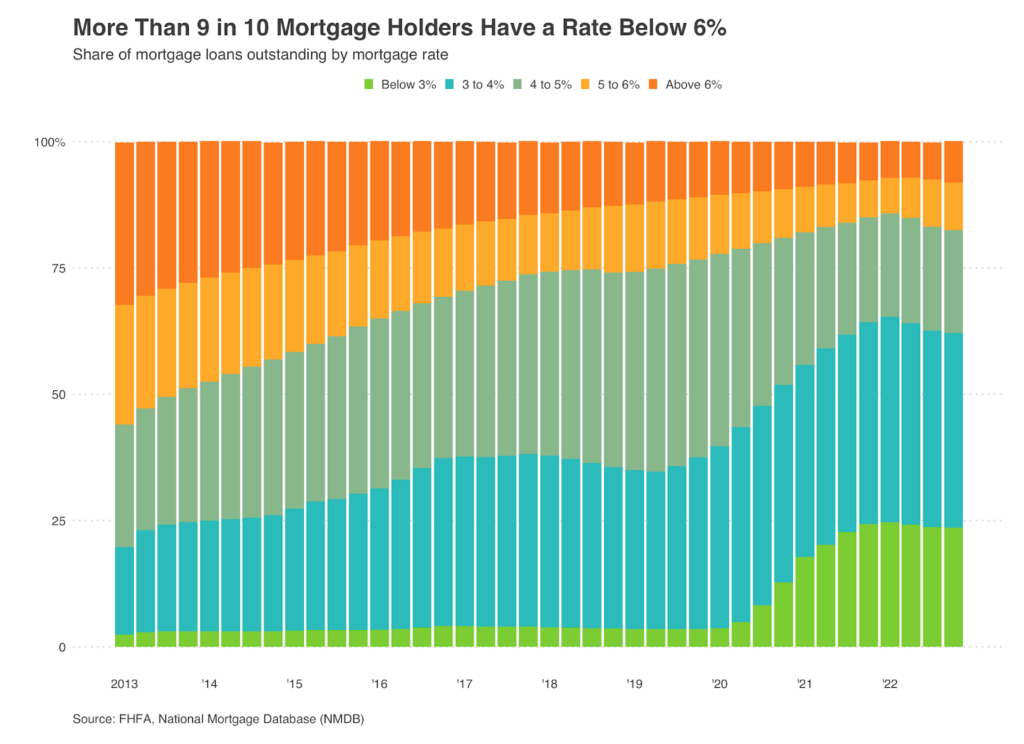

More than nine of every 10 (91.8%) U.S. homeowners with mortgages have an interest rate below 6%. That’s down just slightly from the record high of 92.9% hit in mid-2022.

That means well over 92% of homeowners with mortgages have mortgage rates below the current weekly average of 6.71%, which is near the highest level in over 20 years. Homeowners holding onto their comparatively low mortgage rates is the main reason for today’s major shortage of new listings.

This is according to a Redfin analysis of Federal Housing Finance Agency (FHFA) data as of the fourth quarter of 2022, the most recent period for which data is available. This analysis is limited to households with outstanding mortgages. See the bottom of this report more on methodology.

Here’s the full breakdown of where today’s homeowners fall on the mortgage-rate spectrum:

Many would-be sellers are staying put rather than listing their home to avoid taking on a much higher mortgage rate when they purchase their next house. This “lock in” effect has pushed inventory down to record lows this spring. New listings of homes for sale and the total number of listings have both dropped to their lowest level on record for this time of year, which is fueling homebuyer competition in some markets and preventing home prices from falling further even amid tepid demand.

Even though the share of homeowners with mortgage rates below 5% or 6% has come down slightly because more people have bought homes with today’s elevated rates, it’s still true that nearly every homeowner would take on a higher mortgage rate if they moved. That’s making most people who don’t need to move stay put, which means it’s slim pickings for buyers. Pending home sales are down about 17% from a year ago.

“High mortgage rates are a double whammy because they’re discouraging both buyers and sellers–and they’re discouraging sellers so much that even the buyers who are out there are having trouble finding a place to buy,” said Redfin Deputy Chief Economist Taylor Marr. “The lock-in effect is unlikely to go away in the near future. Mortgage rates probably won’t drop below 6% before the end of the year, and most homeowners wouldn’t be motivated to sell unless rates dropped further. Some of them simply don’t want to take on a 6%-plus mortgage rate and some can’t afford to.”

Just over one-quarter (27%) of U.S. homeowners who are considering listing their home in the next year would feel more urgency to sell if rates dropped to 5% or below. That’s according to a Redfin survey conducted by Qualtrics in early June. Roughly half (49%) would feel more urgency if rates were to drop to 4% or below, and the share increases to 78% if they were to drop to 3% or below—a situation that is highly unlikely any time in the near future.

“The only people selling right now are the ones who need to,” said Atlanta Redfin Premier agent Jasmine Harris. “The last three potential sellers I’ve met are people who are moving out of the country. I’m also working with someone who’s moving out of town for a new job and another person who needs a smaller home for health reasons. So there are some homes coming on the market, but not nearly as many as there would be if rates weren’t so high. In more typical times, we’d also have people selling simply because they wanted to move to a different neighborhood or wanted a bigger home and/or one with different features.”

It’s worth noting that for some homeowners, the fact that home prices soared throughout the pandemic means they have enough equity to justify selling and taking on a higher rate. Home prices have come down from the peak they hit in 2022, but the median U.S. sale price is still more than 30% higher than it was just before the pandemic started. People who are buying a less expensive home than the one they’re selling, perhaps because they’re relocating to a more affordable part of the country or downsizing, may be more likely to move even if it means taking on a higher rate.

The typical homebuyer purchasing today’s median-priced U.S. home (roughly $380,000) at the current average 6.7% mortgage rate would take on a monthly payment of roughly $2,600, a record high. That’s up more than $300 from a year ago and up more than $1,000 from three years ago, using the median sale price and average mortgage rates from those time periods.

Nearly everyone has a mortgage rate below the one they would get if they bought a home today, but the difference in monthly payments varies depending on each individual situation. A mortgage holder in the 3% to 4% range is more likely to feel handcuffed to their home than someone in the 5% to 6% range, for instance.

Consider these hypothetical homeowners:

This report is based on a Redfin analysis of fourth quarter 2022 data from the FHFA’s National Mortgage Database, which is a nationally representative 5% sample of residential mortgages in the U.S. The fourth quarter is the most recent period for which data on outstanding mortgages is available. Homebuyer mortgage rates don’t typically change significantly from quarter to quarter, as most homebuyers take out 30-year mortgages.

Redfin applied FHFA’s data to the roughly 80 million owner-occupied households we estimate existed in the U.S. in 2022 based on Census data. We refer to these households as “homeowners” throughout this analysis. Roughly 60% of homeowners have an outstanding mortgage.

Editor’s note: This report has been updated. A previous version erroneously stated that 60% of mortgage holders have lived in their home for four years or less; in fact, 60% of mortgage holders have either gotten a new mortgage or refinanced an existing mortgage within the last four years.