main reason homes are selling above their asking price, with new listings down 25% from a year ago and the total number of homes for sale down 12% as homeowners hang onto relatively low mortgage rates. Despite the double dilemma of low inventory and high prices, early-stage homebuyer demand is picking up. Redfin’s Homebuyer Demand Index–a measure of requests for home tours and other buying services from Redfin agents–is up 4% from a month earlier and near its highest level in over a year.

“Almost every home is getting multiple offers and selling over asking price,” said Portland, OR Redfin agent Jeremy Lucas. “The lack of supply is making it feel almost like 2021 all over again, but higher rates mean bidding wars are happening more in the $500,000 range than the $700,000 range because people can afford less. I’m advising buyers to shop a little under their price range so they can make a strong offer.”

Unless otherwise noted, the data in this report covers the four-week period ending July 2. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.