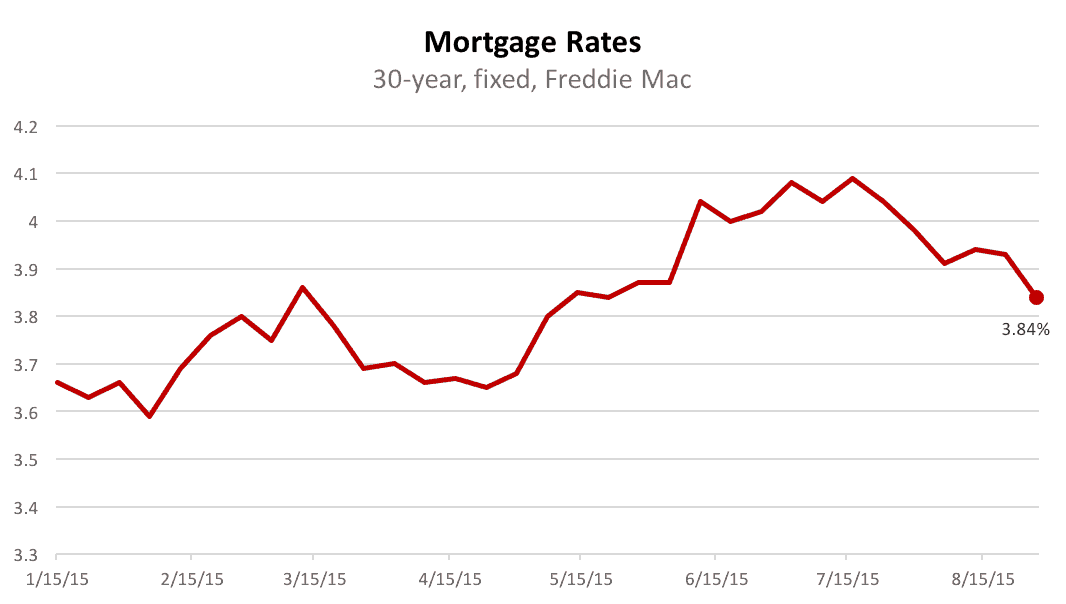

The Super Bowl of Fed meetings is only three weeks away. As you get the office pool together, there’s good news today on the mortgage rate watch. The average cost of a 30-year, fixed-rate loan hit its lowest since May, coming in at less than four percent for the fifth week, according to Freddie Mac.

We all know China’s financial turmoil has caused the stock market to roller-coaster. Less obvious is what it’s been doing to mortgage rates, which have been volatile, too.

“Interest rates also rocked up and down — although to a lesser extent than equities — as investors alternated between flights to quality and bargain hunting among beaten-down stocks,” Freddie Chief Economist Sean Becketti said. Given the craziness, Becketti thinks central bankers might “think twice” before raising interest rates when they meet next month.

He’s not alone. Yesterday, Fed VIP William Dudley said a September rate hike looked “less compelling” than it did a few weeks ago. Dudley, who’s president of the New York Fed, also said his opinion might change between now and then.

In fact, we’ve gotten good economic news in the 24 hours or so since he spoke. Financial markets are showing signs of life and the Commerce Department said the economy grew faster than we thought in the second quarter. The Fed will raise rates only if the economy is strong enough to handle it.

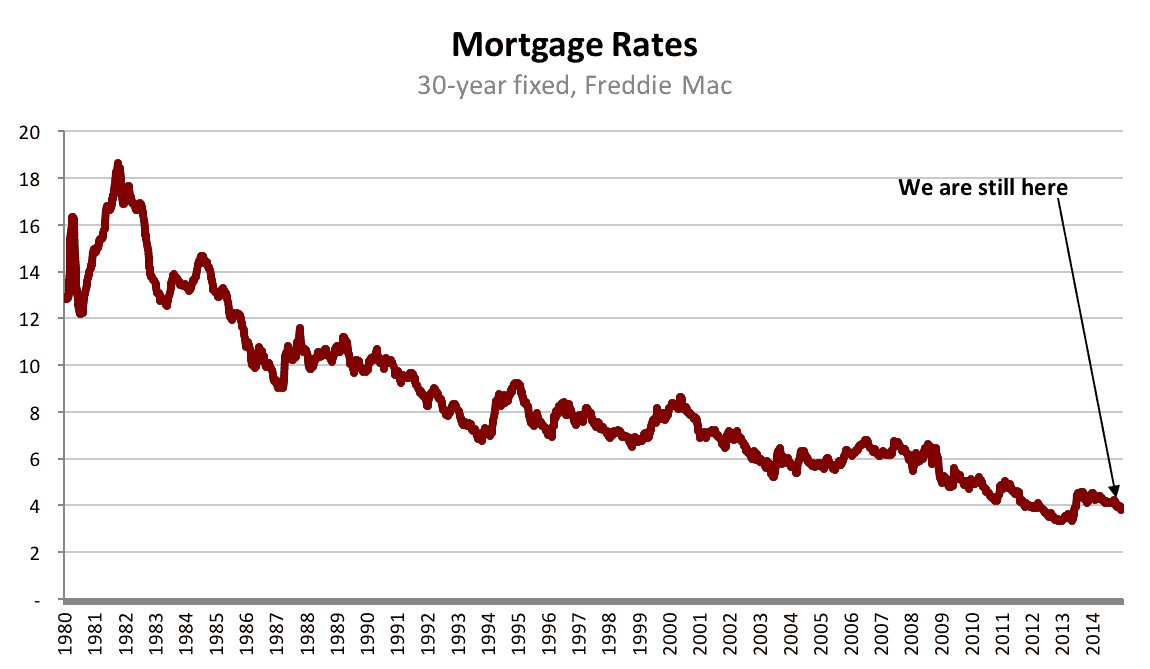

Remember, the Fed doesn’t control your mortgage rate, but its decisions do influence the cost of borrowing. That’s why so many of us are so focused on what the Fed will do when it meets Sept. 16 and 17. The central bank last raised rates in 2006, when the Steelers trounced the Seahawks in Detroit and Redfin had just opened shop.

For now, not much has changed for the housing market going into September’s meeting. The U.S. economy is doing pretty well, prices are rising, houses are selling, and mortgage rates are as low as they’ve been in a generation. Remember this chart:

Questions? Comments? I’m at lorraine.woellert@redfin.com

Mortgage Rate Watch: No Bad News Here

- BY System Admin

- DATE 23/11/2024