Today we go on rate watch. We’re a month from the Federal Reserve’s next meeting, where they might decide to raise interest rates for the first time since 2006. Between now and then, let’s check in every week to see what mortgage rates are doing.

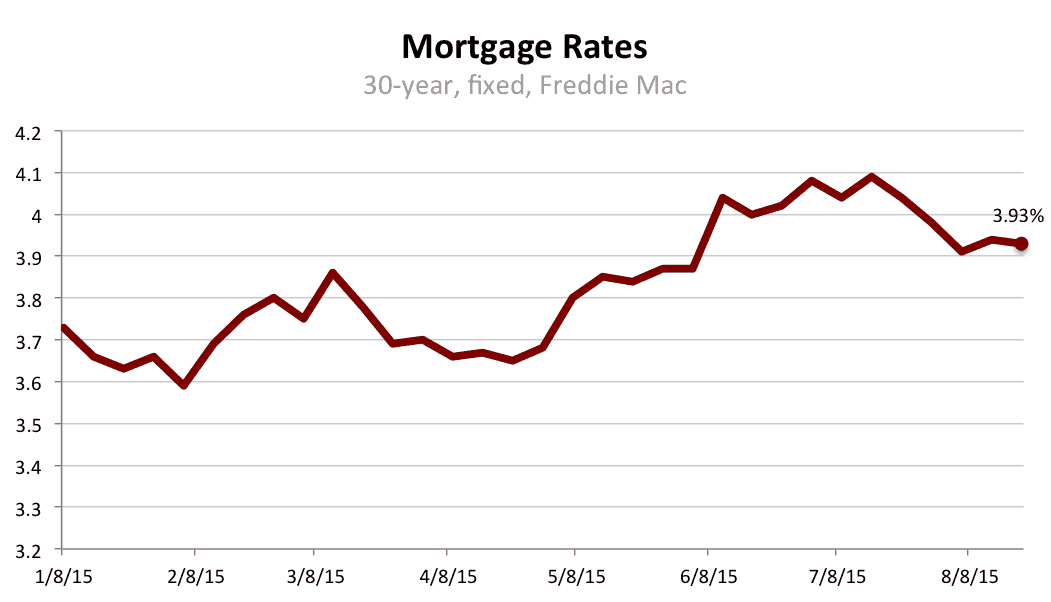

So far, so good. On average, 30-year, fixed-rate mortgages have been below four percent for a month, according to Freddie Mac.

The Fed doesn’t control your mortgage rate, but it has a significant effect on financial markets and the broader economy, which do influence the cost of a 30-year, fixed-rate loan. That’s why so many homebuyers are laser-beam focused on what the Fed will do next.

For a long time, most economists were pretty sure Fed policy makers would announce a rate hike after their meeting Sept. 17. Then we had the Greek bailout brouhaha, China’s stock market and currency gyrations, and falling oil prices. Even though the U.S. economy is steady, we’re not immune to exogenous shocks. Economic growth is lackluster, wages are going nowhere and inflation is almost nonexistent.

Yesterday, when Fed policymakers released minutes of their July meeting, we learned they were more worried than we thought.

In a way, all that bad news overseas has been good for your mortgage. When things get dicey, the world’s money looks for a place to hide. Frequently, it winds up in ultra-safe U.S. government debt — Treasuries. It’s called a flight to safety and it makes it cheaper for the U.S. government to borrow. Generally when it’s cheap for the U.S. to borrow, it’s cheap for homeowners to borrow, too.

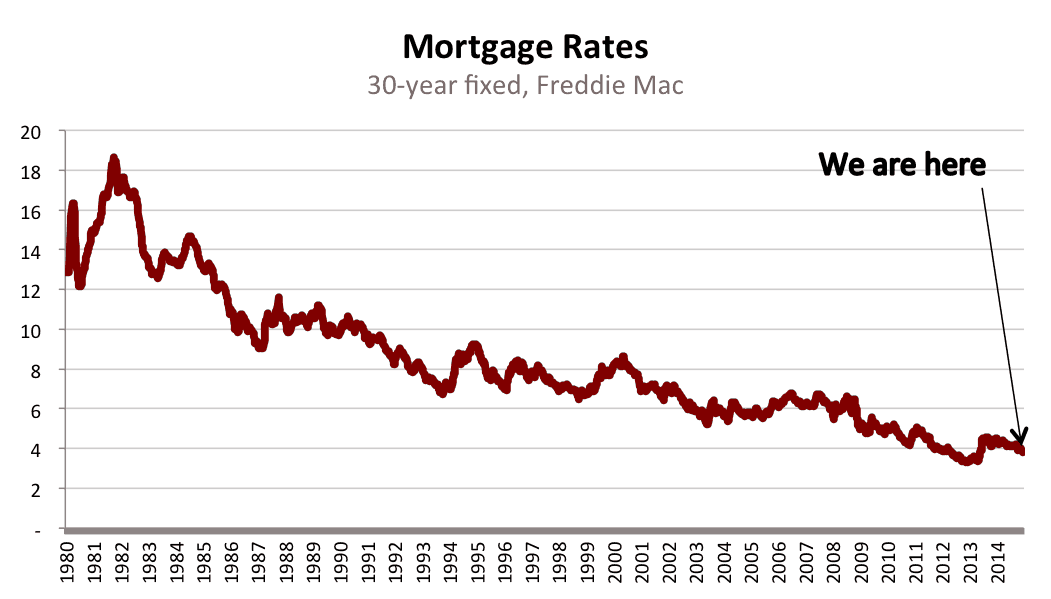

Tune in next Thursday for an update. And if rates do rise, keep this chart in mind.

Questions? Comments? I’m at lorraine.woellert@redfin.com.

Mortgage Rate Watch: Does the Fed Matter?

- BY System Admin

- DATE 24/11/2024