Mortgage rates fell to their lowest level in more than three years, reaching 3.62 percent, down from 3.65 percent last week. They’ve been falling all year and if history is any guide they might drop even more.

A year ago, the cost of a 30-year, fixed-rate mortgage averaged 3.80 percent, according to Freddie Mac’s weekly survey of lenders. Home loans today are also cheaper than they were in December, when the Federal Reserve raised its own short-term rates for the first time in almost a decade.

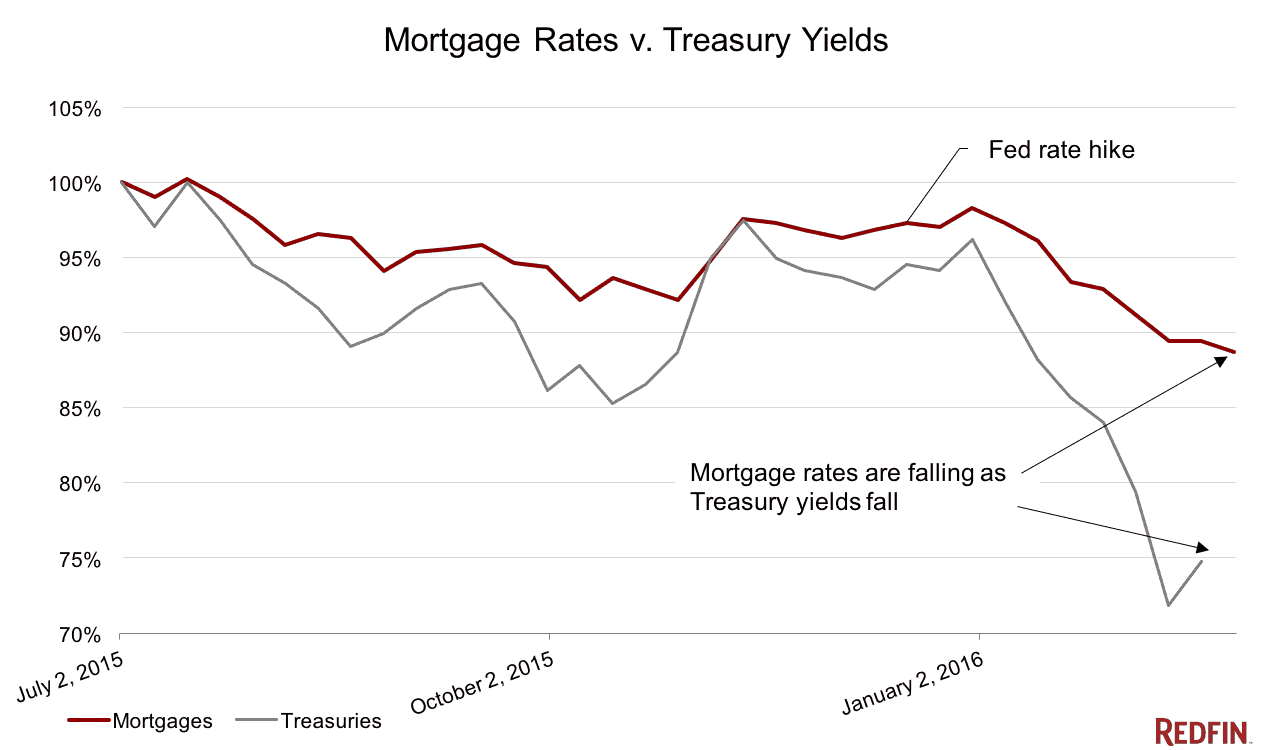

The market determines how much your home loan will cost, but a general rule of thumb is that mortgage rates move when 10-year Treasuries move. And Treasuries have been dropping fast as global investors pour their money into the safety of government bonds. That means mortgages might fall more, too.

Mortgages already have been getting cheaper all year, which has boosted home sales and prices. Last month, sales were up 6.7 percent from a year ago. Prices were nearly 8 percent higher and properties were moving quickly, according to Redfin’s Market Tracker. We expect a competitive market for buyers this year.