Howdy Redfinnians!

Time for our monthly tell-you-everything analysis of the real estate market! We just hit $5 billion in home sales, where Redfin agents represented either the buyer or the seller, all in our don’t-crowd-me-baby style. For every customer, deal or no deal, Redfin surveyed the customer and published the answer.

And on every home, we’ve paid our agents a bonus based on the survey result, not just a commission. Ninety-seven percent of our customers would recommend us to a friend. We’re so proud! Break out the Dom and the Dixie cups!

But enough bragging. How’s the market? It’s been sick so long no one has noticed it’s getting better. But it is! Sure September prices slipped, driven by the animal spirits of economic malaise. But consider:

We don’t expect a miraculous recovery: prices will be low for years, and will probably weaken slightly in the remaining months of 2011. But being a little sick isn’t so bad. You watch TV. You fry an egg for lunch. You haven’t yet forgotten how terrible it was before, when you spent all night in the bathroom.

Welcome to residential real estate in late 2011. Let’s dig into the numbers shall we?

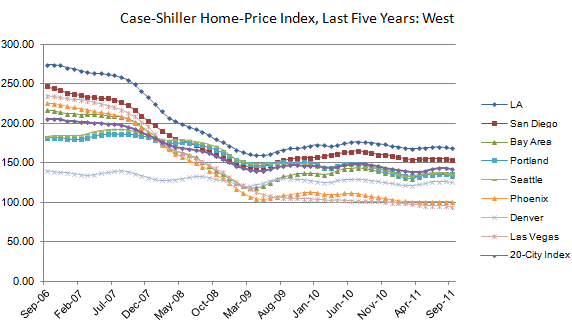

September prices dipped .6%. On the bursting-bubble’s five-year birthday, Las Vegas homes prices now sit 60% off their peak.

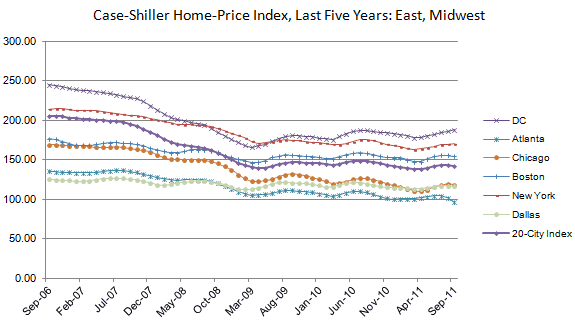

What difference does the overall economy make? Well consider Dallas, where prices have fallen only 8%: $4-gas has been good to Texas.

For now, we seem to have arrived at the rocky bottom with a downward trend that Karl Case predicted in February:

In the East and Midwest, there may not even be a downward trend.

But the damage has been done. Adjusting for inflation, all appreciation in the ’00’s is gone.

The renters sure are laughing now! But perhaps they’re also finally getting ready to move. Rental vacancy rates just fell to their lowest level since 2006, and rents seem likely to keep rising, by 3% in 2012. The ratio of home prices to rents is at a five-year low, though still roughly 15% higher than historical averages.

One sign renters are buying: the proportion of Redfin customers who are first-time home-buyers has increased 18% in three months.

What’s ahead? As we predicted last month, pending home sales in October increased 10.4% since September. Closed sales also increased. The increase was viewed with only meek enthusiasm by economists, since it was a rebound not a surge.

But we expect pending home sales in November to keep rising. The number of Redfin customers signing offers increased for three consecutive weeks in November before Thanksgiving. The November 30 Federal Reserve Beige Book reports that U.S. real estate activity increased, though not everywhere and not by much.

Not a clean bill of health by any means, but some improvement.

The reason Redfin’s been saying all year that prices don’t have far to drop was that there aren’t many homes for sale. A lot of homeowners owe too much on their mortgage to sell, and a lot more just don’t want to sell right now. Would you, if you didn’t have to?

Since the late 2007 peak, the number of homes for sale has declined 60%, a trend that continued this month. The laws of supply and demand are starting to do their work.

What about the scary stuff, all the foreclosures that banks haven’t even tried to sell yet, and all the past-due mortgages that should have been foreclosed months ago? We worry about that too.

We just hired an asset manager from a big bank, who just told the whole company how many repossessed homes the banks are waiting to list. It was like the vast evil egg farm Sigourney Weaver discovered in Aliens.

When are these little devils going to hatch?

Well, the rate of new foreclosures has been low for a year, a trend that continued in October. The number of homeowners who owed more than their home was worth has been dropping since 2009 and continued to drop in October. At this point, 27% of Americans are still either underwater or nearly so.

This tells us that for years there will be a steady stream – not a tidal wave — of distressed properties hitting the market, accounting for about 1 in 5 listings nationwide. Price can’t go up by much until this stuff runs out.

But it really helps that banks have become eager to approve short sales – where the bank lets the owner sell the property for less than the mortgage — in lieu of a foreclosure.

And the fact that many 2006 loans have an expiring 5-year teaser rate probably will make a difference: the new rate is actually lower than the teaser, and many folks’ mortgage payments just fell.

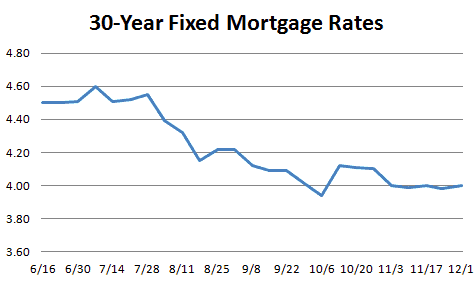

So now we arrive at the real reason the market has been improving: mortgage rates have been at historic lows, once again dipping below 4%.

I once said these rates can’t last, and everyone said I sounded like a used-car salesman, and that I was wrong. That was a year ago. I was wrong! But hey, so was half the government! These rates can’t last forever — but they’ll probably last a while yet. The Fed is committed to keeping them low for years.

Thanks for your support!

Best, Glenn