Older Americans who own their home are staying put largely because they’re financially incentivized to do so. It’s contributing to the shortage of homes for sale.

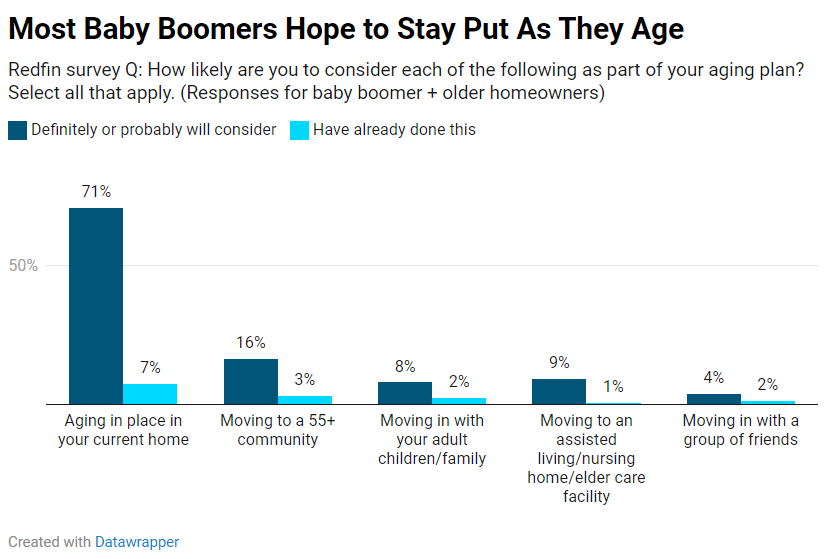

We asked baby boomers in a recent survey what they anticipate their living situation to be as they grow older. The most common response: staying right where they are. More than three-quarters (78%) of older American homeowners plan to stay in their current home as they age. That’s by far the most common aging plan for older homeowners.

The next most common plan is moving to a 55+ community; one in five (20%) baby boomers are considering moving into a 55+ community or have already done so. Next comes moving in with adult children, with 10% of baby boomers citing that as a possible plan, and moving to an assisted-living facility (10%). Those are followed by moving in with friends (6%).

This is according to a Redfin survey conducted in February 2024. This report focuses on the 838 responses from baby boomers (60-78 years old) and 62 members of the Silent Generation (79+; over half of respondents from the Silent Generation were aged 79-81) who own their home, and their responses to a question about how likely they are to consider each of the aging plans outlined above. Respondents could choose “definitely considering,” “probably will consider,” “have already done this,” “might or might not consider,” “probably will not consider” or “definitely not considering” for each option. When we say “plan” in this report, we’re referring to the respondents who said they’re definitely or probably considering or “have already done this.” A more detailed methodology is at the end of this report.

The results from baby boomers who rent their home are similar to the results for homeowners noted in this report.

The fact that the vast majority of baby boomer homeowners plan to age in place could prolong the shortage of homes for sale. Inventory is sitting at historically low levels (though new listings have started climbing in recent months) in large part because homeowners who scored ultra low mortgage rates during the pandemic are staying put to avoid taking on a new rate at today’s elevated levels. Many of those homeowners are baby boomers.

Baby boomers staying put is one reason young Americans are having a hard time finding a family home, according to a separate Redfin analysis. It found that empty-nest baby boomers own 28% of three-bedroom-plus U.S. homes, while millennials with kids own just 14%. Baby boomers have an outsized impact on the housing market because they’re most likely to own homes: Nearly 80% of boomers own the home they live in, compared to 55% of millennials.

Another Redfin analysis found that older Americans staying in their homes is already a driving force behind increasing homeowner tenure and the lack of homes for sale: More than half of baby boomers have lived in their home for over 10 years. Low inventory pushes home prices up, exacerbating the housing affordability problem in this country.

Baby boomers are holding onto their homes largely because there’s not much financial incentive to let go of them. Most (54%) boomers who own homes have no mortgage, and for those who do have a mortgage, nearly all have a much lower interest rate than they would if they sold and bought a new home. Tax systems in some states, like California and Texas, also make it financially beneficial for people to stay in their homes as they age. And with medical and tech advancements, it’s increasingly possible for people to stay in their homes as they get older.

“Older Americans are aging in place because it makes financial sense, but also because it’s human nature to avoid thinking about challenging scenarios such as needing help as you get older,” said Redfin Chief Economist Daryl Fairweather. “In reality, many homeowners and renters will need to move somewhere that better meets their needs as they age, like a senior-living community or a one-story home in an accessible neighborhood. But the government isn’t prioritizing building housing for seniors, which is further encouraging older Americans to stay put, exacerbating the inventory shortage. Politicians should focus on expanding housing stock that meets the needs of older Americans, which could help with housing affordability and availability for all.”

More than half (51%) of baby boomers who aren’t planning to sell their home anytime soon say it’s because they like their home and have no reason to move, according to the same Redfin survey. More than a quarter (27%) say it’s because their home is completely or almost paid off, and roughly one in five (21%) are staying put because home prices are now too high.

This is according to a Redfin-commissioned survey of 3,000 U.S. homeowners and renters conducted by Qualtrics in February 2024. The survey was nationally representative. To achieve representativeness, initial recruitment to the survey was balanced on key demographics, separately for both homeowner and renter heads of household. These key demographics include race/ethnicity, age, region, educational attainment, and an indicator for whether the household moved within the past year. Additionally, we employed statistical raking to calibrate weights so that the distribution of key demographics for survey respondents matched those observed in the full population of U.S. homeowners and renters.

This report focuses on the 838 responses from baby boomers (60-78 years old) and 62 members of the Silent Generation (79+; over half of respondents from the Silent Generation were aged 79-81) who own their home, and their responses to the following question: “How likely are you to consider each of the following as part of your aging plan? Select all that apply. Aging in place in your current home, moving to a 55+ community, moving in with your adult children/family, moving to an assisted living/nursing home/elder care facility, moving in with a group of friends.” Respondents could choose “definitely considering,” “probably will consider,” “have already done this,” “might or might not consider,” “probably will not consider” or “definitely not considering” for each option. When we say “plan” in this report, we’re referring to the respondents who said they’re definitely or probably considering or “have already done this.”