Housing Market Activity After Labor Day Likely to Be the Strongest in 5 Years

Homebuyers who have been willing to wait for better deals are starting to be rewarded for their patience, as sellers drop listing prices to meet buyers’ more value-focused expectations. Two market developments in July are spurring this change in housing activity as the market transitions from the summer to the fall buying season. The first is a slowdown in home price growth. For the first time in five months, price growth was essentially flat in July.

![]()

The second is a shift in pricing power from sellers to a more balanced market. That shift has been nearly nine months in the making from when sales began to first decline last November. As a result of this shift, the number of homes that sold above list price in July is down nearly 7 percentage points to 20.1 percent from 26.8 percent a year ago, the biggest drop of the year.

We expect the confluence of these two trends to drive an unusual surge in home sales this fall. We also expect prices to continue to flatten, and to potentially decline month over month in September or October. If that happens, it will be the first three-month price decline since the fall 2012.

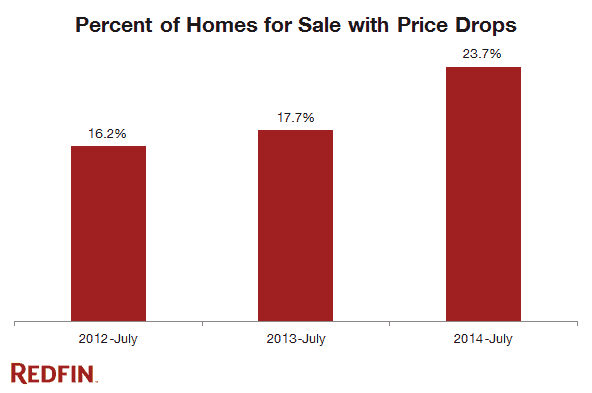

This month, Redfin looked at the percentage of homes for which sellers dropped the listing price. The percentage of price drops in July of this year was higher than the two previous years and has bolstered a closer alignment between seller and buyer expectations on price.

“Sellers are finally catching on that it’s not a seller’s market anymore,” said Virginia Redfin agent Jeremy Cunningham.

As a result, sellers are adjusting prices more aggressively than at the end of previous summer selling seasons. Redfin agents are also seeing more negotiation between buyers and sellers at the beginning of the process and post inspection.

According to Boston Redfin agent Adam Welling, “The price drops are often done in small amounts of just a few thousand dollars around particular milestones — two weeks on market, 30 days on market, etc. When a buyer sees a price drop, she takes it as ‘blood in the water’ and wonders what’s wrong with the house and wants to negotiate for an even lower price.”

Price drops are most prevalent in markets that have seen a big buildup in inventory and/or a sizeable increase in home price appreciation over the past year. In Denver, the metro area with the largest percentage of listing price drops, the median sales price has increased by 15 percent year over year, compared with an average of 5.5 percent for all metros.

On the other hand, Ventura County and Sacramento had more moderate price growth year over year but saw the number of homes for sale increase significantly: by 25.6 percent and 18.3 percent, respectively. These metros had the second and third largest percentage of homes for sale with price drops in July. Metros with fewer price drops had smaller increases in median home prices and inventory by comparison.

A clear indication of the change in the market this month is fewer homes sold for more than their list price. Twenty percent of homes sold above their listing price compare with 26.8 percent a year ago. Long Island, New York; Philadelphia; and Charlotte, North Carolina, have the lowest percentage of homes selling above list price at 10.4 percent, 11.3 percent and 11.5 percent respectively. Relatedly, homes in these areas tend to sit on the market longer, at least 20 more days on average than the 32-day median for all markets.

Metros in which a significant number of homes continue to sell for more than list price include the large West Coast markets of San Francisco, San Jose, Los Angeles and Seattle.

It’s typical for home price growth to slow from June to July and that’s what we are seeing this year as well. The fact that prices were essentially flat this month compared with a 3 percent monthly increase in June was expected. What’s atypical is the amount of variance across markets.

The big difference in price growth across metros is most acutely seen in the year over year growth changes. In some metro areas, including San Jose, Phoenix, Denver, Boston, Charlotte and Raleigh, prices are slowing to a historically normal range of between 4 and 6 percent.

Other metro areas are still showing an unsustainably high level of growth that is not supported by economic fundamentals such as similar income or population increases. For example the Florida markets of West Palm Beach, Fort Lauderdale and Miami all posted double-digit year-over-year growth of 15.9 percent, 15.2 percent and 12.5 percent, respectively.

Finally there’s a third group of metro areas, mainly located in mid-Atlantic states, in which prices may have gone up too high, too quickly, and home prices are now flat or even declining year over year. These include Philadelphia (0.9 percent), Washington, DC (0.8 percent) and Baltimore (-3.8 percent).

In short, some markets are still overheated while others have cooled too much. By year end we expect an increase in the number of metro areas that exhibit a sustainable level of price growth that can be supported by local economies.

The number of homes for sale edged down in July by 1.1 percent from a month ago. Going into the fall selling season, inventory has increased just 3 percent from this time last year.

The national numbers on inventory don’t begin to tell the whole story. We know that inventory for affordably priced homes has been slower to rebound than at the high end of the market. And across all Redfin markets, the number of new listings has decreased for the past two months, with big declines in areas with notoriously tight supply like Boston (-16.2 percent) and San Francisco (-9.3 percent).

Yet some markets saw a late summer bounce in new listings. Those include the Florida markets of Fort Lauderdale (8.9 percent), Orlando (8.7 percent), and Tampa (6.2 percent), as well as the California metros of San Jose (6.2 percent) and San Diego (3.9 percent).

Homes sold across 36 markets declined by 2.2 percent month over month in July after posting the year high for 2014 in June. Going forward, we expect sales to behave differently this fall than in 2013. Last year home sales dropped 3 percent from July to August, and no wonder. July 2013 was the strongest sales month in housing post crisis. Moreover, sales from July to September dropped 18 percent and kept on falling in October before finally petering out around the holiday season.

This year is different and we expect a surge in sales in September and October. We continue to see strong buyer demand as we head into fall. The number of tours and offers across Redfin markets continue to accelerate from July and into August. This is a good indication that buyers are continuing their home searches.

The buyer fatigue from competing against multiple offers, bidding wars and tight inventory is diminishing, and Redfin agents are reporting that buyers are more energized about their home search. Additionally, the widespread increase in price drops is likely to give buyers even more confidence that they have regained some of the bargaining power lost last year.

Two other factors bolster our view of a fall surge. First, mortgage rates continue to hover at lows for the year. Second, the selling season started late this year as many buyers and sellers sat on the sidelines trying to make sense of a slowing economy, tight inventory, a surge in 2013 house prices and a pickup in mortgage rates. The carryover demand and supply from earlier this year sets the stage for a fall selling season that will be stronger than any other in the past five years.

* Note: Dallas and Houston do not disclose sale prices, so list prices are substituted.

Full data for July 2014 may be downloaded in this spreadsheet.

If you’d like to stay up to date on all of Redfin’s reports, please subscribe to the RSS feed here or follow us on Facebook, Twitter or Google+.