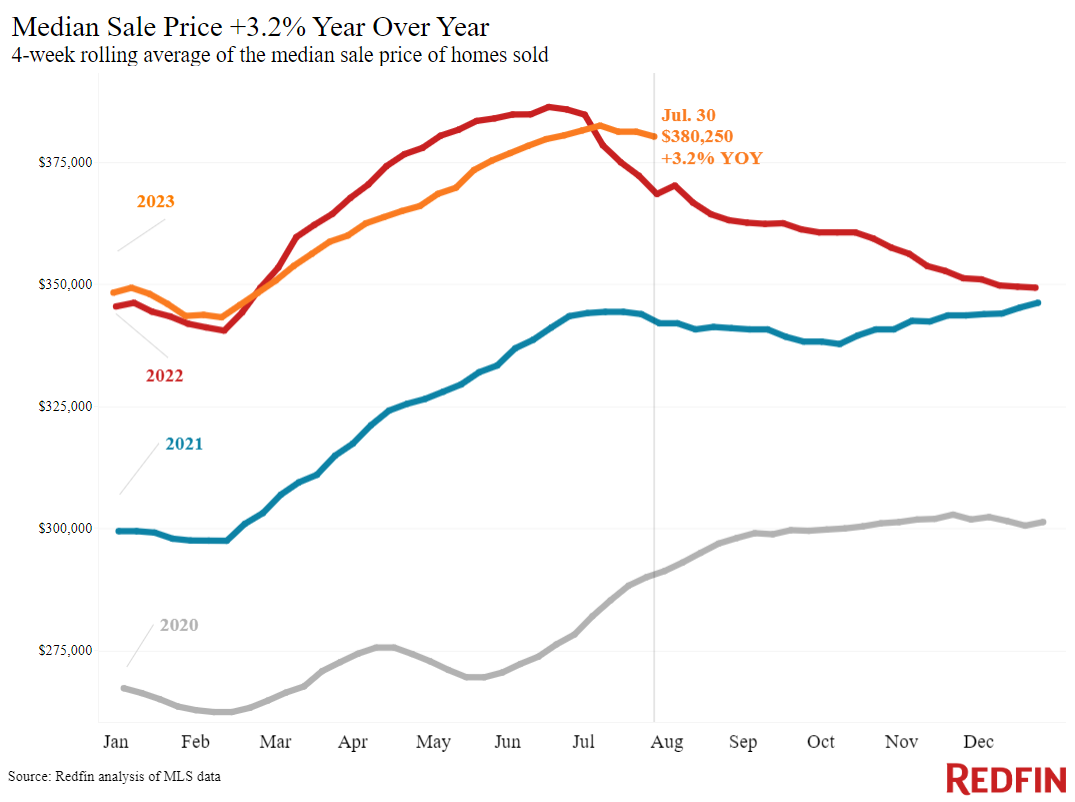

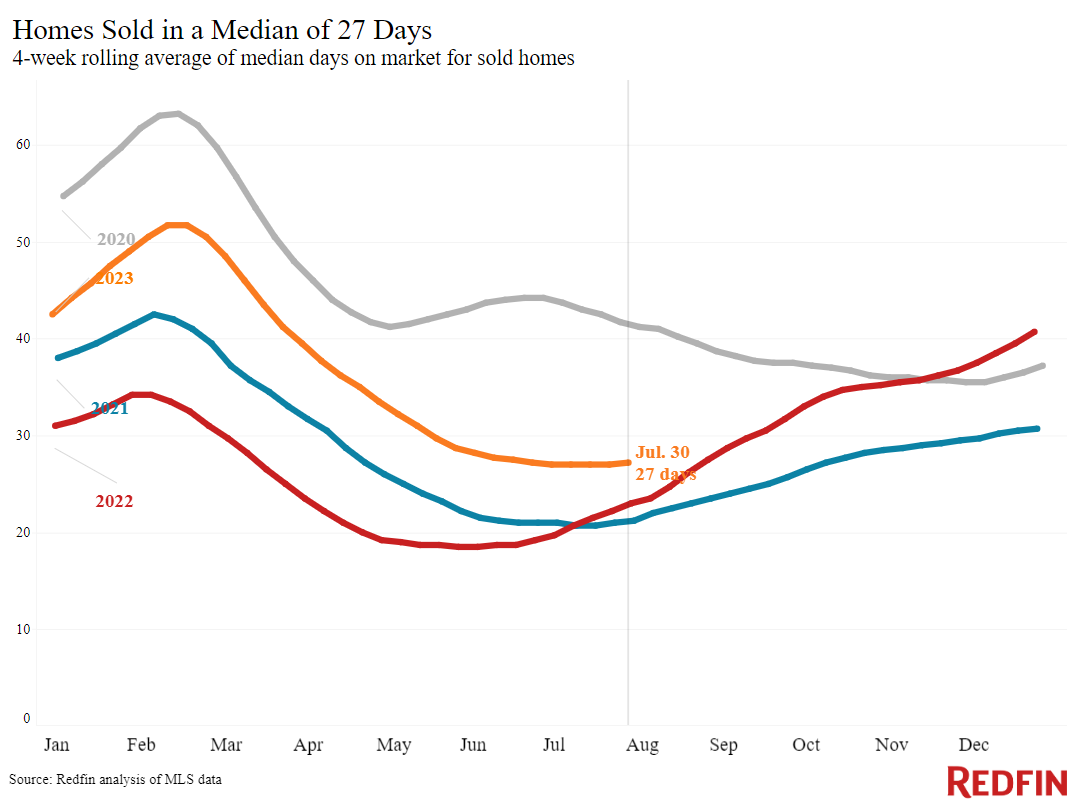

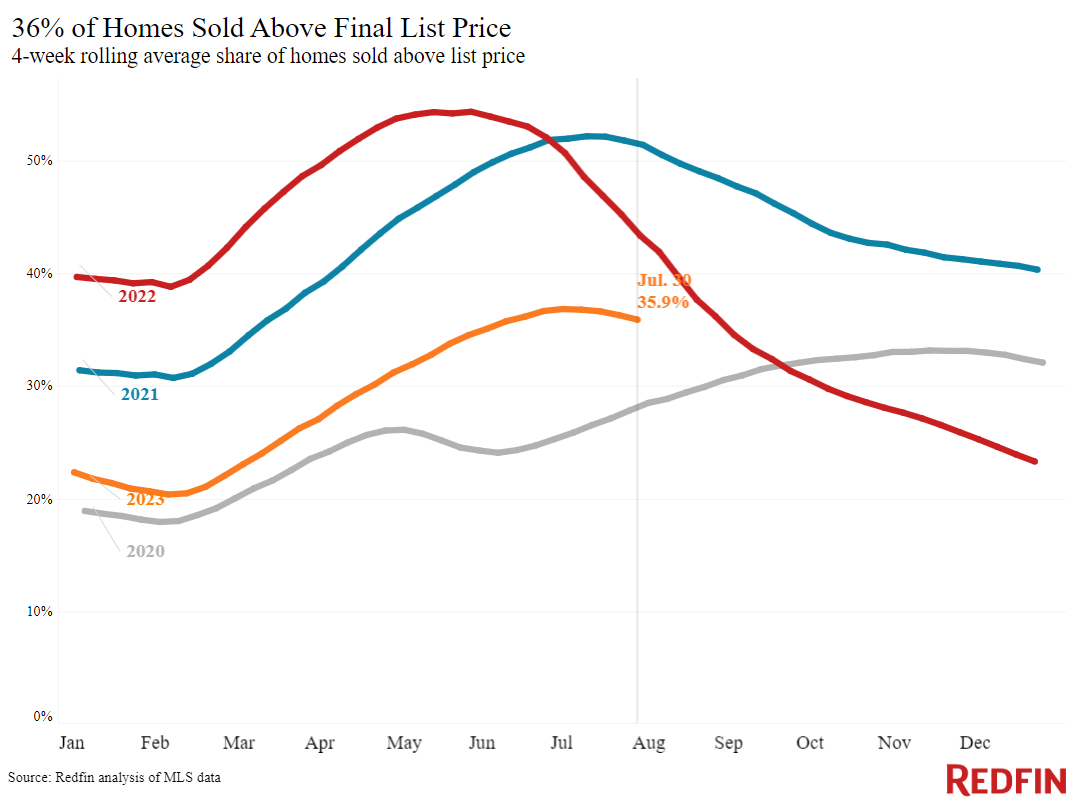

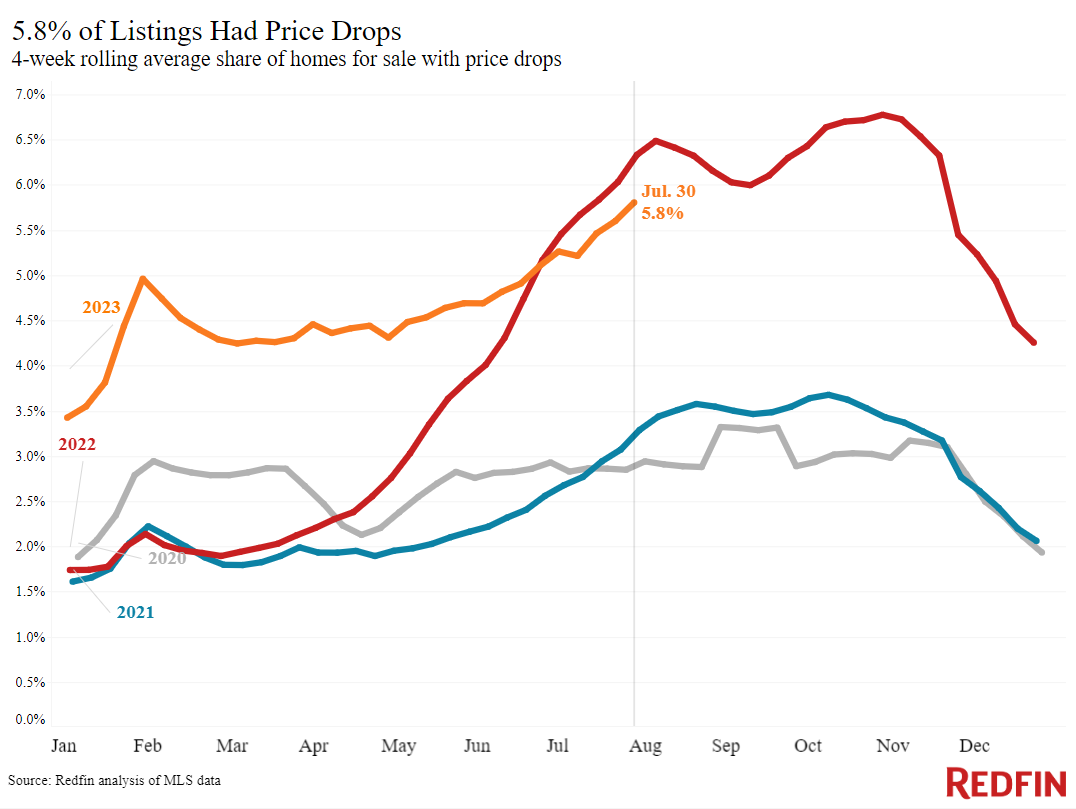

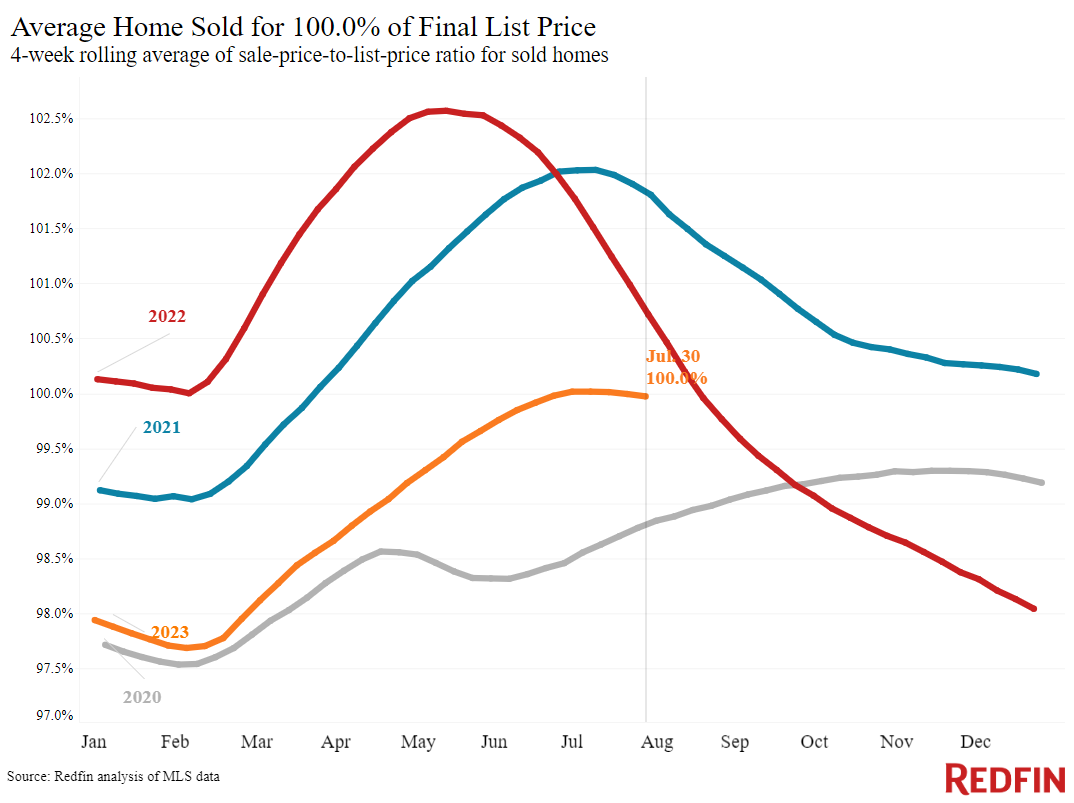

The median U.S. home-sale price is up 3.2% year over year, the biggest increase since November, and mortgage rates remain elevated. Prices are increasing largely due to the lack of supply, with inventory posting its biggest drop in 18 months as homeowners grasp onto low rates.

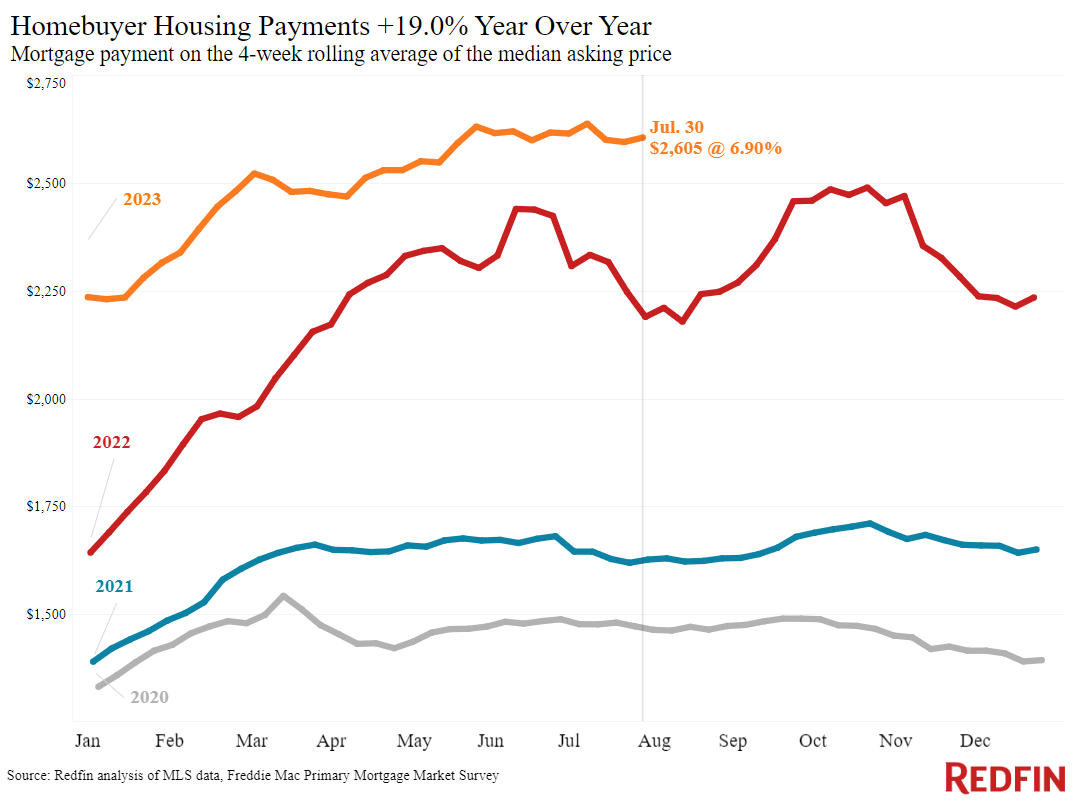

The typical U.S. homebuyer’s monthly mortgage payment was $2,605 during the four weeks ending July 30, up 19% from a year earlier and down just $32 from early July’s all-time high. Housing payments remain historically high because mortgage rates remain elevated, with weekly average rates clocking in at 6.9% this week, and home prices are on the rise. The median home-sale price is up 3.2% year over year, the biggest increase since November.

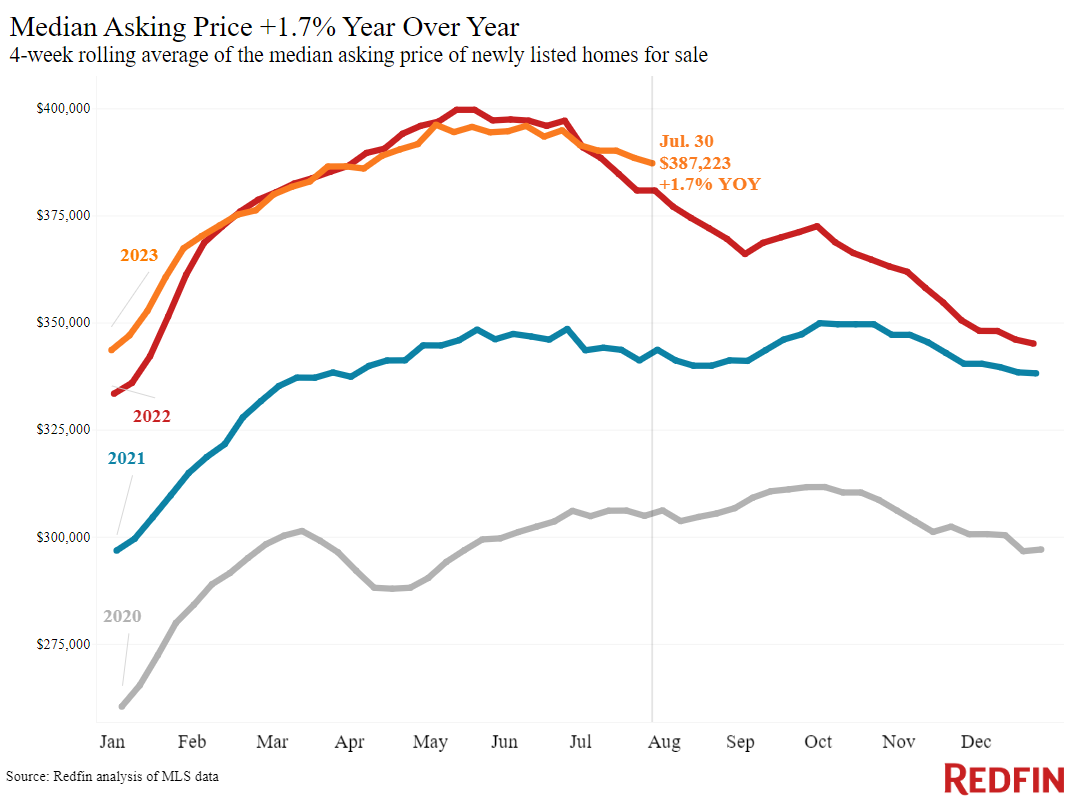

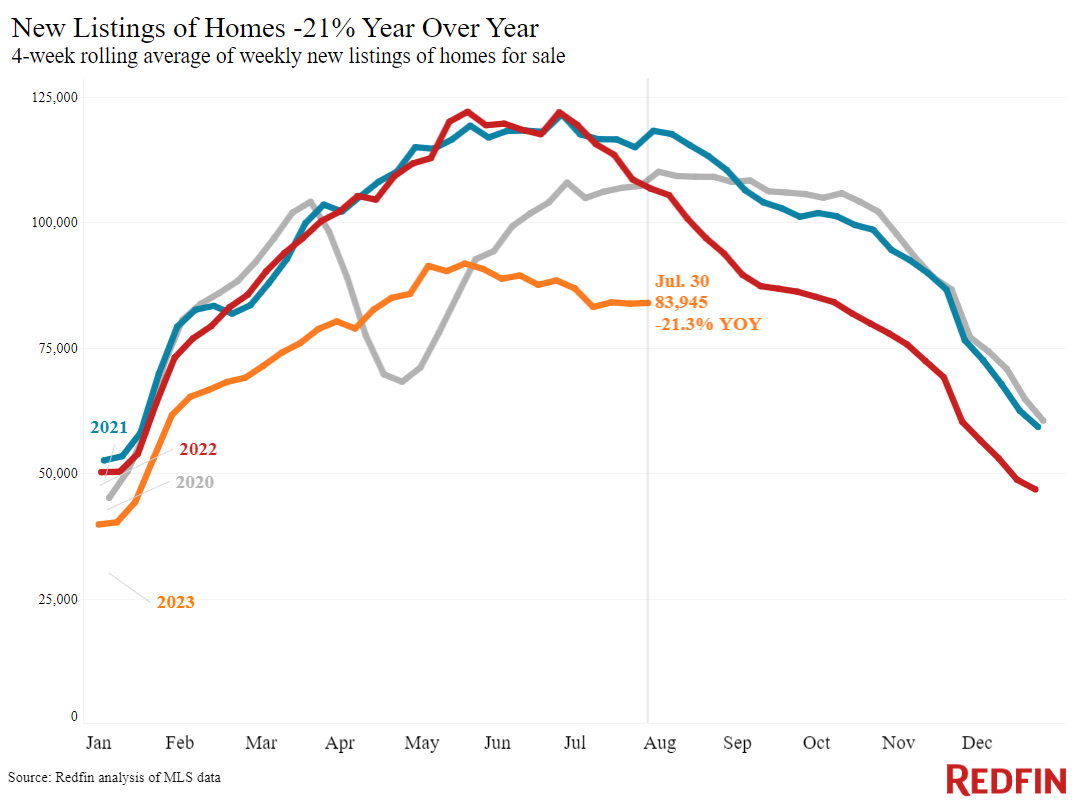

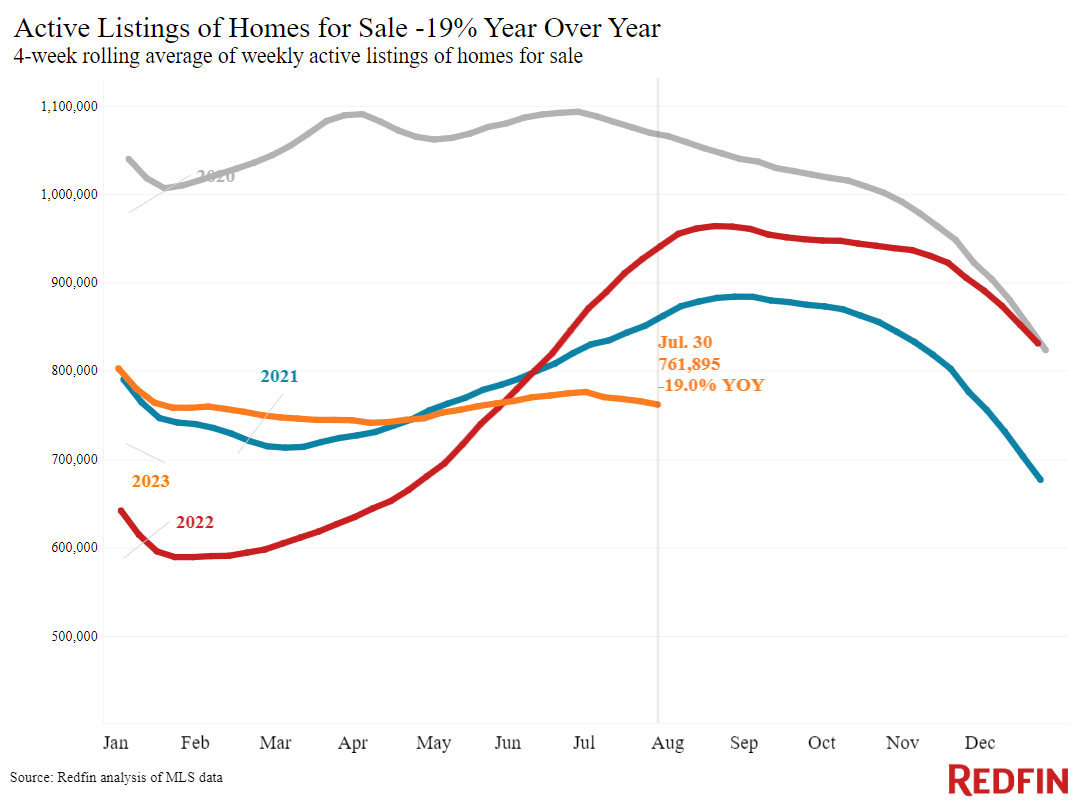

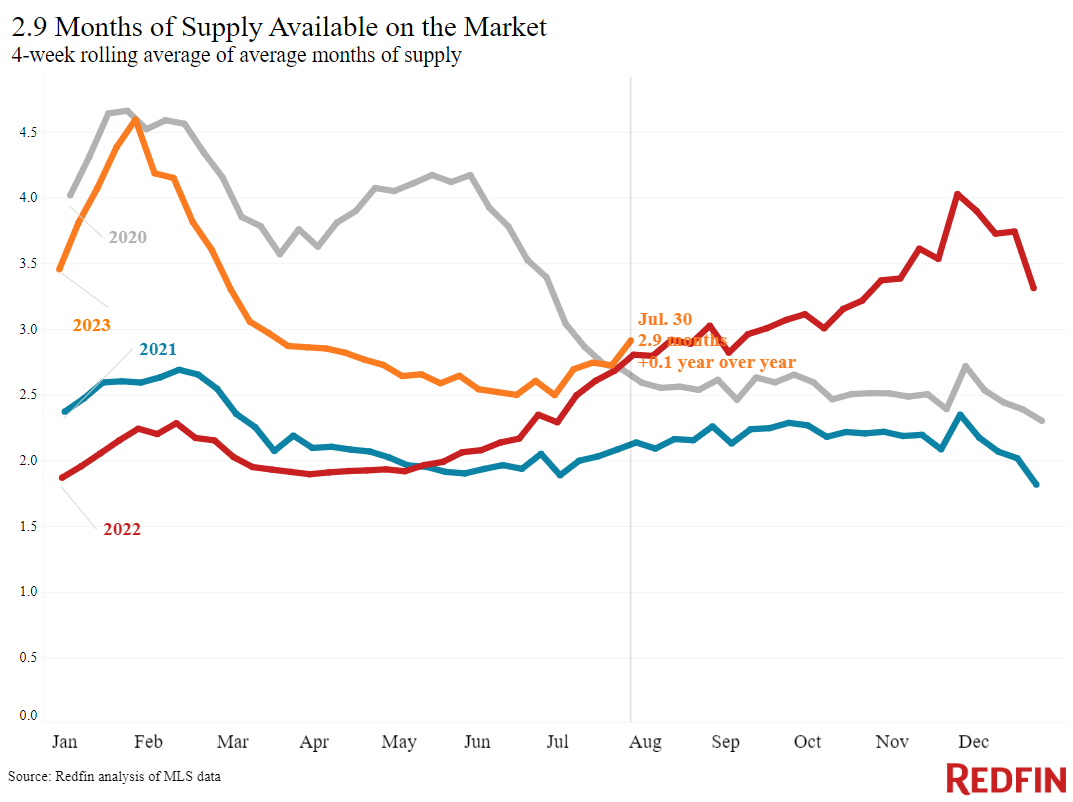

Home prices are increasing because of the mismatch between supply and demand. High mortgage rates have pushed many would-be sellers out of the market, with homeowners hanging onto their relatively low rates. The total number of homes for sale is down 19%, the biggest drop in a year and a half, and new listings are down 21%.

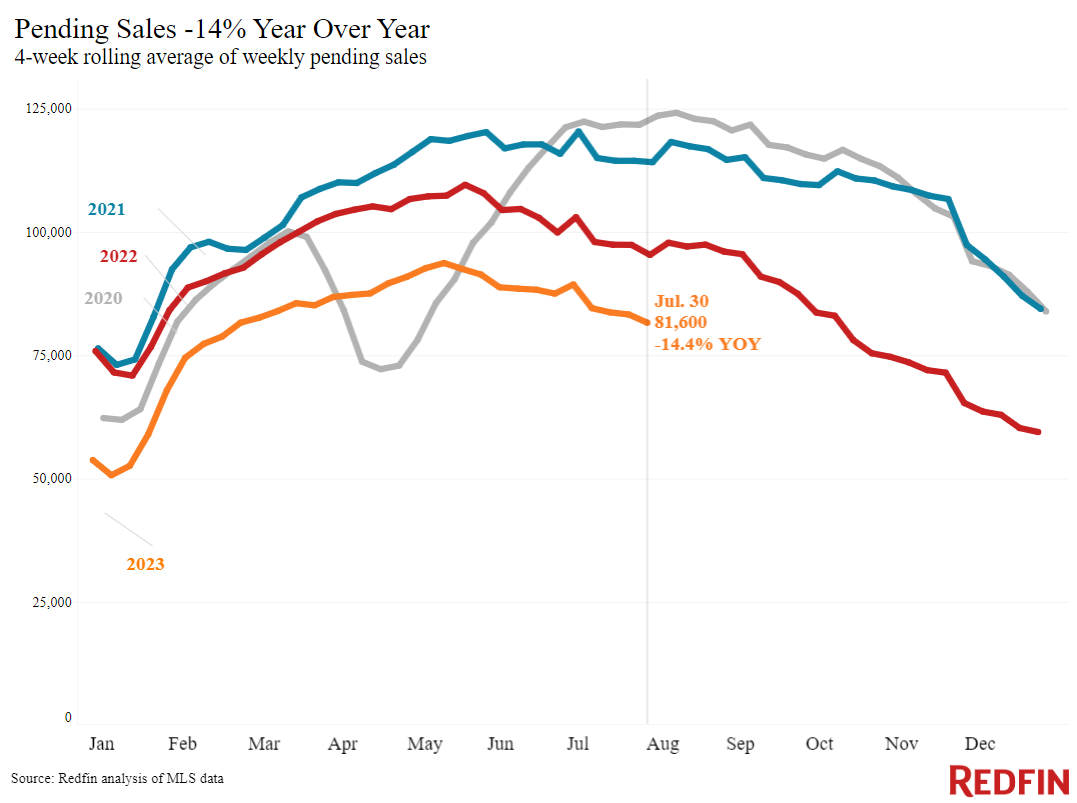

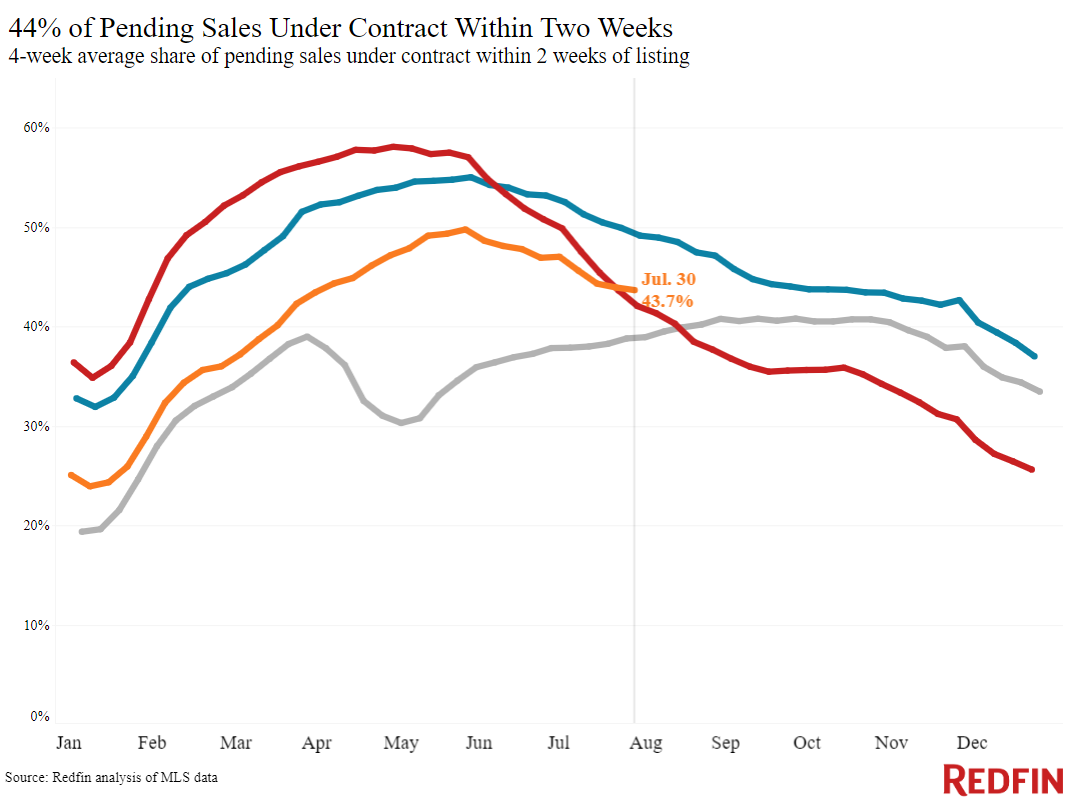

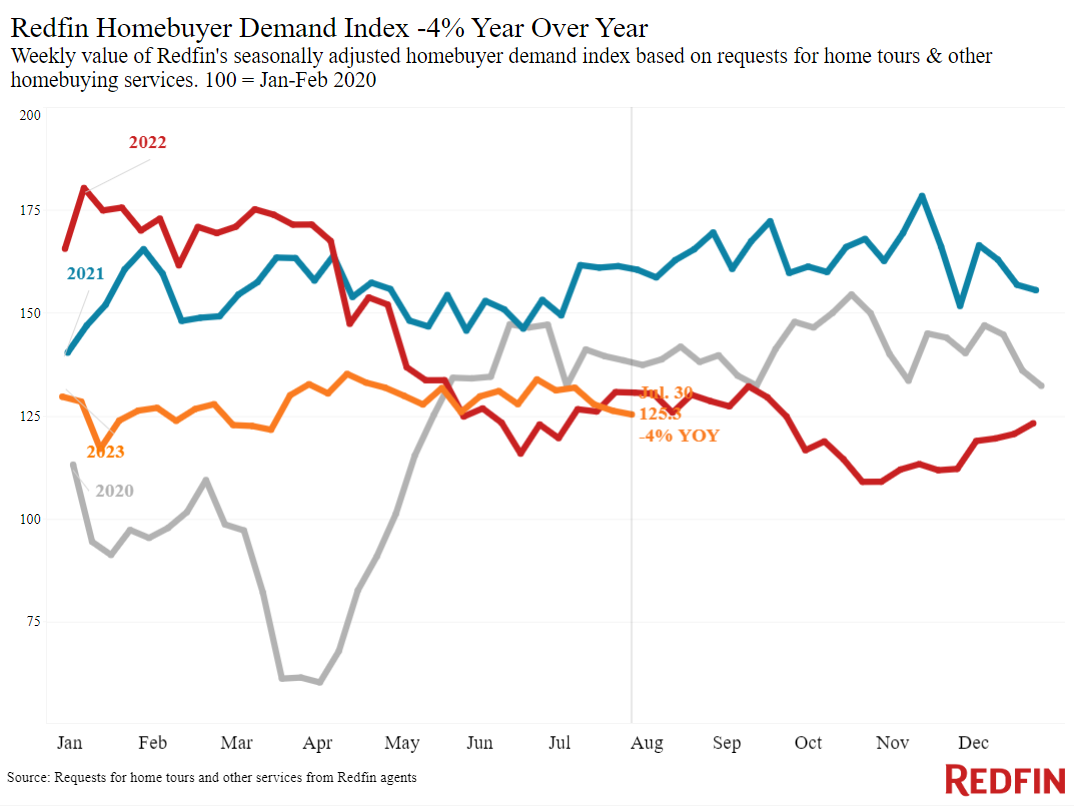

High rates are also sidelining prospective buyers, but not as much as they’re deterring would-be sellers. Redfin’s Homebuyer Demand Index, which measures early-stage demand through requests for tours and other buying services from Redfin agents, is down just 4% from a year ago.

Unless otherwise noted, the data in this report covers the four-week period ending July 30. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.