As usual, today’s employment report had both pluses and minuses. It showed that the economy still has momentum, creating 295,000 positions in February. And it was the 12th month in a row that employers added more than 200,000 jobs.

But the report also told us that wages aren’t rising nearly as quickly. Average hourly wages grew just 3 cents last month, up 2 percent from a year ago. One reason is the strong growth in low-paying jobs like retail clerks and restaurant workers. When adjusted for inflation, most Americans haven’t had a real raise in years.

In contrast, house prices have been surging. While it’s beginning to slow to around 4 percent annually, price growth is still outpacing wage growth, making homeownership just a dream for many families. That’s why some industry watchers are waiting for employment to pick up in high-paying sectors like manufacturing and construction before declaring good news in the housing market.

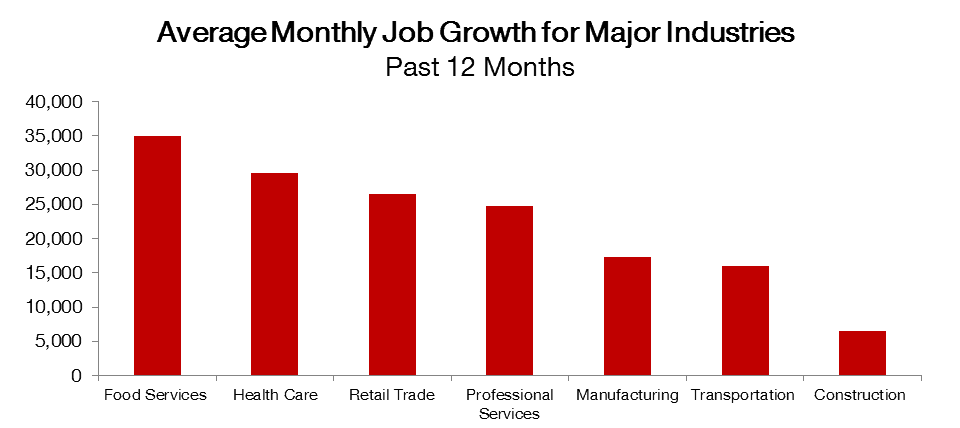

And while we did see growth in construction and manufacturing last month, many more of the jobs created over the past year have been in low-paying sectors like food and beverage service, health care and retail. The food and beverage services sector created an average of 35,000 jobs over the past 12 months, more than any other major industry.

While low-paying jobs in hospitality and retail are easy to dismiss in terms of their significance to the housing market, they do in fact play a role. In the face of continued wage stagnation, these jobs are the unsung heroes of the housing market. For a family with one primary wage earner, the addition of a second income, even if it’s from a part-time or low-paying job, could make or break their ability to save for a down payment or afford a monthly mortgage payment.

The fact is, it takes many middle-class families two incomes instead of one to afford a home. A second gig at a bar or hotel plays an important role in the household budget, especially when wages refuse to grow.

Low-Paying Jobs Are Good for Housing, Especially Now

- BỞI System Admin

- Ngày 06/07/2025