About half (51%) of U.S. homeowners with mortgages have a mortgage rate under 4%—substantially below today’s level of 5%. About one-third (32%) of all homeowners—including those without mortgages—have a mortgage rate under 4%. With rates now at their highest level in over a decade, many of these homeowners may be incentivized to stay put because selling their home and buying another could mean giving up their ultra-low mortgage rate and increasing their monthly housing bill. This may be contributing to a decline in home listings.

That’s according to a Redfin analysis of Federal Housing Finance Agency (FHFA) data from the fourth quarter of 2021—the most recent period for which data was available. This report covers roughly 80 million owner-occupied U.S. households, of which about two-thirds (62%) have an outstanding mortgage. We refer to these households as “homeowners” throughout this analysis. The average mortgage rate was 4.2% as of the fourth quarter.

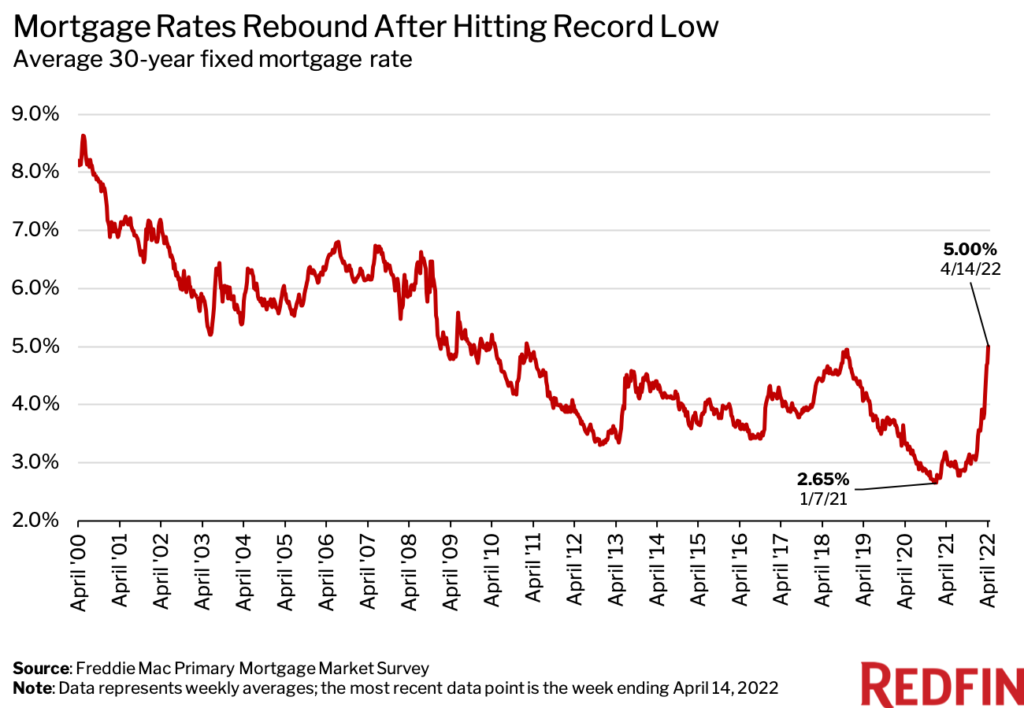

Mortgage rates have surged as the government seeks to combat inflation. The average 30-year fixed mortgage rate hit 5% for the first time since 2011 during the week ending April 14, up from a record low of 2.65% in January 2021. That has helped push the typical homebuyer’s monthly mortgage payment to a record high of $2,288, up 35% from about a year ago.

Redfin economists are watching closely to see whether the rise in mortgage rates has a measurable impact on housing supply, which is already at historically low levels. New listings fell 7% year over year during the four weeks ending April 10. By comparison, they were only down 1% at the end of February, before mortgage rates skyrocketed.

“Higher mortgage rates may already be putting a damper on home listings, but they’re also curbing the insatiable homebuyer demand for those listings,” Redfin Deputy Chief Economist Taylor Marr said. “That slowdown in demand may cause homes to stay on the market longer, in effect giving buyers more options to choose from. Overall, that could mean housing inventory actually gets better, not worse.”

There are already early signs that demand is starting to back off. Home sellers are increasingly cutting their list prices to find buyers, and Redfin has seen a drop in buyers requesting service from its agents in pricey coastal markets. Mortgage purchase applications fell 6% year over year during the week ending April 8, and home-touring activity is below last year’s levels.

This slowdown in demand is likely another reason some sellers are staying put, as they’re worried they’ll no longer be able to get top-dollar for their homes. With rents on the rise, many homeowners are opting to rent out their properties instead of sell—another way for them to hold onto their low mortgage rates. Americans are also staying in their homes for longer in general; the typical U.S. homeowner in 2021 had spent 13.2 years in their home, up from 10.1 years in 2012.

In Utah, 46% of homeowners had a mortgage rate below 4% as of the fourth quarter of 2021—a higher share than any other state. Next came Colorado (43%), Washington, D.C. (42%), California (40%) and Washington (40%). The list is slightly different when looking only at homeowners with outstanding mortgages. The top spot is still held by Utah, where 65% of mortgage holders had a rate below 4%, but next came South Dakota, Colorado, North Dakota, Washington and Idaho—all at roughly 60%.

Meanwhile, just 18% of total homeowners in West Virginia had a mortgage rate below 4%—the lowest share in the country. It was followed by Mississippi (22%), Louisiana (23%), New Mexico (24%) and Oklahoma (24%). West Virginia also had the lowest share of mortgage holders (39%) with rates below 4%. Next came New York, Florida, Mississippi, Louisiana and Oklahoma, all at about 44%.

Redfin agents say the rise in mortgage rates is having varying impacts on homeowners, causing some to stay put, but others to list their homes more quickly.

In Salt Lake City, the rise in mortgage rates is exacerbating a phenomenon that was already prompting many homeowners to stay put, according to Ryan Aycock, Redfin’s market manager in the Utah capitol.

“Many homeowners haven’t been selling because housing prices have surged so much, they’re worried they won’t be able to find a replacement home,” he said. “The rise in prices has helped homeowners build equity, but often not enough to afford the house they want next, and higher mortgage rates are now making that next home even more unaffordable.”

Aycock knows of one homeowner who bought a Salt Lake City house for $235,000 in 2015, and was recently planning to sell, but chose not to even though their home is now worth about $650,000. They opted to remodel instead because their current home has a mortgage rate of just 2.4%, and they don’t feel the equity in their current home is sufficient to cover the $850,000 to $1 million replacement home they want next—especially with today’s higher mortgage rates.

In Phoenix, Redfin agent Heather Mahmood-Corley has noticed a different trend: homeowners feeling more urgency to sell.

“Many homeowners want to sell now because they’re concerned that if rates keep going up, it will hurt homebuyer demand and they’ll have to drop their price,” she said. “Rising rates are always a shock at first, but people still have to move. Some sellers will have to adjust their expectations and understand they may not be able to afford the same house they could have two years ago.”

This report is based on a Redfin analysis of fourth quarter 2021 data from the FHFA’s National Mortgage Database, which is a nationally representative 5% sample of residential mortgages in the U.S. The fourth quarter is the most recent period for which the database has data on outstanding mortgages. We define a homeowner with a mortgage rate substantially below current levels as one who had a rate below 4% as of the fourth quarter.

The FHFA’s outstanding mortgages dataset includes data on the share of residential mortgages with rates below 4%. To calculate the share of all homeowners—with and without mortgages—with rates below 4%, Redfin applied the FHFA data to the roughly 80.3 million owner-occupied households we estimate existed in the U.S. in 2021. That estimate is based on 2016-2020 American Community Survey data on owner-occupied households. We applied to it the growth rate from the additional number of households with a mortgage found in the 2021 FHFA data when compared to the same figure in the 2016-2020 Census data.