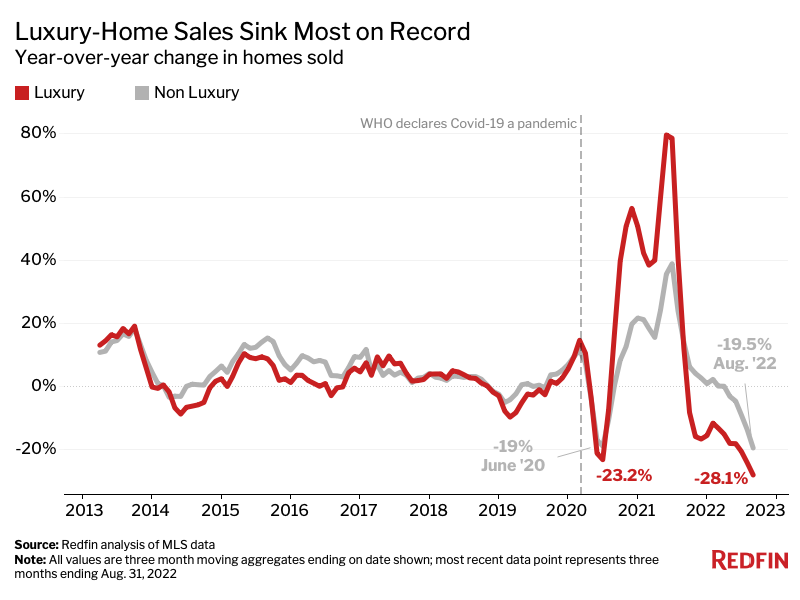

Sales of luxury U.S. homes fell 28.1% year over year during the three months ending Aug. 31, 2022, the biggest decline since at least 2012, when Redfin’s records begin. That eclipsed the 23.2% plunge that occurred when the onset of the coronavirus pandemic brought the housing market to a near standstill roughly two years ago.

Sales of non luxury homes also fell the most on record, but just by a hair, decreasing 19.5% during the three months ending Aug. 31. That slightly outpaced the 19% decline during the three months ending June 30, 2020.

This is according to an analysis that divided all U.S. residential properties into tiers based on Redfin Estimates of the homes’ market values as of Sept. 10, 2022. This report defines luxury homes as those estimated to be in the top 5% based on market value, and non luxury homes as those estimated to be in the 35th-65th percentile based on market value.

Rising interest rates, inflation, a tepid stock market and economic uncertainty are causing luxury buyers to back off. The average 30-year fixed mortgage rate eclipsed 6% last week, hitting the highest level since 2008. While high-end buyers are more likely to pay in cash, many still take out mortgages—sometimes as an investment strategy. The story in the luxury market is similar to the story in the overall housing market, but more extreme, said Redfin Chief Economist Daryl Fairweather.

“High-end-house hunters are getting sticker shock when they see the impact of rising mortgage rates on paper. For a luxury buyer, a higher interest rate can equate to a monthly housing bill that’s thousands of dollars more expensive,” Fairweather said. “Someone who was in the market for a $1.5 million home last year may now have a maximum budget of $800,000 thanks to higher mortgage rates. Luxury goods are often the first thing to get cut when uncertain times force people to reexamine their finances.”

All-cash buyers who like to park their funds in high-end homes may also be shying away from the real estate market given deteriorating investment prospects; with home prices poised to drop in many cities, some luxury house hunters are likely moving their money into other investments, like bonds, which may offer a better rate of return.

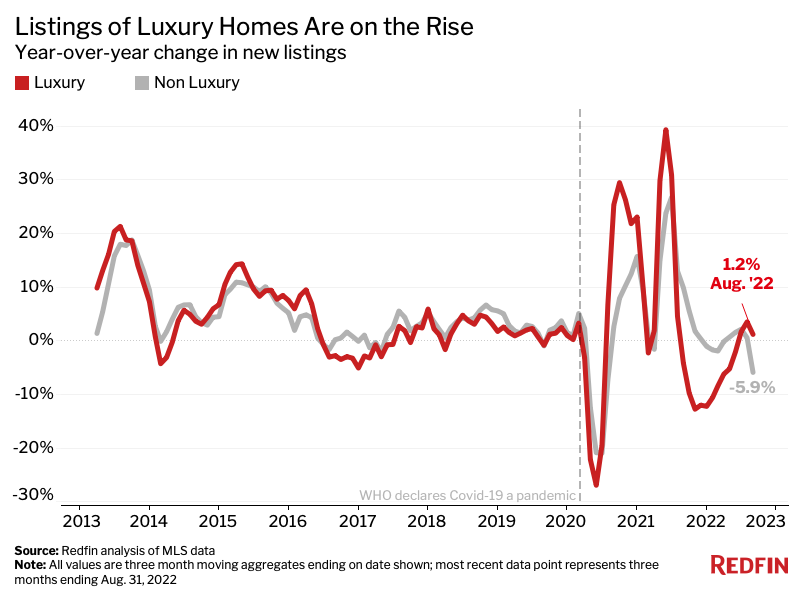

Expensive California markets are leading the drop in high-end-home sales. In Oakland, CA, luxury-home sales plunged 63.9% year over year during the three months ending Aug. 31, the largest decline among the 50 most populous U.S. metropolitan areas. San Jose and San Diego also experienced decreases of more than 55%. These markets have something else in common: they’ve seen larger declines in luxury listings than anywhere else in the country as sellers have backed off in response to ebbing demand. This has exacerbated the decline in home sales; when there are fewer homes hitting the market, there are fewer homes that can be sold.

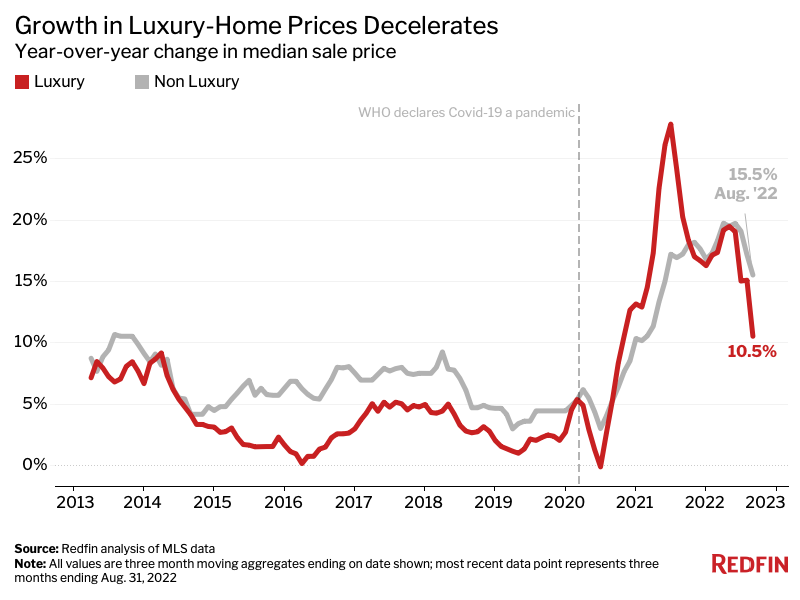

Home-price growth in the luxury market is slowing as demand cools. The median sale price of luxury homes rose 10.5% year over year to $1.1 million during the three months ending Aug. 31, compared with an annual increase of 20.3% a year earlier and a record gain of 27.8% during the three months ending June 30, 2021.

Prices of luxury homes are rising at a slower pace than prices of non luxury homes, which increased 15.5% year over year to $335,000 during the three months ending Aug. 31. That’s down slightly from an annual increase of 17.2% a year earlier and a record gain of 19.7% during the three months ending March 31, 2022.

“Luxury-home prices have ballooned so significantly that many buyers just don’t feel they can justify the purchase. That decline in demand is causing price growth to slow,” said Sam Chute, a Redfin real estate agent in Miami. “Some homes that would’ve sold for $5 million before the pandemic are now priced at $10 million or more, even though they’ve only received minor cosmetic updates. That’s a hard pill for today’s buyers to swallow, especially in a cooling market.”

Chute continued: “A lot of luxury buyers are sitting on the sidelines in hopes that the market will turn and they’ll find a better deal. They have the flexibility to wait out the market, unlike less-affluent buyers, who may be forced to move quickly because rising costs and a shortage of homes for sale are making their areas less affordable.”

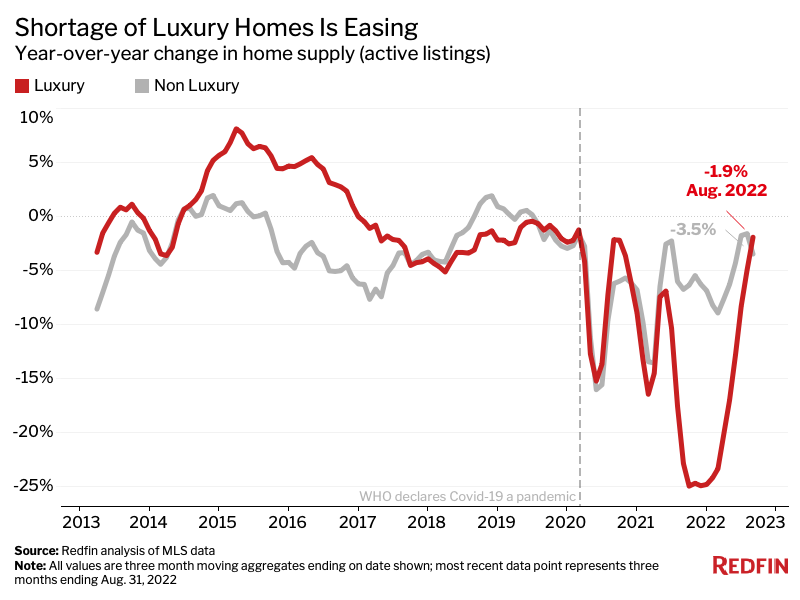

Price growth in the luxury market is also likely decelerating in part because the supply crunch is easing overall, which means house hunters have more options to choose from and less competition.

The number of luxury homes for sale fell 1.9% year over year to roughly 169,000 during the three months ending Aug. 31, compared with a record decline of 25% about a year earlier. Luxury-home supply is still down on a year-over-year basis, but has increased from the start of the year. The number of luxury homes on the market is up 39.2% from a record low of roughly 121,000 during the three months ending Feb. 28.

The supply of non luxury homes fell 3.5% year over year during the three months ending Aug. 31. That’s the first time in roughly two years that luxury-home supply fell at a slower clip than non luxury supply.

The supply crunch in the luxury market is easing for two reasons: a decrease in demand and an increase in homes hitting the market. While listings are declining in expensive coastal markets including Oakland and San Diego, they’re increasing overall. Nationwide, new listings of luxury homes rose 1.2% year over year during the three months ending Aug. 31, while new listings of non luxury homes fell 5.9%.

Redfin’s metro-level analysis includes the 50 most populous U.S. metropolitan areas. Scroll down to the table below to find data on your metro.