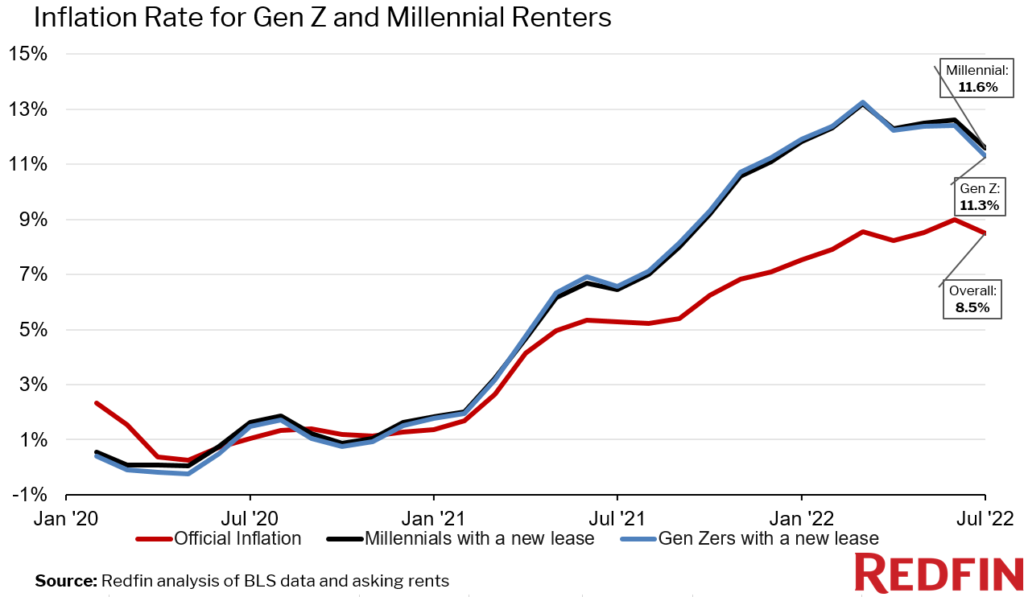

Millennials who took on a new rental lease in July saw their overall cost of goods and services increase 11.6% year over year, substantially higher than 8.5% for the U.S. population as a whole. The personal inflation rate for Gen Z renters taking on a new lease came in at 11.3%, nearly as high.

That’s largely due to soaring rental costs, with asking rents up 13.5% year over year in July. While rental price increases have slowed after skyrocketing in 2021, asking rents are roughly 25% higher than they were before the pandemic. Millennials and Gen Zers allocate more than one-quarter of their income to housing, the largest chunk of all spending categories. For the sake of comparison, they spend about 13% on food and 7% on fuel. And although inflation has eased a bit after hitting a 40-year high in June, it’s still causing widespread economic turmoil and leaving many Americans struggling to pay the bills.

This is based on a Redfin analysis of the cost of goods and services for Gen Z and millennial renters based on their spending habits, as measured by the U.S. Bureau of Labor Statistics’ Consumer Price Index. The analysis, which incorporates Redfin’s data on asking-rent prices, weighs each component of inflation–including food, fuel, shelter and other variables–to come up with inflation rates for millennials and Gen Zers who are taking on a new lease. Adult Gen Zers are 18 to 25 years old, and millennials are 26 to 41 years old.

While inflation has cut into the budgets of most Americans, it’s more severe for younger generations. Gen Zers overall have an inflation rate of 9.2% and millennials clock in at 9.6%. That’s lower than the 11%-plus rates specifically for members of those generations who rent, but it’s higher than 8.5% for the general population.

Inflation is also more severe for renters overall, who tend to be young. The price of goods and services rose 9.2% year over year in July for all renters. Less than half (48.5%) of millennials own their home, and while official data isn’t available for Gen Zers, the rate is likely significantly lower. That’s compared with homeownership rates near 80% for baby boomers and 70% for Gen Xers. Older generations tend to have lower personal inflation rates partly because they’re more likely to own their homes and earn money from rising equity rather than spend money on rent.

Inflation is particularly difficult for Gen Z adults to grapple with because they typically have relatively low entry-level incomes and don’t own many assets–but they’re still bearing the brunt of rising costs. Inflation is also having an outsized impact on millennials, as older millennials have been playing financial catch-up since starting their careers during the Great Recession and younger ones are early in their careers with fewer savings and lower incomes.

“Inflation is hitting young renters hard because not only have prices of everything from food to fuel soared, but so have rental prices,” said Redfin Senior Economist Sheharyar Bokhari. “Homeowners are forking over more money at the grocery store and the gas pump, but at least the number on their mortgage statement isn’t going up every month. Combine high rental prices with student loan debt and relatively low incomes, and it’s difficult for millennials and Gen Z renters to put money into savings, retirement accounts and down-payment funds to eventually buy a house. They may also have higher interest rates on debt, which cuts further into their potential savings.”

Incomes for both Gen Zers and millennials have increased 9.7% from 2020 to 2022–but expenses rose much more, about 17%. Costs increasing faster than incomes have left young Americans without much disposable income.

For the typical Gen Z adult, just 1.9% of their $40,953 median income is left over after accounting for housing payments and other expenses including food and transportation. That’s down from 7.7% of their income in 2020. While that technically leaves just a sliver of their income for discretionary spending, many Gen Z adults–which includes those who are college aged–live with their parents and/or receive financial help from them.

The typical millennial has about 26% of their income left over after accounting for housing payments and other expenses, down from 30% in 2020. These figures are higher for millennials mostly because they earn more money. The typical millennial income of $85,233 is more than double the typical Gen Z income.

If the typical Gen Zer saved all of their disposable income, they would have just $766 at the end of the year. Millennials would have $21,959. At that rate, it would take millennials four years to save enough for a 20% down payment for the median-priced U.S. home ($413,000). It would theoretically take Gen Zers more than 100 years to save at that rate, but that figure isn’t realistic because we expect the youngest workers’ incomes to grow as they age.

Four in 10 (39%) recent or current first-time homebuyers didn’t buy a home sooner because of the high cost of rent, according to an August Redfin survey. The high cost of rent was the most commonly cited obstacle, ahead of other obstacles including debt and pandemic-related financial setbacks. Nearly 80% of the respondents to this question were millennials or Gen Zers.

“The combination of expensive housing, high inflation and relatively low incomes have forced many young renters to save money in creative ways,” Bokhari said. “Some are living with their parents or roommates longer than they would like, and others are moving to more affordable areas.”

Seattle Gen Zers who signed a new lease in June–the most recent month for which data is available– saw prices of goods and services rise 17.1%, the highest inflation rate of the 21 metros in this analysis and substantially higher than the 10.1% overall June Seattle inflation rate. The metros included in this analysis are ones for which metro-level inflation data is available.

Next comes Miami, where members of Gen Z signing a new lease in June had an inflation rate of 14.2%, compared with 10.6% for the metro overall. Rounding out the top three is New York, where Gen Zers taking on a new lease in July have an inflation rate of 12.8%, nearly double the metro’s overall rate of 6.5%.

The list is the same for millennials, with those signing a new lease in Seattle experiencing 16.8% inflation, followed by 14% in Miami and 12.6% in New York.

That’s partly due to quickly increasing rental costs in those three coastal metros. Seattle and New York are both among the 10 metros with the fastest-rising rents in July, with the typical asking rents increasing 22% year over year to $3,157 in Seattle and 23% to $4,209 in New York. Miami asking rents rose 18% to $3,068.

Minneapolis is the only metro in this analysis where young renters have a significantly lower inflation rate than the general population. Gen Zers and millennials who took on a new lease in July had inflation rates of 5.4% and 5.7%, respectively, compared with 8.2% overall. Minneapolis was one of just three metros where asking rents fell year over year in July, declining 8%. Millennial and Gen Z renters have slightly lower inflation rates than the general population in Riverside, CA, Tampa, FL and Phoenix.

Ranked by highest to lowest inflation rates for Gen Zers signing a new lease

To measure the varying impacts of inflation for this analysis, we used the Consumer Price Index (CPI) as measured by the U.S. Bureau of Labor Statistics (BLS). We adjusted the weights of various spending categories for the millennial and Gen Z generations based on the 2020 Consumer Expenditure Survey (CES), conducted by the BLS.

To calculate the inflation rate for those who sign a new lease, we replaced the CPI’s “shelter” component with Redfin’s rental data, using year-over-year growth in asking rental prices. For the metro-level analysis, we used the corresponding year-over-year growth in rental asking price for metros for which inflation data is available.

We estimated the share of income left over for each generation using the expenditures and income after taxes reported in the 2020 CES. For 2022, we increased the expenditure of each component using the corresponding CPI change, and the income after taxes using growth in average hourly earnings for private employees.