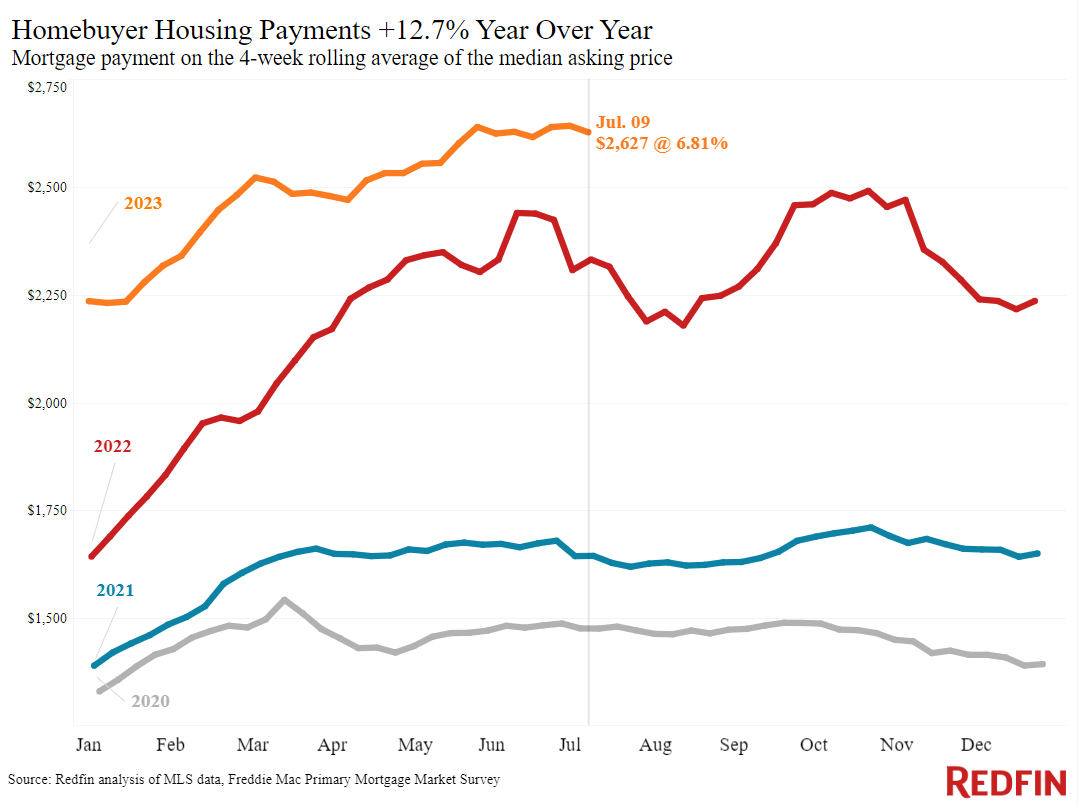

Elevated mortgage rates are cutting into homebuyers’ budgets; a buyer on a $3,000 monthly housing budget has lost $30,000 in purchasing power over the last five months. But this week’s inflation report–which shows that consumer prices are cooling quickly–provides a glimmer of hope that mortgage rates could gradually start to come down.

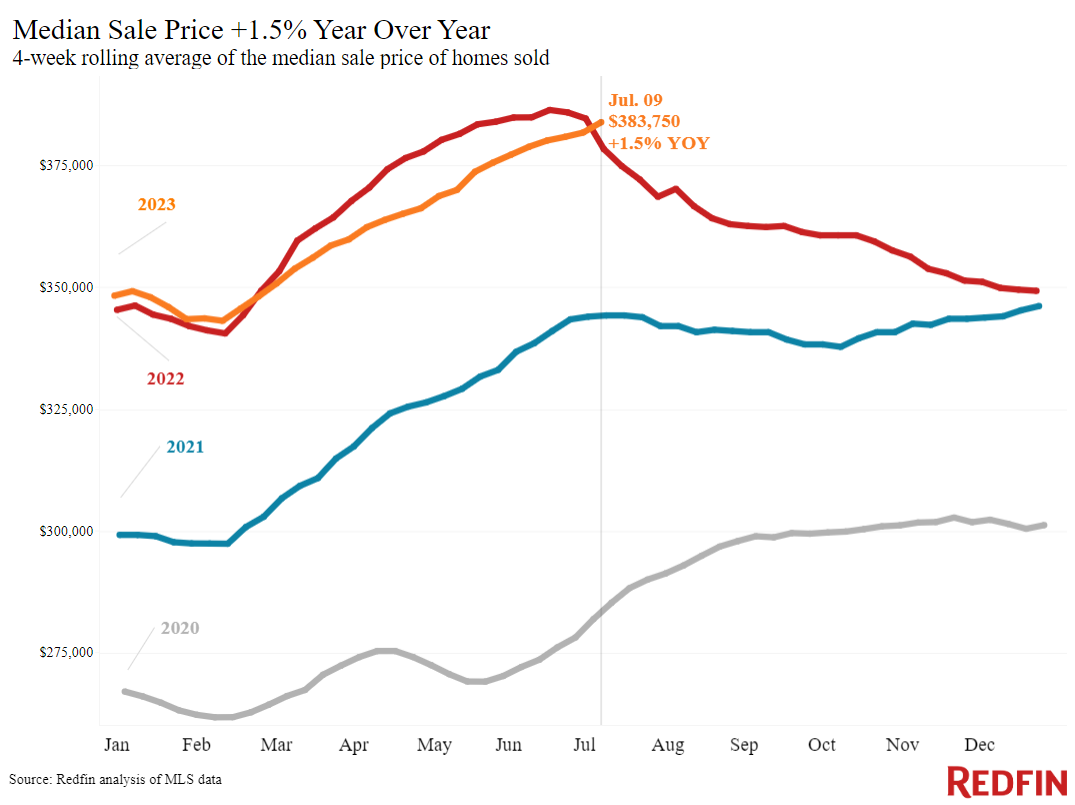

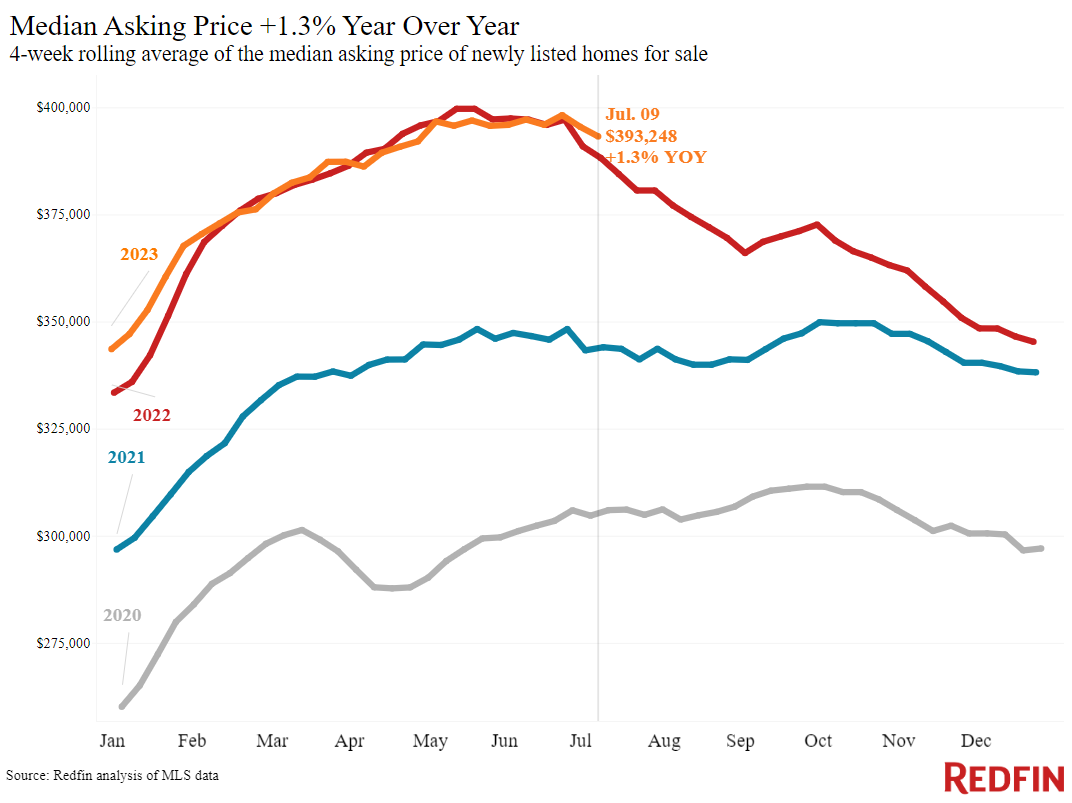

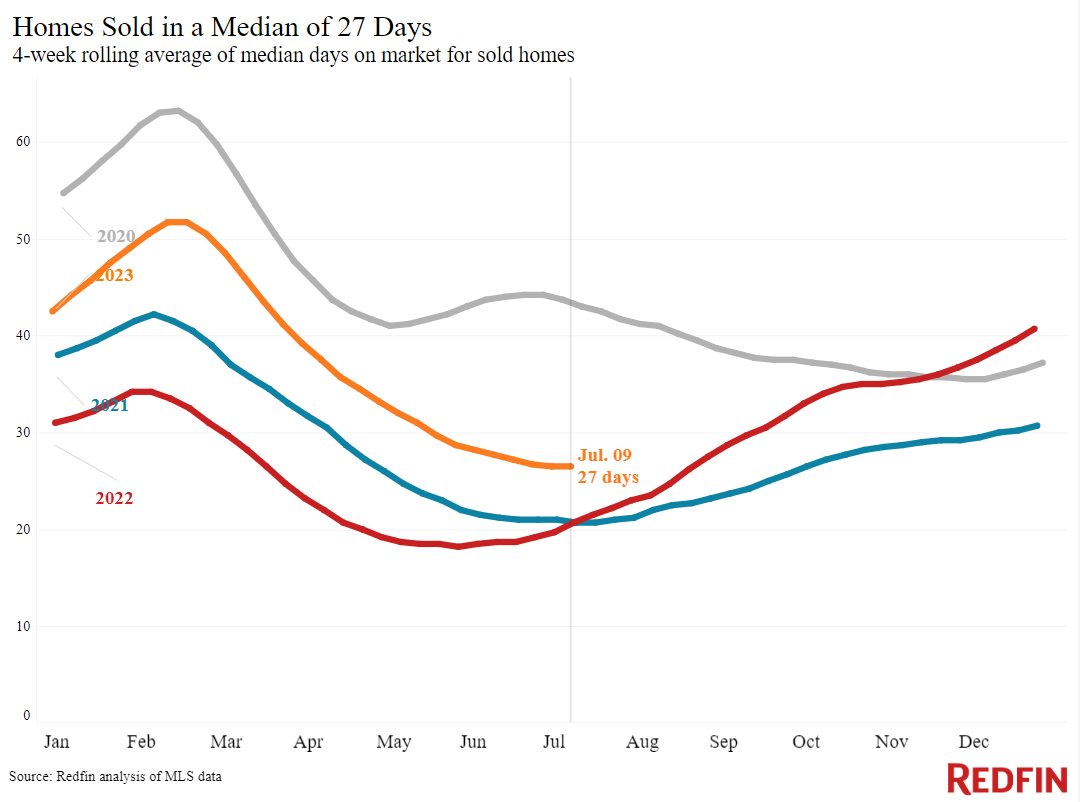

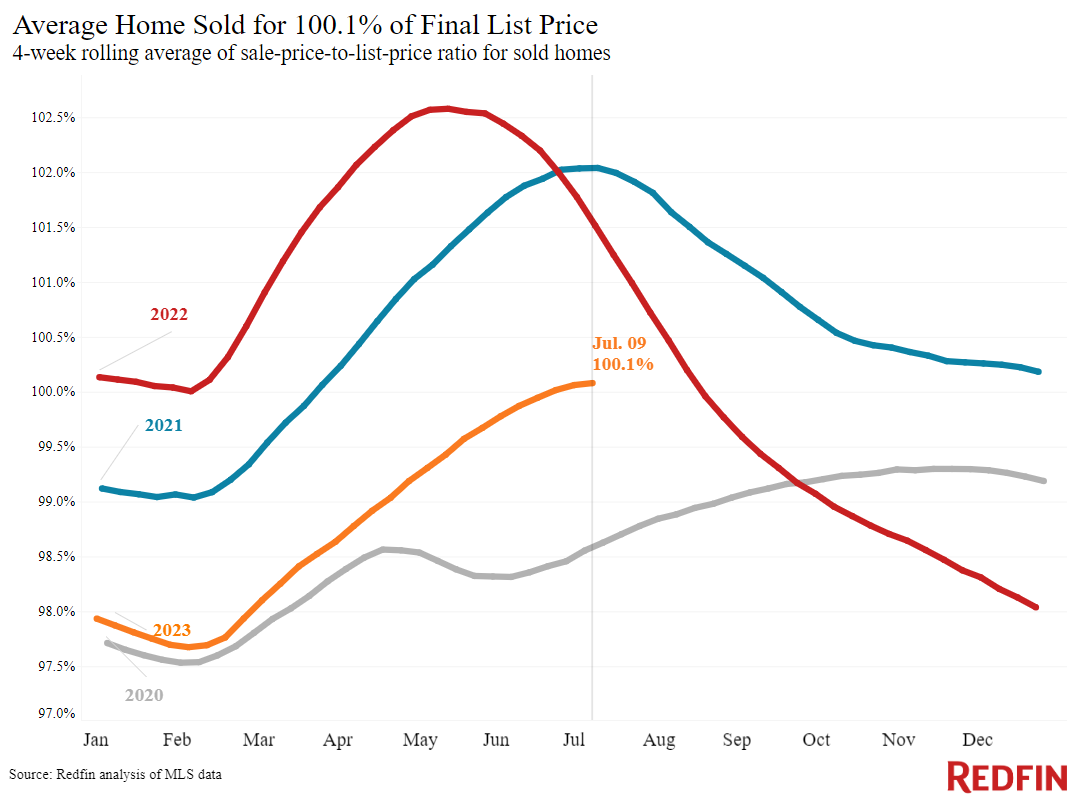

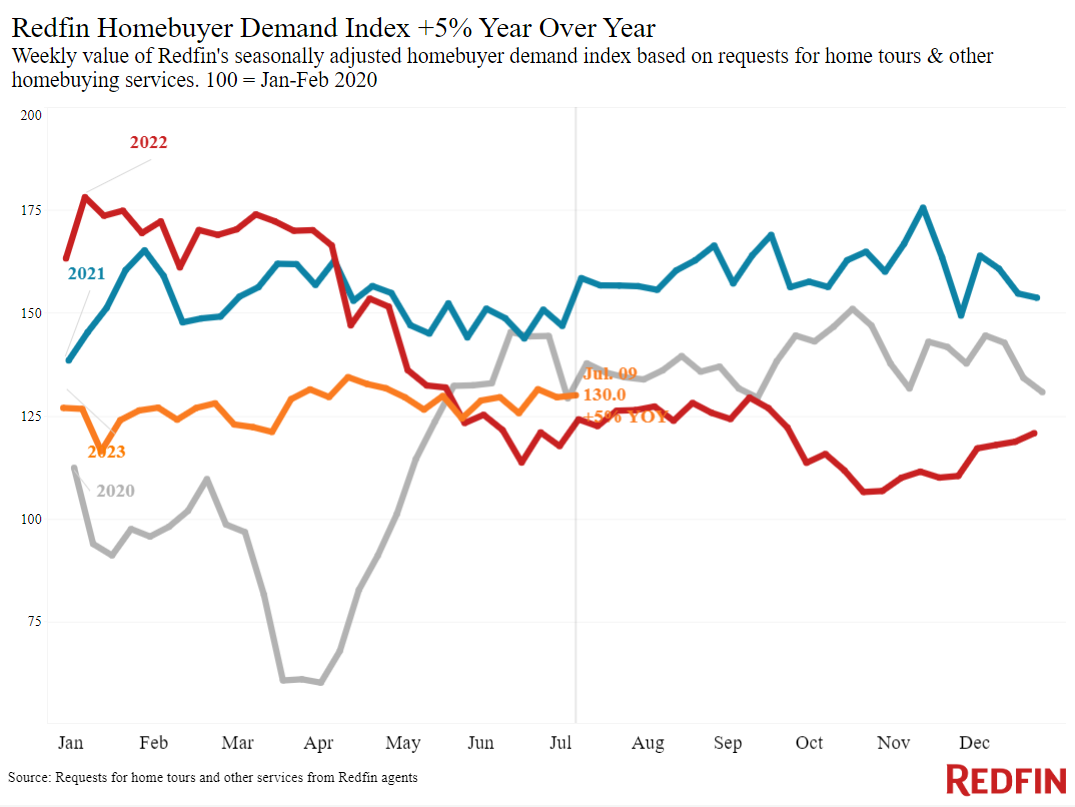

The median U.S. home-sale price rose 1.5% from a year earlier during the four weeks ending July 9, the first increase in nearly five months. Average weekly mortgage rates are at their highest level since November 2022, bringing the typical homebuyer’s monthly payment to a near-record-high of $2,627.

To look at the hit on affordability another way, a homebuyer on a $3,000 monthly budget can afford a $450,000 home with today’s average rate. That buyer has lost $30,000 in purchasing power since February, when they could have bought a $480,000 home with that month’s average rate of around 6%. The drop is more extreme when compared to a year ago, when a $3,000 monthly budget would have bought a $510,000 home at a rate of about 5.3%.

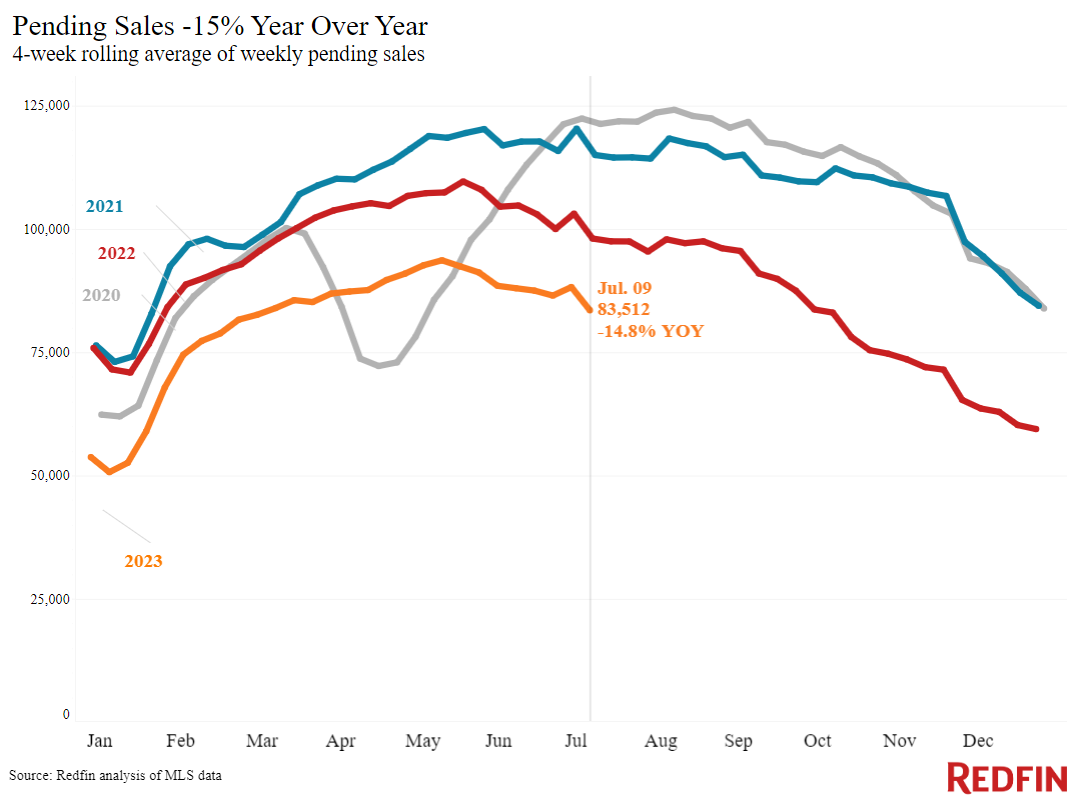

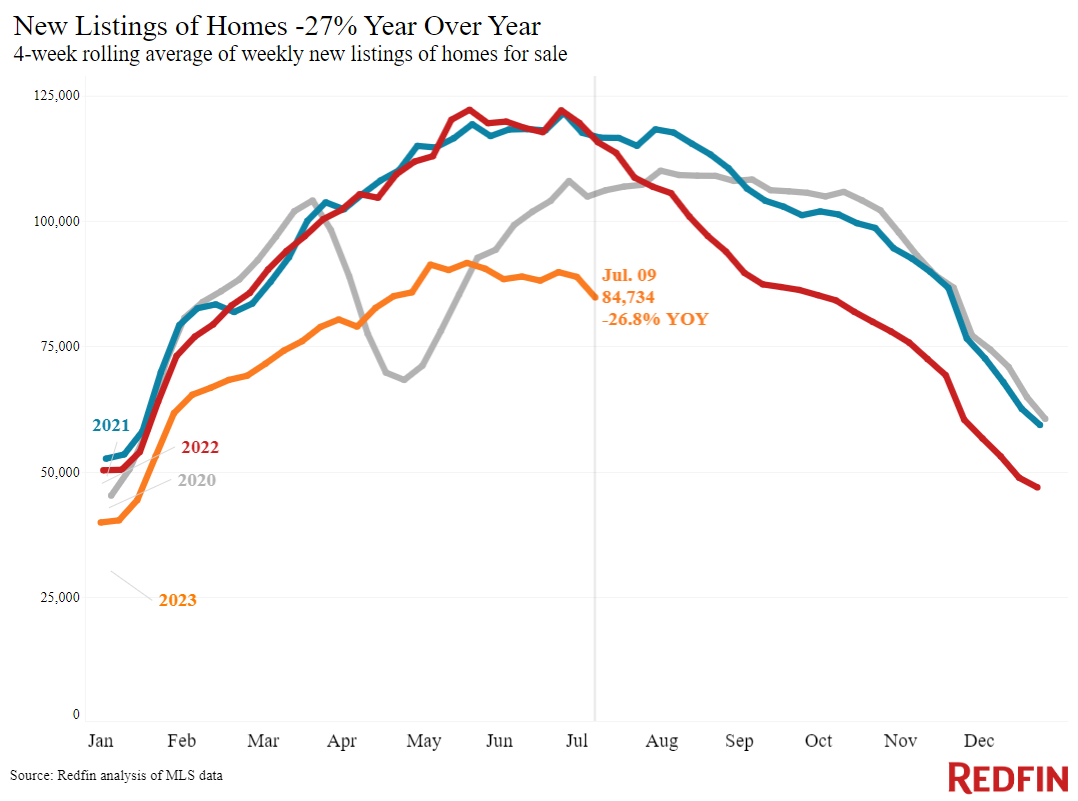

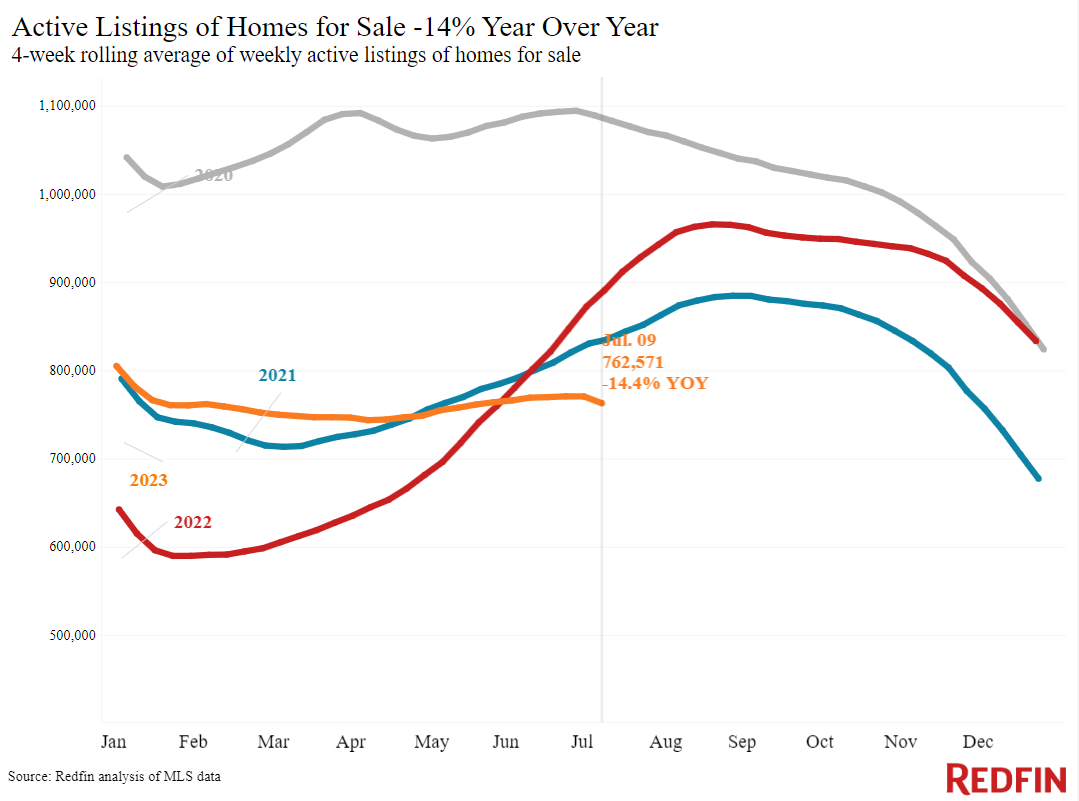

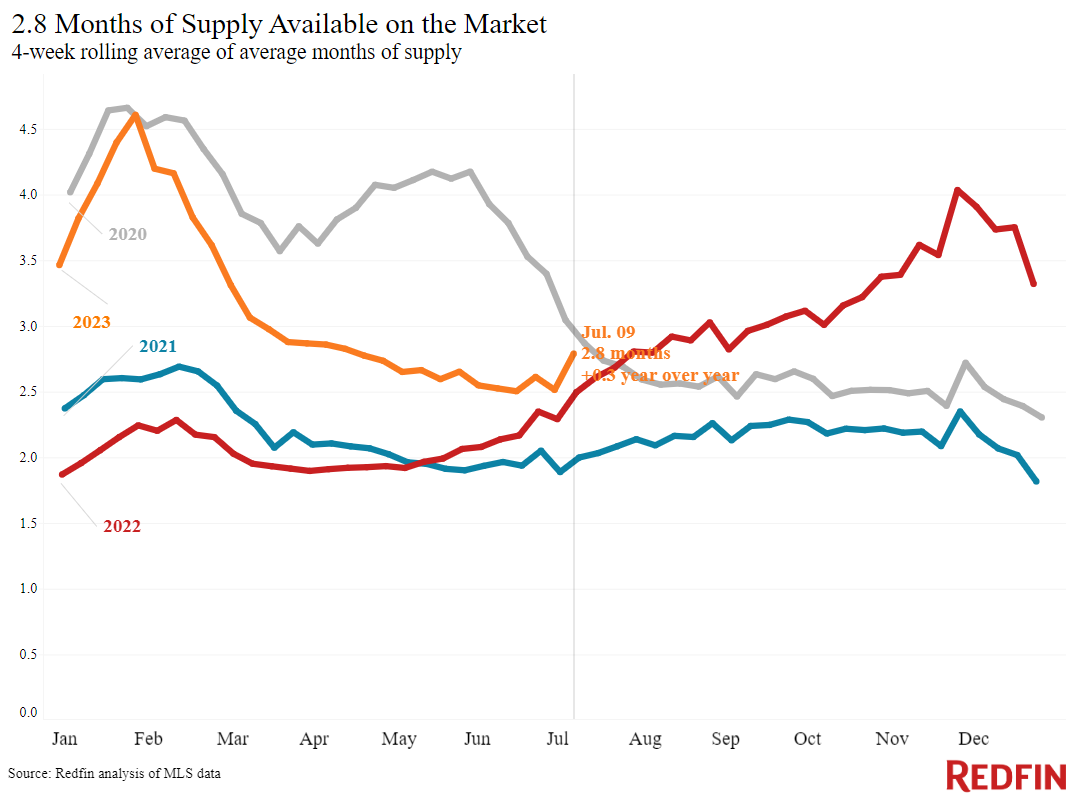

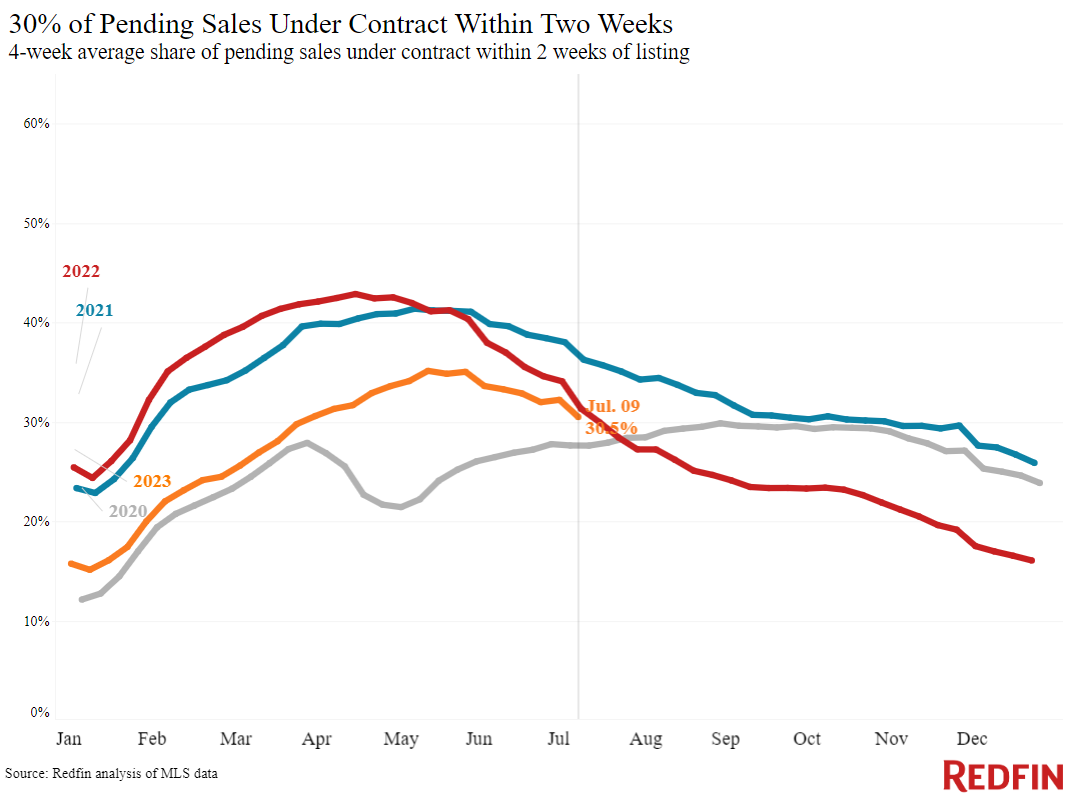

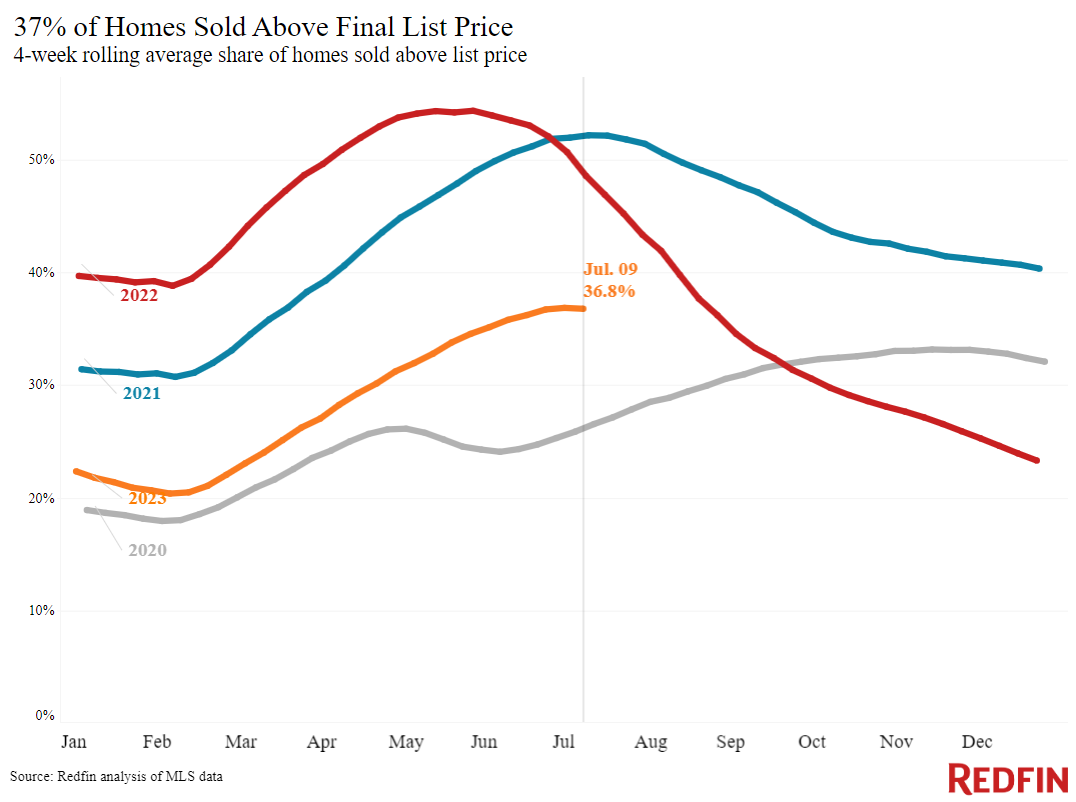

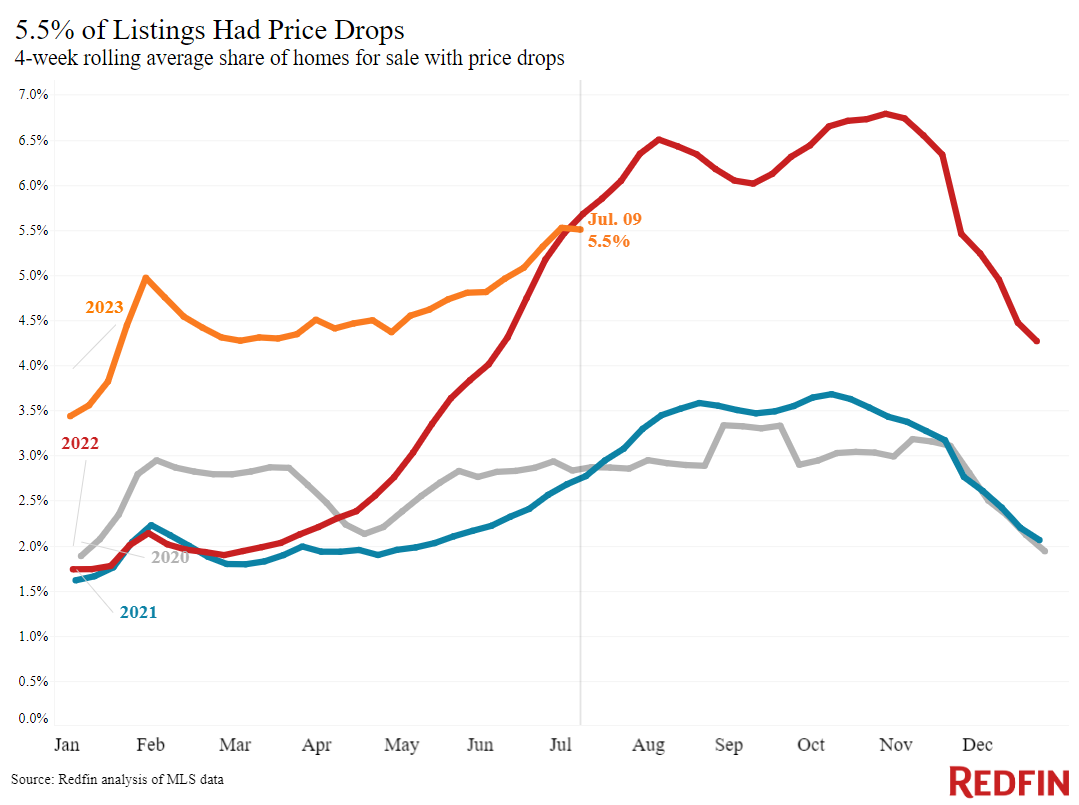

Prices are rising despite relatively low demand because there are so few homes for sale. New listings are down 27% year over year, the biggest drop since the start of the pandemic, and the total number of homes on the market is down 14%, the biggest drop since March 2022. That’s mostly because potential sellers are locked in by low rates; nearly all homeowners have a rate below 6%.

On the bright side, this week’s economic news provides a glimmer of hope for the housing market. The latest consumer-price index report shows that inflation cooled more than expected in June, largely because it has started reflecting months of cooling housing costs.

“This month’s inflation report is likely to bring mortgage rates down a bit from their recent highs. It shows that the Fed’s interest-rate hikes are working and ups the chance they’ll only hike rates one more time this year,” said Redfin Economic Research Lead Chen Zhao. “Because elevated mortgage rates are responsible for both of today’s major homebuying challenges–high monthly housing payments and low inventory–any decline is welcome news for buyers. But even though rates will come down slightly, they’ll likely remain well above 6% until the Fed sees several more months of inflation readings closer to their target.”

Unless otherwise noted, the data in this report covers the four-week period ending July 9. Redfin’s weekly housing market data goes back through 2015.

For bullets that include metro-level breakdowns, Redfin analyzed the 50 most populous U.S. metros. Select metros may be excluded from time to time to ensure data accuracy.

Refer to our metrics definition page for explanations of all the metrics used in this report.