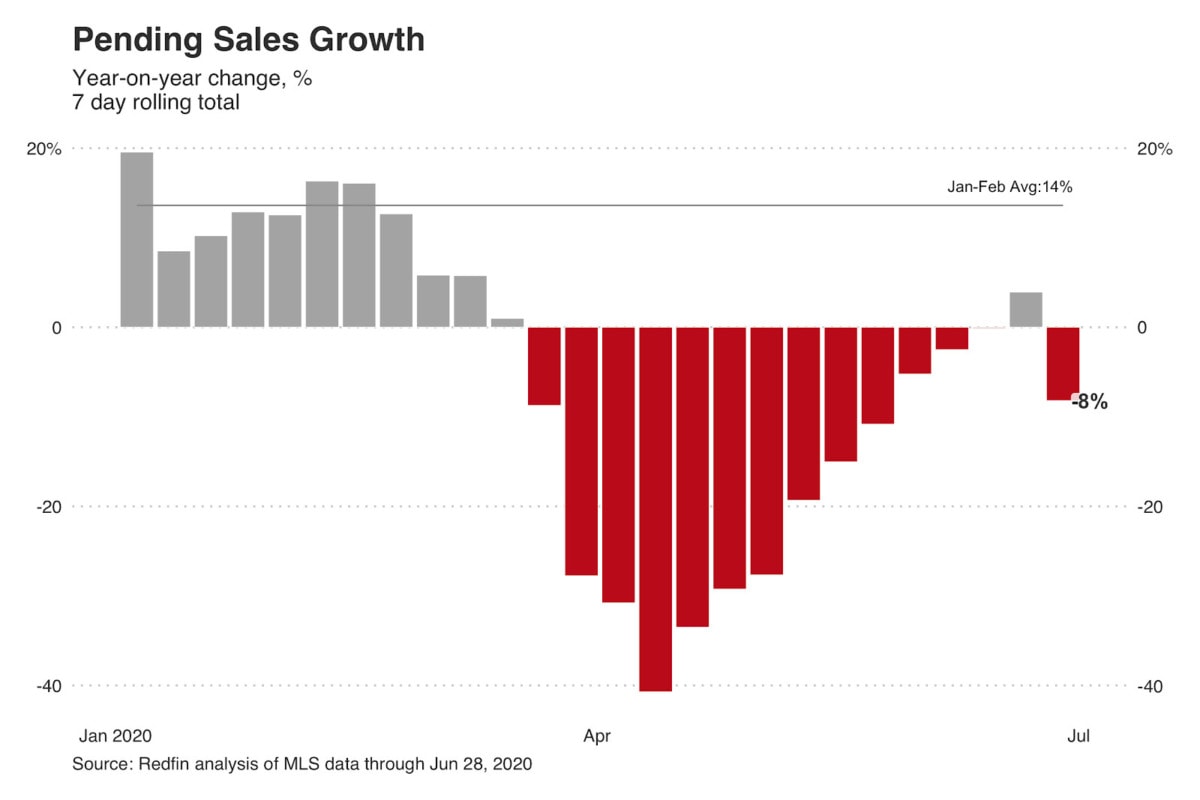

The housing market closed out the month of June on somewhat uneven footing as pending sales pulled back slightly despite another record low for mortgage interest rates.

For the week ending June 28 pending home sales decreased 8.2% year-over-year, a sharp change from the revised 3.9% year-over-year increase a week earlier. However, after adjusting for seasonal effects the decline was only 3%.

This decline in pending sales may be a sign that pent-up homebuyer demand from March and April has mostly worked its way through the market, but it could also be due to a continued shortage of homes for sale.

New listings were down 8.3% from a year earlier for the week ending June 28, which is slightly better than the 9.2% decline a week earlier, indicating that sellers are slowly returning to the market. But they aren’t returning quickly enough; active listings of homes for sale remain down 27%, leaving buyers with a very limited selection of homes to choose from.

“Homebuyers are becoming frustrated because they’re just not seeing a lot they want to buy,” said Redfin Houston agent Irma Jalifi. “The lack of homes for sale has caused two of my buyers to just give up, when they had been trying to find a home before their leases were up at the end of July. It’s disappointing to spend so much time and effort and come up empty-handed.”

Despite the dip in pending sales, newly-listed homes were still selling at a record pace during the week ending June 28—47% of new listings sold within two weeks, the same as the previous week and the highest level since we started measuring this data in 2012. The imbalance between supply and demand is also driving up home prices, with the median list price of new listings rising to $330,000, the highest point this year and up 12% from the same week in 2019.

“Single-family homes priced between $300,000 and $600,000 are flying off the market right now,” said Redfin Miami agent Maria Carcia-Gonzalez. “We have to educate our homebuyers about what is happening right now, because they tend to think that due to the coronavirus things aren’t selling, or prices will drop and they can wait. In reality, for affordable single-family homes you have to be ready to make an offer close to list price and expect multiple offers with homes going off the market quickly.”

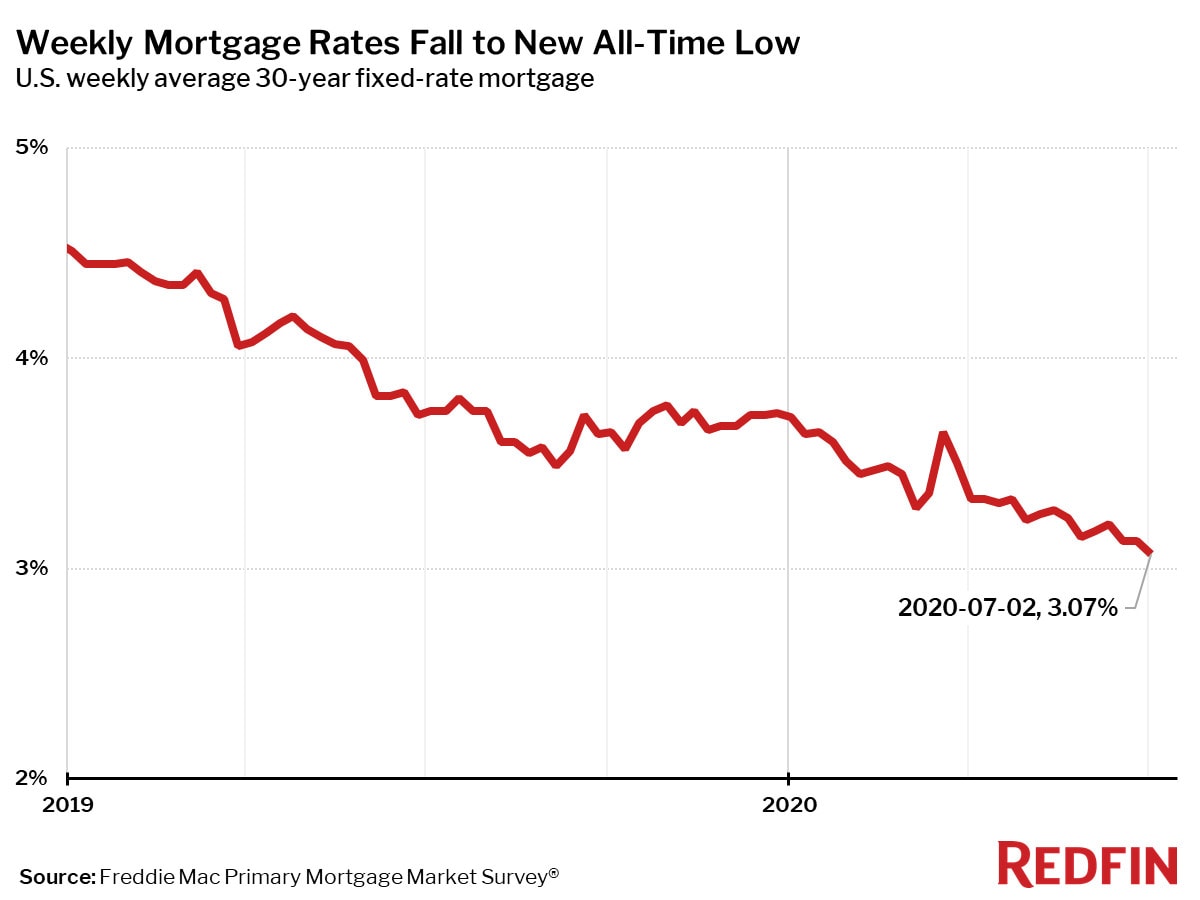

Mortgage rates continued to fall, with the average 30-year fixed rate hitting an all-time low of 3.07% for the week ending July 2. Despite the drop in rates, purchase mortgage applications were down 2% compared to the prior week. Even record-low mortgage rates can’t lead to more home sales when there just aren’t many available homes for sale.

The outlook improved this week for another round of stimulus to keep the economy afloat during a significant rise in coronavirus cases as both President Trump and Democrats in Congress have signaled support of an additional series of direct payments to Americans.

The renewed surge in COVID-19 cases in some parts of the country may be correlated with a local decline in pending sales, but it’s too soon to say for sure. For example, as of June 28 the number of daily new cases of COVID-19 in the Phoenix area surged to over 2,000 from only 220 four weeks earlier, while the year-over-year change in pending home sales fell to -15%, down from a peak of +27% two weeks prior. Similar patterns can be seen in Las Vegas, Austin, and Houston. New listings have also pulled back in these markets, and are down 11% to 14% from a year earlier, compared to single-digit year-over-year declines a few weeks earlier.

“A few of the homebuyers I’m working with have decided to stay home with the sudden rise in COVID-19 cases here locally,” said Jalifi. “They’re not going out to look at homes in person right now; they’d rather just look online.”

In contrast, Chicago has not seen a major rise in COVID-19 cases and has continued to see strong year-over-year growth in both pending sales (+33%) and new listings (+7%). Pending sales haven’t declined in every market experiencing a surge in coronavirus cases—so it’s too soon to say if health concerns are putting a damper on the market or if there may be another explanation.

The two big questions for the housing market are whether sellers will begin to come back in force, and whether homebuyers will remain as confident as they have been since the market began recovering in May. If the economy continues to slowly heal and another round of stimulus does pass this month, both homebuyers and sellers are likely to be optimistic about the housing market through the next few months of 2020, but if the number of coronavirus cases continues to rise and some markets begin to shut down again, home sales and listings could pull back as well.