For many home-buyers, REOs are an opportunity for a bargain. Short for “Real Estate Owned,” REOs are bank-owned properties (also known as foreclosures). Already this year, 39% of Redfin’s offers in Southern California have been on these homes, while the entire East Bay market’s REO sales are up 103% year-over-year. Real estate news site Inman News recently published a report on bank-owned inventory reporting that “the foreclosure market ‘is the housing market’ in 2009.”

What does this mean for you the buyer? You can get a deal on an REO, but be prepared to pay for repairs and work with banks managing large inventories of these homes.

If you’re looking to buy a distressed property, REOs are your best bet. With short sales and foreclosure auctions, there’s a lot more stress without much guarantee of actually buying a home. REOs have reached their final resting place in the banks hands, are listed in the MLS and ready to sell.

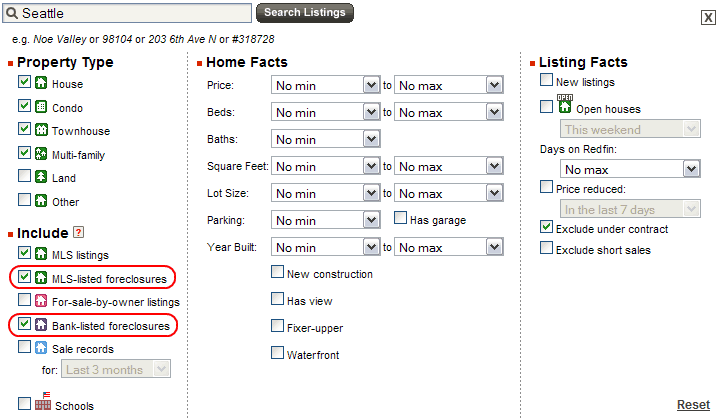

To search for bank-owned properties on Redfin, click on Prices, Beds… next to the search box and check MLS-listed foreclosures and bank-listed foreclosures.

Redfin shows all the homes for sale, but only provides service for MLS-listed foreclosures. We don’t service bank-listed foreclosures not in the MLS (the ones with the purple house icon ![]() ). Another good resource is RealtyTrac, where you can search for all types of foreclosures for a fee of $45/month.

). Another good resource is RealtyTrac, where you can search for all types of foreclosures for a fee of $45/month.

As with any home you like, be sure to see a REO in person. On your tour, pay close attention because it’s up to you to spot issues with the home. The bank won’t be paying for any repairs. If you decide to make an offer, the bank isn’t required to give you disclosure documents that describe the condition of the home—they’re always included in California and Washington when you buy from an individual owner.

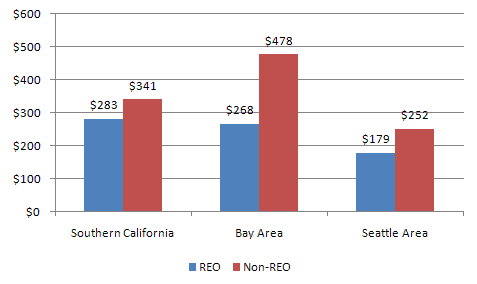

We found that on average, the REOs Redfin helped people buy in the last nine months in Southern California were 17% cheaper per square foot than non-REOs, 29% cheaper in the Seattle area, and 44% cheaper in the Bay Area. Note that this price differential reflects the fact that REOs are often sold in less desirable neighborhoods, while homes sold by individuals are often in nicer areas and sell for more. For more information, check out this recent USA Today article on the concentration of REOs by county across the US.

Redfin data man Arthur Patterson pulled these numbers from the Redfin listing database from May 16, 2008 – February 15, 2009. We only include Southern California, San Francisco, and Seattle deals since our East Coast markets haven’t yet closed enough REO deals to make sound conclusions.

Banks set competitive prices to move their inventory, so there’s a good chance there will be multiple offers on the home. If the home is in good condition and priced well; expect to get caught up in a bidding war. In Southern California, regardless of the condition of the home, you can almost always expect more than 10 offers — former Redfin agent Joyti Goundar has seen as many as 105! Forget about low-balling.

In the Bay Area, local Redfin real estate agents report that:

The cleaner the offer, the better. Banks won’t be open to any special arrangements regarding repairs in your negotiations; so be prepared to put your best foot forward. In terms of financing, banks are usually the most responsive to buyers with conventional mortgage loans and 10 – 20% down payments.

When an REO has been on the market for 30+ days, the banks may be more likely to negotiate below list prices. But, this could also mean that the home isn’t in great shape. And remember, the bank won’t be paying for repairs. Seattle real estate agent Trevor Smith notes that sometimes it can be unclear how much banks are willing to negotiate—it often depends on how much internal pressure they’re under financially to get their loan money back. But, as foreclosed inventory continues to pile up in the coming months, banks may continue to lower prices as supply increases.

The table below shows the average sale price to list price ratio for Redfin REO deals compared to non-REOs for the past nine months. You can see the bidding war effect in Southern California as REO homes sell above list price.

If you have questions on what to offer on an REO property, Redfin real estate agents will help you with local pricing guidance. To help you to find an agent with REO experience, we pulled data on the number of signed REO offers our west coast agents have worked on since January 1, 2009:

*In Seattle, the REO surge is just starting to hit. Special thanks to Redfin Seattle agent Allie Howard who urged us to write this post to educate customers about REOs and provided great insider information.

Each bank selling REOs has different policies for handling the offer process. Sometimes, the bank’s asset managers, who are responsible for selling the property, require that their own lenders issue the pre-approval letter that accompanies the offer. You can still switch lenders later, but there won’t be much time to get a second one on track. This could make it more difficult for you to get a different lender for the REO purchase.

Once you submit your offer on the standard MLS Purchase and Sale Agreement form, almost all counter-negotiations will proceed verbally between you and your agent, the selling bank, and the listing agent; in a normal transaction, these counter-negotiations are typically done in writing.

Our agents report that they’ve been involved in negotiations that can take anywhere from a few days to a week depending on the responsiveness of the selling bank and their listing agent. Normally, these negotiations take less than 24 hours with an individual seller. But once you come to agreement, the process often goes faster since banks are eager to sell homes. We found that Redfin REO deals in the last nine months close on average one week faster compared to normal transactions in our West Coast markets.

After an agreement is reached verbally, most banks will sign and return the original Purchase and Sale Agreement along with an addendum on their own forms. Addendums include:

Banks can easily take advantage of their position by crafting the addendum according to their own interests. For example, former Redfin agent Rachelle King noticed that her client’s $10,000 closing credit failed to show up in the addendum. In this case, the bank addendum stated that any changes made would nullify the entire document. But, Rachelle took charge and got the bank to add the closing credit anyway.

Sometimes, the bank will require you to do a formal inspection of the property before you put in an offer—an up-front cost of $400 – 500. But most often, you’ll proceed with the inspection once you agree on the deal. Since the inspection contingency period is often shorter with REO purchases, make sure to move quickly. If utilities like water and heat are shut off, you’ll need to shell out $100 – 200 to get the property de-winterized.

Appraisers will be more conservative than ever: they may raise issues with the home that could become conditions of your loan. Southern California Redfin agent Anna Nevares says “repairs oftentimes must be required by the lender in order for the bank to consider doing them. Even then, the buyer sometimes must complete the repair on their own, prior to close of escrow, with the bank’s permission, but at the buyer’s liability and risk of not closing escrow.” Repair costs are often in the thousands in Southern California: Joyti Goundar recently had a client who had to pay $6,000 for a termite inspection.

The following items are usually paid for by the home-owner in a normal transaction, but often get overlooked with REOs. Expect to pay extra for:

The process can be stressful, but stick it out and you can get a good deal on the home. Check out our real estate forums for more recent REO discussion. What else do you think buyers need to know about REOs? We’d love to hear from you. We’ll compile what we learn into a set of best practices to help future buyers.

Here are some links to some helpful REO blogs out there: