Remote work and low mortgage rates have prompted scores of Americans to buy homes during the pandemic. The result? A severe housing shortage that’s fueling record-high prices and cutthroat competition. Many homebuyers are finding that in order to win, they must tour more homes, cut bigger checks and waive more contingencies.

This analysis reveals just how much homebuying has changed during the coronavirus pandemic. All data represents the period of Sept. 1, 2020 through Feb. 28, 2021, which we refer to as “the last six months” for the purposes of this report. We also frequently compare that period with the same period a year earlier. Scroll down for a full table of the data in this analysis.

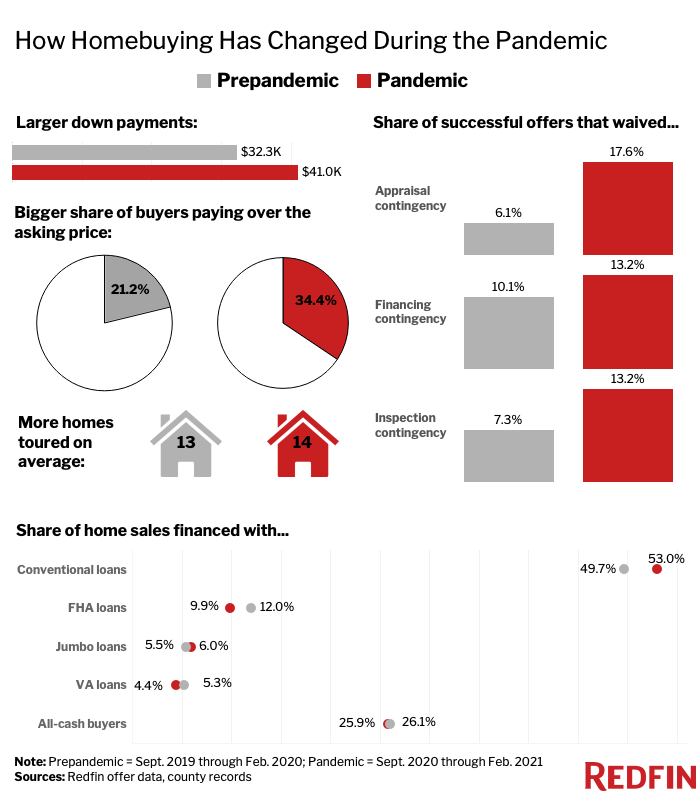

The median down payment on a home during the last six months was $40,987, up from $32,261 during the same period a year earlier. That’s an increase of 27%, or nearly $9,000. The typical homebuyer made a down payment equal to 15.9% of the sale price, compared with 15.3% a year earlier.

Down payments have increased primarily because housing prices have jumped. The median home sale price over the last six months was $333,322, up from $292,945 a year before.

“The surge in home prices actually hasn’t resulted in higher monthly mortgage payments for most buyers because it has been offset by low mortgage rates, but it has driven up down-payment costs,” said Redfin Chief Economist Daryl Fairweather. “This is likely putting homeownership out of reach for many cash-strapped first-time buyers who can’t afford to put an additional $9,000 down.”

In addition to spending more on down payments, homebuyers have been boosting their bids. During the last six months, 1 in 3 buyers (34.4%) paid more than the seller’s original asking price, up from 1 in 5 buyers (21.2%) a year earlier.

“It’s extremely competitive out there. One of my buyers recently beat out 25 other bids by offering $120,000 over the $425,000 asking price on a three-bedroom single-family home,” said Portland, OR Redfin real estate agent Mark Peterson. “There was a competing offer for the same amount, but my client won by opting for a shortened inspection period, accepting the home `as-is’ and agreeing to pay up to $20,000 extra in the event that the appraisal came in low.”

Over the last six months, 17.6% of successful offers submitted by Redfin agents waived the appraisal contingency, up from just 6.1% during the same period a year earlier. The share of successful offers waiving the inspection contingency jumped to 13.2% from 7.3%, and the portion waiving the financing contingency increased to 13.2% from 10.1%.

With more than half of home offers encountering bidding wars these days, buyers are finding that they need to sweeten their offers and get creative in order to win. Waiving these contingencies is a strategy buyers use to make their bids more competitive by assuring the seller that the deal will close without unforeseen headaches.

“A seller of mine recently received 27 offers for their four-bedroom single-family home in Antioch, CA,” said Ralph Martinez, a local Redfin listing specialist. “The winning bid was $31,000 over the $499,000 list price and waived the inspection contingency and the appraisal contingency.”

The inspection contingency allows the buyer to cancel a purchase or request repairs if they find an issue during the inspection period. The appraisal contingency allows the buyer to cancel a deal or renegotiate the price if the appraisal comes back lower than the offer price. In the event that a buyer waives the appraisal contingency and the appraisal comes in low, the buyer must have enough cash to cover the difference between the appraised value and offer price. The financing contingency allows the buyer to cancel the deal if their loan isn’t approved by a certain date.

These stipulations are built into standard home purchase agreements as protections for the buyer, so waiving them can put the buyer at risk. The decision to do so should be made carefully with the guidance of a trusted real estate agent.

More than half (53%) of home sales in the last six months were paid for using conventional loans, or loans that are provided by private lenders and not backed by the federal government. That’s up from 49.7% a year earlier. The portion of sales financed with jumbo loans, which are regularly used for purchases of higher-end homes, increased to 6% from 5.5%. Slightly more than a quarter (25.9%) of home purchases were paid for exclusively in cash, little changed from before the pandemic.

Meanwhile, the share of sales financed with Federal Housing Administration (FHA) loans fell to 9.9% from 12%, and the share of sales financed with Veterans Affairs (VA) loans dropped to 4.4% from 5.3%. FHA loans are backed by the U.S. government and are frequently used by first-time homebuyers and Americans who don’t qualify for conventional loans due to lower credit scores. VA loans are used by military service members and veterans, and allow recipients to finance 100% of a home’s cost without a big down payment.

“Lenders have been tightening up requirements for borrowers during the pandemic because so many families are at risk of defaulting on their mortgage payments,” Fairweather said. “This means that many lower-income Americans have been unable to qualify for the loans they need to become homeowners and start building home equity. But as lenders become more confident in the economic recovery, they will be more willing to offer loans to borrowers with less-than-immaculate credit.”

Homebuyers toured 14 homes on average during the last six months, up from 13 homes a year earlier. From start to finish, the homebuying process took a median of 96 days, compared with 91 days during the same period the prior year. It’s taking longer to find homes in part because there’s an intensifying housing shortage that’s causing many house hunters to get repeatedly outbid.

“Within hours of a home hitting the market, the showing schedule is often completely booked up,” said Laurene Broccard, a Redfin real estate agent in Raleigh, NC. “We’ve seen properties get over 70 showings in three days and up to 30 offers. There are frequently buyers who want to see a home, but it goes under contract before they even have a chance to tour it.”

For the data on down payments and the share of homes bought with all cash, conventional loans, FHA loans, VA loans and jumbo loans, we looked at county sale records for all homes purchased from September 2019 through February 2020 and September 2020 through February 2021.

Data on median days from tour to close and average number of homes toured is based on the details of more than 25,000 homebuyers who bought homes with Redfin agents from September 2019 through February 2020 and September 2020 through February 2021.

Data on the share of successful offers that waived contingencies is based on records submitted by Redfin agents in select markets from September 2019 through February 2020 and September 2020 through February 2021.

Data on median sale price and the share of homebuyers paying above the asking price comes from multiple listing service (MLS) records and county records from September 2019 through February 2020 and September 2020 through February 2021.