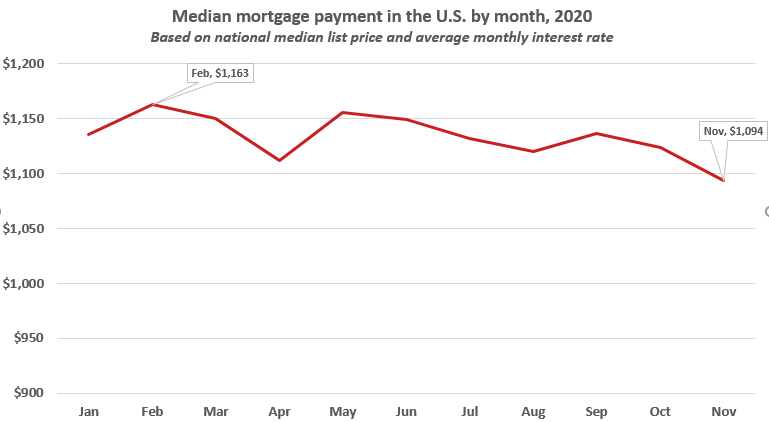

November was the most affordable month to buy a home in 2020. The median monthly mortgage payment nationwide reached a low of $1,094 in November, down from a peak of $1,163 in February, the month before the coronavirus was declared a pandemic.

That’s according to a Redfin analysis of affordability by month so far this year. We analyzed median monthly mortgage payments based on each month’s median list price* and average mortgage rate by month, both nationally and for the 50 most populous metros in the U.S., excluding December.

The median list price nationwide was $336,000 in November, the highest median price on record, but that was offset by an average mortgage rate of 2.77%, the lowest on record. Both sides of the equation were fueled by the pandemic: Prices were driven up by remote work and Americans’ desire to move to more spacious homes, while low mortgage rates are in part a consequence of the Federal Reserve’s response to a struggling economy.

“It’s easy to forget that the price is just one part of the equation of how much house a buyer can afford,” said Redfin chief economist Daryl Fairweather. “The relationship between historically low mortgage rates and surging home prices has been fascinating to watch this year. We’ve seen mortgage rates drive unforeseen levels of homebuyer demand, which has pushed prices up by upwards of 15% in recent weeks. The good news for those buyers who are persevering through a dearth of homes for sale and fierce bidding wars is that once you do land a home, today’s sub-3% mortgage rates are largely cancelling out the high prices.”

April was the second-best month of the year for homebuyers, with a median monthly mortgage payment of $1,112, just $18 more than November. The relatively low median payment in April was due largely to a slump in the housing market caused by buyers’ uncertainty about purchasing a home at the onset of a pandemic. Prices rose 4.9% year over year to $304,000 in April, a slowdown from 7% growth the month before. The average mortgage rate was 3.31%, a dip from 3.62% at the beginning of the year.

Although November was the most affordable month to purchase a home, the low number of homes for sale and high bidding-war rate made it difficult for many potential buyers to find and win a home.

Nationwide, 54.3% of Redfin offers faced competition in November, the sixth straight month during which more than half of offers encountered competition.

Seattle Redfin agent Shoshana Godwin said most of her homebuying clients are frustrated with rising prices and competition, even though mortgage rates are low.

“A lot of my buyers would be surprised to hear that November was considered a good month to buy,” Godwin said. “Although monthly mortgage payments are lower than they were at the beginning of the year, buyers are still facing five to 15 competing offers on desirable homes. People have to find a home and get their offer accepted before they can take advantage of low rates.”

The median mortgage payment nationwide in November was up slightly—$21—from the year before. But the median mortgage payment was down from last November in 30 of the 50 metros included in this analysis.

November was the best month to buy a home in 35 of the 50 largest metro areas in the U.S. That includes San Francisco, where the median mortgage payment for a home purchased in November was $4,420, the highest payment of any metro included in this analysis, and Seattle, where the payment was $2,047.

April was the best month in five metros, including Los Angeles, where the median payment that month was $2,382. January and October were each the best months for four metros.

Highlighted in Green = Best Month