Offers Increase 1.5%; Tours Down 2.1% in April

Our latest numbers on home tours and offers indicate that housing demand in Redfin markets is holding steady despite missing a crucial ingredient: a sustained surge in new listings.

Redfin data has shown that prospective buyers respond to supply surges. New listings get the attention of would-be buyers, prompting them to go on home tours. However, new listings increased just 8 percent in April, compared with 25 percent growth in March, and that slower growth had a dampening effect on home tours.

The typical reasons people decide to list their homes — a job in a new city or needing more room for a growing family or less space as kids leave the nest — have been challenged by the weak jobs market and decreasing home affordability. Heading into the summer months, this absence of new supply will be keenly felt in the demand numbers and by consumers who may be frustrated looking for a home to purchase.

Housing has yet to enter back into what is known as a virtuous cycle: where housing demand incentivizes sellers to put their homes on the market and become homebuyers again themselves, spurring still higher demand and subsequently more supply. This virtuous cycle leads to a robust housing market. In 2005, 10 percent of the existing housing stock turned over annually; that percentage shrunk to 7 percent in 2014.

And new listings aren’t picking up the slack. According to U.S. Census data, single-family home construction is less than half what it was prior to the recession in 2007. The average number of monthly housing starts before the recession was 1.74 million. Since the end of the recession in 2008, the monthly average has fallen to 719,000.

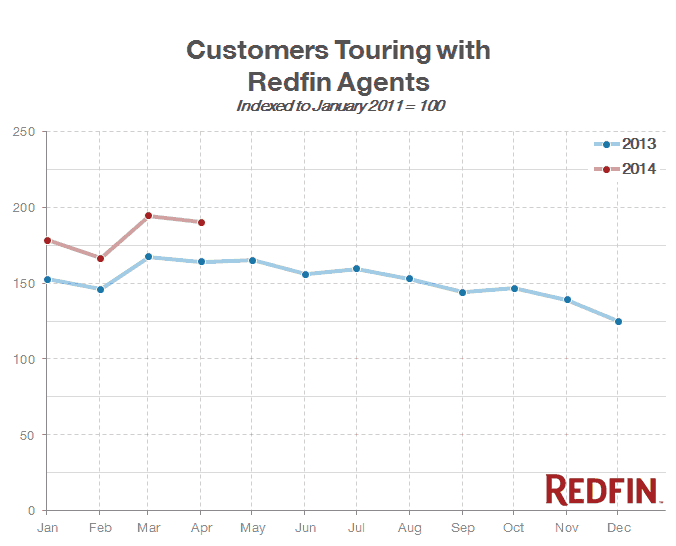

Despite the scarcity of new inventory, Redfin customer tours were down just 2.1 percent from March to April, about the same percentage as this time a year ago when new listings increased by 11 percent. Redfin home tours are up 15.8 percent year over year, indicating demand is there but a sustained surge in supply has yet to materialize.

In many areas of the country, homebuyer demand has been reduced by stagnating median incomes that have not kept up with inflation. However, for most major markets, if sellers list it, buyers will come. This fact is evidenced by the speed at which a home typically sells. In April 2014, the typical home was on the market for 34 days, compared with 31 days last year.

“Homes listed on Seattle’s most trafficked streets that would typically be considered less desirable and in the past have been known to languish on the market have recently been selling in a matter of days,” said Redfin agent Febe Cude.

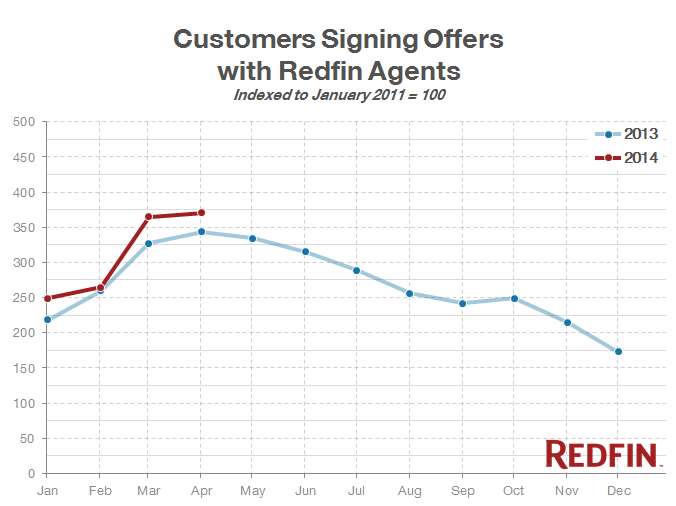

Thus far there is little indication that there is going to be a huge pickup in sales in the second quarter to make up for the lethargic housing market endured in the first three months of the year. Customers signing offers were up 1.5 percent in April, compared with 5 percent at this time a year ago. Redfin offer data, an early predictor of future sales, suggests that the market will post a slow steady pace of home sales into the summer months — not the spike that many believed would occur after the end of the extremely cold winter. Even with the polar vortex behind us, low inventory and rising prices continue to be significant headwinds to housing demand.

The full Demand Pulse index data is available for download here, where you can check out four years of trends. If you’d like to stay up to date on all of Redfin’s reports, please subscribe to the RSS feed here or follow us on Twitter, Facebook, or Google+.

Note: Starting this month, the Research Center made changes to the Demand Pulse Report. The report now highlights actual customer tours instead of customer requests for tours to provide a more robust measure of demand. We also changed the measurement period to monthly instead of the preceding four weeks, to increase consistency across Redfin statistics.

If Sellers List, Buyers Will Come

- BỞI System Admin

- Ngày 30/07/2025