The typical home listed on a Tuesday, Wednesday or Thursday sells for $1,700 more than one listed on the weekend, and it sells nearly two days faster. And make sure not to overprice: Homes get 64% more views the day they first hit the market than the day after a price drop.

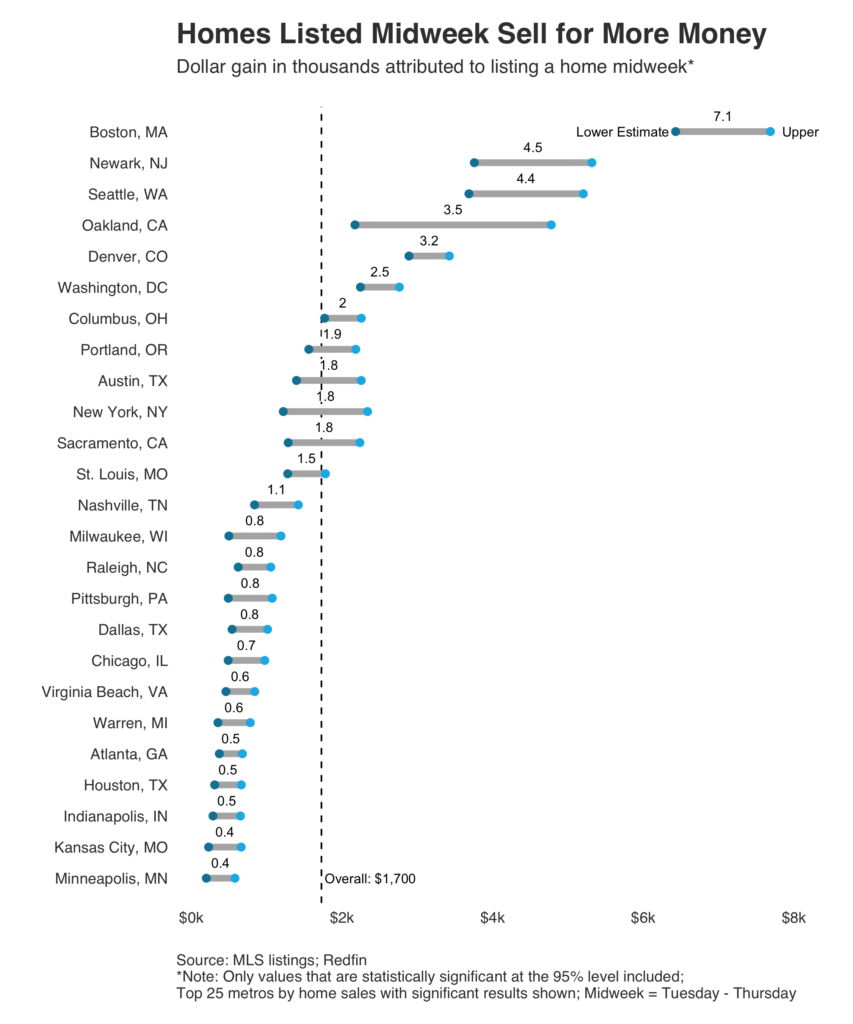

Homes listed for sale midweek sell for an average of $1,700 more than homes listed on the weekend.

That’s according to a Redfin analysis of the sale price of homes listed for sale on a Tuesday, Wednesday or Thursday—considered “midweek”—versus Friday, Saturday, Sunday or Monday. The analysis determines how much homes sold above their list price from July 2020 through February 2021, both nationwide and by metro, for each category.

“Because the market is so competitive right now, most homes will receive plenty of attention regardless of when they’re listed. But sellers can still maximize their potential profit simply by listing in the middle of the week, which gives potential buyers a few days to see the home, talk to their agent and set up a showing for Saturday or Sunday,” Redfin Chief Economist Daryl Fairweather said. “It’s also important to price homes appropriately. If the home is priced too high, fewer buyers will see the home, but if it’s priced too low, the seller may be inundated with so many tour requests a serious buyer could give up before laying eyes on it. The goal is to get as many serious buyers as possible to tour your home, make offers and drive up the sale price.”

Putting a home on the market on a Friday or Saturday means potential buyers may have already filled their weekend with other home tours. That’s especially important during the pandemic, when it’s more likely that buyers and their agents are required to book individual appointments to tour homes. And listing on a Sunday or Monday means buyers may lose interest before the following weekend.

Homes that hit the market midweek in Boston sell for an average of $7,100 more than homes listed on the weekend, by far the biggest premium of the 25 metro areas included in this analysis. It’s followed by Newark, where homes listed midweek sell for $4,500 more, Seattle ($4,400), Oakland ($3,500) and Denver ($3,200).

Minneapolis and Kansas City have the smallest midweek premium, with homes listed Tuesday-Thursday fetching just $400 more than those listed the other days of the week. Next come Indianapolis, Houston and Atlanta, which each have a $500 midweek premium.

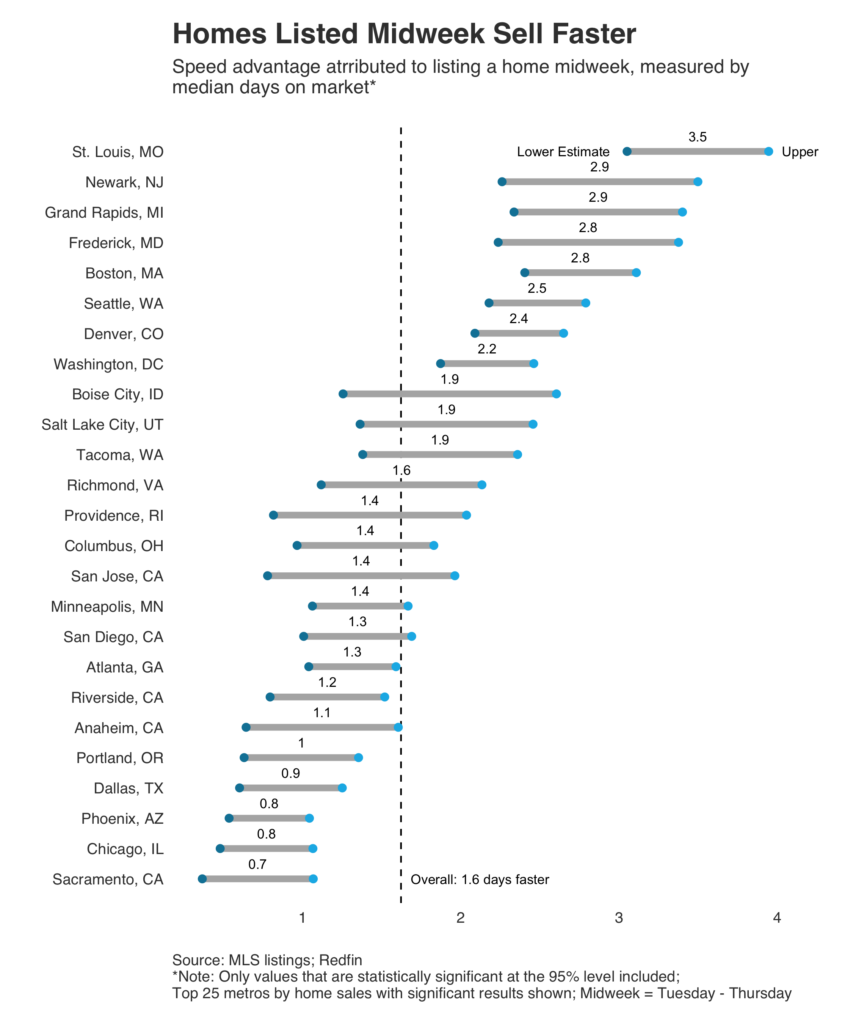

Additionally, homes listed for sale midweek sell for an average of 1.6 days faster than homes listed on the weekend.

In terms of speed, the advantage of listing midweek is biggest in St. Louis, where the typical home listed midweek sells 3.5 days faster than one listed on the weekend. It’s followed by Newark (2.9 days), Grand Rapids (2.9), Frederick, MD (2.8) and Boston (2.8).

The advantage is smallest in Sacramento (0.7 days), Chicago (0.8), Phoenix (0.8), Dallas (0.9) and Portland, OR (1).

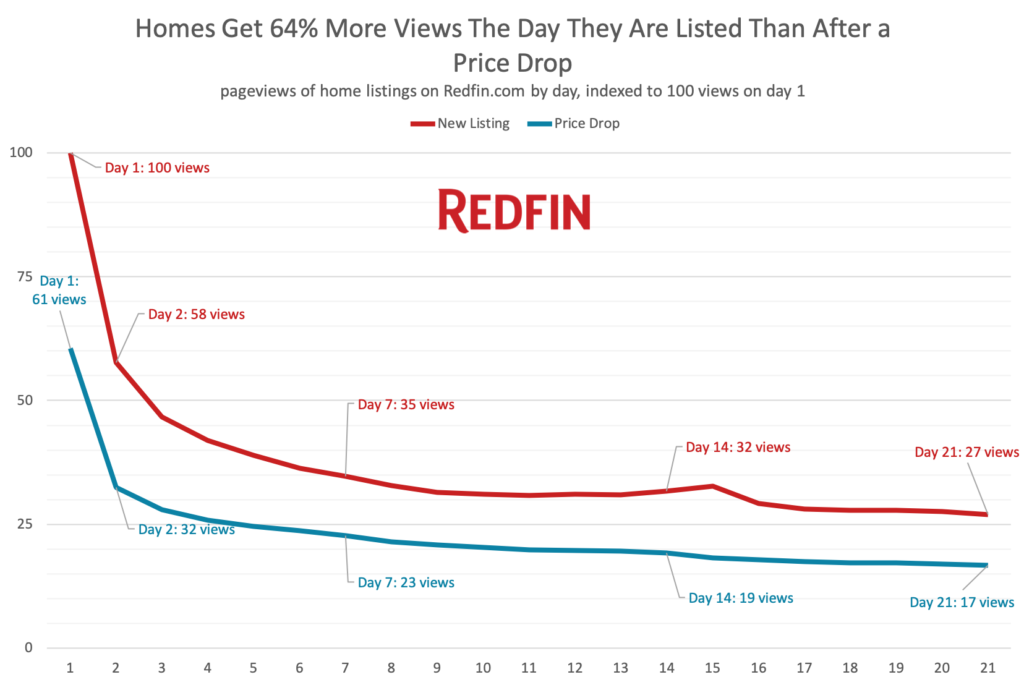

Listings of homes for sale get 64% more views the day they first hit the market than the day after a price drop. For example, if a home listed for sale gets 100 views its first day on the market, it would get 61 views the day after a price drop.

The moral of the story: Sellers shouldn’t overprice their homes, even if most homes in their area are selling for higher than their asking price. If the home doesn’t go under contract within a reasonable time and the seller has to drop the price, fewer potential buyers who are searching within the home’s new price range will see it.

“I’m advising sellers not to overcompensate for the hot market by overpricing their home,” said William Soto, a Redfin real estate agent in Orange County, CA. “Select a price that will attract serious buyers to the property, not one that will scare people away.”

The data in this report is from a Redfin analysis of the sale price and sale speed of homes listed for sale on a Tuesday, Wednesday or Thursday—considered “midweek”—versus Friday, Saturday, Sunday or Monday, controlling for market fixed effects, seasonality, property type, price point and time on market. . The price analysis determines how much homes sold above their list price for each category. The speed analysis determines the median days on market for each category. The analysis, which included 1.8 million listings, was done both nationwide and by metro and includes data from July 2020 through February 2021.