Ouch. Last week, Redfin’s Market Tracker showed a huge jump in home sales and healthy price increases for July. Good good. But that was then, this is now, and all bets are off as markets tumble and traders load for a bear market. Quiz: What do your 401(k), a train wreck and Donald Trump have in common? Answer: It’s painful to look, you don’t want to look, but you look anyway. To see what the future holds for housing, watch this space. Tomorrow, the Redfin Demand Index will forecast September home prices and sales. Also: Panda population growth.

Oh, stop it already. The housing market is in decent shape. Home prices were up 5.8 percent in July from a year earlier, our data show. We expect prices to continue rising, just at a slower pace than they have been.

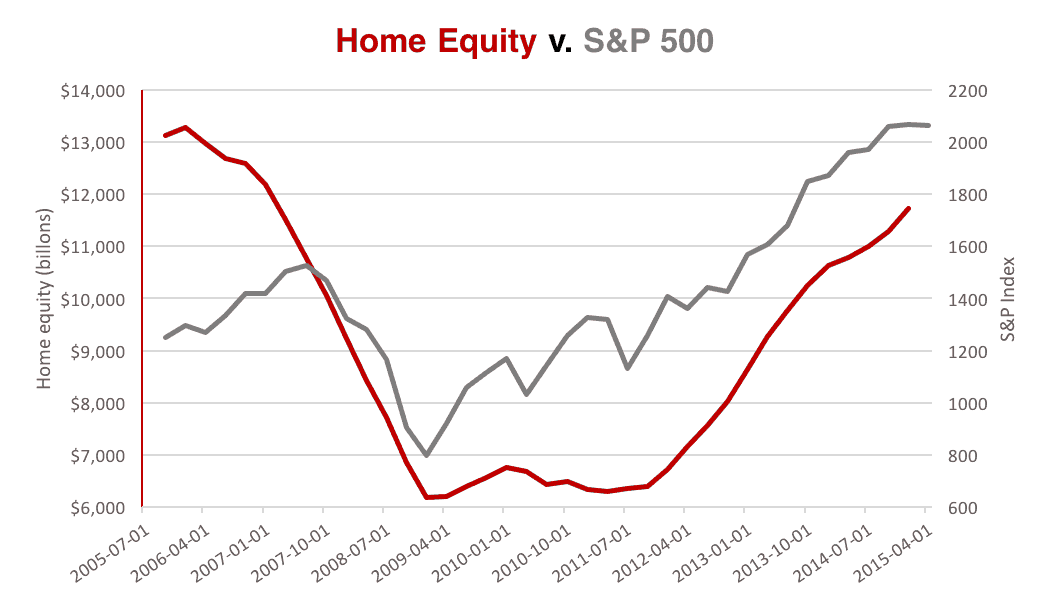

Now look at the next chart. Yes, home values and stocks have shared the same trajectory since the market peaked in 2006.

“A sustained market correction could spook would-be buyers,” Redfin Chief Economist Nela Richardson said. “On the flip side, expect mortgage rates to dip this week as investors flock to safe assets like Treasuries. It’s too soon to know how the correction will affect housing, whether lower rates will be enough to overcome consumer unease.”

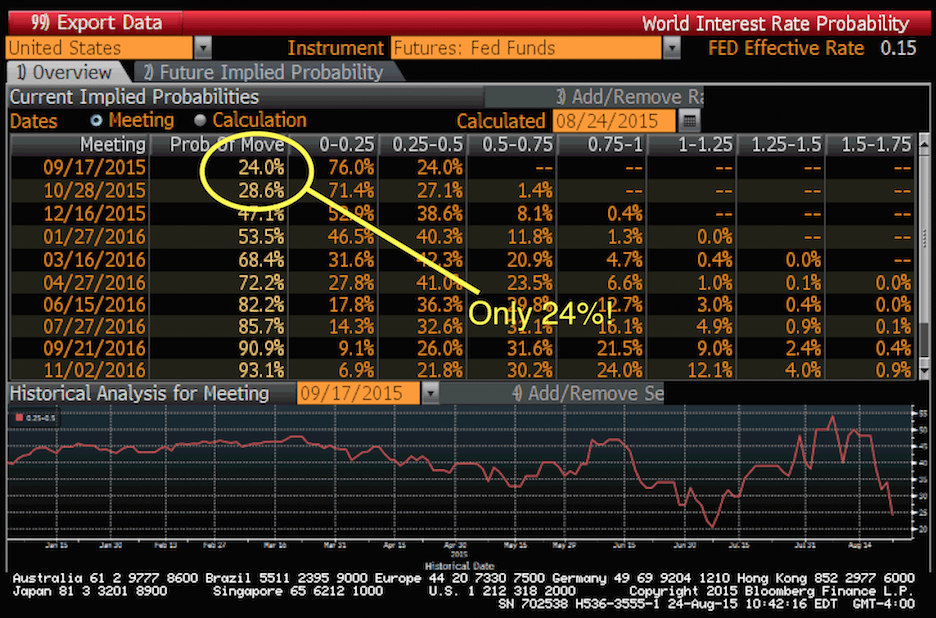

OK, it’s not exactly an easy chart. Bloomberg’s algorithms and its thousands of obsessed Fed watchers like to put numbers on everything. Here’s the machine’s probability of a September rate hike.

No love for Fannie and Freddie. The Federal Housing Finance Agency (FHFA), which oversees mortgage giants Fannie Mae and Freddie Mac, set new goals for funding affordable mortgages and, for the first time, affordable rentals. Surprise, surprise, everyone threw shade on the FHFA. Housing advocates (CAP) said the agency missed an opportunity to do more to help low-income and minority borrowers. Folks who want Fannie and Freddie to just go away already (AEI) accused FHFA of “doubling down on past policy failures” with its new apartment goal. The agency itself admits banks and thrifts are doing plenty of lending, but “conditions can change and both Enterprises must have the capability to serve the small multifamily market.”

Privately, more than a couple people said the FHFA threaded the needle just fine given these crazy times for housing policy.

Cash sales are at their lowest since 2008, says CoreLogic.

Builder Stock. The housing sector took it on the chin last week along with everyone else. Housing Wire updates the HW30.

Redfin is going to bat for the Buckeyes. Hello, Columbus.

Household formation. D.C. gets two new residents. This is sort of housing-related, right? Check out the Giant Panda Cam.

Have a question about housing? Mortgages? Pandas? Just ask. Lorraine.woellert@redfin.com